VDE: A Major Share Price Correction Could Be On The Way

Summary

- Vanguard Energy Index Fund ETF Shares face a risk of significant price correction because the impact of the sharp drop in oil prices has yet to be factored in.

- Higher supplies and weakening demand suggest that oil prices are unlikely to rise in 2023.

- Energy stocks and ETFs are likely to suffer from a sharp drop in earnings as well as high valuations.

sefa ozel

I believe there is a significant risk of price correction for Vanguard Energy Index Fund ETF Shares (NYSEARCA:VDE) because a number of negative events have yet to impact price performance. Oil prices have already dropped by about 40% from recent highs, and there is little chance that they will recover in 2023 due to increased supplies and a deteriorating macroeconomic outlook. Record-breaking profits in 2022, which have thus far helped energy stocks and related ETFs to demonstrate resilience against falling oil prices, may also be the biggest heading in 2023. Forward valuations suggest that energy stocks and ETFs are also overvalued.

Crude Oil Prices and Energy Stocks

VDE Price Change vs Crude oil (Seeking Alpha)

There is a strong correlation between energy stocks and crude oil prices. When crude oil prices fall, energy stocks and ETFs follow suit. However, despite a 40% drop in oil prices over the last year, energy stocks and ETFs such as VDE have shown resilience. One of the primary reasons for investor optimism in energy stocks and ETFs was the expectation that oil prices would recover in 2023. I am still bearish on oil prices, as I was in my previous two analyses published in June and December, due to two factors: an impending recession and increased supply.

Oil prices spiked in the first half of 2022 due to restrictions on Russian oil, but they quickly fell in the second half as Russia bypassed those restrictions by selling large quantities of oil at low prices to its allies. Furthermore, supply cuts from OPEC and partner countries appear insufficient to offset the impact of higher supplies from non-OPEC producers, who are expected to increase total liquid fuel production by 1.9 million barrels per day (b/d) in 2023 and 1.0 million b/d in 2024. According to the EIA's most recent report, global oil production is expected to average 101.3 million barrels per day in 2023, while global oil consumption is expected to be 100.87 million barrels per day. Moreover, crude oil supplies are expected to rise sharply once OPEC's cuts expire in 2024.

Although the EIA has predicted a global oil market surplus for 2023, they have also noted that rising risks in the US and international banking sectors raise the possibility that actual demand for liquid fuels will be lower than expected. I also believe there is a high risk that fuel consumption will remain lower than forecasts because the world's largest economy has been heading toward recession and a prolonged trend of slower economic growth. The US economy grew by only 1% in the first quarter of 2023 compared to the previous year, with a further slowdown expected in the second quarter. The growth trends outside of the US also seem unfavorable to support a sharp increase in oil production. The World Bank recently issued a warning about a "lost decade" in global growth. The bank predicts that global growth will average around 2% per year by 2030, the slowest rate of expansion in the last three decades.

Declining Earnings Potential

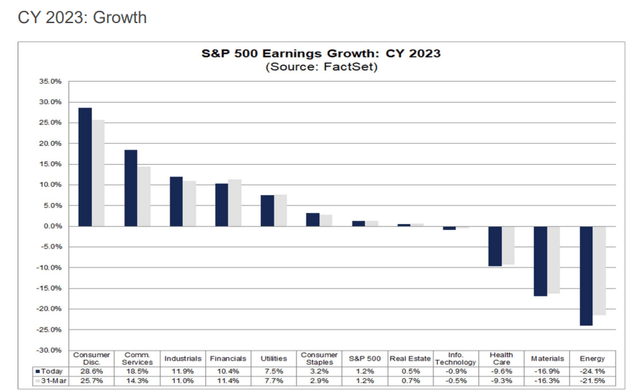

Fiscal 2023 Earnings Expectations (FactSet Data)

Another factor that contributed to the VDE's share price resilience in the face of a significant drop in oil prices was record-breaking earnings in 2022. This factor, however, is likely to become a downside risk for energy stocks in 2023, as lower oil prices mean lower earnings. According to FactSet data, earnings in the energy sector are expected to fall by 24% year on year in 2023.

