U.S. Debt-Ceiling Standoff Pushed ETF And Mutual Fund Investors Toward Safe-Haven Plays

Summary

- On May 1, Treasury Secretary Janet Yellen warned in a letter to Congressional leaders that a U.S. default could occur as soon as June 1 if Congress doesn’t raise the nation’s borrowing limits.

- For the fund flows week ended Wednesday, May 3, mutual fund and ETF investors were net purchasers of fund assets, injecting a net $5.8 billion.

- Investors were net purchasers of short-term assets, padding the coffers of money market funds while being net redeemers of equity funds, taxable bond funds, and tax-exempt fixed income funds for the week.

- There is still a large dichotomy between ETF and mutual fund flows—even in the government-Treasury funds macro-classification.

Feverpitched

Over the last few months, investors have had to contend with greater market uncertainty given the news about failing regional banks, rising interest rates, inflationary worries, and now rising concerns about protracted debt-ceiling negotiations—and a possible fiscal crisis, caused by a potential default.

Both sides of the political aisle appear to be digging in their heels over the debt-ceiling issue. House Republicans recently approved a bill that would raise the debt-ceiling while slashing federal spending and rolling back a range of Democratic policies to the consternation of House and Senate Democrats who contend that Congress should raise the debt limit without spending cuts or other conditions.

The current U.S. debt-ceiling of $31.4 trillion was already reached on January 19, 2023, but the markets initially ignored that news, focusing on more imminent issues (rising inflation, interest rate hikes, bank failures, and the like) because most analysts believed that the Treasury still had the means of funding the operations of the federal government until at least September. However, on May 1, Treasury Secretary Janet Yellen warned in a letter to Congressional leaders that a U.S. default could occur as soon as June 1 if Congress doesn’t raise the nation’s borrowing limits.

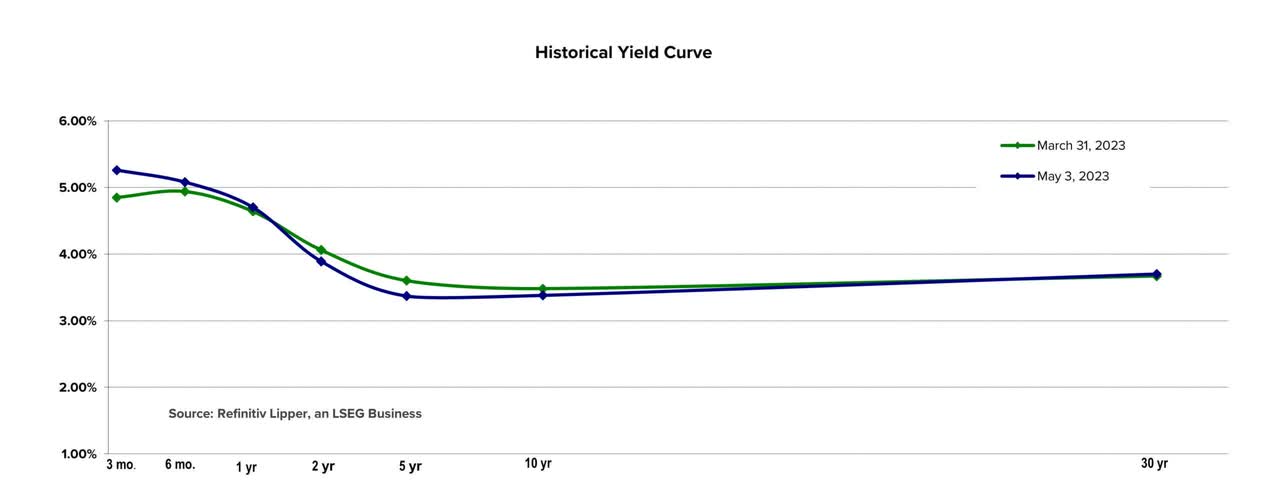

And while most pundits believe there is a very small likelihood of the U.S. actually defaulting on its debt, we have recently seen an unusual rise in the three-month T-Bill yield maturing in late-June to mid-July. So now the asset considered by global markets to be the standard risk-free rate is suddenly being impacted by credit risk because of the uncertainty of those negotiations and the Treasury’s possible inability to service the government’s obligations in a timely manner.

