PEY: Should You Buy This 4.80% Dividend-Yielding ETF?

Summary

- PEY holds 50 companies across all size segments that have increased dividends for ten consecutive years. I expect a 4.80% yield, and PEY has attracted $1.4 billion in AUM.

- A high yield is virtually guaranteed, making it suitable for income-only investors. However, there are flaws in the selection process that make it inappropriate for those looking for capital gains.

- Despite the dividend increase screen, PEY's profitability score is lower than most other high-dividend ETFs. Even after the March reconstitution, PEY is still 8% Regional Banks.

- Its largest sector exposure area, Utilities, is also under pressure. Many small- and mid-cap Utility stocks missed analyst expectations this quarter, while historic rate increase requests hang in the balance.

- PEY has great ten-year returns, but my annual performance rankings table highlights the inconsistency. There are too many concerns to issue PEY a buy rating at this time.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

Khosrork

Investment Thesis

The Invesco High Yield Equity Dividend Achievers ETF (NASDAQ:PEY) is poised to deliver a 4.80% dividend yield. However, that's mostly where the good news ends. PEY is a low-quality fund unlikely to perform well in a slowdown. Sales, earnings, and dividend growth prospects could be better, and its constituents are underperforming the market this earnings season. In addition, PEY's annual returns are inconsistent, so it's not a "sleep well at night" holding. Therefore, I don't recommend buying PEY except for the virtually guaranteed high yield, and I look forward to explaining why in further detail below.

PEY Overview

Strategy Discussion

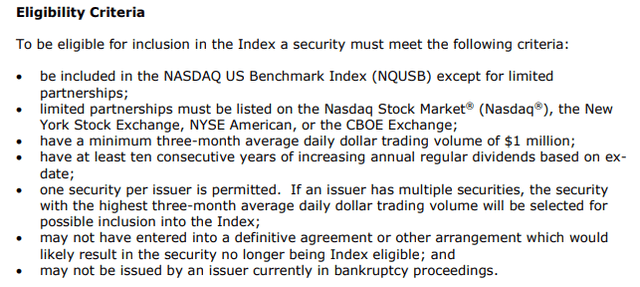

PEY tracks the NASDAQ US Dividend Achievers 50 Index, selecting 50 securities by dividend yield from the NASDAQ US Broad Dividend Achievers Index. The eligibility criteria for this parent Index are below.

The Index reconstitutes annually in March and reconstitutes quarterly according to target weights. The Index excludes REITs and limited partnerships and sets a minimum $1 billion market capitalization. Finally, the Index is yield-weighted. This feature effectively ensures a high dividend yield because the Index continuously rotates into the highest-yielding dividend-payers.

Sector Exposures and Top Ten Holdings

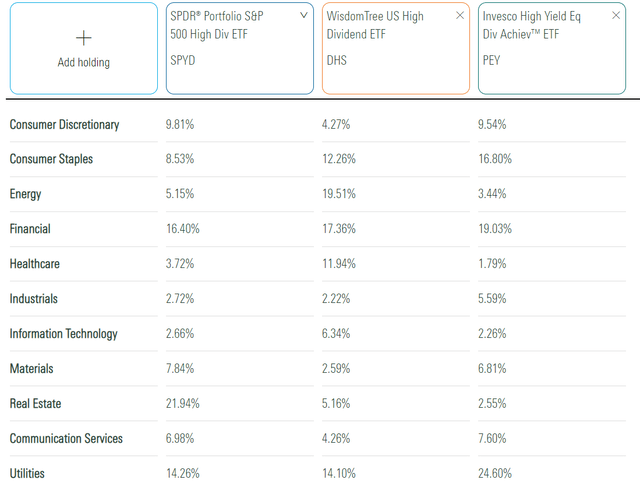

The following table highlights sector exposures for PEY, the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), and the WisdomTree U.S. High Dividend Fund (DHS). Trailing dividend yields for the three are 4.52%, 4.73%, and 4.34%.

