Euronet Worldwide: Expecting 2023 Record Revenue And Undervalued

Summary

- Euronet is a leading international company in electronic payment processing.

- I expect that the recent increase in withdrawal transactions derived from recovery in travel will continue in 2024, 2025, 2026, and 2027.

- With several assumptions about future expansion of the ATM networks, better user experience, and the technological development of new products, I believe that future FCF growth is likely.

Prostock-Studio/iStock via Getty Images

Euronet Worldwide, Inc. (NASDAQ:EEFT) recently delivered double digit sales growth and EBITDA growth in its most recent quarter, and expects record revenue and adjusted EPS for the full year 2023. Considering the increase in traveling seen recently, potential expansion, sophistication of the ATM network, technological development of new products, and new products in the epay segment, FCF growth will likely continue. Even taking into account some risks from the total amount of debt or new regulations, under my DCF model, I believe that the stock is undervalued.

Euronet

Euronet is a leading international company in electronic payment processing. The company offers payment and transaction services to various financial and banking entities, agents, retailers, and independent clients. Its main products include, in addition to outsourcing and solutions for cards, ATM machines, points of sale, electronic payment distribution, international payments, and foreign exchange services.

Euronet's operations are divided into three reportable segments: the Electronic Funds Transfer segment, the Electronic Payments segment, and the Electronic Money Transfer segment. The first of these segments has an activity of more than 600,000 points of sale and 47,000 ATMs operating internationally. This segment is in charge of all services related to ATMs, and it represented, by 2022, 28% of the company's revenues.

The epay segment distributes and manages payments already made through a network that is also international in scope. 816k points of sale are part of this network, mainly used to pay for digital content in Europe, the United States, and Asia. It also includes vouchers, payment coupons and distribution of purchase cards and related services.

Finally, the money transfer segment facilitates consumer-to-consumer exchanges internationally. These services are provided through the Ria and IME brands in a network of more than 520k locations, and in addition to money transfers, they also include the possibility of paying for services or international currency exchanges. This segment, for its part, represented the remaining 42% of Euronet's revenues in 2022, being the segment with the highest revenue for the company.

Euronet offers a wide range of products and solutions, digital and physical, for the transaction of money in a large number of operations, and has, since its foundation in 1994, grown to be active today in more than 200 countries.

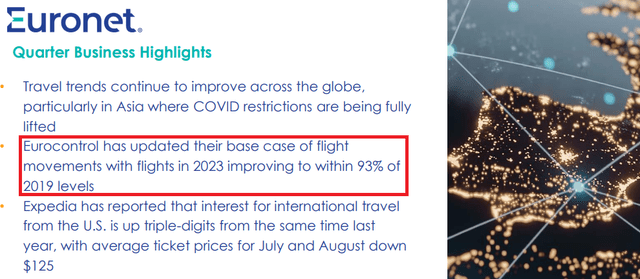

I believe that Euronet is a good read mainly after having a look at the most recent quarterly report. Considering the recent increase in travel trends reported in Q1 2023 and the massive increase in flights as compared to that in 2019, I modified my expectations for the coming years.

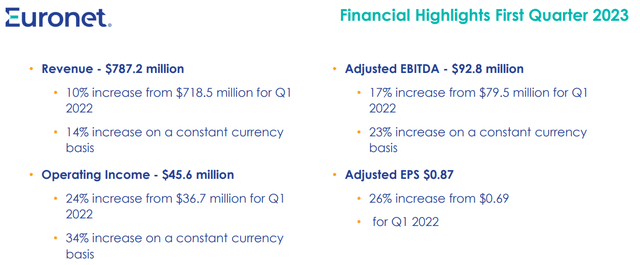

For those investors who like looking at the past, the numbers for the quarter Q1 2023 were beneficial. The company reported double digit sales growth, adjusted EBITDA growth, and adjusted EPS growth.

With that about the past, it is, in my view, worth noting that management expects to deliver record revenue and adjusted EPS for the full year 2023. Taking into account the words of management, in my view, a full review of the future financial figures of Euronet is a beneficial idea.

We continue to see improving travel trends across Europe, with major airports anticipating higher volumes than in the prior year, supporting our expectation of continued transaction improvements as we enter the seasonally stronger second and third quarters this year. With this improved travel, together with strong transaction growth trends in epay and Money Transfer, we believe we are on track to deliver record revenue and adjusted EPS for the full year 2023. Source: Quarterly Report

Competitors Are Large Companies, And Innovation Does Matter Quite A Bit.