For the Refinitiv Lipper fund flows week ended Wednesday, May 3, mutual fund and ETF investors were net purchasers of fund assets, injecting a net $5.8 billion. However, the headlines don’t tell the complete story. Investors were net purchasers of short-term assets, padding the coffers of money market funds (+$21.5 billion) while being net redeemers of equity funds (-$14.0 billion), taxable bond funds (-$930 million), and tax-exempt fixed income funds (-$846 million) for the week.

Given the rise in regional bank concerns and the remote threat of a possible default by the U.S. government, it wasn’t too surprising to see money market funds (+$21.5 billion) witness their second consecutive weekly net inflows. U.S. Government Money Market Funds (+$8.2 billion) took in the largest draw of net new money for the week, followed by Money Market Instrument Funds (+$4.8 billion), U.S. Treasury Money Market Funds (+$3.5 billion), Institutional U.S. Treasury Money Market Funds (+$3.5 billion), and Institutional U.S. Government Money Market Funds (+$606 million), while Institutional Money Market Funds (-$1.4 billion) suffered the only net redemption. Year to date, the money market funds macro-group has attracted $414.7 billion.

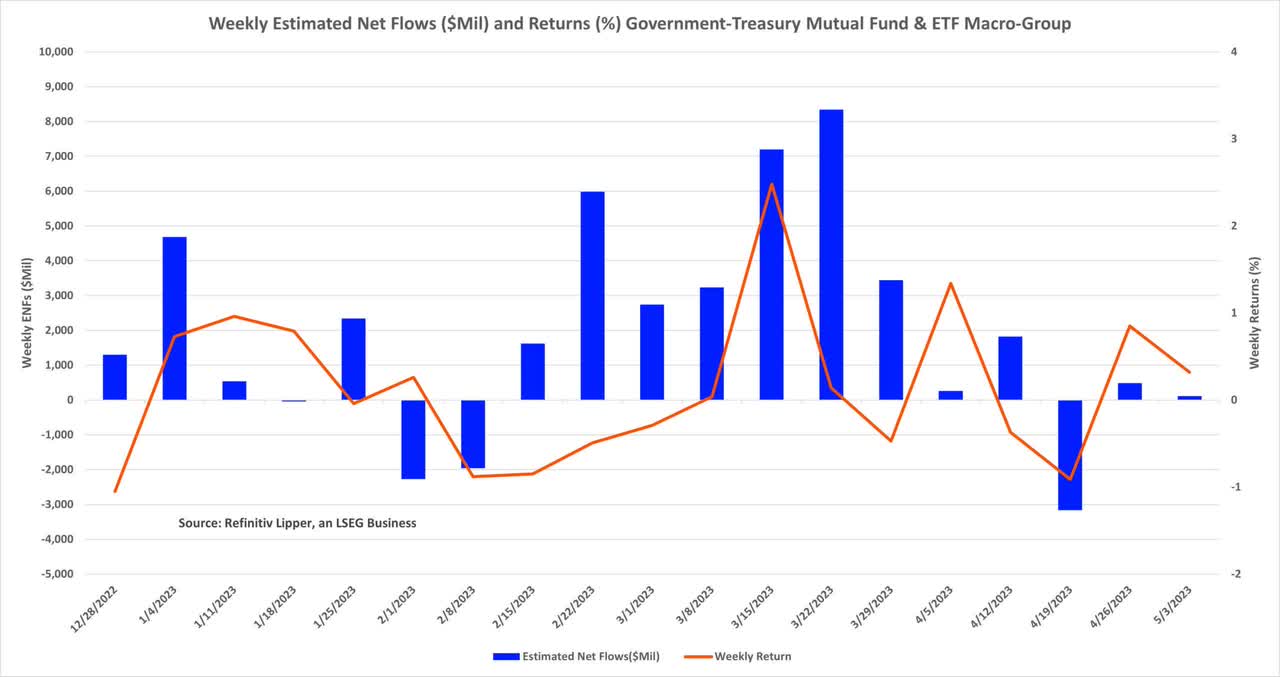

However, despite the concerns of a U.S. default and the Federal Reserve Board’s 25-basis-point interest rate hike on May 3, investors continued to inject net new money into government-Treasury funds and ETFs for the week, but with the group attracting just $114 million this past week.

