The pivot charts indicate that the Nifty may get support at 18,236 followed by 18,209 and 18,165.

The market erased gains in the later part of the trade and finally settled the session flat on May 9 as auto, technology and pharma stocks provided support to benchmark indices, but there was selling pressure in select banking and financial services and FMCG stocks.

The BSE Sensex was down 2.92 points at 61,761, while the Nifty50 was up 1.6 points at 18,266 and formed a Spinning Top kind of pattern on the daily charts, with a neutral pattern indicating tug of war between bulls and bears.

"A small negative candle was formed on the daily chart with minor upper and lower shadow. Technically, this pattern indicates the formation of a Spinning Top or High Wave Type candle pattern, not a classical one. Such pattern formations after a reasonable upmove or at crucial resistances act as a short-term reversal pattern on the downside post confirmation," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels that the short-term uptrend of Nifty remains positive, but the signs of tiredness have started to be visible at the important resistance of 18,300 levels.

"Some more consolidation or minor downward correction is not ruled out in the short term before showing another round of upside bounce from the higher lows. Immediate support is at 18,100 levels," Shetti said.

The Nifty Midcap 100 and Smallcap 100 indices also closed flat, while the market breadth was in favour of bears.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,236 followed by 18,209 and 18,165. If the index advances, 18,324 is the initial key resistance level to watch out for followed by 18,351 and 18,394.

The Bank Nifty fell 86 points to close at 43,198 and formed a bearish candlestick pattern on the daily charts.

"The support is at 42,800, which is expected to act as a cushion for the bulls. This means that if the index falls to this level, buyers are expected to enter the market and push the price back up," Kunal Shah, Senior Technical and Derivative Analyst at LKP Securities said.

The resistance is at 43,500, which is a level that the index needs to surpass in order to reach an all-time high. If the price manages to break through this level, it could indicate a shift toward a bullish trend for the index, he feels.

As per the pivot point calculator, the Bank Nifty may take support at 43,130, followed by 43,034 and 42,878. Key resistance levels are expected to be 43,441 along with 43,537 and 43,693.

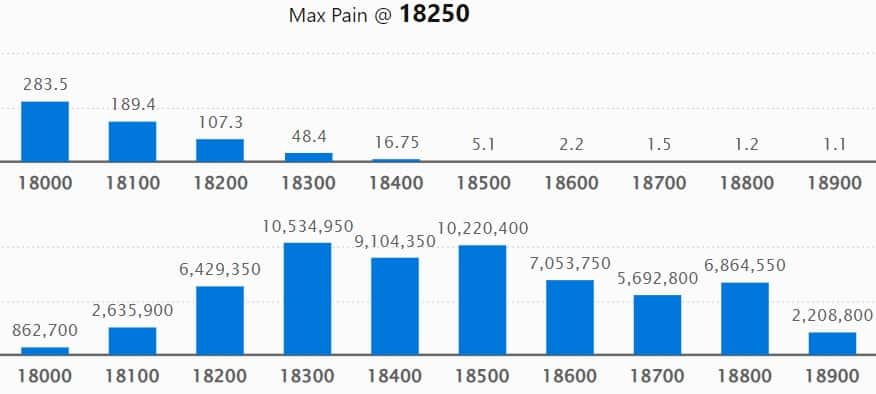

On the weekly options front, we have seen the maximum Call open interest (OI) at 18,300 strike, with 1.05 crore contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 18,500 strike, comprising 1.02 crore contracts, and 18,400 strike, with more than 91.04 lakh contracts.

Call writing was seen at 18,400 strike, which added 25.89 lakh contracts, followed by 18,300 strike, which added 23.45 lakh contracts, and 18,600 strike which added 17.38 lakh contracts.

Call unwinding was at 18,200 strike, which shed 7.8 lakh contracts, followed by 18,100 strike, which shed 2.26 lakh contracts, and 18,000 strike, which shed 77,000 contracts.

