Gladstone Commercial Hits Numbers With Rarely Used Accounting, While A Debt Maturity Looms

Summary

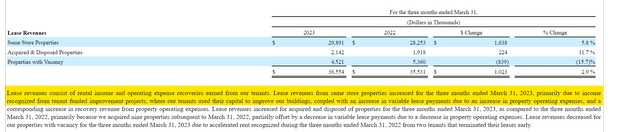

- Gladstone Commercial reported a 5.8% increase in same-store properties revenue “primarily due to income from tenant-funded improvements.” This represents a novel interpretation of ASU 2016-02.

- GOOD has not addressed the $29.3 million mortgage loan that matures in August and is secured by a leased but largely vacant office property in Austin.

- According to management, proceeds from the sales of their office properties with near-term lease expirations would approximate the debt and/or book value. These assets represent 1.85% of rents or $0.035/share.

- What happened to the Stock Repurchase Plan GOOD announced in March?

aydinmutlu/E+ via Getty Images

Upon first reviewing Gladstone's (NASDAQ:GOOD) 1Q23 Earnings Release I was surprised that they had matched consensus FFO as consensus had baked in acquisitions which did not occur. (They did have to round up to get there.) It should have been easy to project their numbers as they had a quarter with no dispositions or acquisitions. At first, I thought they must have had some termination fees like in 3Q22, but there were none. It was only after hearing management mention same store growth of 5.8% a couple times on the call that I knew something did not make sense. NNN assets should show very little same store growth. Since rents are straight lined, even cash rent bumps (unless they are based on CPI) do not show up as growth. Digging into their 10Q I found one of the most intriguing sentences I have ever read in a REIT filing with the SEC which stated GOOD is recognizing income from tenant funded improvements.

In essence GOOD is counting tenant funded improvements to a property as an asset. In theory, if a tenant invests in new fixtures in an effort to retain its employees, GOOD would treat those fixtures as an asset on its books. Given that in accounting everything needs to balance, the liability would likely be deferred rent. Over time the deferred rent is amortized with the life of the lease and the appropriate offset is an increase to revenue and equity. (When the asset is depreciated the depreciation will not hit FFO.) This treatment probably explains why GOOD provides investors with the line Tenant funded fixed asset improvements included in deferred rent liability, net in its Supplemental and Non-Cash Information. (GOOD's 1Q23 10Q p. 6)

While booking revenue based on a tenant spending money to improve an asset may sound nonsensical, I am sure GOOD and their auditors would point to ASU 2016-02 (Topic 842) for justification. GOOD adopted ASU 2016-02 in 2019. (GOOD 10-K 2019) ASU 2016-02 requires lessors to reduce the PV of their leases for any lease incentives before they go through the exercise of straight-lining the rents. For example, if the lessor pays $50,000 to their tenant to incent them to sign a lease, the PV of the lease payments is reduced by $50,000. It gets a little tricker when looking at improvements to the property that the landlord is responsible for. Before ASU 2016-02 at a high-level all improvements to a property paid for by the lessor were treated as an asset and then depreciated. Now with ASU 2016-02 if an improvement is considered to be specific for the tenant or has an expected life that is at or less than the term of the lease it is treated as an incentive and reduces the PV of the lease. GOOD seems to have used the logic of symmetry to determine that if a tenant funds improvements to an asset that increases its value and has an expected life that is greater than the length of the lease its value should be included in the PV of the lease before it is straight-lined. While I am not qualified to opine on whether this is a correct interpretation of ASU 2016-02 (Topic 842), I am certain that tenant funded improvements can not fund dividends and most investors would not want to include these improvements in their FFO calculations. (I think it must be interesting for GOOD's auditors to track and comfort the Tenant funded fixed asset improvement included in deferred rent liability, net listed on GOOD's Supplemental and Non Cash Information.) Given that GOOD's same store lease revenue growth of $1.64 million primarily came from "income recognized from tenant funded improvements", it is safe to assume at least $800k of revenues or $0.02 a share of FFO came from this source. Without this revenue GOOD would have been looking at another quarter of missing estimates.

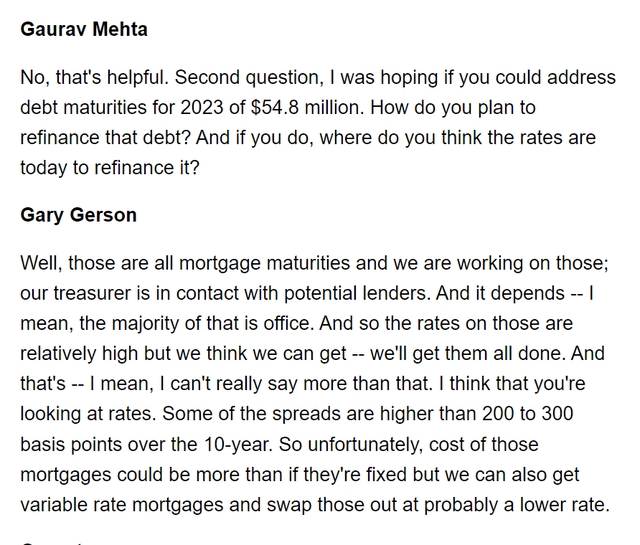

August Debt Maturity

As I wrote about in Gladstone Commercial: The Pain Is Likely Just Beginning in February, GOOD has a $29.3 million that matures in August. Given the length of time it takes to arrange an 8-figure mortgage, at this stage most borrowers would be pretty far along in the process. Even though the loan is currently open to prepayment without penalty (GOOD 8-K 08/18/22 - Schedule 6.25) , management was not able to provide details on the process. GOOD is likely facing an uphill battle as the primary tenant for the property, GM, has moved out even though their lease runs through 2026. Not something a lender wants to see. Management's answer on their plans for dealing with their 2023 debt maturities do not inspire confidence.

