CF Industries: Hidden Gem For Potential Upside

Summary

- CF Industries has recently signed a memorandum of understanding with NextEra Energy Resources to build a hydrogen project of zero-carbon intensity.

- The has reported net sales of $2.01 billion, a decrease of 29.84% compared to $2.86 billion in Q1FY22.

- The company is trading significantly below its sector median and 5-year average P/E ratio, which shows that CF is undervalued.

BanksPhotos

Investment Thesis

CF Industries Holdings (NYSE:CF) deals in manufacturing and distributing nitrogen fertilizers. The company recently announced a memorandum of understanding (MOU) with NextEra Energy Resources, which deals in the generation of renewable energy and battery storage. I believe this MOU can act as a primary catalyst to accelerate the company's growth by increasing its production levels and helping it to address the rapidly rising demand in the fertilizer industry.

About CF

CF mainly manufactures & distributes nitrogen fertilizers. It operates nitrogen manufacturing facilities in the United States, the United Kingdom & Canada and has an extensive transportation, storage & distribution network in North America. The company's primary product is anhydrous ammonia (ammonia), which includes 82% nitrogen and 18% hydrogen. Its other nitrogen compounds offered to industrial customers include diesel exhaust fluid (DEF), urea liquor, nitric acid, and aqua ammonia. It conducts its business in five reportable segments: Ammonia, Granular Urea, UAN, AN, and Other. The Ammonia segment deals in the production of anhydrous ammonia. The ammonia business includes ammonia sales to external customers for its nitrogen content as a fertilizer in emissions management and other industrial applications. This segment contributes 27.62% to the company's total net sales. Its Granular Urea segment makes granular urea with a 46% nitrogen content. This segment contributes 25.85% to the company's total net sales. The UAN segment manufactures urea ammonium nitrate solution (UAN), a liquid fertilizer with a proportion of nitrogen that ranges from 28% to 32%. This segment generates 31.93% of the company's total net sales. The AN segment includes the production of ammonium nitrate (AN). This segment contributes 7.55% to the company's total net sales. The Other segment consists of the sale of products such as Diesel exhaust fluid (DEF), Urea Liquor, and Nitric acid. This segment represents 7.03% of the company's total annual net sales.

New Green Hydrogen Project

The outlook for agricultural profitability has remained positive for nearly all the major crops in North America. According to the Prospectives Planting report released by USDA's National Agricultural Statistics Service (NASS), producers plan to cultivate 92.0 million acres of corn in 2023, which could increase corn production by 4%. The total wheat planted area for 2023 is anticipated to be 49.9 million acres, a 9% increase from 2022. I believe this significant increase in production can create potential opportunities for the participants in the fertilizer industry. Identifying these opportunities, the company recently announced a memorandum of understanding (MOU) with NextEra Energy Resources, which is one of the world's leading producers of solar & wind energy and one of the largest battery storage companies. This MOU is signed for a joint venture to build a hydrogen project of zero-carbon intensity at CF Industries' Verdigris Complex in Oklahoma. This project was included in the funding proposal submitted to the U.S. Department of Energy (DOE) this month by the HALO Hydrogen Hub, a three-state effort founded by Arkansas, Louisiana, and Oklahoma to compete for funds from the DOE's regional clean hydrogen hub program. The proposed project envisions a jointly owned 100-megawatt (MW) electrolysis plant at the Verdigris Complex, which would be fueled by a specialized 450-MW renewable energy facility built by NextEra Energy Resources. The green hydrogen would produce up to 100,000 tons of zero-carbon green ammonia per year, which would be made possible by debottlenecking Verdigris' ammonia plants. The resulting green ammonia production is expected to aid in the shift of American agriculture to low- and zero-carbon fertilizers, removing up to 130,000 metric tonnes of carbon dioxide emissions from the agricultural supply chain per year. I believe this MOU can act as a primary catalyst to boost the company's growth and expand its profit margins as it can significantly increase its production volumes and help it to address the increasing demand in the market. As per my analysis, the company can sustain this growth for a long time as the US government expects the population to rise in the coming decades, which can ultimately increase the need for agricultural products. In addition, I think the industry has a strong entry barrier, as developing a fertilizer company from scratch requires enormous investment and research. The strong entry barrier ensures that the rising demand can be distributed among the existing players. After analyzing all the opportunities and strengths, I think the company can grow rapidly in the coming years, leading to solid financial results and returns for investors.

Financials

The company has recently reported its first-quarter results. It has reported net sales of $2.01 billion, a decrease of 29.72% compared to $2.86 billion in Q1FY22. The decline in revenue resulted from a low average selling price. Average selling prices were lower in 2023 than in 2022 due to increasing global supply availability, as lower international energy costs led to elevated global operating rates. Net sales of UAN, Ammonia, AN, Granular urea, and Other segments decreased by 34.28%, 33.75%, 28.69%, 20.13%, and 32.88%, respectively, compared to the same period of the previous year. The sales volumes of UAN, Ammonia, and AN were lower in Q1FY23 than in Q1FY22, but higher granular urea sales volume partially offset this decline. The company's adjusted EBITDA decreased by 47.45% YoY from $1648 million. The company reported a net income of $560 million, a 36.57% YoY decrease compared to $883 million in Q1FY2022. Decreased net income resulted in diluted earnings per share of $2.85, significantly lower than $4.21 in the previous year. Free cash flows stood at $2.32 billion. Its first quarter ended with $2.82 billion in cash and cash equivalents. The company underperformed compared to the previous year as the global nitrogen prices decreased in the first quarter of 2023 as stronger global operating rates improved supply availability during a period of low global demand due to delayed agricultural purchases and high inventory levels in Europe from 2022 imports. However, the company has confirmed that it is experiencing strong demand in North America, India, Brazil, and Europe. After considering the company's strong demand dynamics and strengths, I believe we can expect solid financial results in the coming quarters.

