CWS: An Active ETF That Flies Under The Radar, But Shouldn't

Summary

- CWS is a small, largely-ignored active ETF that should get more attention. So I'm writing about it.

- Active ETFs are still emerging. What I like about this one is its focused, 25-stock portfolio and risk-management approach.

- I rate it a Hold since the entire stock market appears to be going nowhere. But this could be a go-to once mega-cap mania fades.

Ruslanshug/iStock via Getty Images

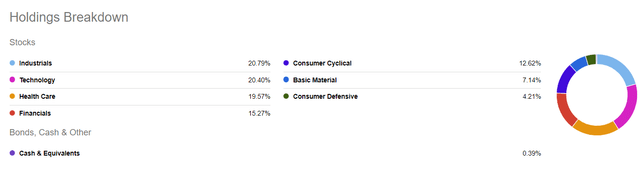

AdvisorShares Focused Equity ETF (NYSEARCA:CWS) has all the elements of what I call an "undiscovered" ETF. It has been around for more than 5 years, but has only accumulated about $55mm in AUM. CWS is an active ETF, so opposed to the vast majority of Exchange Traded Funds, it does not merely track an index. It is based on a sound equity investment process, but not one that has been splashed all over the headlines. It is not flooded with FAANG stocks, investing instead across large, mid and small cap names. It does not spread its wealth across hundreds of stocks, instead owning a tight group of 25 equities. And, it has just gone about its business, delivering alpha just when investors needed it most, in 2022 and 2023.

But you won't find a lot of news or press about CWS. It is just not sound-bite, headline-grabbing sexy. It is just a neat little active ETF that more investors should know about, but probably won't any time soon. But it is exactly the type of ETF I like to research, and bring to the Seeking Alpha audience. Because modern investment markets get more challenging every day. And that means looking beyond the "usual suspects" when building portfolios is more important now than ever before.

I rate CWS a Hold, mainly because there is virtually nothing I see in the current equity market that would qualify as a high reward potential equity ETF with low risk. And that high reward/risk tradeoff is what I seek as an investor. But CWS is on my watchlist, and definitely on my list of the best "undiscovered" ETFs. Time will tell if it shakes that undiscovered tag. But as an investor, I could care less about that. What I care about is finding good pieces to my portfolios, sort of like a general manager of a sports team looking for players to fill their organization's system and pipeline. And this one makes the watchlist.

Portfolio management process

CWS stands for "Crossing Wall Street, which is a website and financial publishing business started over a decade ago by Eddy Elfenbein. This ETF is based on the equity strategy he created, which puts a fund wrapper around a process he has written and spoken about in newsletter form and publicly since 2006. Thus, its documented thinking on equity selection goes back to that time. It is better-described as a value orientation, not an ETF that seeks the highest potential earnings growers at any price.

CWS emphasizes fundamentally-strong businesses, what the active manager refers to as "first in class" firms with clear competitive advantages. Among the attributes sought in portfolio holdings are proven management, solid balance sheets, competitive economic advantages, strong market niches, and a long history of steadily increasing sales, earnings, and dividends.

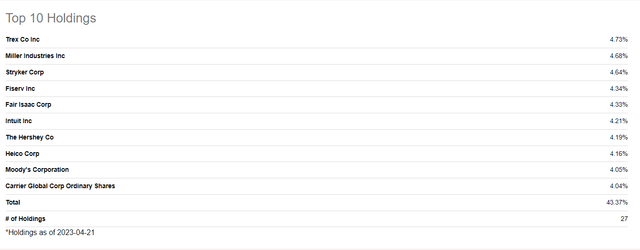

This is long-term focused strategy, and changes its holdings only once a year. Every year, 5 of the 25 stocks are removed, and replaced with 5 different ones. While that certainly carries some price risk at the stock-specific level, it also allows the investor to know what they own. As I see it, CWS can be used as an ETF holding, but can also be viewed as a research list for long-term, fundamentally-sound stocks. Since I don't view any single ETF in isolation, one likely use case I envision for CWS is as a core portfolio piece that can then be managed around. Naturally, any investor can just buy the 25 stocks individually, save the expense ratio, and change out 5 stocks once a year. But that's analogous to eating dinner out or cooking it yourself. To each their own.