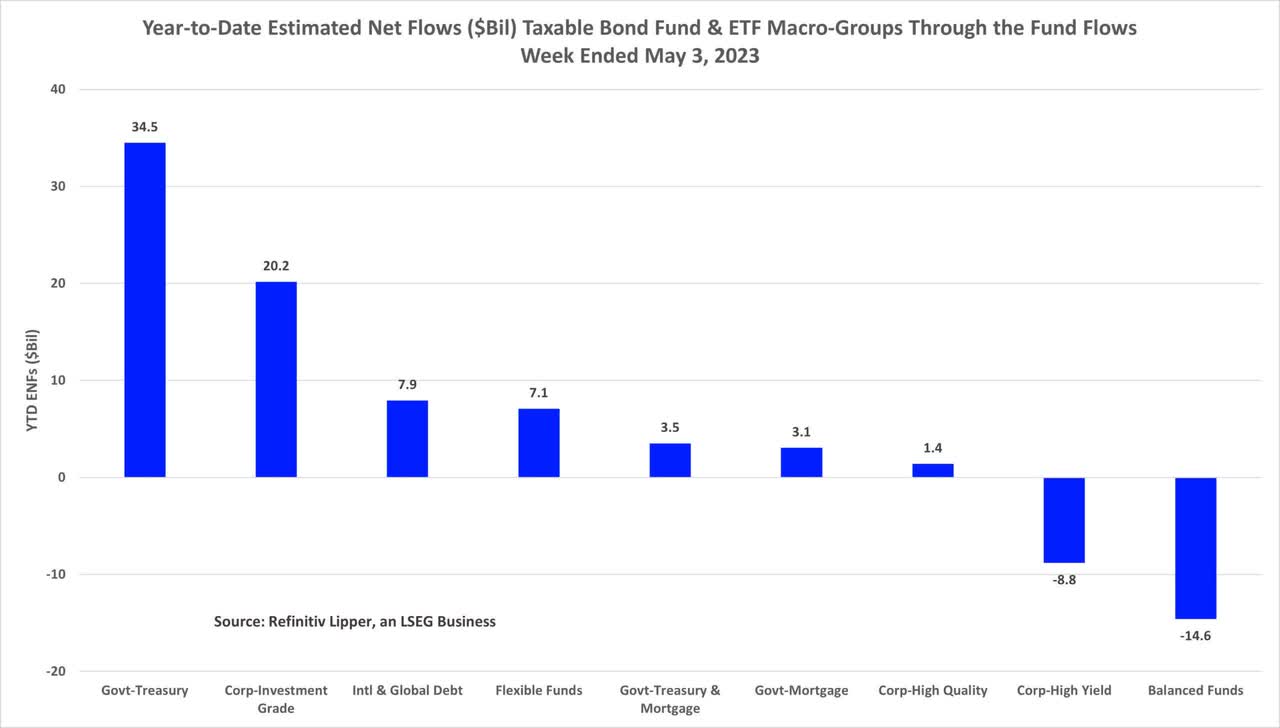

Nonetheless, year to date, the government-Treasury macro-group has attracted the largest amount of net new money of any of Lipper’s taxable bond fund macro-groups—taking in some $34.5 billion as investors continue to look for safety, followed closely by the corporate investment-grade debt funds (and ETFs) macro-group (+$20.2 billion).

