DBA ETF: Agriculture Offers Upside In May 2023

Summary

- The war in Ukraine continues to impact Europe’s breadbasket- Ukraine and Russia are leading producers, and the Black Sea ports are a logistical hub.

- The trend in the U.S. dollar supports agricultural commodity prices- The dollar index is at a critical level.

- The weather is the critical factor- Mother Nature dictates the path of least resistance of prices- The world depends on bumper crops.

- Invesco DB Agriculture Fund ETF holds grains, softs, and animal proteins.

- The trend is your friend - the DBA ETF has been in a bullish trend since June 2020.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Olga Kostrova /iStock via Getty Images

Agricultural commodities feed and increasingly power the world. After falling to pandemic-inspired lows during the first half of 2020, grains, soft commodities, and animal protein prices increased significantly. Grain prices reached multi-year or all-time highs in 2022, and animal proteins have made higher lows and higher highs over the past three years. Soft commodities were the best-performing sector of the commodities market in Q1 2023, posting a double-digit percentage gain. In Q2, sugar, and cocoa futures rose to new multi-year highs, and FCOJ reached a new record peak. Cotton was stable, but coffee recovered and probed above the $2 level before pulling back.

The Invesco DB Agriculture Fund (NYSEARCA:DBA) holds agricultural futures in grains, animal proteins, and soft commodities. After a steep rally from June 2020 through May 2022, DBA corrected and has been consolidating in a trading range. Risk-reward and fundamentals favor the upside in DBA in May 2023.

The war in Ukraine continues to impact Europe’s breadbasket

In May 2023, farmers in the Northern Hemisphere planted the seeds that are growing into the crops that feed and increasingly power the world. In Europe’s breadbasket. There are more pressing matters in Europe’s breadbasket as the war in Ukraine continues to rage, and the fertile soils that produce wheat, corn, and other grain products are battlefields. Meanwhile, the Black Sea Ports, a critical logistical hub distributing grains worldwide, remains a war zone.

The ongoing war in Europe’s breadbasket continues to put pressure on other growing regions to satisfy the growing demand for agricultural products during the 2023 crop year.

The trend in the U.S. dollar supports agricultural commodity prices

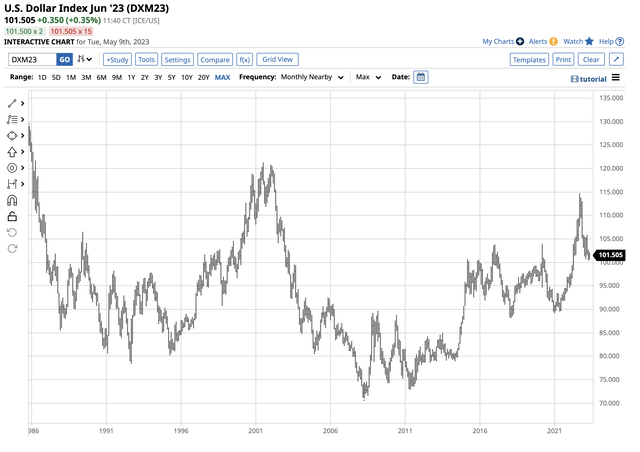

The U.S. dollar is the world’s reserve currency and the pricing benchmark for most commodities, including agricultural products. After reaching a two-decade high in September 2022, the dollar index, measuring the U.S. currency against the other world reserve foreign exchange instruments, has declined.

Chart of the U.S. Dollar Index Futures Contract (Barchart)

The chart highlights the rise in the dollar index that took it to 114.745 in September 2022, the highest level since May 2002. The index ran out of upside steam and declined to around the 101.50 level on May 9. Since the dollar is the benchmark pricing mechanism for most raw materials, a falling dollar tends to be bullish for commodity prices as they become less costly in other currency terms, supporting dollar-based prices because of the elasticity of demand. Since agricultural products feed and fuel the world, the falling dollar index is a supportive factor. In a recent Seeking Alpha article, I highlighted the reasons for continuing bearish price action in the U.S. dollar.

The weather is the critical factor

Mother Nature is the leading cause of agricultural commodity volatility. Drought, floods, natural disasters, and crop diseases can cause shortages during the crop year. In 2012, drought caused corn and soybean prices to rise to record peaks. Adverse weather conditions can wipe out a crop during the growing season. Meanwhile, in 2022, the war caused price spikes that took corn and soybeans to highs that stopped short of the 2012 peaks. Nearby soybean futures rose to $17.84 per bushel in June 2022, only 10.75 cents below the 2012 high. Corn futures rose to $8.27 per bushel in April 2022, just 16.75 cent shy of the 2012 record peak. Meanwhile, nearby CBOT soft red winter wheat futures had reached an all-time $13.3450 high in 2008. Since Russia and Ukraine are leading wheat-producing countries, the price eclipsed the 2008 high in March 2022, reaching $14.2525 per bushel.

