Rental Properties Vs. Residential REITs: Which Is Better?

Summary

- Rentals have much more leverage earlier on, which means beginners can earn higher returns.

- REITs have lower variance of returns due to diversification and lower leverage. They also have better economies of scale, which results in better operating margin.

- As more rentals are added to a portfolio of private real estate, the returns will begin to look like that of a REIT.

- REITs and rental properties share the tax benefits and the ability to buy at discounts. These are not differentiating factors between the two.

Kuzma

The choice between investing in rental properties and investing in REITs is a common question after an investor reaches a point where either option is available. I am at that stage right now, having recently closed on a second rental property and having recently added to my REIT holdings. This article synthesizes my research findings and conclusions about the physical real estate versus REITs question. It is specifically tailored to readers who are (or could be) only beginning their physical property investment journey. For instance, to keep an apples-to-apples comparison, I will only talk about residential REITs here because real estate investors generally start with residential real estate. Most loans available to beginner property investors are specifically for residential properties and not for commercial properties.

Overview of Findings

Physical real estate has a much higher variance of returns. Residential REITs should on average, and over a long time frame, perform better than the average physical real estate investor’s property portfolio, if we hold leverage constant.

Because physical real estate offers more leverage, this alone can lead to average returns higher than that of the average residential REIT initially. It is important to note that this only occurs around the beginning of the property portfolio. As the number of properties in the average portfolio increases, the return of that whole portfolio should begin to approach that of the average residential REIT. However, this leverage effect is substantial at early stages, which is important for the intended audience of this article: beginner property investors.

Nearly all tax benefits are shared between physical real estate and REITs, so taxes are not a consideration for this analysis. Buying assets below market value is possible for both options – foreclosures and idiosyncratic negotiations for physical properties and discount to NAV for REITs – so this is not a consideration either.

Physical Real Estate

Physical property will have higher variance of returns because of personal control and concentration. This is the first advantage, but it is also a double-edged sword. One can manage a small portfolio of properties with a highly idiosyncratic use case for each property. For instance, a deal with the tenant of one single family home may allow him to transform some rooms into Airbnb’s and share the sub-leasing profits with the landlord. This could provide outsized returns, assuming the tenant is on board and delivers consistent results. Another property in the portfolio might be used to throw house parties with an entry fee. This could occur on weekends and the rest of the time the house might be used for short term rentals. The point is that each property’s utility can potentially be extended to yield much higher than average returns. One tradeoff is the lack of diversification. Having to evict a single tenant could freeze a big portion of total cash flow for a while. Another tradeoff is that determining and implementing appropriate idiosyncratic strategies for each house takes work, and the price of labor and time must be factored into the calculation of real returns.

The second advantage of physical real estate is that one can start out with enormous leverage through a 20% down payment, fixed-rate mortgage. The leverage is relatively “safe” because it is secured by the purchased asset (the house) and it is predictable because the payment amount is fixed. Moreover, the time frame for default takes a while, and grace periods are generally applicable to late payments. Thus, mortgage leverage is very different from margin trading leverage. Margin leverage is secured by a much more volatile asset – existing stocks which have a constant mark-to-market PNL and a much faster enforcement period. Most brokerage terms of service will state that they do not even have to alert you to start liquidating assets in the event of a margin call (the call itself is a courtesy). With margin leverage, the “default” can be forced upon you under certain conditions. The interest rates for margin leverage also fluctuate, which adds to unpredictability.

Using special mortgages like the VA or FHA loan can also lead to much, much higher leverage. VA loans are 0% money down and FHA loans are 3.5% money down. Both loans may only be used on a residential property intended to be the buyer’s primary residence. However, multi-family homes are valid for such loans, which means that the buyer can live in one unit and rent out the others (up to three other units, because the max is four units, or “quadplex”). This strategy allows intermittent rental cash flows to help service the mortgage, all while the buyer has a place to live and builds equity in the property. The buyer can also move out of the home after living there for a while, change primary residence, and then proceed to rent it out. All of this can be accomplished with very little upfront cost, which makes the leverage truly enormous.

The question of leverage is ultimately about the source of financing. Conventional, FHA, and VA mortgages are not the only options. One might borrow money from family and friends or negotiate an owner financing solution. These are other manifestations of how idiosyncratic features of each individual deal may be used to generate above average returns. Just like the first advantage, leverage is a double edged sword. A portfolio of several mortgage-financed properties, all relying on rental income to pay the mortgages, can easily suffer foreclosures across multiple properties if rents stop coming in. This can rapidly erase equity value, even if the asset values do not decrease.