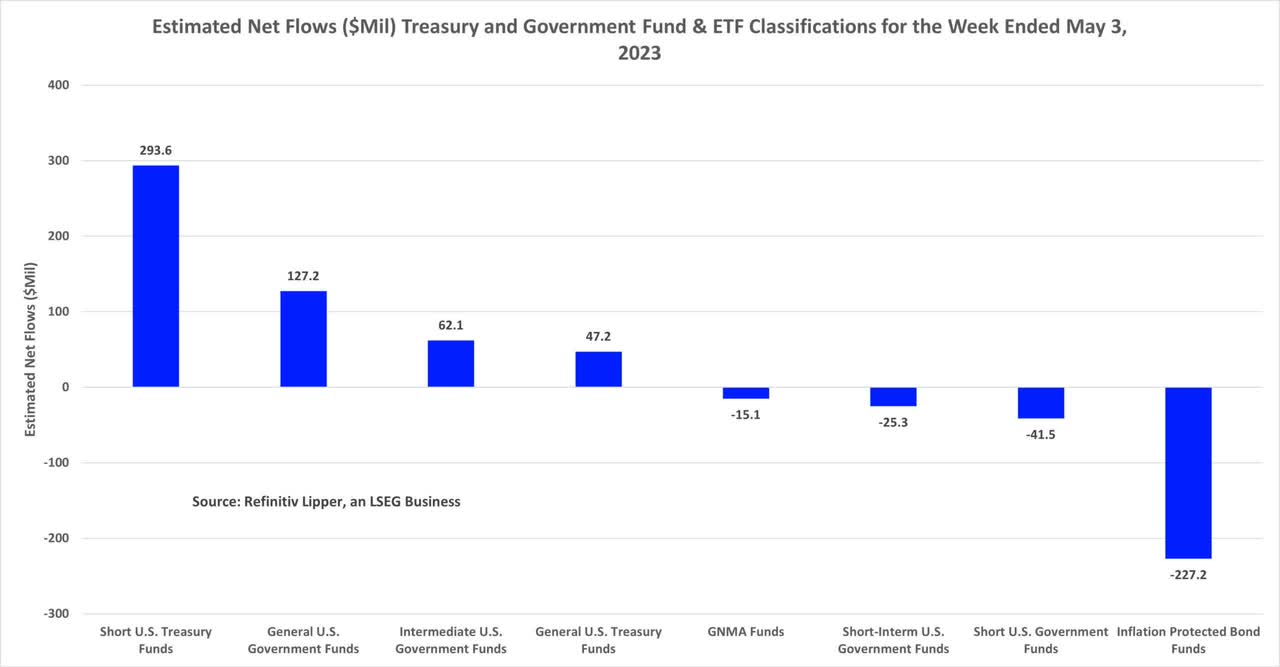

Drilling down to Lipper U.S. mutual fund and ETF taxable fixed income classifications for the most recent fund flows week, Core Bond Funds (+$2.8 billion), Absolute Return Bond Funds (+$448 million), and Core Plus Bond Funds (+$229 million) took in the largest amount of net new money, while High Yield Bond Funds (-$1.5 billion) and Corporate Debt BBB-Rated Funds (-$1.2 billion) experienced the largest outflows. However, some government and Treasury classifications managed to attract minor net inflows for the week, with Short U.S. Treasury Funds (and ETFs) attracting the largest draw (+$294 million) of those classifications.

For the flows week, SPDR Bloomberg 1-3 Month T-Bill ETF (BIL, +$235 million) took in the largest sum of net new money in the government-Treasury funds (and ETFs) macro-group, followed by iShares U.S. Treasury Bond ETF (GOVT, +$189 million), iShares 20+ Year Treasury Bond ETF (TLT, +$118 million), and GMO US Treasury Fund (GUSTX, +$115 million). Meanwhile, iShares 7-10 Year Treasury Bond ETF (IEF, -$410 million) and iShares 1-3 Year Treasury Bond ETF (SHY, -$123 million) handed back the largest individual net redemptions for the week.

As we have pointed out before, there is still a large dichotomy between ETF and mutual fund flows—even in the government-Treasury funds macro-classification, with the former attracting some $32.2 billion year to date, while the latter took in just $2.3 billion.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by