I believe Wells Fargo who holds the $29.3 million mortgage will probably only allow an extension to occur if GOOD sets up a hard lockbox, so all cash flow from the property stays at the asset level (and cannot fund GOOD's dividend) and GOOD agree to a material pay down. This of course will require GOOD to draw on its ATM and dilute existing shareholders by issuing equity at current prices. On the next earnings call management will no longer be able to say we will deal with this at the appropriate time as the maturity is 3 months from now. Sell side analysts will be forced to adjust their models for the outcome, which I believe will pressure FFO/share for GOOD for the back half of 2023 and beyond.

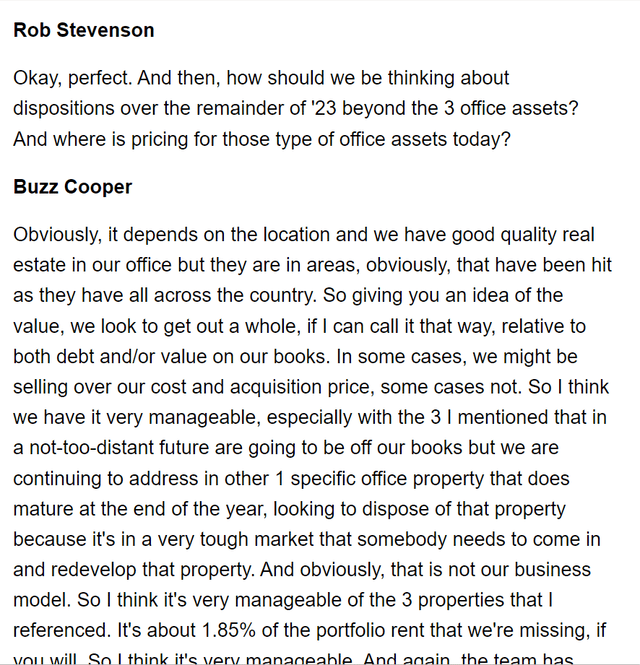

Continuing Challenges in the Office Sector

It seemed on the earnings call that management has come to the realization about just how challenging disposing of their office properties is going to be. (In the past, they have talked about positive resolutions for properties in both Utah and South Carolina.) Below is their statement from this call.

If we assume these assets, which management stated represent 1.85% of annual base rents are sold for an amount equal to their mortgages, no cash will come back to GOOD. This means 1.85% of base rents or $0.035 of FFO/share would disappear and there would be nothing to reinvest. This is another reason I would expect FFO to trend down and not stabilize to support the new dividend.

Buy Back?

On March 20th GOOD announced that its board had authorized a $50 million repurchase program. The stock traded up and GOOD bulls on Seeking Alpha cheered the news as a sign that things with the company were just fine. There was no mention of the repurchase program on the call or in the 10-Q's Subsequent Event Note, however, there was discussion of using the ATM to issue equity. It looks to me that GOOD won't likely be using this authorization. The question as to why the authorization was put in place is unanswered.

Conclusion

This was another tough quarter for GOOD. Even with the elimination of the manager's Incentive Fee, they needed to use non-cash items (tenant improvements) to hit consensus FFO. As is always the case for REITs, once they start believing their FFO numbers (not AFFO) represent cash flow and can support a dividend they are always playing catch up because they need to issue shares or debt to plug the capital hole. This game can go on for a longtime in a world where the cost debt is close to zero. In today's environment with SOFR above 5% which means borrowings on GOOD's Credit Facility come with 6.5% rate (GOOD 1Q23 10Q p. 15 and updated SOFR) and its dividend yield north of 10% the difference between FFO and cash flow is quickly revealed. This is why I believe GOOD will likely need to revisit its dividend rate in the near future.

Risks to Shorting GOOD

It is important for readers to understand that despite the problems I believe GOOD faces in 2023, the stock is very volatile as its investor base turns over. This means any number of things could cause the stock spike price to spike temporarily. A short seller without sufficient capital could be forced to liquidate their position at a loss in this scenario. It is easy to envision circumstances where GOOD's stock price rises rapidly on perceived good news, For example, GOOD could report the sale of an asset at a substantial gain or they could use accelerated rents or termination fees to exceed analysts' estimates like they did in Q322 as was discussed in my earlier piece on GOOD. Alternatively, they could announce an arrangement with their line lenders that the market views as a benefit. Additionally, GOOD will likely continue to pay its reduced dividend until its lenders tell them they need to stop. Not only does the dividend represent a cost to a short seller, I believe the dividend will put a floor on the stock price for some time as there will always be investors who are seeking yield. My assumption is that lenders will wait until the last possible moment to ask GOOD for an additional reduction to its dividend. In the interim, they will simply pressure GOOD to raise more equity to help their position in the capital stack. In other words, I believe someone shorting GOOD needs to have the patience and capital to wait until the market has a clear and informed view of GOOD's remaining 2023 and possibly 2024 FFO/share.

Additionally, short-sellers need to be prepared for the possibility that if GOOD successfully leases some of their vacant office space at attractive rates the stock could move upward.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of GOOD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.