EEM: From Technological Innovation To Resilient Banks, Emerging Markets Could Be It

Summary

- EEM invests in companies across many emerging countries.

- Many economies of emerging countries are better positioned for medium-term growth than that of the United States, which could make them more profitable during this time.

- Even with the growing potential, there are still ample geopolitical implications within emerging markets securities, especially those that dabble in China and Taiwan.

- I rate this ETF a Hold, as China in particular taking a bigger stake in global economic growth could proliferate both the profits of EEM as well as the geopolitical risk for investors.

aluxum

Inflationary pressures and concerns have been increasingly appearing on United States headlines as the Fed remains relentless in raising interest rates. However, the situation is more tame in emerging markets. Evidently, slowing inflation is already appearing in locations like China, Brazil, and South Korea. This is primarily a result of said countries initiating their rate-hiking cycles before the United States did so.

Many emerging markets are further on the path to economic recovery compared to the United States. Continuation of this trend could serve emerging markets assets quite well in the coming periods. However, economic growth does not eliminate geopolitical risks, which are fundamental in emerging markets securities. Especially in regards to China's relationship with both the United States and Taiwan, investors may still want to tread lightly with certain funds. For these reasons, I rate the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM) a Hold.

Ultimately, emerging markets represented in this ETF could be well-suited for medium-term growth compared to the United States. This comes down to how emerging market banks have responded to economic downturns, and also how exchange rates have changed as a result. For example, emerging market banks purchased fewer government bonds while credit demand was strong and inflation was a greater threat. Furthermore, the U.S. Dollar has depreciated compared to certain foreign currencies, which has increased the value of many emerging market assets and could attract more investors.

Strategy

EEM tracks the MSCI EM NR USD Index and uses a representative sampling technique. The designated index consists of securities from over 20 emerging market countries. Some of these locations include but are not limited to China, Taiwan, Brazil, and Saudi Arabia. From aiming to track the benchmark rather than beat it, this ETF reduced certain risks of active management like poor security selection. Furthermore, this strategy may also lower costs and minimize portfolio turnover.

Securities are selected based on how well they represent the nature of the underlying index in terms of market capitalization, industry weightings, and liquidity measures.

Holdings Analysis

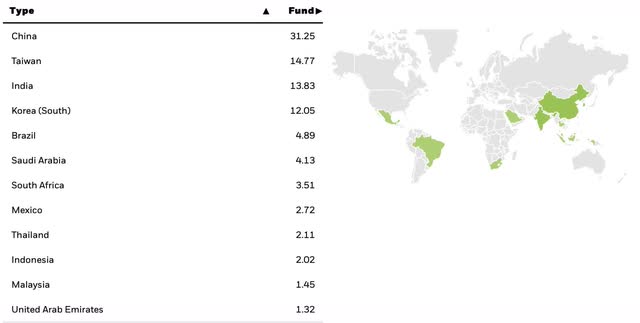

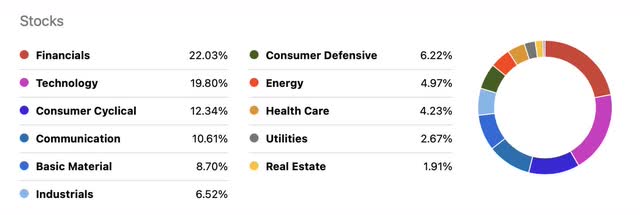

This ETF's holdings reside within multiple non-United States countries, with not one country accounting for more than a third of geographical composition. China and Taiwan together represent just under half of EEM.

EEM also invests in a variety of sectors, with not one sector accounting for more than a quarter of the total sector composition. The most prominent sectors in this ETF are financials, technology, and consumer cyclicals, which together comprise just over half of this ETF.

This ETF therefore exposes investors to a variety of industries within an array of countries, minimizing concentration risk on a geographical and sector basis. Furthermore, the top 10 holdings in EEM account for roughly 23% of the total fund while the top 25 also comprise almost a third of this ETF. Given that this fund consists of almost 1300 stocks, EEM could be considered quite top-heavy in regards to individual holdings.

Investors might therefore be putting significant performance up to just a few holdings, but they also know what's moving the needle amid this mountain of stocks.

