Monster Beverage: This Company's Growth Knows No Bounds

Summary

- Rising prices have not affected sales volumes too much.

- Once again no guidance has been released, making it difficult to make estimates.

- Monster is still growing in double digits, but I'm waiting for a more reasonable price per share before I buy it.

jetcityimage

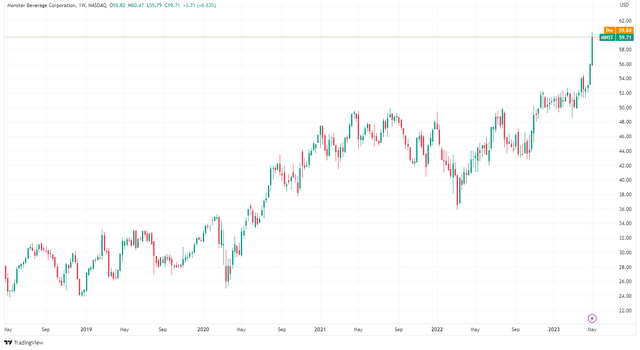

Perhaps not everyone knows this, but for the past 20 years Monster (NASDAQ:MNST) has been the best performing U.S. stock: a compound annual return of 42 percent.

Such a return may seem absurd for a company that primarily sells energy drinks, but it is more than justified. Not surprisingly, the price per share is at its all-time high; after all, Monster continues to grow in double digits and has no problem maintaining high margins with negative net debt.

In Q1 2023 the company once again demonstrated its resilience and reliability regardless of the macroeconomic environment.

Comment on Q1 2023

Commenting on a quarterly report of Monster is rather complex since management is reticent in disclosing the prospects of this company. There is no guidance, and the report beyond the strictly necessary information does not have much additional content. Either way, it is possible to comment on key results and management's most interesting answers during the conference call.

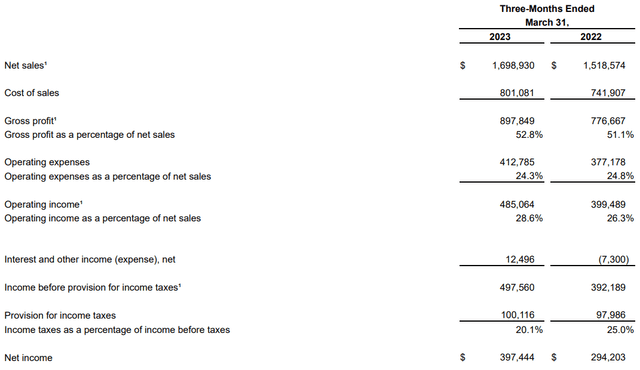

Net sales for the 2023 first quarter increased 11.9% to $1.70 billion from $1.52 billion in the comparable period last year. In the first quarter Monster had never generated so much net sales, so it is a record for the company. However, another set of considerations must be added to this result:

- In constant currency, growth would have been 15.30% for Q1 2023, about $52 million more.

- The international segment is growing faster than the domestic segment and now accounts for 37% of total sales in Q1 2023. With a constant currency assessment, YoY growth would have been 21.90%. In short, an outstanding achievement in the current macroeconomic environment.

But Monster is not just energy drinks, or at least not anymore. After the acquisition of CANarchy last year, the company is also targeting alcoholic beverages. This segment increased 204.4% to $46.3 million for Q1 2023, up from $15.2 million in Q1 2022. The Beast Unleashed™ released on February 1, 2023, has the potential to continue the strong growth of this segment. It will be very interesting to see how it performs in the coming quarters.

The positive aspects of this quarterly report do not stop at net sales growth, however; there is more.

Operating costs as a percentage of net sales decreased by 0.50% to 24.30 %. This is overall a small improvement, but not obvious in the current macroeconomic environment. Most companies belonging to the consumer staples sector have expressed their concern about the persistent inflation still weighing on input costs. From this perspective, Monster had a Q1 in contrast to its sector, in fact its margins increased:

- Gross margin had a 1.70% increase to 52.80%.

- Operating income had an increase of 0.30% reaching 28.60%

But what is the reason for such a positive performance? As Co-CEO Hilton H. Schlosberg explained, there were several factors although inflation remains a problem in certain areas:

Gross profit margin percentages continued to increase on a sequential quarterly basis, primarily as a result of pricing actions, decreased freight-in costs and decreased aluminum can costs, as well as the moderation of certain other challenges in our supply chain. The increases in certain ingredients and other input costs, as well as co-packing fees, remain challenging.

The company did not release specific data on price increases in its individual segments, but I believe they were substantial given the strong increase in net sales. Anyway, what surprises me most is that the volume still remained stable according to management's comment:

We are pleased to report that our pricing actions, which have been implemented to partially mitigate inflationary pressures have not significantly impacted consumer demand.

The company declined to give volume estimates and just said that there may be a slight reduction in volume but that it will not limit net sales growth. So, price elasticity seems to be low for this company's products, which is why pricing allows for such growth in net sales.

As for future margins, the company did not release estimates and reiterated that price increases have not had much resistance from customers. Personally, with inflation coming down month after month and customers buying regardless of price increases, I believe that everything will lead to higher margins in the coming quarters, but that is just my assumption.

Finally, I conclude this quarterly analysis with management's reply to an interesting question from Mark Astrachan regarding a possible buyback given the increasing liquidity in the balance sheet.

Mark, we continually are examining options to deal with our cash balances, and it's something that, again, is a board issue that is receiving attention. So, I really don't want to comment, more than we have that -- intention is to hopefully buy back shares continue that program. But we are looking at -- some opportunities for further investments. And that's too premature to talk about them. But there are a number of possibilities that that we're looking at. And in addition, it is our plan to continue buying back our shares.

At first glance, this may seem like yet another generic response from management; it might be, but I have my own interpretation on this.

Currently, I think buyback is not the priority for this company since Monster's price per share has reached all-time highs.

After a rise with such strength the stock may be overvalued and management knows it; therefore, making a buyback may prove to be the wrong choice. There may be other more interesting investments. This does not detract from the fact that the buyback is a long-term goal, but at least until there is a price retracement it will be avoided. This is only a temporary choice.

If my interpretation is correct, I think it is reasonable for the company to choose not to make buybacks just to please shareholders and support the price per share: this is not what generates the greatest returns in the long run.

Clearly, if I think this, it is because I believe Monster is currently overvalued; not primarily because of the recent price increase, but because the discounted future cash flows do not justify the current share price. This, however, could be the subject of another article; in this one I am just commenting on the quarterly report.

Overall, Q1 2023 was a success on multiple fronts and the market is rewarding the resilience of this company growing regardless of the macroeconomic environment. Personally, I am just waiting for a more reasonable price to buy Monster stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.