If we talk about the competition for Euronet, we must name companies of a similar size or greater international expansion and active operations in a large number of countries along with small companies that offer specific services in one of the areas in which Euronet is developing. The biggest competitor in the money transfer segment is Western Union (WU).

It is important to note that many of the national competitors are represented by digital development projects, in a fertile market for innovation and transformation, in line with the trend towards digitalization of currencies and the future of cryptocurrencies. In this regard, I believe that lack of technological innovation in Euronet will likely lead to lower sales growth.

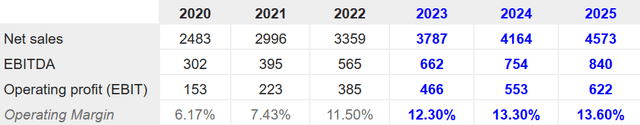

Market Expectations Include Significant Sales Growth And Double Digit FCF/Sales Margin

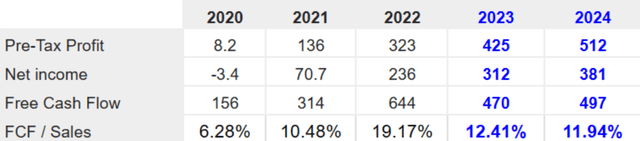

Analysts are expecting beneficial financial figures for the years 2023, 2024, and 2025. 2024 net sales would be close to $3.787 billion, with an EBITDA of $662 million, EBIT of $466 million, 2024 net income of $312 million, and 2024 free cash flow of $497 million.

The FCF margin is expected to remain around 12%-11% in 2023 and 2024. In my view, it is an impressive FCF margin for a company making international transfers of money and electronic payment processing.

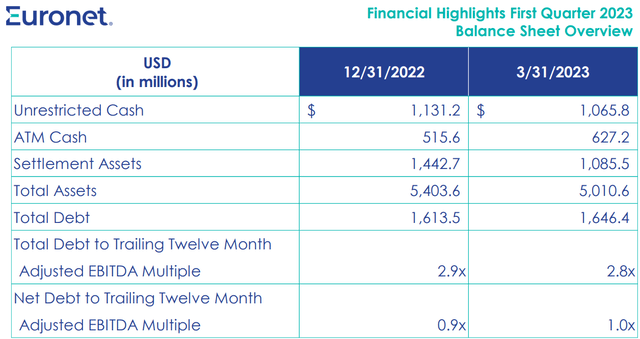

The Balance Sheet Included Some Reduction In The Net Debt/EBITDA Ratio

Euronet reports a significant amount of cash in hand, settlement assets, and a lot of goodwill. The assets are financed by a considerable amount of debt. The net debt/EBITDA multiple stands at 0.9x, and the ratio decreased recently. I believe that further reductions in this ratio will likely lead to further interest from investors.

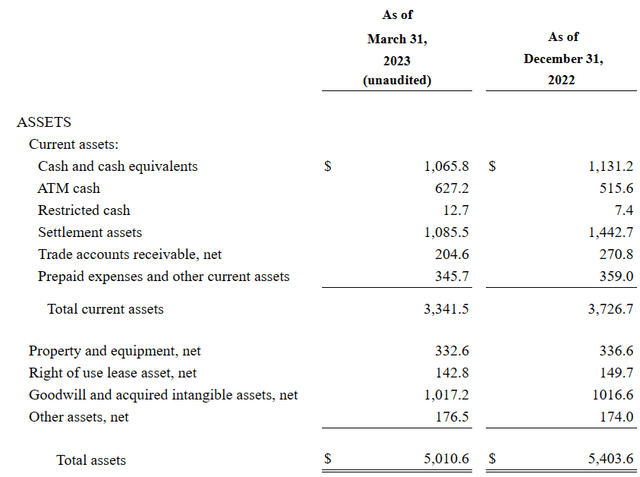

As of March 31, 2023, the company reported cash and cash equivalents worth $1065.8 million, atm cash of $627.2 million, and restricted cash of $12.7 million. I believe that the amount of cash will likely retain the attention of investors.

