Sanmina Corporation: Concentration Risk, Tech Investments, And Recession Concerns

Summary

- Sanmina Corporation faces significant concentration risk due to its reliance on a small number of key clients, which makes it vulnerable to revenue fluctuations and client-related issues.

- Rapid technological advancements in automation, robotics, and manufacturing techniques necessitate heavy investments in R&D and capex, putting pressure on Sanmina's already negative operating cash flow growth per share.

- The potential for an upcoming recession and global economic uncertainty may adversely affect Sanmina's cyclical clients, impacting the company's revenues and earnings.

- Sanmina's financials reveal concerns such as stagnant margins, increased COGS, and a deteriorating debt ratio, indicating challenges in controlling costs and generating operating cash flow.

- Despite the stock being potentially undervalued on some metrics, Sanmina's concentration risk, technological challenges, and macroeconomic factors make it a sell recommendation.

Sundry Photography

Sanmina Corporation (NASDAQ:SANM) presents a compelling sell recommendation for several reasons. This is due to its reliance on a handful of key customers for generating earnings, rapid changes in automation, robotics, and manufacturing techniques it must keep on top of to maintain those clients, and a generally bearish and uncertain macro backdrop. I feel these issues will culminate in Sanmina needing to spend more on capex as well as research and development, which will further dent its already negative operating cash flow growth per share and pressure its lackluster margins, leading to a lower company valuation in the future.

Let's delve deeper into the stock's performance and future prospects to better understand this thesis.

Introduction

Sanmina Corporation provides integrated manufacturing solutions, components, products, and other services to its roster of international clients. The company has been in operation since 1980 and has its headquarters in San Jose, California. The company operates in a number of industries which includes communication networks, defense, medical, automotive, and more.

The key to understanding my bearish thesis to this stock is to unravel its main operating segment, which in this case is Integrated Manufacturing Solutions (IMS). This segment involves providing an end-to-end solution for the design, engineering, and manufacturing of electronic and mechanical products for its customer base.

IMS operating segment in detail

It cannot be overstated how important the IMS operating segment is to the growth and health of Sanmina Corporation. According to the company's financial report for 2022, 80 percent of its total revenues came from this segment, while its Components, Products and Services (CPS) segment contributed the remaining 20 percent.

Furthermore, within the IMS segment, sales to the company's ten largest customers typically represent approximately 50% of its net sales, with Nokia and Motorola each representing 10% or more of its net sales in 2022.

What this means in practice is that Sanmina carries a high amount of concentration risk, since the loss of a key customer would significantly impact its revenues by as much as 10% or more in the worst case scenario. Another implication of this is that Sanmina would also strongly inherit the problems of its key customers, as well as benefit from tailwinds such as rising consumer demand. Sanmina can therefore be thought to be as much as an extension of its key customers as it is a separate entity. Therefore, it's essential to analyze Sanmina's client roster and evaluate the quality of its customer relationships to understand its concentration risk and the potential impact on its financial performance.

Additionally, since much of the company's fate is in the hands of only a small number of customers, the retention of its existing customer base and the acquisition of new high-value customers are what pushes the needle for its earnings and ultimately its valuation as a company.

Technology risk

The problem at hand for Sanmina as an electronics manufacturing services (EMS) provider is that it uses a number of technologies and processes in its manufacturing operations. These technologies allow it to produce high-quality products for its customers, but when combined with its revenue concentration, reveals serious risks for its business model.

Sanmina is already exploring high-tech manufacturing techniques to serve equally complicated industries such as defense and aerospace, and this trend will likely continue as technology evolves at a rapid pace.

The problem is that investing in high-tech industries requires heavy research and development costs and capital expenditures on cutting-edge equipment, along with specialized knowledge, cyber security precautions, and complicated digitization of its supply chain with its customers and suppliers.

These issues are exacerbated by Sanmina's concentration risk which can manifest itself in a number of ways. It then makes it more vulnerable to the downsides of being reliant on these technologies as when things go wrong they can directly affect their relationships with their major clients and damage the company's overall business performance.

For example, Sanmina will be feeling the pressure to innovate and constantly keep on top of the latest technologies in robotics, artificial intelligence and other trends more than its less-concentrated competitors. This in turn will lead to higher investment costs for equipment and employee training in order to stay competitive.

The revenue concentration also means that if Sanmina experiences a cyber attack or faces business disruptions or delays for a few of its key clients, this could permanently damage its reputation.

To mitigate all these risks, it can be expected that Sanmina will increase its already swelling cost basis even more, and keep in mind its three-year operating cash flow growth per share is sitting at a negative 3%.