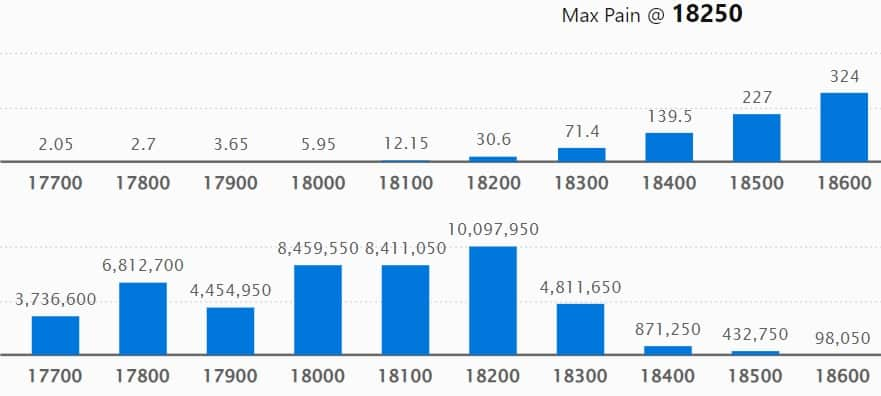

The maximum Put open interest was at 18,200 strike with 1 crore contracts, which is expected to act as an important support level in the coming sessions.

This was followed by the 18,000 strike, comprising 84.59 lakh contracts, and the 18,100 strike where we have 84.11 lakh contracts.

Put writing was seen at 17,800 strike, which added 25.87 lakh contracts, followed by 18,300 strike, which added 12.57 lakh contracts, and 18,000 strike, which added 12.32 lakh contracts.

We have seen Put unwinding at 17,500 strike, which shed 12.97 lakh contracts, followed by 17,600 strike, which shed 8.73 lakh contracts, and 18,200 strike, which shed 8.68 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in MCX India, Atul, Sun Pharmaceutical Industries, HCL Technologies, and Hindustan Unilever, among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 39 stocks, including Mahanagar Gas, Tata Communications, Indraprastha Gas, Lupin, and SRF saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 49 stocks including BHEL, Cummins India, Whirlpool, Dalmia Bharat, and HDFC AMC saw a long unwinding.

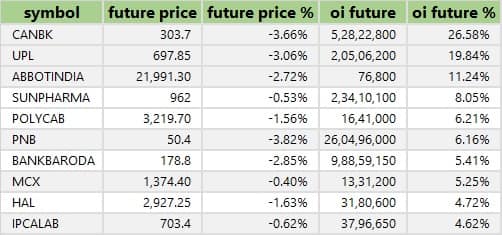

59 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 59 stocks, including Canara Bank, UPL, Abbott India, Sun Pharmaceutical Industries, and Polycab India saw a short build-up.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 42 stocks were on the short-covering list. These included Vedanta, Dabur India, Astral, Manappuram Finance, and Axis Bank.