The key takeaway for physical real estate investment is that its advantages are greater control and much higher leverage. These advantages also have tradeoffs.

Residential REITs

Residential REITs will have lower variance of returns because they are diversified by nature and the management of the properties are stabilized by the consistency of a publicly traded company’s leadership who are beholden to shareholders. Right here, we see that the tradeoff made by private real estate investors to gain control and concentration is an advantage of REIT investors. REIT investors do no work at all (no control) and enjoy diversification (minimized concentration). The tradeoff is that REIT investors give up the potential for very abnormal returns.

A major difference between REITs and private real estate is economies of scale. A REIT could have contracted maintenance teams who, because of the business relationship, can provide quality service at lower costs. This makes the average REIT’s operating margins better than the operating margins of the average private real estate investor. Assuming equivalent leverage in REITs and private real estate portfolios, the REITs should generate higher returns due to their lower average operating costs derived from their better economies of scale. Another way to say this is that REITs should have better unlevered free cash flow margins.

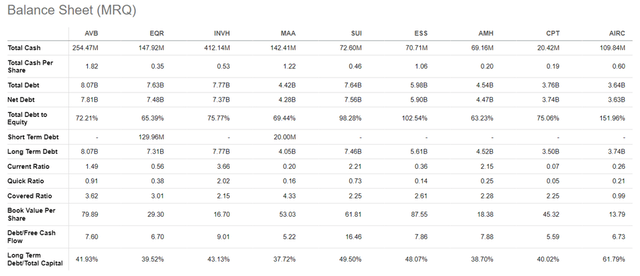

Another big difference between REITs and physical property is leverage. REIT leverage is visible from the published balance sheet. Assets divided by equity gives us a good measure of this leverage. REIT leverage is never as high as the 5x leverage offered by a 20% down payment mortgage. For example, below are balance sheet metrics for a few of the biggest residential REITs by market cap. You can set up a similar side-by-side comparison using Seeking Alpha’s “Comparisons” feature. I used the Seeking Alpha “Stock Screener” to find these REITs. Both multi-family and single-family residential REITs are included.

Residential REITs Comparisons (Seeking Alpha)

Look at the bottom row. This is roughly debt divided by assets. It is clear that debt is generally less than the book equity value (another way to see this is that the “Total Debt to Equity” row is mostly less than 100%), which puts the leverage just under 2x.

If we glanced at market caps and enterprise values, we see that the effective leverage based on the market value of equity is even smaller. I calculated the weighted average leverage and got 1.33x. To be clear, this is the weighted average enterprise value divided by market cap, weighted by the size of enterprise value.

Residential REITs Comparisons (Seeking Alpha)

The key takeaway for REITs is that their lower variance is due to both lower leverage and greater diversification. Also, economies of scale can lead to better operating margins in REITs.

Reconciling the Differences

It should be clear that the higher leverage of private real estate in the earlier stages of a portfolio can contribute to much higher total returns initially. As more properties are added to the portfolio, the total leverage tends to shrink. There are a few reasons for this:

- Lenders use debt to income ratios to determine interest rates and preapprovals. Assuming rents are greater than mortgages but not substantially greater, the investor will have to make larger down payments in later purchases to keep the debt to income ratio at a manageable level.

- The investor might use cash to prematurely pay down existing debt to lower the debt to income ratio.

- The outstanding debt from earlier mortgages would have organically decreased because a little bit is paid off monthly.

- The value of properties (and equity) might increase, which lowers the leverage without affecting the amount of debt.

The leverage of a portfolio that is consistently adding new properties will eventually begin to approach the leverage of REITs. Likewise, the year-over-year returns of such a portfolio will also begin to approach the year-over-year returns of REITs. An astute property investor might then develop the same kind of cost-saving business relationships which REITs have, taking advantage of increased economies of scale. At that point, the portfolio is effectively a REIT.

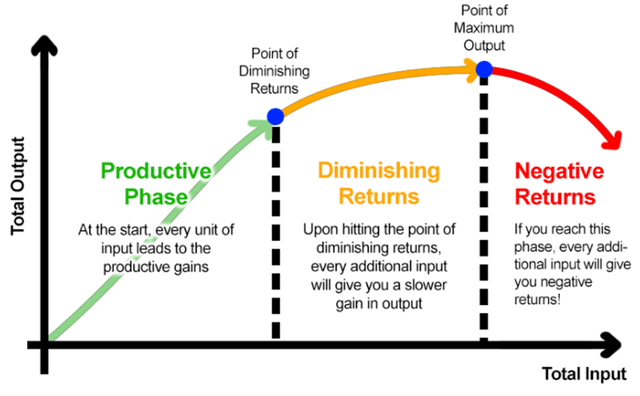

This thought experiment shows that beginner physical real estate investors have the potential to benefit from the “productive phase” in the Law of Diminishing Returns. But later on, the marginal returns will be similar to that of REITs.

