Reynolds Consumer Products: Likely No Dividend Increase Anytime Soon

Summary

- The company is on a slow-growth track, limiting its investment returns.

- Investors should wait for a higher dividend yield.

- The company is slowly reducing its debt and still carries a high level of debt.

- I don't believe the company can increase its dividend or do share buybacks.

HT Ganzo

I rated Reynolds Consumer Products (NASDAQ:REYN) a hold in my December 2022 article. Since then, the stock has performed as predicted, meaning poorly. It has lost 13% on a total return basis, while the S&P 500 Index (SP500) gained 5%. Today, the stock trades at a forward GAAP PE of 20.4x, a lower valuation than its December PE of 25x. Given its limited options to improve cash flow generation and high debt levels, the stock is fully valued. The company will release earnings on May 10. Given the growth prospects and valuation, expect the stock to move sideways. If the U.S. enters a recession in 2023, the stock should be rated as overvalued, as demand headwinds and higher advertising costs may reduce margins and cash flows.

Back to low growth

In 2022, the company increased its revenue by 7% compared to its prior year. Three of the company's four segments performed exceedingly well. In Q4, the laggard was the company's Cooking and Baking segment which saw a modest decline in revenues of 3% and a substantial decline in adjusted EBITDA of 49%. This revenue decline was driven by lower consumption and high inventory at the retail stores. Volumes declined by 10% in this segment. The company may have shot itself in the foot by not paying attention to its equipment maintenance. Equipment failure led to higher manufacturing costs in Q4 in this segment, which may have been the primary contributor to the decreased profitability.

The rest of the company's three segments had good performance in Q4. The Hefty Tableware segment was a star performer, with revenue increasing 28% and adjusted EBITDA increasing 88%. Volume increased by 1%. The Hefty Waste and Storage segment saw revenue increase by 4% while adjusted EBITDA increased by 57%. The Presto Products segment increased revenue by 8% and adjusted EBITDA by 76%. The economic slowdown may dent the demand for the company's products. Consumers can reduce consumption or switch to private-label brands if the unemployment rate increases.

The company faces heavy competition from store brands and is a price taker across most of its products, and its product prices must align closely with the private label brands. The company could lose market share if Reynold's products sell at a higher premium than the store brand. The company has been innovating to get into adjacent markets. Still, those new products may prove to be niche segments and not drive high volumes that would make a substantial difference to its revenue growth and profitability. But, the company has to continue innovating to stay ahead of the private label brands.

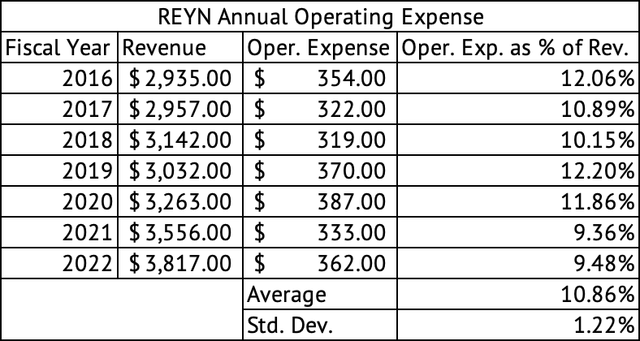

The lack of a durable competitive moat is challenging, increasing advertising and marketing costs and reducing profitability and cash flows. The company's marketing costs are accounted for in its operating expenses. The company's operating expense has averaged close to 11% since 2016 (Exhibit 1). Due to the pandemic-driven demand, which increased sales substantially, its operating expenses were lower in 2021 and 2022. Michael Graham, the CFO, mentioned that 2022 adjusted EBITDA was lower due to lower volumes and higher advertising costs. In the future, its innovation efforts may bear fruits helping it land a product with a substantial competitive moat and drive high volumes, a must-have product. But that product does not seem to exist yet, and the company's valuation has to be based on its current revenue growth and profitability.

Exhibit 1:

Reynolds Consumer Products Annual Operating Expense as a Percentage of Revenue (Seeking Alpha, Author Calculations)

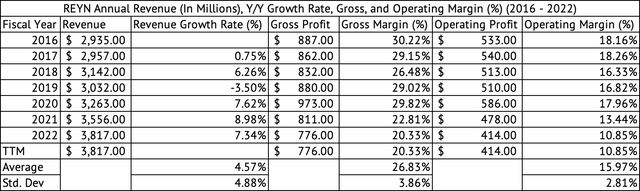

The company's strong revenue growth in 2020, 2021, and 2022 is well behind it (Exhibit 2). The company's revenue grew above 7% annually in those three years. The company expects its revenue to be flat to plus or minus 1% in 2023 (Exhibit 3). These projections may be based on the U.S. economic strength, and any economic slowdown will take a bite of its revenue. The Reynolds Cooking and Baking segment accounts for nearly 36% of its revenue; any issues can hurt the overall performance. The company's gross and operating margins have suffered due to inflation, maintenance issues, and a lack of pricing power. In short, the company does not expect any growth.

Exhibit 2:

Reynolds Consumer Products Annual Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 3:

Reynolds Consumer Products 2023 Outlook (Reynolds Consumer Products Investor Presentation)

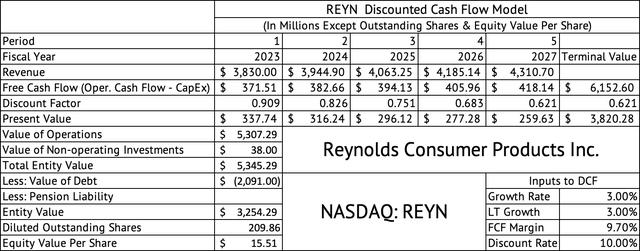

The company's quarterly gross margin started its decline in March 2021 and has yet to recover. In Q4 2022, the company's gross margins were 22.6% compared to its average of 24.1% since June 2020 but recovered from a low of 18.4% in Q3 (Exhibit 4).

