Moncler: Stone Island Disappoints But China Recovers

Summary

- China restarts and consequently so does Moncler.

- The Stone Island brand is still struggling, especially in the Americas. Work will be done on brand perception with the new CEO.

- I like this company but not at the current price.

fbxx

Companies operating within the luxury market at the moment are not feeling the burden of the recession, and Moncler (OTCPK:MONRF) is one of them.

The Italian fashion company this quarter managed to beat analysts' estimates; in fact, expected revenues were €685.66 million versus the reported €726 million.

As we will see later this was possible thanks to the recovery of demand in China, a crucial business area. Sales of the Moncler brand experienced a strong increase YoY, while the Stone Island brand still struggled a bit. Overall, this Q1 2023 was positive especially considering the macroeconomic environment, but this company is increasingly dependent on China.

Comment on Q1 2023

Before I begin the commentary, I would like to point out that these results are in constant currency to aid comparability between Q1 2023 and Q1 2022. With that said, here are the figures from this quarterly report.

Revenues increased by 23% over Q1 2022, which is a very good result. However, the company's two main brands performed very differently:

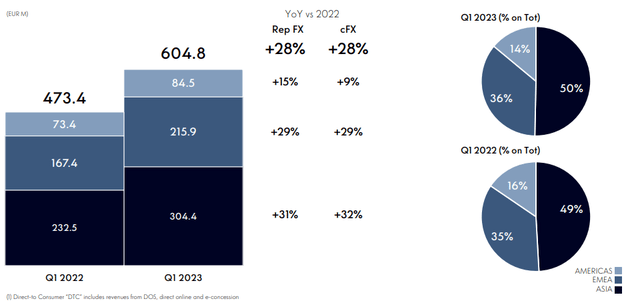

- Moncler grew 28% YoY and generated revenues of €604.80 million.

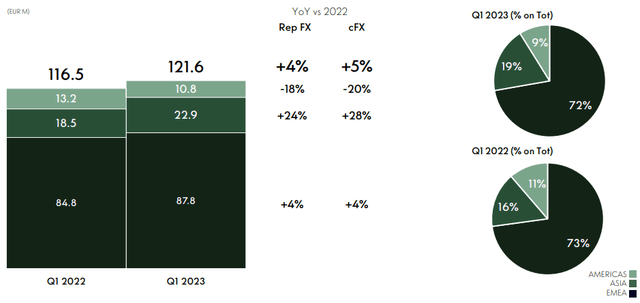

- Stone Island grew 5% YoY and generated revenues of €121.60 million.

While previously the Moncler brand was responsible for 80% of total revenues, this figure has now updated to 83%. In short, it certainly pleases the overall growth but worries the low growth of Stone Island. But why is it growing so slowly? Mainly there are two reasons.

The first reason is related to the changing business model that is increasingly oriented toward DTC rather than wholesale.

In fact, Stone Island's revenues increased 40% YoY in the DTC segment, while the wholesale segment had a 7% decrease. What's more, the weight of the latter is becoming less and less relevant. There is a move toward a strategy that can lead the Stone Island brand to be increasingly exclusive.

The second reason relates to a brand perception problem, which is that Stone Island is still not appreciated in the same way as Moncler. There are regions where this stands out more, for example The Americas.

As we can see in this image, the Stone Island brand had a sharp 20% YoY drop in this region. The fact that the sales of this brand in the Americas has such little weight meant that such a result did not weigh too heavily on total revenues. However, as Luciano Santel said, work will be done specifically on brand perception in the future so that the company will not be too dependent on the Moncler brand. And that is also why Robert Triefus was appointed as the new CEO:

We saw, we realized the need of having a new leadership for Stone Island with all the responsibility and the capability to drive the business and the brand and the brand first. So that's why we decided to get in touch and at the end to hire Robert Triefus. I mean I think you know his CV. I mean, he has spent the last 15 years in Gucci, contributing to the strong brand success of Gucci before in Armani. And so he is bringing his strong know-how and experience in the brand strategy, which is something that's really important because, again, we have, in our hands, a beautiful brand with a great potential. Of course, now we have to increase the voice of that brand, the audience of that brand and the relevancy of that brand. So that's why, I mean, we rely on the capability and the strong experience of Robert Triefus.

As for the Moncler brand, however, we are in a totally opposite situation.

The 28% YoY growth was made possible by the 32% growth in the Asian segment. Clearly, the fact that there was a loosening of lockdowns in China this quarter in contrast to Q1 2022 weighed heavily here. So, this growth is not sustainable in the long run, but it is still a great result that shows the full recovery of revenues from the east. China is a key building block for this company, and about 1/3 of revenues come from there; more generally, 50% of revenues come from Asia. In short, there is a huge dependence towards this geographical area.

Finally, to conclude the analysis of this quarterly, I think it is important to highlight how pricing has affected sales volumes. On this aspect, a question was asked by Louise Singlehurst during the conference call; Luciano Santel's response follows:

About price mix and prices compared to volume. In the first quarter, I mean the volume represented about 70% of our comp. The other 30% was price. You may remember, I'm sure you do remember that we increased the prices about 10% in this current spring/summer season, mostly in Europe, but not only. And I mean, the price impact was about 30% of our gross rate comp growth rate. The other 70% was volume. Very interesting and important highlight because it means that the price resistance has not been strong at all. I mean people have bought our brand notwithstanding the price increase and increase in the volume of our business.

In short, pricing did not reduce sales volumes; on the contrary, sales volumes increased. Price elasticity has been basically absent, and customers have been buying more and more despite rising prices. Personally, I expected such a result, after all, someone who buys a €1500 Moncler jacket will probably not take into account €50-100 more. Haute couture brands have a low elasticity because those who buy these products are typically wealthy people (obviously not always). Currently, luxury is a sector that has not been affected by any economic slowdown, and we can also see this from the outstanding performance of LVMH, the luxury company par excellence.

Overall, I rate this quarterly as positive, but I would appreciate it if the company would limit its dependence on China. Sometimes it is better to geographically diversify your revenues, and I think this is the case. Personally, being Italian, I am very familiar with both Moncler and Stone Island brands and I know how valued they are, however I would not buy this company at the current price, as I believe it is not at a discount. Five or six months ago it might have been a good time, around €45-50 per share, now I prefer to wait for a drop.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.