Macro risks

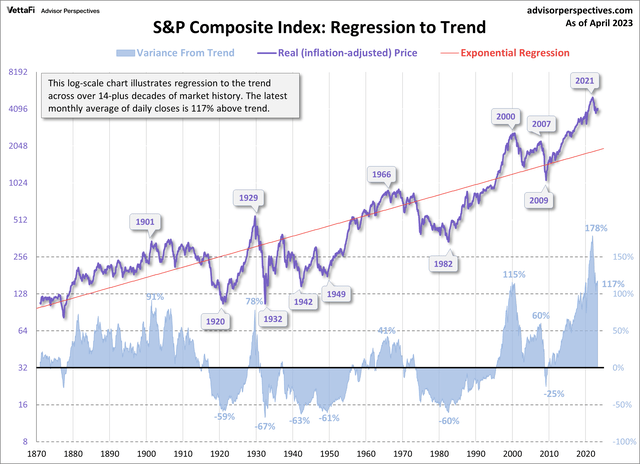

The second is that it seems we may enter into a recession, and that equities in general may be trading at overvalued levels on a systemic basis.

A recession is a catalyst for my bearish thesis, but not a requirement, and I will not cover an exhaustive list of reasons for why I believe a recession is coming. But consider that, on a long-term perspective, the S&P 500 has always intersected the regression trend line in the chart below sooner or later, and that we just emerged from a black swan event with COVID-19 and witnessed a once-in-a-lifetime equities rally which was the biggest in human history.

Advisor Perspectives Advisor perspectives

The P/E ratio of the S&P 500 is around 28.9x, or 1.1 standard deviations above the modern-era average. Although the market has since recovered to pre-COVID levels on a P/E basis, we're also in a high interest rate backdrop with a significantly higher levels of uncertainty and risks of entering into recession than compared with the late 2018 era. The war in Ukraine and other geopolitical conflicts, especially involving China, are material to the situation, as well as the upcoming election in the United States, persistent "sticky" inflation, and a slowing global economy also makes matters worse.

How this all ties into my thesis for Sanmina is the following. Although the company does benefit from diversification by operating in several industries, more than half of its clients operate in the cyclical ones of communications, industrials, as well as storage and computing, according to its annual report in 2022. Nokia and Motorola, two clients that have systemic importance to Sanmina, are included in these industries.

Therefore, if a downturn does take place, it's likely that Sanmina would be hit particularly hard since its clients and by extension its own revenues are earnings are particularly sensitive to changes in the business cycle. Also note that a recession may not even need to actually unfold for Sanmina to be affected. A compelling threat of a recession occurring might be enough for its customers to justify reducing their manufacturing output, and there would be little that Sanmina could do about it. Although it's true that Sanmina does have contracts and supply agreements in place with its customers, according to its 2022 annual report, "these agreements generally do not obligate the customer to purchase minimum quantities of products". This means that the contract offers little to no direct protection for its top or bottom lines for when times are bad.

What ties Sanmina's hands behind its back, however, is that is that if its precious roster of clients do churn or cut back on spending, then it may be very difficult in a recession or less certain environment for the company to go out and replenish them in short order. Holding unsold inventory is expensive, and in a cost-cutting environment reducing that may be the first thing that managers will look to. Also consider its revenue concentration could suggest that there are very few unicorn clients like Nokia and Motorola left in the wild for Sanmina to approach in the first place, otherwise why doesn't it have a stronger roster of clients already? In summary, since Sanmina's client roster is small, tightly concentrated, and that over half of its clients operate in industries sensitive to changes in business cycle, along with unfolding macro uncertainties, it seems likely that it will face challenges in the near future. It's impossible for a recession to not unfold eventually, and at some point bulls must concede it's a natural part of the economy, and with today's headwinds it seems that day will come sooner rather than later.

Financials

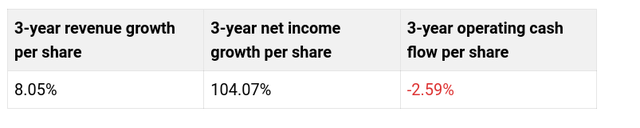

Besides Sanmina's concentration risk, there are a few other weaknesses of its fundamentals that should be explored. On a three-year, per-share basis, its revenue growth is 8.05%, while its net income is a staggering 104.07%. The problem, though, is that its operating cash flow growth shrank by 2.59%. Much of the growth over the past three years was due to a rebound after COVID, which affected much of the industry. This then suggests such a performance is a once-off.

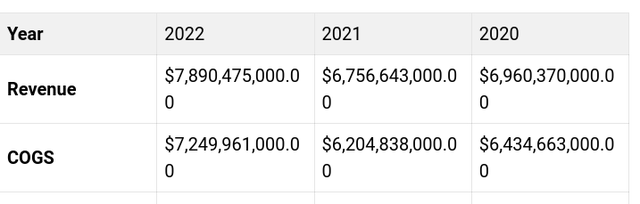

Some of that pressure on its cash flow per share can be chalked up to a sizable increase in COGS from 2021 to 2022.

According to the cash flow statement, a significant amount of that can be attributed to being spent on capital expenditures, which could be a positive provided that the company sees a return on its investment. However, as outlined in my original thesis, this line item is expected to swell in the future and it scrambles to keep on top of the rapid changes in technology, which could lead to margin deterioration.