The company also reported settlement assets worth $1085.5 million, trade accounts receivable of $204.6 million, and prepaid expenses and other current assets close to $345.7 million. In sum, total current assets were equal to $3341.5 million, more than the total amount of current liabilities.

Non-current assets also included property and equipment worth $332.6 million, right of use lease assets of around $142.8 million, and goodwill and acquired intangible assets of $1017.2 million. Total assets stood at $5010.6 million.

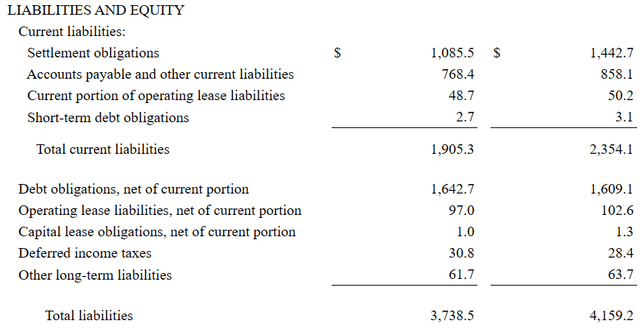

In the last quarterly report, the company reported settlement obligations worth $1085.5 million, with accounts payable and other current liabilities close to $768.4 million and total current liabilities of $1905.3 million. Total current liabilities are worth less than the total amount of current assets.

Besides, with debt obligations of $1642.7 million, operating lease liabilities close to $97 million, and deferred income taxes of $30.8 million, total liabilities stood at $3.7385 billion.

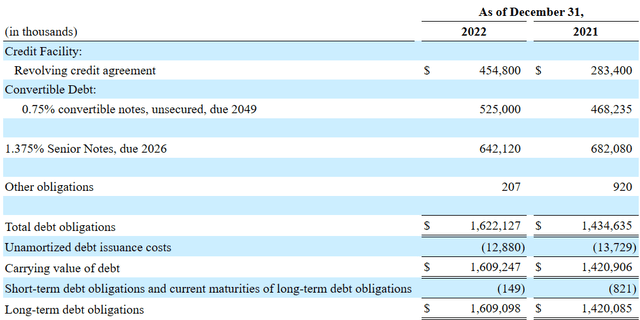

Considering the total amount of debt, I believe that investors may want to have a careful look at the maturities. The company reported a revolving credit agreement worth $454 million, 0.75% convertible notes, unsecured, due 2049 of $525 million, and 1.375% senior notes, due 2026 of $642 million. I believe that management will likely be able to renegotiate its debt agreements or find new debt investors. Considering the amount of FCF generated per year, I am not worried about the total amount of financial debt.

My DCF Model: Further Increased Withdrawal Transactions, Geographic Expansion, Correct Selection Of ATM Networks, And Technological Innovation.

Under my financial model, I expect that the recent increase in withdrawal transactions derived from recovery in travel will continue in 2024, 2025, 2026, and 2027. In this regard, I invite investors to study carefully the words in the last quarterly report.

Revenue, operating income and adjusted EBITDA growth in the first quarter 2023 was driven by increased domestic and international withdrawal transactions resulting from a strong recovery in travel. Source: Quarterly Report

Besides, I expect that the revenue due to new acquisitions and a significant increase in low-priced payment processing all over the world will likely bring FCF growth. I also believe that further development of new ATM networks and correct selection will likely bring more sales growth and FCF enhancement. Management discussed its efforts in the most recent annual report.

We continually strive to make our own ATM networks more efficient by eliminating underperforming ATMs and installing ATMs in more desirable locations. We make selective additions to our own ATM network if we see market demand and profit opportunities. In tourist locations, we also shut down ATMs during the winter season when tourist activity is low. Source: 10-k

Finally, I would also expect further addition of services it provides through differentials in the user experience and the technological development of the products. It is worth noting that the highest profit segment, money transfer, has the immediate objective of maximizing money transactions and actively participating in exchange corridors between the United States and Mexico and with Europe.