China As A Profitable Emerging Market

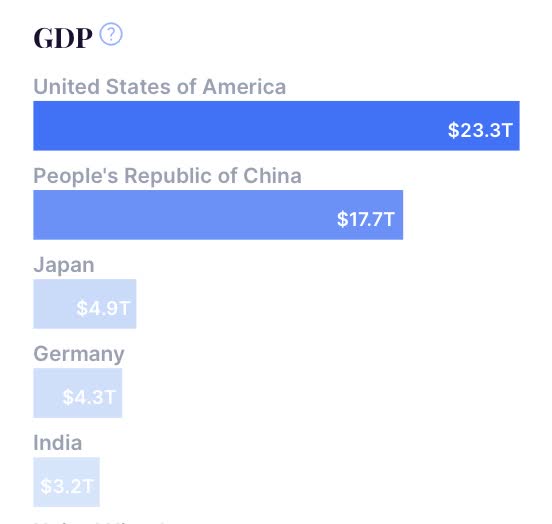

China currently has the second largest economy behind the United States, valued at just under $18B.

WiseVoter

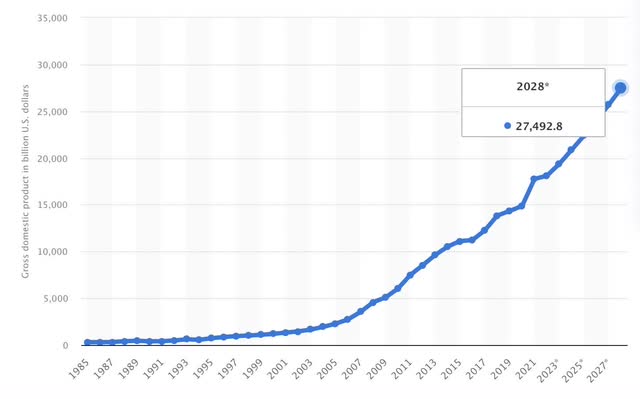

On this same note, China could become a more significant driver of global GDP within the next several years. As seen in the forecast below, China's economy could be worth more than $27T by 2028.

Furthermore, by 2028 China could be the largest contributor to growth in the world economy, as seen below.

As this emerging market becomes a significant player in future innovations and technology races, the value of Chinese assets could increase significantly. EEM's high concentration of Chinese stocks could therefore serve it well in the long-term.

The Mighty United States Dollar Is Depreciating

The exchange rates for the Chinese Yuan and the Taiwan New Dollar have both increased in the last month as the U.S. Dollar continues to modestly weaken. Given that China and Taiwan are the two most-represented nations in this ETF, appreciation of their home currencies against the Dollar could increase the value of EEM.

The United States Dollar Vs. The Chinese Yuan

Depicted below is the exchange rate trend of the U.S. Dollar to the Chinese Yuan.

Though it has leveled off recently, the Chinese Yuan has become decently valuable compared to the U.S. Dollar. If the U.S. Dollar continues to depreciate, I could see this trend progressing positively, and Chinese assets becoming more attractive to investors as a result.

The United States Dollar Vs. The Taiwan New Dollar

The Taiwan New Dollar has also picked up some momentum over the U.S. Dollar during the last month. This currency slightly declined compared to the U.S. Dollar at the beginning of the month but quickly popped back up. I could also see this trend continuing in the coming periods.

The Resilience Of Emerging Market Banks

The banks in emerging markets may have several advantages over those within the United States. Compared to developed market banks, emerging market banks often have a better diversified, more fragmented depositor base. This makes these banks less vulnerable to sudden deposit outflows like the ones that sent U.S. regional banks collapsing back in March. Furthermore, this also makes having held-to-maturity (HTM) securities less concerning, as these assets only become a problem once deposits start flowing out. Strict regulations toward emerging market banks have also served them quite well, as these institutions now often have surplus capital in case of emergency.

International Pitfalls and Other Long-Term Concerns

EEM's geographical composition could create a number of geopolitical risks for investors. In particular, China and Taiwan being the top holdings may expose investors to headwinds created by tensions and uncertainties between these two countries. In addition to Taiwan, the relationship between China and the United States could become a greater concern with time. With how competitive these two parties are becoming in the technology space, intensifying competition could significantly worsen geopolitical risks for investors. Furthermore, though the ongoing semiconductor shortage may be easing, I believe this situation is still one to consider when Taiwan Semiconductor Manufacturing Company (TSM) is the top holding in this ETF.

Currency risk could also invigorate this ETF's volatility down the road. Though certain east-Asian currencies have been surpassing the U.S. Dollar recently, the tables could just as easily flip with time. That being said, international exposure adds an extra layer of uncertainty that one wouldn't have to incur if they continued with a purely-U.S. fund.

Conclusion

This ETF could possess a silver lining down the road as emerging markets pull ahead of the United States in terms of economic growth and recovery. Therefore, EEM could be one for the coming periods as the U.S. struggles with inflationary pressures. In the event that geopolitical tensions don't significantly interfere with growth, I think this ETF could be one for the long-term. On the same note, investors might still want to assess their geopolitical risk tolerance before running with this one. For these reasons, I rate EEM a Hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.