SmartCentres REIT: Smart Value Creation Through Intensification

Summary

- SmartCentres Real Estate Investment Trust properties enjoy high occupancy, primarily anchored by Walmart Supercenters.

- SmartCentres is embarking on a massive $15B intensification program.

- The new SmartLiving segment has been created to focus on residential developments and mixed-use opportunities.

- Despite the 7.1% yield, the REIT’s high payout ratio further distribution increases into question.

- This is a REIT to play a value-creation opportunity, not necessarily one to own solely for a stable distribution income.

Christa Boaz/iStock Unreleased via Getty Images

Author's Note: All figures are in Canadian currency unless otherwise noted.

Investment Thesis

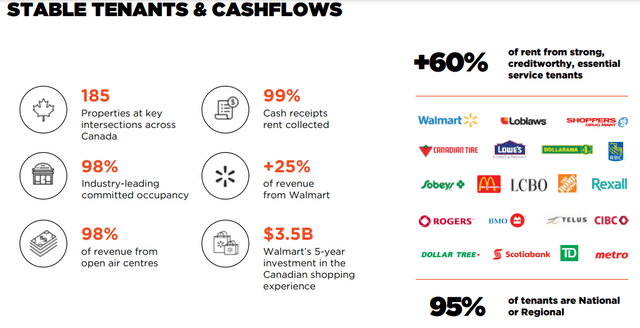

A necessity-based retail focus has resulted in consistently high occupancy and collection rates for SmartCentres Real Estate Investment Trust (TSX:SRU.UN:CA, OTCPK:CWYUF). With 98% occupancy rates in grocery-anchored sites, SmartCentres has been a byword for stability in the Canadian real estate investment trust ("REIT") space. This stable portfolio featuring Walmart Canada (WMT) as its defensive flagship tenant has supported a generous monthly distribution for the past 20 years. At current levels, SmartCentres offers investors a 7.1% distribution yield, a little ahead of the REIT's long-term average.

While this yield is attractive, in recent years, SmartCentres has paused distribution growth and seen its distribution payout ratio climb to potentially unsustainable levels. With distribution growth unlikely, it is important to look beyond SmartCentres' yield for its potential to unlock value through a portfolio-wide intensification program.

SmartCentres is investing $10B into a transformation program expected to cost approximately $15B, that will see the retail portfolio develop into a true mixed-use diversified portfolio. This program, leaning heavily on a joint venture model, leverages the REIT's valuable land positions in Canada's largest urban areas.

The REIT's pivot from a leading retail REIT developer and operator to a much more complex and diversified developer will have several outcomes including a more diversified revenue base. The REIT's ambitious development program will undoubtedly change its capital priorities in the coming years to focus more on development and less on its distribution. This pivot in capital allocation may have implications for the composition of the unit-holder base. Higher turnover of units could lead to increased volatility in the near term as investor priorities realign with capital allocation expectations. Over the longer term, SmartCentres is well-positioned to reward shareholders as it adds density on its current assets and diversifies its revenue mix.

REIT Profile

With a market capitalization of $4.7B, SmartCentres is the 4th largest REIT in Canada by market cap. In Canada, SmartCentres is inextricably linked to Walmart, as 114 Walmart-anchored open air shopping centers form the core of SmartCentres 185 property real estate portfolio. Since the REIT's founding in 2001, SmartCentres has been focused on non-mall retail property development and management through its "SmartCentres" platform.

Increasingly, the REIT will be leveraging its 3,500 acres of land, to capitalize on a massive $15B program of intensification projects. This program of mixed-use developments and joint ventures will fall under the "SmartUrban" platform. The REIT plans to unlock value from its considerable land position, that includes approximately $12B of real estate assets, 76% of which are located in Canada's six largest urban centres of Vancouver, Edmonton, Calgary, Toronto, Ottawa, and Montreal. SmartCentres properties comprise approximately 35 million square feet of GLA, with representation across all ten Canadian provinces, providing geographic diversification across the portfolio.

SmartCentres Tenant Portfolio Mix (SmartCentres)

SmartCentres REIT is led by founder and CEO Mitchell Goldhar. Goldhar previously served as Executive Chairman of the board and has a deep corporate history working with Walmart Canada. Goldhar has an approximately 21% equity interest in SmartCentres REIT ensuring a high degree of alignment between management and unit holders.

Recent operating results have been positive with all major metrics back up above pre-pandemic levels. 90% of all maturing tenancies were renewed in 2022, with a 3.1% increase over maturing rents. At the end of the Q4, 2022, same-property NOI increased by $5.1M, or 4% over the previous quarter.