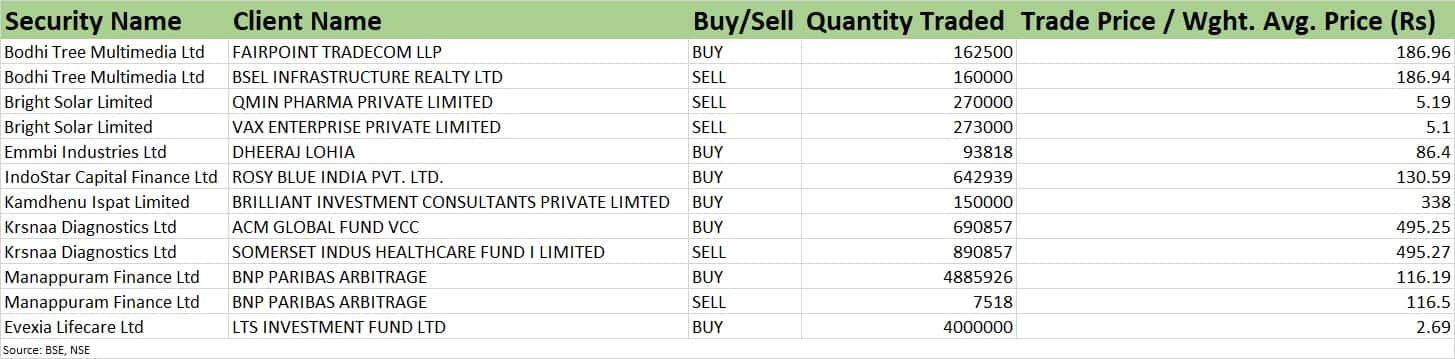

(For more bulk deals, click here)

Larsen & Toubro, Dr Reddy's Laboratories, Bosch, Escorts Kubota, Godrej Consumer Products, BASF India, Cera Sanitaryware, Chambal Breweries & Distilleries, Gujarat Gas, HG Infra Engineering, JBM Auto, Novartis India, Orchid Pharma, Procter & Gamble Hygiene & Health Care, Pricol, Relaxo Footwears, Sanofi India, and Venky's India will be in focus ahead of quarterly earnings on May 10.

Stocks in the news

Nazara Technologies: The diversified gaming and sports media platform has recorded a massive 92 percent year-on-year growth in consolidated profit at Rs 9.4 crore, driven by healthy topline and operating numbers. Revenue for the quarter grew by 65 percent to Rs 289.3 crore compared to year-ago period. EBITDA increased by 86 percent YoY to Rs 27.7 crore in the same period.

Apollo Tyres: The tyre manufacturer has registered a 277 percent year-on-year growth in consolidated profit at Rs 427.4 crore for the quarter ended March FY23, supported by strong operating numbers. Revenue from operations at Rs 6,247.33 crore increased by 12 percent over a corresponding period of the last fiscal.

Greaves Cotton: The engineering company has completed the first stage acquisition of 60 percent shareholding in Excel Controlinkage.

Raymond: The company has received board approval for the issuance of non-convertible debentures of up to Rs 2,200 crore in two or more tranches on a private placement basis to associate Raymond Consumer Care, for repayment of external debt.

SRF: The chemicals company has increased its capex to set up an aluminium foil manufacturing facility to Rs 530 crore from Rs 425 crore earlier. In March this year, the company incorporated a wholly-owned subsidiary for setting up the said manufacturing facility. The increase in capex is due to changes being made to the machine configuration to enhance output, product portfolio, and quality along with some increase in civil and preoperative expenses.

Castrol India: The automotive and industrial lubricant manufacturing company has registered an 11.3 percent year-on-year decline in profit at Rs 202.5 crore for the quarter ended March FY23, dented by disappointing operating numbers. Revenue from operations at Rs 1,293.9 crore increased by 4.7 percent compared to the corresponding period last fiscal.

Latent View Analytics: The digital analytics consulting and solutions firm has reported a 4 percent year-on-year decline in profit at Rs 34.2 crore in March FY23 quarter, impacted by disappointing operating numbers. Revenue from operations jumped 20 percent YoY to Rs 141 crore in Q4FY23.

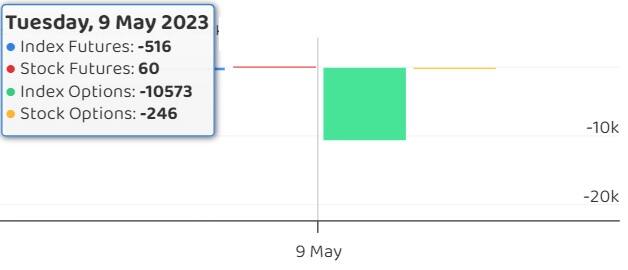

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,942.19 crore, while domestic institutional investors (DII) purchased shares worth Rs 404.70 crore on May 9, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange added Canara Bank, and retained BHEL, GNFC and Manappuram Finance to its F&O ban list for May 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.