GXC: Ride The Next Inning Of The China Rebound

Summary

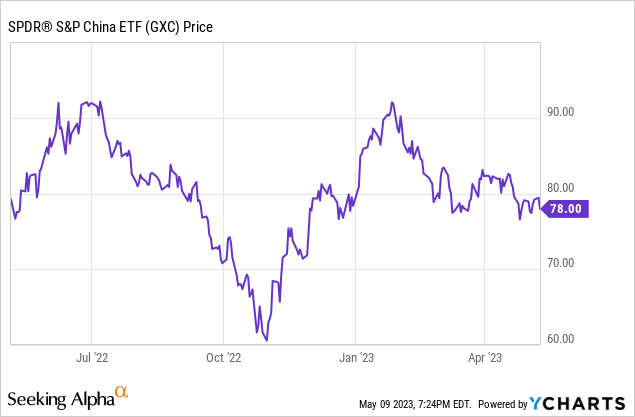

- State Street's SPDR S&P China ETF has underwhelmed in recent years amid the 'zero-COVID' impact, but the long-term track record remains solid.

- Alongside the economic growth rebound in Q1, sentiment in Beijing is also turning more supportive of the private sector, and GXC's tech-heavy portfolio should benefit.

- With valuations still undemanding relative to earnings growth, GXC remains poised to outperform.

owngarden/E+ via Getty Images

If the strong service-led rebound in Q1 is anything to go by, China looks poised to outperform the rest of its Asia Pacific peers this year. But the road ahead won't be straightforward - the first inning of the post-reopening rally (i.e., the fastest stage) is likely in the rearview mirror, and a weaker external backdrop is emerging as a material headwind. But policymakers have kept expectations low, and the strong Q1 GDP print indicates the ~5% target this year will likely prove conservative. Plus, there remain pockets of weakness in the Chinese economy, as acknowledged at the recent Politburo and Central Financial and Economic Affairs Commission (CFEAC) meetings, supporting the case for an accommodative policy backdrop. This time around, expect tech/consumer-focused ETFs like the SPDR S&P China ETF (NYSEARCA:GXC) to lead the way, given the government's private sector-friendly shift, as well as their higher beta to global interest rates (easing likely in H2). With the GXC portfolio trading well below historical levels at ~10x (vs. ~17% EPS growth), the long China trade remains attractive here.

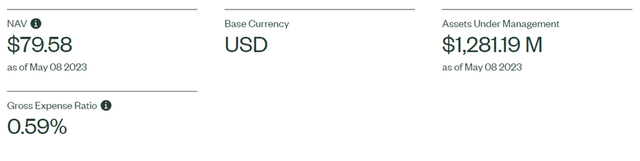

Fund Overview – A Competitively-Priced H-Share-Focused ETF

The State Street (STT) managed SPDR S&P China ETF tracks, before fees, the performance of the market capitalization-weighted S&P China BMI Index, which comprises the universe of listed China-domiciled companies available to foreign investors (including A Shares accessible via the Shenzhen and Shanghai-Hong Kong Stock Connect). Most of the fund's holdings are H-shares, limiting the geopolitical/regulatory risks associated with US-listed Chinese depositary receipts ('ADRs'). The ETF had $1.3bn of net assets at the time of writing and came with a 0.6% gross expense ratio (before fee waivers and reimbursements), making it a competitively priced option to access China Inc.

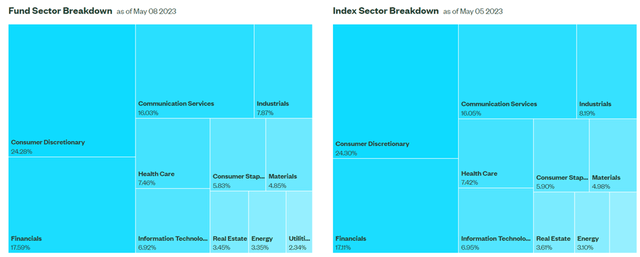

As reflected in the graphic below, the fund's sector allocation skews toward Consumer Discretionary (24.3%), with Financials (17.6%) and Communication Services (16.0%) also crossing the 10% threshold. Industrials are another significant contributor at 7.9%, along with Health Care (7.5%), Information Technology (6.9%), and Consumer Staples (5.8%). The remaining sector allocations are below the 5% threshold. In total, the top-five sectors account for 73.2% of the overall portfolio, making GXC a relatively top-heavy fund from a sector perspective.

