QQQ: FAANG Dominance Is Hurting Equal-Weighted ETFs Like QQQE

Summary

- It's tough out there for an equal-weighted ETF. For many reasons, capitalization-weighted indexes continue to dominate the performance tables.

- This is particularly relevant for any ETF that is in direct competition with QQQ, the cap-weighted Nasdaq 100 ETF.

- Earlier this year, the tide seemed to be turning, but so far, it hasn't. I rate QQQE a Hold. FAANG stocks continue to reign, hurting cap-weighted ETFs.

Vitezslav Vylicil

Its tough out there for a cap-weighted ETF. There once was a time when investors cared more about what they owned relative to how much of it they owned than they do now. This is a big part of how modern markets have changed. The rich get richer, and we see that in the sustained outperformance of the bigger stocks in many ETF investment styles. That has filled the coffers of cap-weighted ETFs like Invesco QQQ Trust (NASDAQ:QQQ). But it has made life relatively miserable for an equal-weighted version of that same index, Direxion NASDAQ-100® Equal Wtd ETF (NASDAQ:QQQE).

The risk side of that same circumstance is that the biggest Nasdaq stocks by capitalization have gotten very, very big. This has led to the type of mega-cap outperformance that is typically seen at the end of market cycles, before they get worse. But since I believe that nearly everything about equity market investing is less reliable than it was just a few years ago, I can't sit here and say I see some imminent collapse in the relationship between QQQ and QQQE. What I can say is that investors should alert themselves to the fact that this has been a risk in the past.

I rate QQQE a Hold, as I do not see a catalyst emerging for the market's love affair with FAANG stocks to end soon. Frankly, there's a better chance it ends suddenly than slowly, given the array of big-picture risks that remain.

Some stock market risks point to a continuation of mega cap outperformance

The debt ceiling issue could rock all stocks, but the mega caps could be the easiest to sell, thus putting them in position to lead the way down. This was part of the 2022 bear market story.

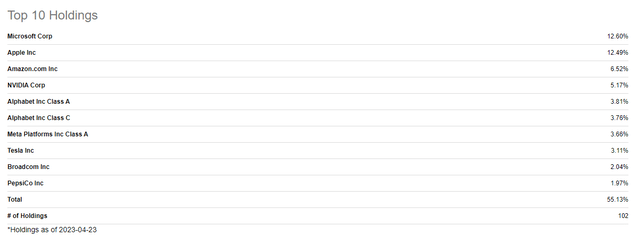

Rising inflation and interest rates likely play favorably toward many of the biggest Nasdaq holdings, and thus QQQ over QQQE. After all, unless you are a volatile EV-car maker, if you are in the Nasdaq 100's 10 largest holdings (shown below), you probably can act more like your own bank. Thus, higher rates don't crimp your growth potential, since you don't require much debt to sustain the business.

QQQ top 10 holdings (SeekingAlpha.com)

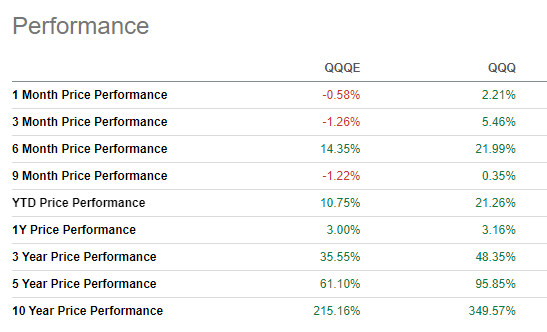

Below is the performance of QQQE, the equal-weighted Nasdaq 100, versus the wildly popular QQQ. You can see why the crowd has gone wild. QQQ has outperformed QQQE over every one of the time periods shown, even when we incorporate the hiccup in the FAANG stocks last summer that dropped QQQ by nearly 20% from mid-August through mid-October.

Seeing Alpha

QQQE: The Ted Lasso of Nasdaq ETFs?

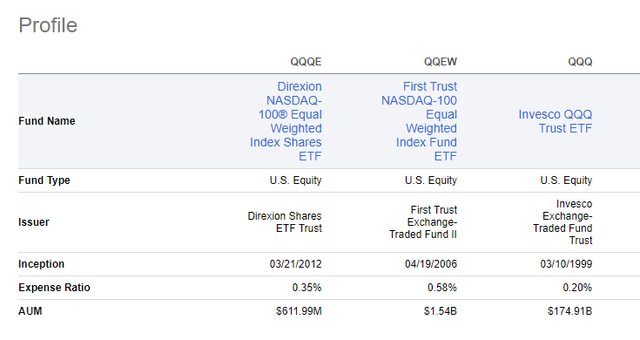

With so much investment decision-making driven by assessing past performance (a habit I truly, along with the investment public, would break away from), this will keep an ETF like QQQE in the "undiscovered" category for a while longer. Below is a quick comparison table including that ETF, a rival equal-weighted offering, and the famous QQQ. You know, the one with its own TV commercials!

QQQ's nearly $175 billion asset base drowns out QQQE's $600 million portfolio. Remember, these are the same stocks in each ETF: the 100 largest companies in the Nasdaq Composite. But after a decade where those admittedly great businesses grew from big businesses into must-own stocks that to many represent "safety" in the stock market (hint: no such thing exists), QQQ has made QQQE look like the Richmond football club in the TV series, "Ted Lasso." The eternal also-ran.