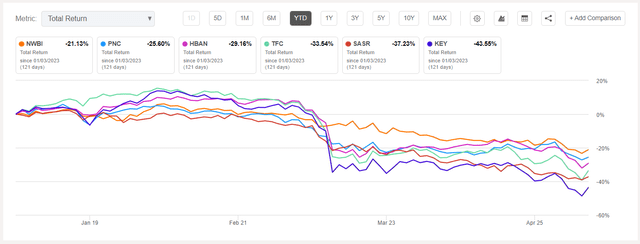

PEY overweights Utilities (25%), followed by Financials (19%) and Consumer Staples (17%). Its exposure to Regional Banks (8%) is concerning. PEY holds six, and each is down substantially YTD.

The current regional banking crisis demonstrates how consecutive dividend years of dividend payments isn't the best quality screen. I didn't forecast the crisis, but I did note PEY's poor profitability score in a previous article and expressed my preference for higher-profitable companies. That view remains today, and as we'll see shortly, PEY still holds numerous low-quality stocks.

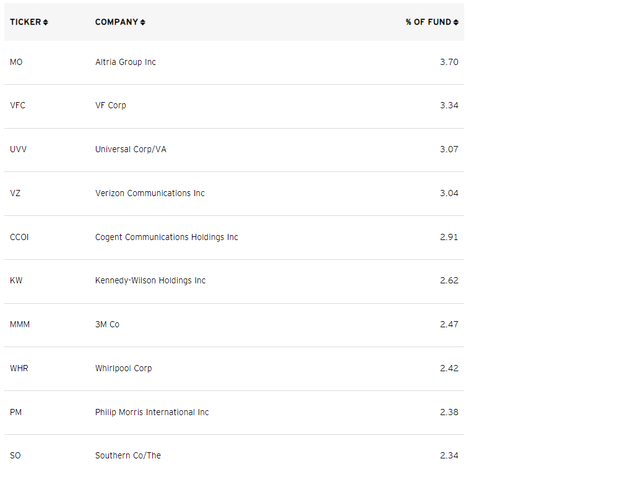

Some are listed in PEY's top ten holdings list. V.F. Corporation (VFC) is one example with a 3.34% weighting, and 5.72% indicated dividend yield. The company recently cut its quarterly dividend from $0.51 per share to $0.30, but the share price still declined 25% since. Clearly, the market wasn't satisfied, and it illustrates the dangers of high-yield investing. Even though a company pays a hefty dividend doesn't mean it should. Companies that fail to "take their medicine" when appropriate will see the impact on their stock prices. Based on the yields of these top ten holdings that average 6.12%, there are likely more yield traps.

Performance Rankings and Dividends

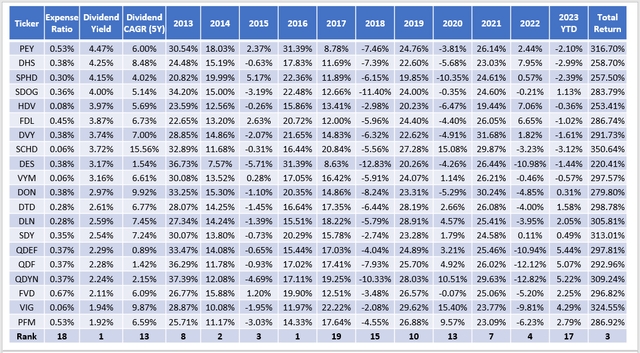

PEY launched in December 2004. However, the Index only introduced sector and stock weight limits (25% and 4%) in 2013. In addition, there is a maximum of 12 securities per sector. For this reason, I don't rely much on results before that year. Instead, I've compiled performance rankings against other dividend-focused funds with at least as much history. There are 20 ETFs in the group, and I've sorted them by their dividend yields in the table below.