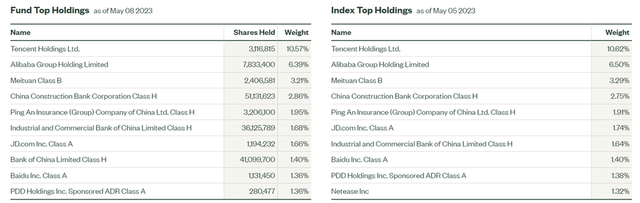

The fund's top holdings are tech/media giant Tencent Holdings (OTCPK:TCEHY) at 10.6%, followed by e-commerce leader Alibaba Group (BABA) at 6.4% and Chinese shopping platform Meituan (OTCPK:MPNGF) at 3.2%. The only other holdings at or above the 2% threshold are China Construction Bank (OTCPK:CICHY) at 2.9% and insurance conglomerate Ping An (OTCPK:PNGAY) at 2.0%. Outside of the top five holdings, which represent ~25% of the portfolio, the GXC portfolio is spread out fairly evenly. The geographical breakdown is listed as 95.3% China and 4.5% Hong Kong, though investors should note that the ETF's China exposure (full list of single-stock holdings here) is predominantly via the Hong Kong listings.

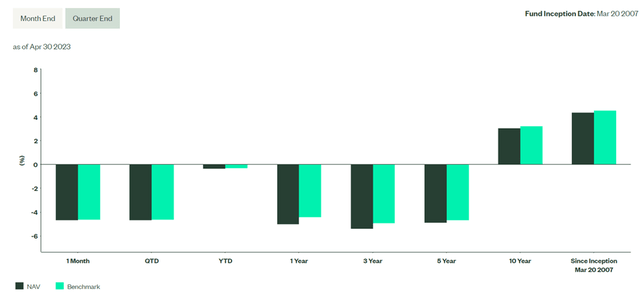

Fund Performance – Solid Long-Term Compounding Despite the 'Zero-COVID' Years

As of GXC's last reporting date, the ETF has returned +1.1% YTD (-0.3% in NAV terms) and has appreciated in value by 4.5% per annum (4.4% NAV) since its inception in 2007. This performance is largely in line with its benchmark index at +4.6%, though on a post-tax basis (+4.1% and +3.7% in NAV and market value terms, respectively) and after accounting for market price fluctuations (currently at a slight % NAV discount), the tracking error is as wide as ~1%pt. Like many other US-listed China funds, however, GXC's tech/consumer focus has resulted in a steeper drawdown through the 'zero-COVID' years; thus, its mid-single-digits % track record since inception is solid, in my view.

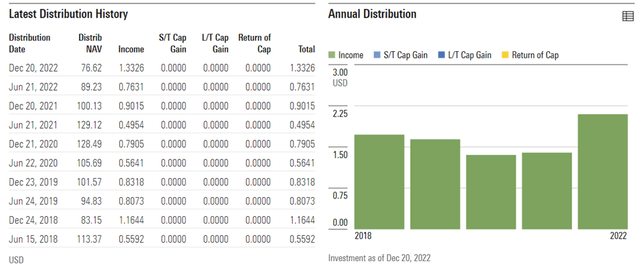

Where GXC stands out relative to its peers is the distribution. Not only is the distribution yield well above par at ~3% on a trailing basis, but it has also come out of a recurring income stream that has been relatively steady through the cycles. Last year, for instance, saw a rise in distributions to $2.10/share following two years of COVID-driven declines in 2020/2021, with all of it coming from recurring income. Expect distributions to normalize higher this year as well, alongside a Chinese economic recovery post-reopening and further earnings growth.