QQQE: the "little" one (Seeking Alpha)

A trend hints at reversing, then doesn't

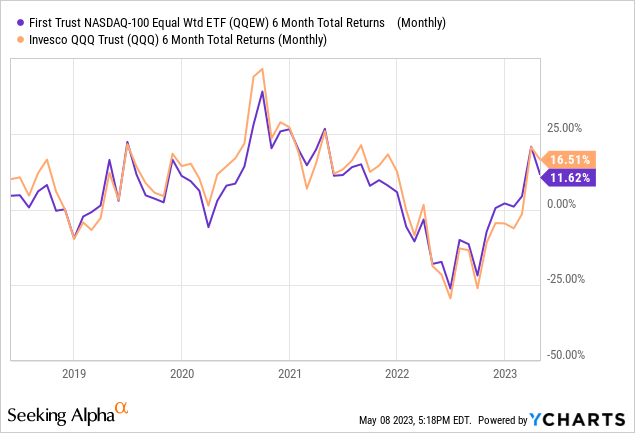

The chart below gave me some hope that the mega-cap stock obsession was starting to turn around in favor of ETFs like QQQE. Toward the far right side of the chart, we saw the first hints of QQEW outperformance of QQQ in quite a while. Alas, it quickly faded, and over the most recent 6-month period, QQQ rose by 5% more than QQQE, 16.5% to 11.6%. The beat goes on.

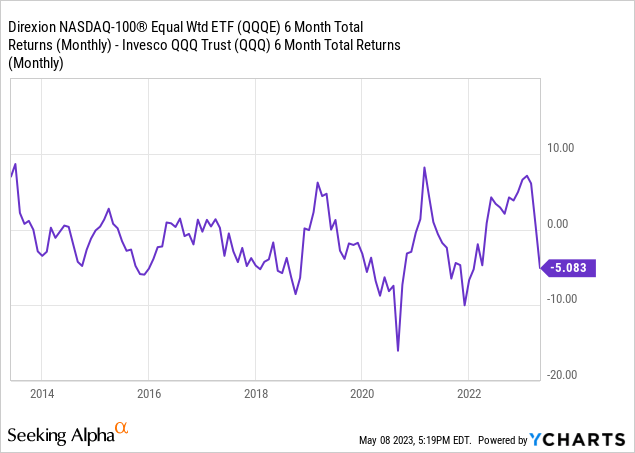

Here's a longer-term (10 years) look at the relationship between the 2. When the number if above zero, that means QQQE has outperformed QQQ for a 6-month time frame. I don't see too many spots above zero in the past decade, and even those were fleeting. This has been the saga of equal-weighted ETFs versus cap-weighted funds.

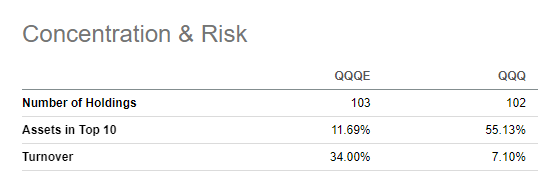

And, here is another view of this pair of nearly identically-constructed ETFs, but for the weighting of the 100 stocks. QQQE naturally holds about 1% of its portfolio in each stock, so the top 10 are less than 12% of assets (the reason it is over 10% is that since QQQE was last rebalanced, the biggest winners had their weights lift up from 1%). But QQQ's top 10 by size are super-sized. 55% of that ETF are in just 10 stocks, and nearly 50% are in just 6 companies. So these days, the Nasdaq is not a stock index, it is 6 giant companies, plus a lot of window dressing. That will go on until it doesn't. And that's what makes this a historically-frustrating stock market to invest in for those who like some variety.

Look at that turnover (difference explained below) (Seeking Alpha)

You can also see in that table above that QQQE's turnover is nearly 5 times that of QQQ. Why is that? I presume because while about 1/3 of the 100 largest companies a year ago are not still in that top 100, none of that matters to QQQ, since its assets are barely invested in the bottom 70-80 of its 100 stock holdings. If any statistic shows you how cap-weighted and equal-weighted ETFs can be such different vehicles at this stage of the stock market cycle, that is the one.

Equal-Weighted ETF outlook: One day, just not today

We old-timers (I started my Wall Street career in the mid-1980s) used to know the Nasdaq as the place where thousands of very small, unproven companies crawled around, hoping to get noticed. Fast-forward to today, and I wonder if many even realize the Nasdaq is a stock exchange. But some excellent branding has made those top 100 stocks, in the form of QQQ, the heart of the FOMO (fear of missing out) movement for investors.

QQQE is an ETF that accesses the innovation of the Nasdaq beyond the 6 companies whose stocks have already gone way, way up. But for now, I don't see a compelling turn in the fortunes of equal-weighted ETFs like this one. That probably won't happen until the bubble that is the FAANG/mega cap stocks bursts, the whole stock market gets wrecked for a while, and actual price-discovery can begin again... if that ever happens.

Thus, QQQE gets a Hold rating from me. And QQQ, which I have been more negative on versus the broad market, also gets a Hold rating, as the 2023 market malaise continues without much resolution.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own a position in QQQ call options.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.