Walmart / Residential Tower (SmartCentres )

Walmart Canada

Being the premier landlord for one of Canada's largest value retailers is a tremendous privilege. SmartCentres has built more than 170 predominately Walmart-anchored centres over the past 20+ years. According to the SmartCentres annual report, in 20 years of operations, no Walmart store has ever relocated from or closed in a SmartCentres shopping center. All of SmartCentres properties have a full line grocery store to anchor the property and nearly 70% are anchored by a Walmart Supercenter.

Grocery-anchoring retail is especially defensive, as it cannot be easily displaced by e-commerce. Grocery stores are also well adapted to mobile ordering and other innovations as they serve as local fulfillment centers for online ordering. Walmart Canada is investing $3.5B into its portfolio over five years to enhance the shopping experience in its locations. To support this goal, SmartCentres is helping to develop a new generation of Walmart anchored retail centers. As SmartCentres' largest tenant with 40% of GLA, Walmart contributes $205M in annualized gross rental revenue, or approximately 25% of total revenue.

Growth Through Intensifications

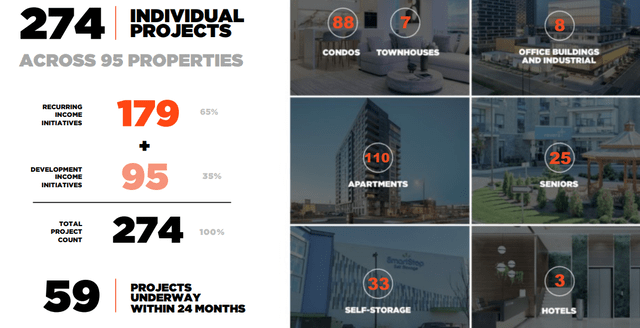

SmartCentres $14.9B, five-year intensification program features 274 individual projects across 95 properties, two-thirds of which are intended to boost recurring income. 59 projects are currently in the ground, or are expected to be underway in the next 24 months, with a further 67 projects considered active within the next five years.

This intensification program dubbed "Project 512" is designed to transform Shopping Centres into City Centres" includes developing a holistic master plan for each property in the portfolio. This master planning process will consider opportunities based on transit connections, density, and amenities. Not only will this project transform SmartCentres from a retail REIT to a diversified REIT, it will also diversify the REITs revenue mix away from Walmart.

SmartCentres Intensification Plan (SmartCentres )

According to SmartCentres, the intensification program is expected to result in a total of 56.1 million square feet of GLA. 27.2 million square feet of this additional GLA has already started or will commence construction within the next sixty months. Of this, SmartCentres' share will be 41.2 million square feet total, with 18.5 million square feet slated for the next five years. In addition to a sizeable number of apartment and condominium projects, SmartCentres will develop eight office and industrial projects, 33 self-storage facilities, three hotels, and 25 seniors facilities as part of this program.

This self-storage portfolio labelled SmartStop self-storage is a joint venture that aims to develop and operate 15,000 units of storage over 1.3 square feet. With seven sites open and three more currently under construction, the project is projected to reach its initial 15 locations by 2024.

SmartLiving

As part of SmartCentres intensification program, the REIT has launched a new operating segment called SmartLiving to focus on residential leasing and development. This segment is poised to grow rapidly through development partnerships that focus on purpose built-rental residential, condo, townhome, and seniors housing.

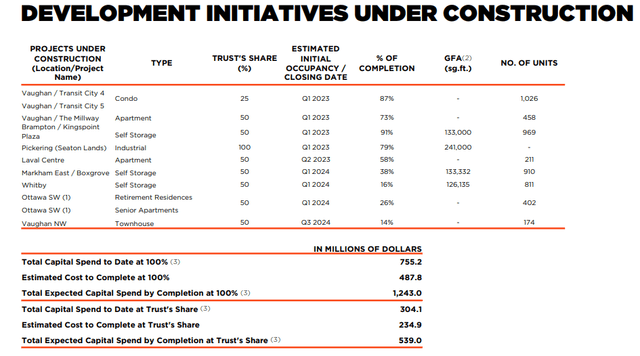

SmartCentres Construction Updates (SmartCentres)

In 2021 SmartCentres made a substantial $513M investment to expand its ownership in its SmartVMC project in the municipality of Vaughn within the greater Toronto metropolitan areas. This move made SmartCentres the largest landowner in the Vaughan Metropolitan Centre and set the REIT up for a significant wave of residential development partnerships.

