Uber Technologies: New Year, New Company

Summary

- Uber has shown good growth and a great improvement in profitability.

- The company has a big market to grow into and the upper hand in the competition.

- The valuation is still attractive at this price.

- This idea was discussed in more depth with members of my private investing community, The Pragmatic Investor. Learn More »

Hispanolistic

Thesis Summary

Uber Technologies (NYSE:UBER) has delivered a strong earnings beat and is up 7% pre-market. The company has shown continued growth and, most importantly, increased profitability.

The recent results are a sign of things to come. Uber has a huge addressable market and is already generating profits. This is a company investors will want to hold for the long term.

Q1 Earnings Beat

Uber just announced its Q1 results, giving investors a much-expected beat on both earnings and revenue.

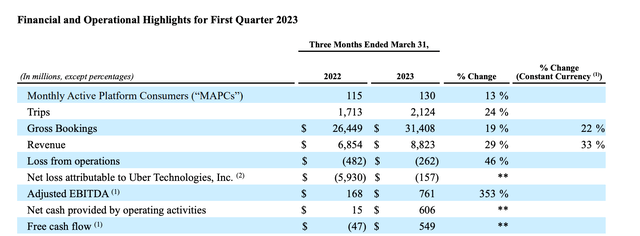

As we can see above, bookings grew by 22% on a constant currency basis, while revenue was up a very healthy 33%.

Even more notably though, adjusted EBITDA was up 353% compared to last year, and the company achieved a positive cash flow.

Looking at the breakdown by segment, we can see that Mobility had the biggest revenue growth, outpacing delivery and becoming the undisputed revenue leader. Freight was down significantly, and this was driven by lower volume, which is to be expected given the general state of the freight market.

Lastly, here’s the breakdown for adjusted EBITDA:

Revenues by segment (Financials)

Most of the profits are of course coming from Mobility, with Freight delivering a loss of 23 million. While G&A and R&D increased for the year, they were outpaced by the growth in revenue.

Investors have been pleased with UBER’s results. UBER’s trajectory shows a company that could be worth significantly more going forward.

Growth Outlook

In terms of forward guidance, the company did not project very ambitious quarterly growth. Uber expects gross bookings of $33.0 billion to $34.0 billion and an adjusted EBITDA of $800 million to $850 million.

This represents a growth in bookings of up to 5%and a growth in Asd EBITDA of around 11%.

Like many other companies, Uber is expecting the next few quarters to be challenging, but the long-term growth prospects are still huge.

According to Mordor Intelligence:

The Mobility as a Service (MaaS) Market was valued at USD 658.62 billion in the current year, and it is projected to grow to USD 1040.70 billion by the next five years, registering a CAGR of 7.43% in terms of revenue during the forecast period

Source: Mordor Intelligence

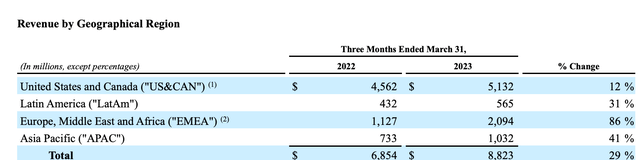

revenues by geography (Financials)

As we can see in the geographical breakdown, Uber has nearly its revenues in Europe, Middle East and Africa, and experienced a 41% growth in Asia Pacific. Uber is a global company with a competitive advantage and moat in many economies around the world.

In terms of profitability, the company is already showing that it can turn a profit, especially if we discount the costs of R&D. The company has now entered a sweet spot where it can begin to fund its own operations, and this is only going to make it even more profitable, as it begins to rely less on outside debt.

