AOK: Just Buy IVV And IUSB Instead

Summary

- AOK is another one of these ETFs that make you pay for no value-add, where its performance is mostly dictated by a combination of two lower maintenance ETFs.

- While AOK would benefit from peak rates, which we think is definitely coming soon, buying IUSB and IVV in the proportions that AOK owns them is cheaper.

- Since index investors benefit from the lowest possible cost with a long-term and tax-efficient strategy, AOK is strictly worse than IVV and IUSB in combination.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Torsten Asmus

The iShares Core Conservative Allocation ETF (NYSEARCA:AOK) is one of these ETFs that we truly believe shouldn't exist, and takes extra money for almost no service. Since ETF investors are looking to keep costs low and make long-term gains, having more than twice the expense ratios actually compounds into a real difference over time. AOK is a way to bet on peak rates, being dominated by the iShares Core Total USD Bond Market ETF (IUSB), but you can reconstruct the holdings in AOK in the same proportions for less ongoing expense ratios. A peak rate bet makes sense, but not through AOK.

AOK Breakdown

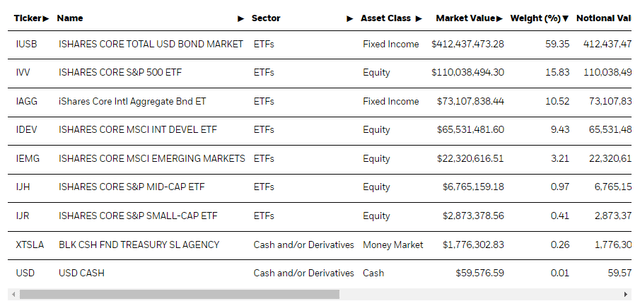

Here are the top holdings in AOK.

Top Holdings AOK (iShares.com)

The portfolio is dominated by IUSB and the iShares Core S&P 500 ETF (IVV), which together account for 75% of the allocation. Both are broad portfolios of the two major US asset classes of bonds and stocks, and together their expense ratio adds up to 0.09%, against the 0.21% expense ratio (gross of a waiver into 2026) of the AOK.

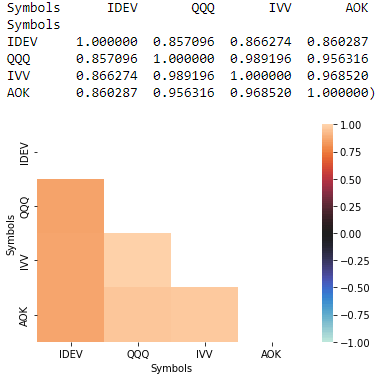

AOK has some additional exposure to foreign market ETFs, namely in foreign bonds, which adds another 10% to the overall allocations of the top three holdings, totaling 85%. The expense ratio of the iShares Core International Aggregate Bond ETF (IAGG) is 0.07%, so the total 0.16% expense ratio for the portfolio you build with 85% of AOK. You pay disproportionately for the last leg of diversification that AOK provides with ETFs you may not even want. IAGG has a lot of Chinese fixed income exposure, about 17%, and otherwise a lot of Japanese bonds which don't yield a lot and therefore have higher duration risks even with a small upward revision in rates, which may or may not come given a new, more hawkish head of the BoJ. Beyond the IAGG you get the iShares Core MSCI International Developed Markets ETF (IDEV), which itself has so much wallet share and correlation to US equity markets since it's all the large-cap stocks from Europe that it adds nothing to AOK in way of diversification.

Correlations (VTS)

Bottom Line

There is a reason to bet on peak rates, and with AOK so heavily levered to fixed income there is exposure to that. The banking issues, especially in regional banking, should take their toll on the credit environment, as we've been saying since the moment the SVB blowup happened. This should impact corporate spending cycles, and certainly impact household wealth since banking concerns spirals with real estate valuations. Inflation is probably coming close to reversing. Even if consumer spending remains stubbornly high, higher rates are going to start doing a number on corporate profits and that's going to transfer into corporate spending and hiring, which will surely hit consumers. This maturity wall is coming in 2024, so the budgeting for this will likely start over the next six months at the latest.

Of course, you may not get it exactly right, but it should be assumed that the higher interest rates are going to eventually work in reducing inflation, otherwise why would the Fed bother. They're not stupid. Signs of rate pivots will see appreciation in fixed income. IUSB has a 6-year duration, so it's sensitive to that upside.

The main risk to the peak rate thesis is the impasse around the debt ceiling. It would be a major blow to the world order and the USD reserve currency status were this not to be resolved in a timely fashion, so it's unlikely to go too far, but divisive politics is a major trend and it could come to a head here.

Still, when betting on peak rates, AOK is a poor vehicle. You get much lower expense ratios for long-term ETF holders by just owning IUSB and IVV in a 4:1 ratio. You'd have the same correlations to AOK, the same fundamental drivers for the most part, and more than a 50% discount on longer-term expense ratios to make your index portfolio as efficient as possible. AOK just doesn't justify its expense ratios.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.