PEY has the highest trailing dividend yield at 4.47% but only ranks #13/20 on five-year dividend growth. Its 316.70% total return from January 2013 to April 2023 was the third-best. However, it's an inconsistent performer. PEY ranked in the top three from 2014-2016 but then #19 and #15 in 2017-2018. These swings may not concern income investors, as PEY should always deliver a high yield. However, better options exist if capital appreciation is part of your plan.

Fundamental analysis can help identify good entry points. One of the reasons PEY is underperforming YTD is that growth stocks are back in favor. ETFs holding more growth stocks, like the Vanguard Dividend Appreciation ETF (VIG), are doing well, but the issue is VIG's low yield. Still, it's all about getting the balance right. These funds might be worth owning if you plan to re-invest dividends anyways. Dividend growth rates tend to be higher, too.

Consider these annual results when calculating standard performance metrics like three-, five, and ten-year total returns. A few good or bad years can easily skew results. In those cases, deeper analysis is sometimes required.

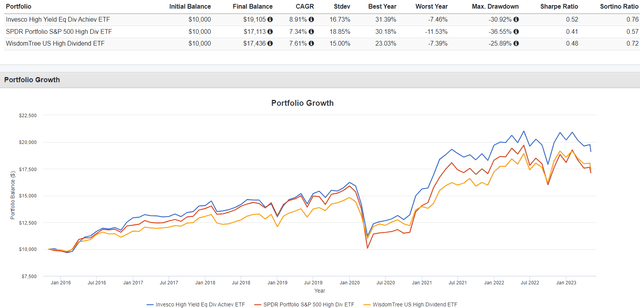

Finally, it's crucial to consider risk. The following graph is constrained to SPYD's November 2015 inception date, but it highlights how PEY's volatility (standard deviation) is between SPYD and DHS. The same is true for its 30.92% maximum drawdown figure, which occurred in Q1 2020.

I know some readers were disappointed in SPYD's performance through the pandemic. The high dividend doesn't guarantee safety, which I've highlighted in my last few reviews. YTD through April, SPYD is down by 2.53%, which would rank third-worst in the sample above and slightly above DHS and the Schwab U.S. Dividend Equity ETF (SCHD). SCHD is another fund I've cautioned readers on. It's not something I'm anxious to add to, and the results speak for themselves. As for DHS, its Energy exposure is excessive at 20%, and I think its days of outperforming are over.

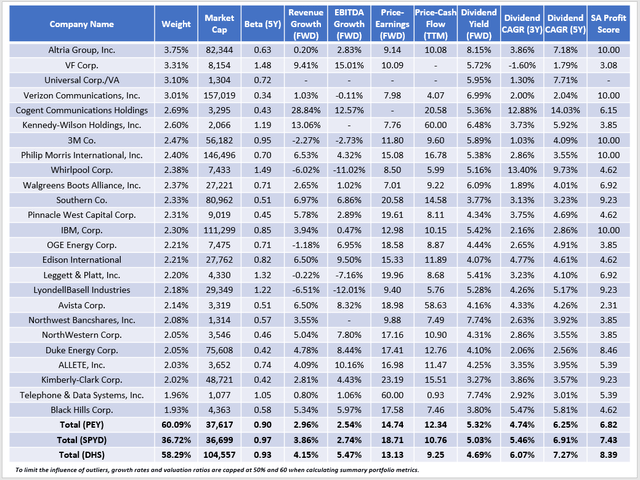

PEY Fundamentals vs. SPYD, DHS

The following table highlights selected fundamental metrics for PEY's top 25 holdings, totaling 60% of the portfolio. Its $38 billion weighted average market capitalization is nearly identical to SPYD but well below DHS. The reason is that PEY and SPYD are yield-weighted and equal-weighted, while DHS employs a modified market-cap-weighting scheme based on total dividend dollars. This approach gives more weight to large but lower-yielding securities.