Law of Diminishing Returns (Personal Excellence)

The first property can be bought with over 28x leverage, in the case of using a 3.5% down payment FHA loan. If things go well, this would be a very, very high ROE. The second property might use a conventional, 20% down payment mortgage. At this point, the weighted leverage of the portfolio might be around 8x – a total of 25% down payment and accrued equity for a total 200% of properties (I’m making some simplifying assumptions like the properties are the same value). If things go well, these two properties could generate a ROE that is still much higher than the total return of the average residential REIT. The third property could use another conventional loan and the total leverage ratio might drop to around 5x. To acquire the fourth property, the investor might have to provide more than a 20% down payment. At this point the total leverage ratio will clearly be below 5x. We can see that each additional property contributes less to the portfolio’s overall leverage, and therefore return potential. The portfolio return and leverage begins to approach that of a REIT as more and more properties are added.

When people say they can make over 30% annual returns in real estate, this is not inaccurate. It is feasible for the average beginner to make returns far exceeding XLRE or SPY returns on single deals here and there. What they do not say is that the process cannot scale because of the Law of Diminishing Returns.

Clearing Up Misconceptions

There is a misconception that private real estate gets better tax treatment. The reality is REITs have the same tax advantages as private real estate. Landlords and REITs alike may claim tax deductions from depreciation and mortgage interest. Unlike normal dividend stocks, REITs do not have double taxation. Pre-tax income passes through to shareholders and are taxed mostly as ordinary income. Private real estate has the same tax treatment because rent passes to the landlord and is taxed as ordinary income. Both REITs and landlords can do 1031 exchanges to delay paying capital gains taxes on property sales. In the case of a landlord, he can pass the properties to heirs and make use of a stepped-up basis to basically delete the capital gains tax. In the case of a REIT, the company’s lifespan is theoretically indefinite so it can delay paying capital gains taxes indefinitely.

Another misconception is investors can only buy discounted real estate through REITs. This is done by identifying REITs which are trading at a discount to their portfolio NAV. Discounts are abundant in physical property as well. For example, one can usually find bargains at foreclosures. Numerous opportunities are generated by sellers who are desperate for quick cash. The work required to locate and capitalize on these physical property bargains would probably be comparable to the work required to accurately identify REITs trading at a discount.

The last misconception, which isn’t completely wrong, is that REITs lack leverage. In comparison to smaller and younger private real estate portfolios, REITs have less leverage. But a REIT’s total returns represent the ROE generated by many leveraged property transactions. So REITs are leveraged as a product. This is like how SPXL is leveraged because leverage is embedded into the design of the product. One could argue that buying SPXL with cash is not a leveraged position, but most would agree that the buyer is in fact somewhat leveraged.

So Which Is Better For You?

The answer to this question is always “it depends.” But in this case it depends on fairly simple things. A new investor will on average get higher returns with physical real estate because of the much higher leverage and for being in the high-growth phase of the Law of Diminishing Returns. However, the variance of possible returns is larger and the investor will need to do some work too. Therefore, choose a private investment property if you:

- Heavily prioritize a superior expected value of returns

- Don’t care much about a higher variance of possibilities (i.e. are risk neutral)

- Are okay with some extra work

If you fail to meet any of these three qualities, a residential REIT is a much more advisable. If you do not meet any of them, then definitely stick to REITs and know that the only house you should ever buy is the one you live in.

The unlisted fourth item on this list is “if you believe you have special knowledge about real estate markets and management.” Think of this as “alpha.” Since alpha is a zero-sum game, I omitted it from the list. The average person has no alpha so beginners will do better to make this decision based on their personality and not on the talents they hope to possess.

In a future article, I will discuss a way to obtain higher leverage on equity invested in residential REITs. This allows one to effectively turn a publicly traded portfolio of properties into a single property and own it using leverage similar to that of a conventional adjustable-rate mortgage. The leverage will not use margin – that is, it will not drop portfolio cash value below 0.

Stay tuned!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.