According to seeking alpha, the company's revenue might range from $6.50 billion to $7.96 billion. I think the revenue estimate of $7.96 billion perfectly captures the impact of low selling prices and strong demand in the company's key markets. The company's 5-year average net profit margin is 14%. I think the company's net profit margin for FY2023 might be lower than FY2022 (net margin of 30%) due to the low average selling price. After considering the strong demand in end markets, I estimate that the company's net profit margin can be higher than the 5-year average net profit margin as the average selling price is still higher than pre-covid levels. That is why I am estimating a net profit margin of 16%. I believe with the revenue estimate of $7.96 billion and net profit margin estimate of 16%, investors can expect EPS of $6.36.

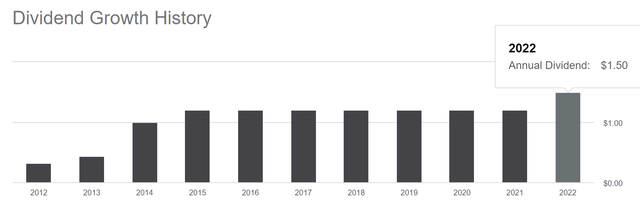

Dividend Yield

Dividend Payment History of CF (Seeking Alpha)

The company has a long and impressive track record of dividend payouts which signals its good positioning in the market. In the previous year, the company distributed a dividend of $0.30 in the first quarter and $0.40 in each of the remaining quarters, which makes the annual dividend $1.5 per share, representing a dividend yield of 2.16% compared to the current share price of $67.55. In the current year, it distributed a dividend of $0.40 in the first. Observing the strong demand in the industry and the company's growth, I believe it can sustain this dividend of $0.40 in the next quarters as well, which makes the annual dividend $1.6 per share, representing a dividend yield of 2.37% compared to the current share price of $67.55. The company's current dividend yield is significantly above its 5-year average dividend yield of 1.54%. The company's dividend yield of 2.37% is 11.79% higher than the sector's median dividend yield of 2.12%. This high dividend yield makes the company an attractive investment opportunity for risk-averse investors looking for fixed returns with a minimum level of risk.

What is the Main Risk Faced by CF?

The fertilizer industry is seasonal. The degree of seasonality in the company's business might vary dramatically yearly according to agriculture industry conditions and other reasons. In North America, the highest demand for its products occurs during the spring planting season, with a second period of significant demand following the autumn harvest. If the seasonal demand is less than the company's expectations, it may be left with excess inventory that would have to be stored or liquidated. Storing can increase the company's storage cost, and liquidating can result in less selling price than the production cost. In both situations, the company can suffer a financial loss which can result in reduced profit margins.

Valuation

The company can significantly increase its production levels due to its recent MOU with NextEra Energy Resources and address the increasing demand, which can further help it generate additional revenues. These positive factors can push the stock upwards, and we can expect a long-term upside. I think the revenue estimate of $7.96 billion and 16% net profit margin perfectly capture the impact of low selling prices and strong demand in the company's key markets. The revenue estimate of $7.96 billion and 16% net profit margin give the EPS of $6.36 for FY2023. The EPS estimate of $6.36 gives the forward P/E ratio of 10.62x. The company's forward P/E ratio of 10.62x is 21.39% below its sector median of 13.51x. The company's 5-year average P/E ratio is 18.14x which is 71% higher than its forward P/E ratio. The company is trading significantly below its sector median and 5-year average P/E ratio, which shows that CF is undervalued. In my opinion, the company might gain significant momentum due to its recent MOU with NextEra Energy Resources, which can help it to increase its production capabilities and help it to trade at its sector median P/E Ratio. Therefore, I estimate the company might trade at a P/E ratio of 13.51x, giving the target price of $85.9, a 27.17% upside compared to the current share price of $67.55.

Conclusion

The company has recently underperformed in the first quarter mainly due to low average selling prices and low production volumes compared to the previous year's same period. It is exposed to seasonality risk, which can contract its profit margins. However, I believe it has a lot of growth potential as it has recently signed MOU with NextEra Energy Resources, which can help it to increase its production levels and cater to the growing demand in the fertilizer industry, which is mainly driven by the rise in agricultural production activities. This growth can help the company to maintain dividend payments in the future, which makes it an attractive investment opportunity for risk-averse investors. The company is recently undervalued, and we can expect a 27.17% growth in the stock from current price levels due to its recent expansion activities. After considering all the above factors, I assign a buy rating to CF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.