Where Some Value Is Hiding In Plain Sight

Summary

- This has been an interesting year, with the major indices up but with a lot of volatility at the same time.

- With bank failures, more Fed rate hikes, and a recession looming (for years now it seems) there is a lot of merit to being cautious. Especially when savers are getting paid to wait.

- As someone with 30% in cash, I would not fault anyone for being conservative at this juncture.

- But I am not willing to move more in to cash and as a working professional I have new money to invest every month. For this review, I describe some corners of the market where I will be allocating that cash.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

ferrantraite

Main Thesis & Background

The purpose of this article is to discuss the broader macro-environment and where I see some value right now for new positions. As I write this on 5/2, the market is seeing a sell-off and readers are likely starting to get anxious - if they haven't been already! With savings accounts/CD's beginning to offer reasonable yields, it could be tempting to shift to cash here and wait for clearer skies ahead.

While that is always tempting when the market sell-offs, we have to resist that urge. The time to sell is when things are too optimistic, not the other way around. In this vein, I am going to touch on three areas where I see some value right now, despite what appears to be a worsening macro-economic backdrop in the U.S. and elsewhere.

Energy Sell-Off Looks Enticing

The first sector I am looking at for the time being is Energy. I don't get too creative in this space, opting for a couple of different ETFs for diversification. I have done well over the years in this more volatile sector because sell-offs typically have represented strong buying opportunities in recent memory. It was the top performing sector in 2022 and, for those who have timed it right in 2023, this has been a profitable year as well.

I like the idea of getting in now because prices have moderated - both equity share prices and crude oil prices. While it sounds straightforward, those two are not always as directly correlated as one would think. Therefore, when I see the crude market get punished along with Energy shares, I almost always buy with a long-term mindset. Given the pullback in prices even after OPEC+'s surprise production cut announcement, that is indeed what we are seeing now:

Brent Crude Prices (Yahoo Finance)

The point I am making is that profitable sector investing often means buying on weakness and that is the scenario now. For those, like myself, that are looking for a place to put some cash at the moment that also registers some relative value, this could be it.

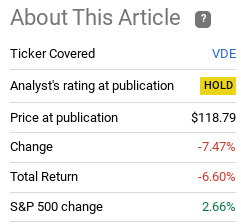

Of course, I would not ignore the risks here. Oil prices often move in-step with economic projections and the projection now is the U.S. (and possibly the EU-zone) are headed towards a recession. If it turns out to be worse than expected we should anticipate lower prices still. This makes Energy ETFs a bit of a risk-on play for now. I am not blind to this, in fact, I wrote an article on this very subject two months ago. I suggested there was a heightened risk for the sector and losses have resulted since then as I surmised:

Fund Performance (Seeking Alpha)

I bring this up not to pat myself on the back for getting cautious at the right now, but to emphasize that this is a riskier move and may not be appropriate for everyone. Weigh this opportunity with your own risk tolerance. But for me personally I see the sell-off in Energy, coupled with the broader market's rise, as a sign that value has emerged. So I am a net buyer here.

*I am long the Vanguard Energy ETF (VDE), the iShares Global Energy ETF (IXC), and the Invesco S&P 500 Equal Weight Energy ETF (RYE).

Emerging Markets and China Are Growth Plays

Another place to look for value is outside U.S. borders. Similar to Energy, this is not an area for everyone. It brings about unique risks and more volatility. But it also offers diversification benefits - an idea that is growing in importance as developed markets continue to face many of the same inflationary and rate-hiking headwinds.

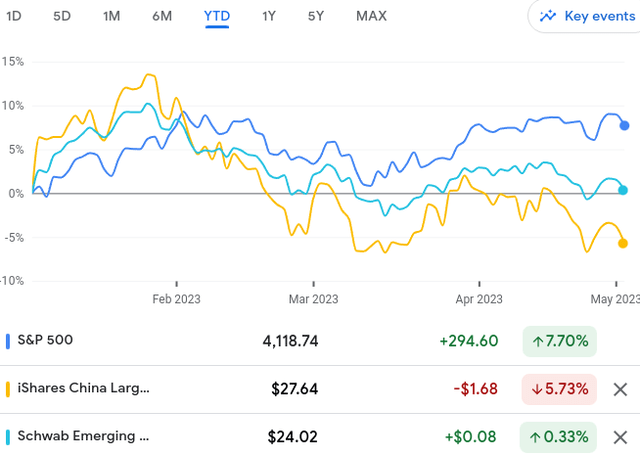

Central to this thesis is the disconnect between economic growth and share performance. While emerging markets are seeing stronger growth in the short-term, their share prices have lagged. This is due for a variety of reasons, but the differential is what piques my interest. If we look at year-to-date performance between the S&P 500 and the iShares China Large-Cap ETF (FXI) and the Schwab Emerging Markets ETF (SCHE) we see a clear winner:

YTD Performance (Google Finance)

So the S&P 500 out-performing - that is important. But that is often the case. The question is why buy EM now if the momentum is clearly elsewhere?