As the 2023 growing season progresses, top grain and oilseed futures prices have declined. On May 9, the new crop contracts were at the following levels:

- New-crop November soybeans: $12.5550 per bushel

- New-crop December corn: $5.1775 per bushel

- New-crop September soft red winter wheat: $6.4975 per bushel.

The new crop prices are significantly below the 2022 highs and under the nearby July futures prices, indicating optimism over the 2023 crop. However, in May 2023, the new-crop price levels are a leap of faith, considering Mother Nature’s plans for the weather and the ongoing war in Europe’s primary growing regions.

Meanwhile, the USDA will report on crop progress and update price and supply forecasts in its upcoming May World Agricultural Supply and Demand Estimates Report this Friday, May 12. The USDA will release the May WASDE report at noon EST.

DBA holds futures spanning three sectors

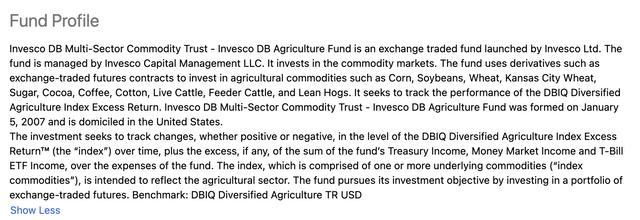

The fund summary for the Invesco DB Agriculture ETF states:

DBA Fund Profile (Seeking Alpha)

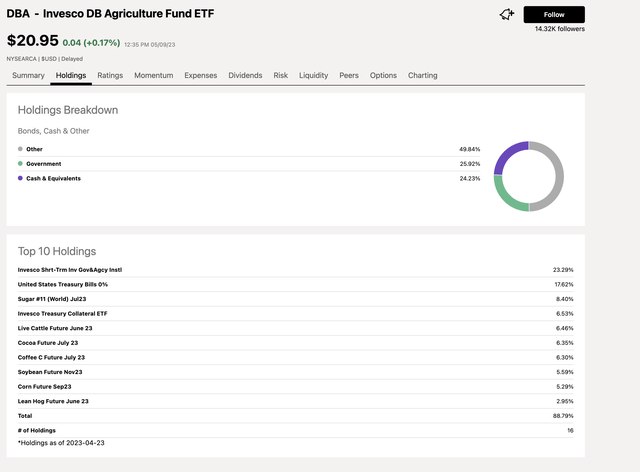

As of May 9, DBA had the following holdings:

Top Holdings of the DBA ETF Product (Seeking Alpha)

Aside from corn and soybean futures, DBA also held long positions in animal proteins (cattle and hog futures) and soft commodities (sugar #11, cocoa, and coffee futures). The animal proteins reflect grain prices as soybean meal and corn are critical inputs in animal feeds. Brazil is the leading producer and exporter of sugarcane and Arabica coffee beans, and the Ivory Coast and Ghana dominate the annual cocoa output. Cattle and hog prices have been trending higher since the 2020 pandemic-inspired lower, and sugar, coffee, and cocoa futures reached multi-year highs over the past months.

At $20.95 per share on May 9, DBA had nearly $900 million in assets under management and charges a 0.91% management fee. DBA trades an average of over 615,000 shares daily, making it a liquid exchange-traded fund ("ETF").

The trend is your friend

DBA fell to a pandemic-inspired $13.15 low in June 2020.

Five-Year Chart of the DBA ETF Product (Barchart)

The five-year chart shows the pattern of higher lows and higher highs that took DBA to a $23.01 high in May 2022, a 75% rise in two years.

DBA corrected to just below the $21 level on May 9 and has been consolidating from $19 to $21 per share since June 2022. After falling to $19.25 in January 2023, DBA has made higher lows and higher highs over the past months, reaching its latest high at $21.37 in mid-April.

At least four factors favor the upside for DBA and agricultural commodity prices in 2023:

- The demand for the products that feed and increasingly power the world is rising, with the global population, closing in on eight billion. The growing population increases worldwide food and energy requirements.

- The war in Ukraine puts pressure on other countries to produce bumper crops. Any weather or other issues that interfere with production could cause sudden shortages.

- The USDA’s recent WASDE reports have highlighted global inventories that have tightened supply and demand balance sheets, increasing the odds of market deficits.

- The highest inflation in decades pushes production costs higher, putting upward pressure on agricultural commodity prices.

While many agricultural commodity prices have moved lower from the 2022 and recent 2023 highs, the bullish trend continues to point to higher prices. DBA has been trading in a range, but the technical trend and fundamental underpinning favor an eventual upside break in the ETF.

The four issues facing the agricultural markets and more are compelling reasons to add agricultural exposure to portfolios via Invesco DB Agriculture Fund ETF. People worldwide need to eat and power their lives, making agricultural products essential. DBA is an ETF that is likely to hold its value. Any surprises from Mother Nature or shortages created by the geopolitical tensions in Europe could cause another upside spike for Invesco DB Agriculture Fund ETF over the coming weeks and months.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount for new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.