CFEAC and Politburo Meetings Signal the Supportive Policy Backdrop is Here to Stay

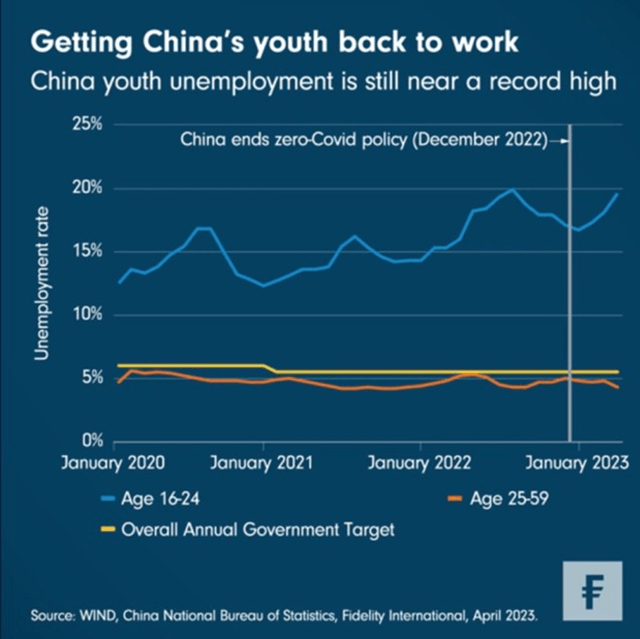

Given the strong Q1 data (+4.5% YoY GDP, +5.4% YoY household consumption per capita, and non-manufacturing PMIs signaling expansion), the recent policy meetings were understandably more bullish on the overall recovery prospects. Also helping is the favorable base effect (recall 2022 was heavily impacted by 'zero-COVID' post-Q1), allowing China a clear path to achieving its ~5% growth target this year. But there hasn't been any complacency thus far; instead, last month's Politburo meeting saw policymakers remaining cautious about the structural challenges and risk factors underlying the economy. The property sector, for instance, is a long way off a full recovery, and until then, local government debt levels will be a concern. Structurally, the high teens % youth unemployment (19.6% in March vs. ~18% in February) is a concern as well, particularly with China's 'demographic dividend' set to reverse in the coming years.

As the base effect that supported the first inning of the post-reopening growth story fades over the coming months, there needs to be added policy impetus to extend the natural recovery, and Beijing looks set to deliver. Noting the lack of aggregate demand and the downside risks for trade and housing, as well as the excess capacity in the system, policymakers' decision to accelerate "building a modern industrial system backed by the real economy" at last week's CFEAC meeting was a positive step. Self-sufficiency-driven objectives such as securing supply chains and promoting "high-quality development" also point to a supportive policy backdrop for the Chinese private sector. The GXC portfolio's outsized exposure to tech leaders (e.g., Tencent and Alibaba) driving the next wave of high-tech job creation in China means the fund is well-positioned to outperform.

Ride the Next Inning of the China Rebound

Divergent macro outcomes appear to be on the cards this year; amid a downturn in the global cycle, China's consumption/service-led growth premium stands out (+5% GDP targeted this year). Yet, the first inning of the China reopening trade has arguably been played out by now, and from here, the onus will be on continued policy support to extend the rally. The tone of recent government meetings has been promising – looking through the strong Q1 GDP print, policymakers have acknowledged that there remain pockets of economic weakness that need to be addressed. Also positive is the commentary on the private sector's role as a growth and job creation engine, as well as the improving consumer confidence and fiscal support. With valuations also attractive vs. underlying growth (~10x fwd P/E vs. ~17% EPS growth), expect GXC's tech/consumer-focused ETF to lead the next leg of outperformance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.