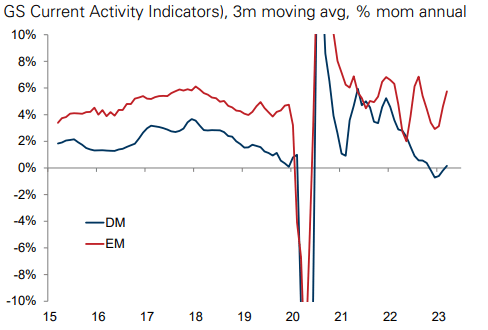

The answer lies with economic conditions on the ground. While growth in the developed world is slowing (and is expected to slow further by 2024), EM is a much different story. The growth in China and elsewhere in the EM space is accelerating and paints a stark contrast:

Economic Growth (Developed Markets vs. EM) (Goldman Sachs)

This is why I see some value here. Unlike Energy where oil is dropping and so are share prices, EM is growing while share prices drop. This disconnect is one I think I can profit off of as more investors realize the potential in Asia especially. While I won't get overweight this region due to the geo-political headwinds that keep popping up, this is an area I expect to want to have at least some exposure to.

*I may initiate a long position in FXI in the coming weeks, but I currently hold no EM exposure.

Bonds Also A Source Of Value

My third area to touch on is the bond market. After 2022 - this one is an area many readers probably have some scars. And with the Fed not officially done with its hiking plans, it may seem premature. But the thesis rests on two points. One, we don't want to wait until the Fed is done, we need to front-run that eventuality to get the most value. Two, yields are high enough to justify taking on some risk here regardless.

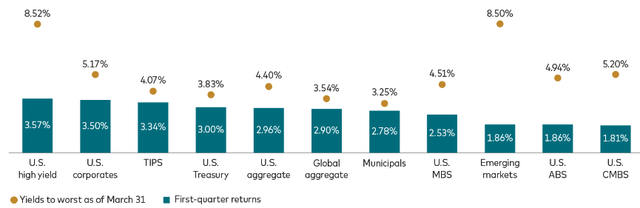

To understand why, let us look at current yields across a variety of sectors:

My followers know I tend to be light on corporate bonds and generally favor munis. While there is an argument for that if we are indeed approaching a recessionary cycle, I see more value in high yield corporate credit/bonds than I usually due. Absolute yields are quite high, and IG corporates are even competitive with munis post-tax adjustments.

The conclusion I draw here is rotating in to bonds as the rate-hike cycle nears its end makes sense. Investors have a chance to lock-in some historically high yields that will become even more attractive if we do enter a recession and long-term yields begin to drift lower. Munis, corporates, and even treasuries are offering yields near or above what savings accounts are offering. So the risk-reward trade here looks reasonable to me.

*I own the Nuveen AMT-Free Quality Muni CEF (NEA), the PIMCO Municipal Income Fund II (PML), the Invesco California Value Municipal Income Trust (VCV), and the BlackRock Taxable Muni Bond Trust (BBN).

Corporate America On A "Cost Cutting" Mission

I will now step back and discuss some broader macro-developments that are important when evaluating whether to put more money in stocks. We are all aware 2022 was a bad year, and the verdict isn't out yet for 2023. So nervous investors could certainly hide out in cash making 4-5% and play the wait-and-see approach. If that fits with your comfort level, I won't talk you out of it!

While I am someone who does have a relatively large cash position right now (around 30%), I am also steadfast in my belief that building on to that is not the ideal situation. That is a comfortable amount that gives me plenty of flexibility if the market sell-offs dramatically. But awaiting that result can be costly if it never happens. Therefore, making sure I am roughly 70% invested is my game plan and part of this stems from how proactive the large-cap U.S. companies have been in navigating this difficult climate.

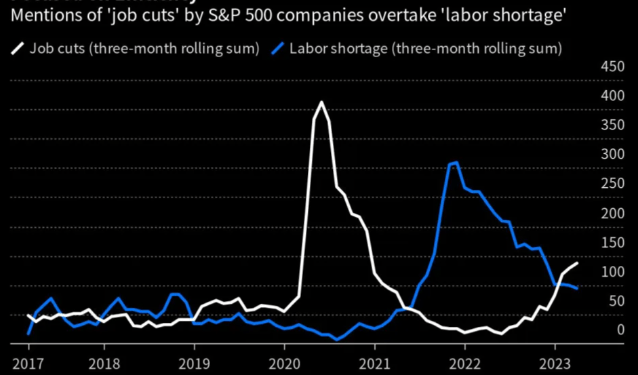

For example, what we heard consistently in both 2021 and 2022 was the "labor shortage" mantra. Companies couldn't hire what they needed - whether in retail or corporate environments - and that was a drag on the economy. Employees had the upper-hand and were demanding remote work (or "no" work jobs in many cases!) and higher payer. Fast forward to today, and the companies that within the S&P 500 have quickly adapted. They have shed redundant positions, curbed back growth plans, and focused on business as usual with what they have existing. This has led to an emphasis on "job cuts" in meetings with investors, rather than woes of a "job shortage":

Earning's Call Dynamics (Bloomberg)

This takeaway I draw from this is corporate America is well aware of the challenges ahead and is planning according. Is this good news for workers or consumers? Probably not. But it is good news for investors who expect prudent financial management during times of economic turbulence. Corporate America is looking for cost cuts to boost earnings, and that supports share prices across the board going forward in to the second half of the year.

Bottom-line

I am always on the hunt for value and today is no exception. With plenty of my portfolio allocated to the S&P 500 and other developed markets, I see some value in Energy, Emerging Markets, and Bonds. While these calls may not work for everyone, I think the underlying value is quite clear. Therefore, I have a bull call on all of those sectors listed above, and recommend readers give some serious thought to each at this time.

Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, VCV, PML, PDO

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VDE, IXC, RYE, NEA, PML, VCV, BBN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.