A few additional observations:

1. PEY's gross dividend yield is 5.32% or 4.80% after fees. That estimate is a 0.33% improvement on its current yield, likely attracting income investors. Another positive is a low 14.74x forward price-earnings ratio, four points less than SPYD. DHS trades even cheaper at 13.13x, but as mentioned earlier, it's 20% Energy. Exxon Mobil (XOM) and Chevron (CVX) account for 10.5% of DHS and trade less than 11x estimated earnings. Without these, the two fund's valuations are close.

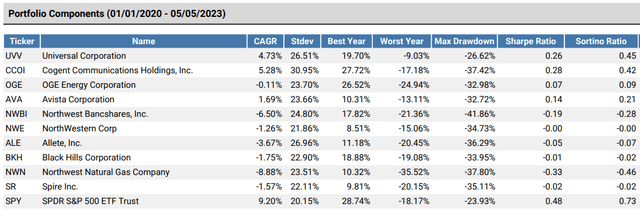

2. PEY's five-year beta is 0.90, average for a dividend ETF but on the low side for the total-market segment. PEY holds several small- and mid-cap stocks with low betas, like Universal (UVV), Cogent Communications (CCOI), and numerous Utility stocks. However, these companies are generally less profitable, suggesting persistent underperformance is likely. Remember that instead of a high dividend growth rate, weak performance is the main reason why they qualified for PEY in the first place. Here's how they have performed against the SPDR S&P 500 Trust ETF (SPY) since January 2020:

All stocks underperformed SPY. Again, it's the concept behind PEY, as low prices result in higher yields. However, recall from the earlier table how the portfolios' weighted average three- and five-year dividend growth rates are just 4.74% and 6.25%. PEY's high yield isn't achieved the "right way." It's not a good dividend growth ETF but rather a contrarian play.

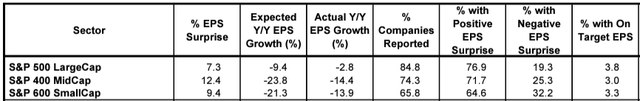

3. Yardeni Research reports aggregate quarterly earnings surprises of 7.3%, 12.4%, and 9.4% for the large-, mid-, and small-cap segments through May 5, 2023. Since PEY selects from all segments, it should benefit from these positive figures.

However, PEY's smaller holdings are underperforming. I calculated the following aggregate earnings surprise figures for the 41/50 constituents that have reported so far:

- small-cap: -1.1%

- mid-cap: 8.3%

- large-cap: 9.9%

Utility stocks are the key culprit. Avista (AVA) missed earnings by 36.85% and will transition to a new CFO effective May 11. NorthWestern (NWE) disappointed by 5.89% and is currently seeking approval from the Montana Public Service Commission to raise rates by 28% compared to August 2022, a request numerous people call "historic and unprecedented." Finally, ALLETE (ALE) missed by 7.99%, and Pinnacle West Capital (PNW) disappointed for the second consecutive quarter.

Weak earnings surprises are concerning for PEY because it has 25% exposure to the sector. The results listed above aren't anomalies, either. Small-, mid-, and large-cap Utility sector aggregate surprises are -2.3%, 2.2%, and -10.1%. It's a reversal of the sector's status last year when I recommended it despite increased competition with bond yields.

Investment Recommendation

PEY offers an enticing 4.80% expected dividend yield, but investors should expect little capital appreciation. In fact, constituents' share prices may further retreat due to poor profitability scores and weak quarterly earnings results. In particular, the Utilities sector is under pressure. Rate increase requests reached an all-time high in 2022 as companies look to pass on increasing costs to ratepayers. These requests may not be fulfilled for various reasons, including political ones, especially if interest rates decline and consumers feel the pinch. Since PEY is 25% Utilities, there are substantial headwinds, so I don't recommend readers invest at this time. Thank you for reading, and I look forward to the discussion in the comments section below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, SCHD, VIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.