Valuation

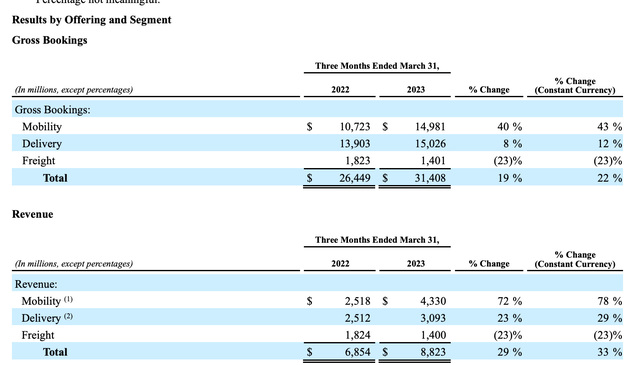

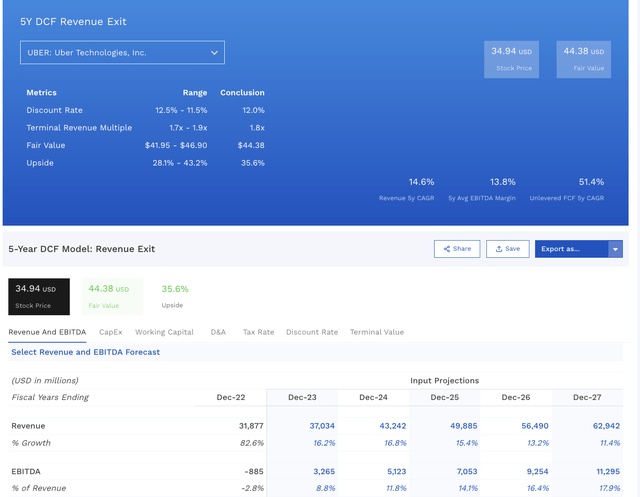

With the above in mind, there’s plenty of upside for Uber, and analysts are also forecasting this:

The company is expected to grow revenues to over $56 billion by 2026 and earnings growth should be even more bullish:

EPS could be over $2.06 by 2026, implying a forward P/E of 15.89

Currently, with a P/S of near 2, the company is not “cheap” from a pure value perspective, but given the forecasted growth and profitability increases, a premium is more than justifiable.

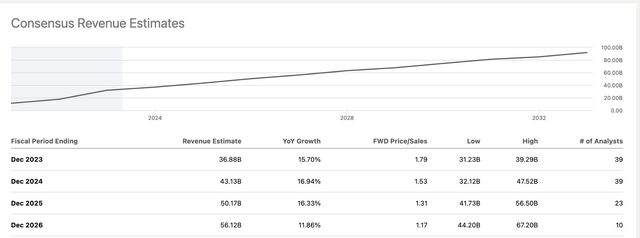

In fact, if we look at a 5-year DCF valuation, such as the one provided by Finbox, Uber has an upside potential of 44%.

Technical Analysis

Looking at the Uber chart, we have formed a good base, and we could be nearing a breakout:

From an EWT perspective, a bottom could be in since we have formed an initial 1-2 and broken above the wave 1 top. In the last sell-off, Uber bounced at the 200 day MA, and has now broken above the 50-day MA. The previous high is now resistance, and above that, the stock could be ready to fly.

Based on fib extensions, the next rally could take us to just below $60.

Risks

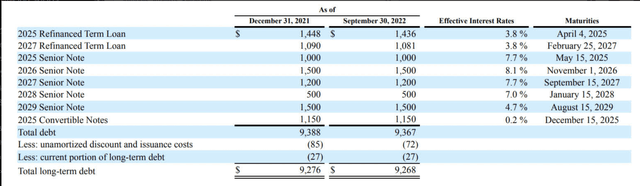

There are some risks, of course. Uber is very much a consumer-facing business, and a recessionary environment would be bad news for the company’s bottom line. On top of that, we can expect some dilution moving forwards due to the conversion of debt maturing in the next few years:

Debt maturity (Uber financials)

Moving forwards, the company should be able to fund its own operations better and eventually even start re-buying shares.

Takeaway

Uber is a tech company that offers not only great growth potential but also significant value. It has come a long way since its IPO, showing investors that the company can be profitable while maintaining great levels of growth. This is a buy-and-hold for the long term.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

- Access to our Portfolio, which features "value tech stocks".

- Deep dive reports on tech stocks.

- Regular news updates

Technology is changing the future, don't just watch it, be a part of it!

This article was written by

James Foord is an economist and financial writer with over five years of experience writing about stocks and crypto. His lifelong interest in monetary policy and innovative technologies led him to specialize in macroeconomics, crypto and technology. Given the current macro outlook, he is focused on commodities, real assets, international equities and value stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UBER either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.