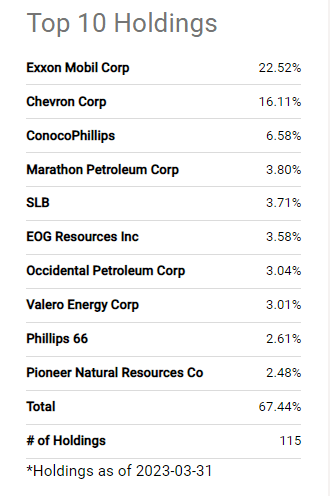

VDE's Top 10 stock holdings (Seeking Alpha)

Exxon Mobil (XOM), VDE's largest energy company with a portfolio weight of 22%, is expected to report a 27% drop in earnings compared to 2022. The drop of a billion dollars in its upstream earnings in the first quarter indicates that the trend of a sharp decline in earnings has already begun. The second-largest company, Chevron (CVX), also reported a 45% decline in US upstream earnings in the first quarter when compared to the same period last year. According to Wall Street analysts, the oil giant is likely to report a 24% drop in earnings and a 16% decline in revenue for the full year. ConocoPhillips (COP), VDE's third largest stock holding, saw its first-quarter earnings fall in half to $2.9 billion from $5.8 billion in the previous quarter. Similarly, EOG Resources (EOG), Pioneer Natural Resources Company (PXD), and other oil production-focused companies have reported a significant drop in quarterly earnings compared to prior periods. On the positive side, refining, oil field services, and drilling companies are still reporting solid earnings growth in 2023 but these companies account for a small percentage of the VDE portfolio or overall energy sector. Thus, the possibility of a high double-digit earnings decline in 2023 may have a negative effect on the price performance of broader energy-focused ETFs like VDE.

Valuation

Another risk that could cause a price correction in energy stocks and ETFs is high valuations. With the exception of Valero Energy (VLO) and Marathon Petroleum (MPC), the remainder of VDE's top stock holdings received poor quant grades on the valuation factor. Exxon, for example, received a D plus on the valuation factor. Its forward price-to-earnings ratio of 10.91 is 33% higher than the sector median, and its forward price-to-book ratio of 2.16 is 56% higher. Chevron, ConocoPhillips, and Occidental Petroleum (OXY) also received D grades on valuation from the SA Quant system. Their forward price-to-book and price-to-earnings ratios are significantly higher than the median estimates.

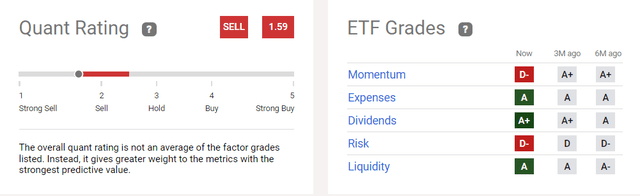

Quant Score

Using the quantitative method to analyze an investment helps to remove emotion from the decision-making process. In addition to poor quant grades on valuation, VDE's overall quant score suggests that the energy sector as a whole is at risk of further losses. The broader energy-focused ETF received a quant score of 1.59, owing to poor grades on momentum and risk factors, two important factors in predicting future price performance. A negative D on momentum indicates that there is little chance of a share price rebound, whereas a 70% higher standard deviation and annualized volatility from the median of all ETFs indicate high chances of a downtrend.

In Conclusion

It might be a good idea to hold off on making an investment in energy-related stocks and ETFs like VDE for a little while. I believe their shares are at risk of a significant price correction as a number of events have yet to be factored into the price performance. Although I see no risk to the dividend stability of energy stocks, dividends alone do not make any investment worthwhile unless they are accompanied by share price appreciation in my view.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.