Construction is nearing completion on Transit City condo towers 4&5 at SmartVMC, comprising a 45-story and 50-story respectively. Occupancy at these sites is expected in early 2023. In Q3 2022 SmartLiving initiated building of its 67%-owned, Park Place phase one project with 1,094 rental units in its massive Vaughn, Ontario development. In the following quarter, the REIT commenced the first phase of ArtWalk a 627-unit residential tower in which SmartCentres has a 50% ownership stake. The deliveries of these sites are expected in 2026-2027.

Distribution Safety

SmartCentres is currently paying a monthly distribution of $0.1542 for an annualized payout of $1.85. At current unit prices, this REIT offers a 7.1% distribution yield, slightly higher than SmartCentres 4-year average yield of 6.8%. The current distribution amount has been frozen since 2019 following a previous period of healthy distribution growth. With compound annual FFO/unit growth of 1% since 2021, there has not been much impetus to increase the distribution.

With a 20-year history of paying monthly distributions, this is the second lengthy distribution freeze, with the other being the years following the global financial crisis. For FY 2022, the distribution equated to a 100% AFFO payout ratio or 89% on an FFO basis. As of Q1 2023, this AFFO ratio had dropped to approximately 92%. This compares Toronto Stock Exchange Retail REIT subsections average yield of 6.2% with an 84% payout ratio. On the most recent earnings call, Chief Financial Officer Peter Slan described the REIT's improving payout ratio:

In terms of distributions, we have maintained our annual cash distribution level of $1.85 per unit throughout the COVID-19 period. For the full-year 2022, our payout ratio to ACFO excluding the impact of the total return swap, condominium and townhouse closings, and the smart VMC West Land acquisition was 92.6%, representing a significant improvement from 96.5% in 2021.

While the payout ratio is now better than before the pandemic, it remains above the sector average. I don't expect the distribution to be at imminent risk of being cut, however, I would remain cautious on owning SmartCentres solely for yield.

Risk Analysis

SmartCentres is one of the 14 investment grade REITs trading on the TSX with a BBB "HIGH" rating from DBRS Morningstar. SmartCentres has total liquidity of $624M including $71M in cash. With $5.21B in total debt, the REIT has a liquidity ratio of 12%, slightly below the TSX REIT sector average of 13.8%.

SmartCentres has a good, but, not great loan maturity profile with 19% of debt due in 2022 and 2024, 25% due in 2025, and more than 40% due after 2027. With a WATM of 4 years, SmartCentres has a marginally shorter loan duration than the sector average of 4.2 years. Debt to EBITDA of 10X puts SmartCentres in line with other retail REIT peers. SmartCentres cap rate is in line with nation-wide Tier 1 anchored retail properties with a rate of 5.9%. As of Q1 2023, that's up about 60 basis points year over year.

As of Q3 2022, The REIT has an attractive weighted average interest rate of 3.67%. By Q4 2022, WAIR had increased to 3.86%. With 82% of debt, locked-in at fixed rates, SmartCentres enjoys relatively low cost of capital for development.

With medium to long-term growth binging on intensification developments, SmartCentres will be deploying a substantial amount of capital in the coming years. With a debt to EBITDA level that is at the higher end of my comfort level, it will be important to watch balance sheet health and the REITs loan maturity profile as this program unfolds. SmartCentres can continue de-risking its growth program by entering into joint ventures.

SmartCentres success has been inextricably linked to Walmart Canada over the past 20 years. More than just an outsized portion of revenue, Walmart is a key strategic development partner and the anchor tenant of approximately 62% of SmartCentres properties. Walmart's portion of revenue should continue to decline as new mixed-use NOI comes online with completed intensification projects. Should the relationship between Walmart Canada and SmartCentres ever deteriorate, there would be a material impact on future cash flow. While a change in relationship is unlikely based on the sheer space needs and infrastructure requirements of a tenant like Walmart, key personnel and succession planning from both parties could be factors in future developments.

Investor Takeaways

In the near term, retail REITs will likely continue to be under pressure. SmartCentres' high occupancy rates and stable grocery-anchored portfolio offers a worthy defense. Expanding into mixed-use and residential properties not only value from the REIT's land assets, but it helps to diversify and improve revenue quality. SmartCentres ambitious intensification program will be truly transformational for the REIT. The REIT's balance sheet may be stretched as it deploys capital to densification and large residential joint ventures.

SmartCentres Real Estate Investment Trust trades at a reasonable 12X FFO and 13X AFFO and offers a 7.1% distribution yield. While this payout ratio is higher than I would like, it has shown slow signs of improvement. Patient investors can participate in this value creation opportunity as SmartCentres REIT executes on its densification strategy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.