Complementary services offered by our epay Segment, where we provide prepaid mobile top-up services through POS terminals, strengthens the EFT Processing Segment's line of services. We plan to continue to expand our technology and business methods into other markets where we operate and further leverage our relationships with mobile phone operators and financial institutions to facilitate that expansion. Source: 10-k

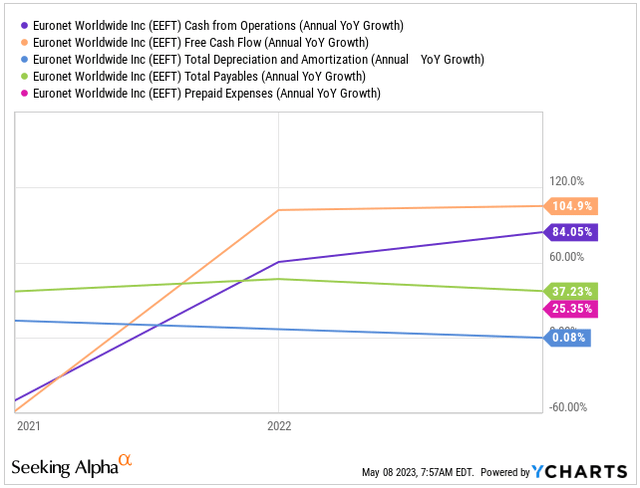

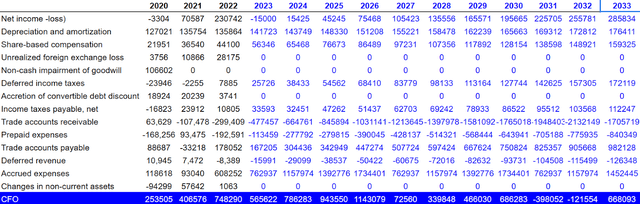

I do believe that my DCF model is as conservative as that of other financial figures. I included net income growth from 2023 to 2033, D&A growth, growing stock based compensation, growing prepaid expenses, growing deferred revenue, and growing income taxes payable. As a result, I expect CFO growth from 2023 to 2033. It is worth noting that my figures are not far from the business growth reported in the past.

My figures included 2033 net income of $285 million, depreciation and amortization of around $176 million, share-based compensation close to $159 million, and deferred income taxes of close to $172 million with changes due to trade accounts receivable of -$1706 million. Also, with changes in prepaid expenses of -$841 million, trade accounts payable around $982 million, changes in deferred revenue of -$127 million, and changes in accrued expenses of $1452 million, I obtained 2033 CFO of $668 million.

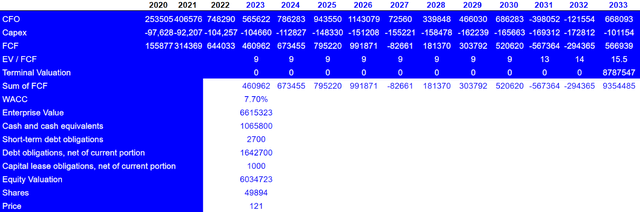

If we also include 2033 capital expenditures close to $101 million, 2033 FCF would be close to $566 million. Also, with an EV/FCF ratio of 15.5x, the terminal FCF would be $8787.5 million. Besides, with a WACC of 7.75%, the enterprise value would be close to $6.6 billion.

Also taking into account cash and cash equivalents of $1065 million, short-term debt obligations of $2 million, debt obligations, net of current portion close to $1642 million, and capital lease obligations, net of current portion close to $1 million, the equity valuation would stand at close to $6 billion. The fair price would be close to $121 per share.

Risks

Among the risks for Euronet we can highlight the large number of regulations to which the business is exposed as well as the financial nature and the variation in legislation in each of the regions in which it operates. To this condition of regulations we must add the inability to renew contracts with its clients, which are mostly signed in the short term. The dependence on third-party companies to carry out its operations is also worth mentioning, which may also be limited in its operation by another series of legal measures.

Another relevant factor, in my view, is the total amount of debt. If the company cannot refinance its total amount of debt, or the credit markets deteriorate, management may have to pay more interest, which may lead to decrease in free cash flow growth. As a result, I believe that investors may sell their equity interests, which may lead to a decline in stock demand and stock price depreciation.

Conclusion

Euronet recently delivered double digit EBITDA growth, and its expectations about the future improved for the year 2023. With this in mind and several assumptions about future expansion of the ATM networks, better user experience, and the technological development of new products, I believe that future FCF growth is likely. I do see risks from the total amount of debt, potential changes in the credit markets, competition, or failed M&A transactions, however the stock price, in my view, could trade at higher marks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EEFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.