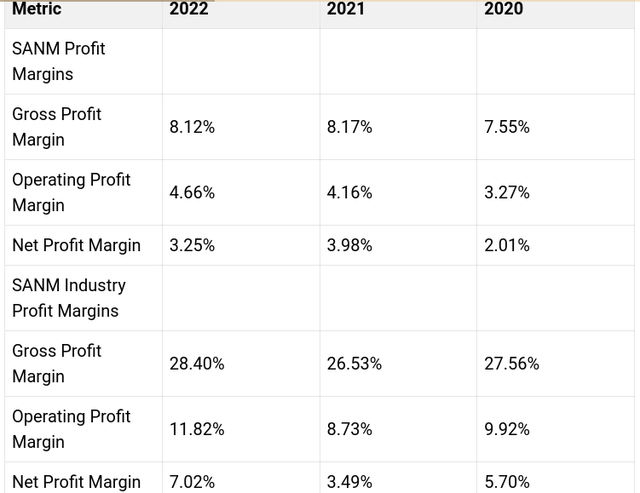

On a higher level, though, the company's margins have fluctuated over the past three years but have generally improved. They are still far below industry benchmarks, particularly its operating profit and gross profit margin, which suggests there are some unresolved issues with how it manages its cost basis.

I feel that these issues will be more fully revealed in a more challenging macro environment and could reveal deeper problems since it is far below the performance of its peers.

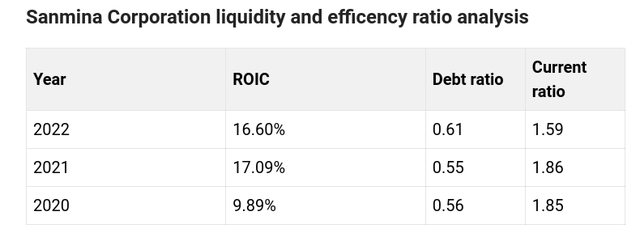

Finally, Sanmina has improved its capital efficiency over the last three years but its current ratio and debt ratio have all taken a turn for the worst, highlighted through taking on additional liabilities on its balance sheet. The company is still very financially stable as reflected by a current ratio of 1.59, but this is a worrying trend.

Valuation

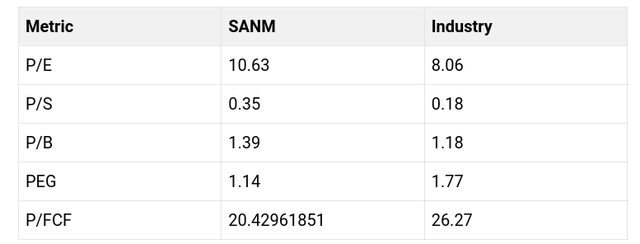

Sanmina's valuation is fair, and it is relatively undervalued on a couple of key metrics, namely the on the PEG and the P/FCF metric compared with its industry.

However, keep in mind that a bearish thesis of a recession may not be reflected in the current ratios, and that the market could be feeling overly optimistic given the recent rebound in tech and manufacturing stocks in general as the stock is currently up 30.16% over the past 52-weeks at the time of writing.

The key takeaway from this section is that although the stock may be seen as a good buy on the surface, the alternative interpretation is that the market is discounting its future prospects as discussed in my introduction. It's also possible the market hasn't fully priced these scenarios into the share price. Either way, I feel that its problems outweigh the potential of it being undervalued compared to its industry peers for some metrics.

Risks

Sanmina's revenue concentration is a real risk, and so is the company's lackluster performance in controlling costs and generating operating cash flow. The stagnant margins, increased COGS, inflating debt ratio and declining current ratio all point toward Sanmina investing in its future growth and assuming some risk in its operations. The decision may come at an inopportune time, given the current macro backdrop and uncertainties, along with the understanding we are well overdue for an economic correction. Although wagering on a recession is indeed speculative, one thing that's for certain is that it will need to continue spending more on capex, training, and assets to keep ahead of its competitors in the technology space.

On the other hand, Sanmina delivers a huge amount of free cash flow and that is its superior draw card when compared to its industry peers. It's also buying back shares and has substantial relationships with blue chip clients. One can also argue that the stock trades at already undervalued levels when looking at its PEG and P/FCF ratios, and that timing a recession is extremely difficult, if not impossible to do so with any degree of accuracy. As mid-cap stock, Sanmina offers substantial room for growth, so selling shares could incur investors with hefty opportunity costs if this bearish thesis doesn't play out as I expect it to.

Conclusion

Sanmina's issues are concerning enough for me to rate the stock a sell. I chose not to rate it as a strong sell given that it may be undervalued already, and that my thesis leans partially on a recession occurring in the foreseeable future.

It's unclear if the company has any realistic contingency plans if it loses its key roster of clients, or if its customer base decides to simply wind down production in lieu of churning to a less expensive competitor.

The company's reliance on advanced technologies may be what sets it apart but is also its Achilles heel. If it doesn't sufficiently diversify its client base it could be one operational misstep away from losing a large part of its earnings and revenues.

The company's profit margins are below average compared to its industry and its cost basis has increased steadily year over year. These issues may become larger for the company when the economy enters a downturn, which would exacerbate its core issues of not generating enough sales to maintain its company growth.

I foresee a lower stock price in the future for this company, and its problems may come to the surface well before a recession materializes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.