Unique fee structure provides further manager incentive

CWS's fee structure is unique in the ETF business. It uses a "Fulcrum Fee" approach to compensating the manager, which means the fee earned varies based on performance. The stated Expense ratio is 0.75%, but depending on performance, that fee can range from 0.65% to 0.85%. For what it's worth, I used to manage a mutual fund that was one of the few that used a Fulcrum Fee system. I'll say this: it is very motivating for the manager, and just provides another reason to like this ETF's approach in a sea of index-tracking funds.

One of the other things I find attractive about CWS's approach is that it always holds 25 stocks. That in itself is helpful, as it avoids over-diversification. But it also signifies to me that this is a bottom-up focused ETF. That is, it looks for the best stocks to buy and fills the portfolio with them. It is not highly "constraint-driven." That is, it is not compelled to hold the largest stocks, a certain weighting in a sector, etc. In that sense, CWS really is an ETF version of what active mutual funds have been for many decades. It is an actively-managed portfolio. Managed, that is, by humans.

Performance analysis: depends on the benchmark used

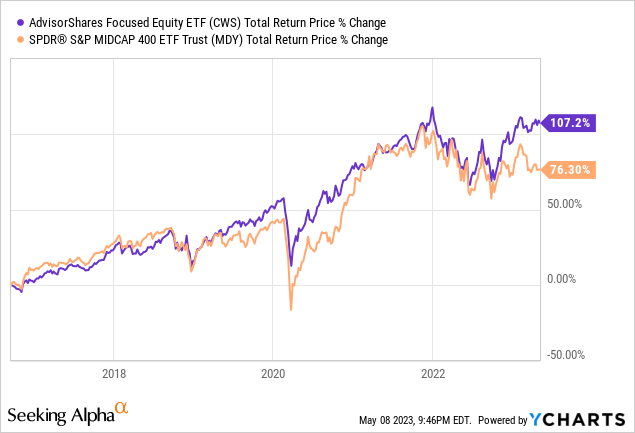

The ETF officially compares itself to the S&P 500, but as the chart immediately below shows, it compares very favorably since inception to what I think is a more relevant benchmark, at least in the intermediate-term. Specifically, CWS has patrolled the all-cap space (large, mid and small) at a time when giant stocks a la the megacaps in the S&P 500 have dominated.

Here, I present 2 different performance looks at CWS, and my opinions on what they mean. First, here's a chart showing that in both 2020 and 2022 the end point of the chart), CWS held in well during the worst of it for midcaps.

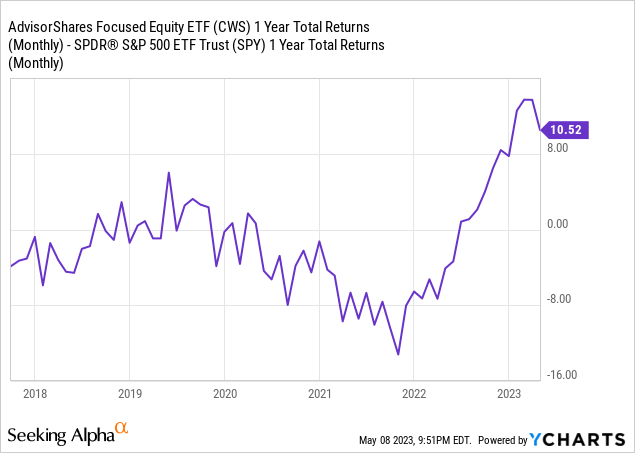

Turning to CWS versus S&P 500, here is a chart of 1-year rolling returns of one over the other. Notice that CWS spent its first few years performing in the range of, or slightly below the S&P 500. It underperformed by quite a bit during the go-go, mega-cap-topping year of 2021, but then outperformed handily when things got tough for the market benchmark. As of the past 12 months, CWS is more than 10% above the S&P 500.

Translation: this is an ETF to consider as a lower-correlation core equity alternative to the many, many ETFs that simply own the S&P 500, but with a slight tilt that makes them look like they are doing something to add value.

CWS is not likely to make a lot of radar screens, but it hit mine, and I'm glad it did. It is not a world-beater, and it won't often be a bragging point at cocktail parties. But its methodical, long-term-oriented, non-S&P 500 tracking approach has some appeal, especially when we finally get a market environment when the biggest, most well-known names no longer represent a place to hide, the way they often have. I rate CWS a Hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.