Exhibit 4:

Reynolds Consumer Products Quarterly Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

Richly valued

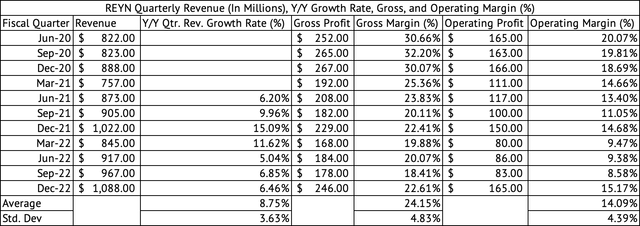

A discounted cash flow model estimates an approximate per-share equity value of $15 (Exhibit 5). The stock trades around $27, about 80% higher than its estimated per-share value. The model used flat revenues in 2023 as its starting point and assumed a growth rate of 3% annually. It assumes a free cash flow margin of 9.7% and a discount rate of 10%. Its current cost of capital may not be close to 10% since most of the company's debt is at low-interest rates.

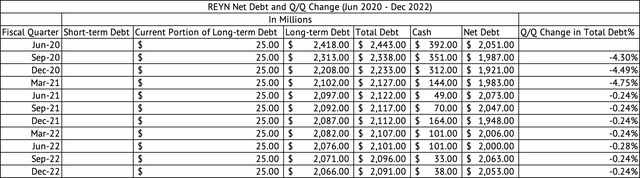

The company had entered into a series of interest rate swap agreements, putting its weighted average annual effective interest rate at 4.42% in 2022. But this effective rate is a substantial jump from its rate of 2.01% in 2021. The company's cost of capital has increased substantially with the rise in interest rates. The company's high debt load would have increased its capital costs too. The company has a total debt of $2.09 billion, down from $2.44 billion in June 2022 (Exhibit 6). The management is making a concerted effort to reduce its debt, trending in the right direction.

Exhibit 5:

Reynolds Consumer Products Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

Exhibit 6:

Reynolds Consumer Products Debt & Cash (Seeking Alpha, Author Compilation)

The company is working on reducing its debt

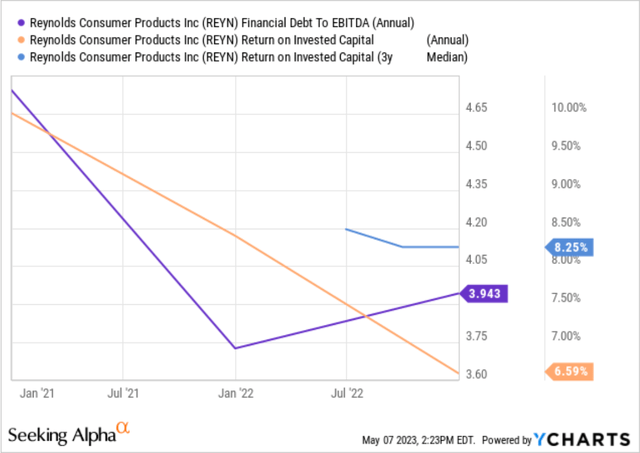

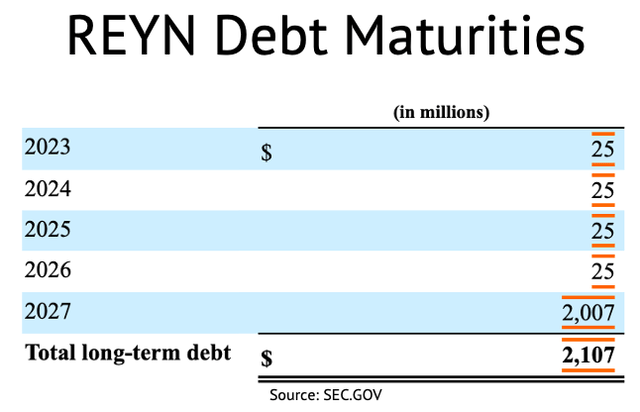

The company's debt should be below $2 billion in 2023, and its debt-to-EBITDA ratio is now below the psychologically important 4x (Exhibit 7). The company has reduced its debt by 0.25% q/q since June 2021. But, it still has a long way to go to attain a more sustainable debt-to-EBITDA ratio of close to 2.5x. Most of the company's debt is maturing in 2027, which gives it time to reduce it (Exhibit 8).

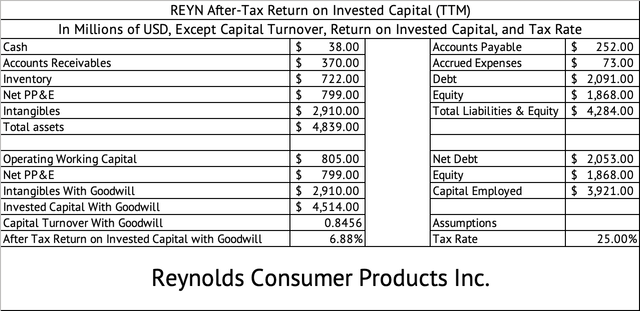

The stock's poor return on invested capital is another reason investors must put a lower valuation on it in my view. Based on the latest quarterly filing, the company's ROIC is 6.8%, a low number compared to its cost of capital (Exhibit 9). The ROIC is 6.59% with a 3-year median of 8.25%, as calculated by Seeking Alpha/YCharts (Exhibit 7). The stock may never get to $15 if things stay stable at the company, but I am looking to add to my holdings at closer to $23 when the stock would yield 4%.

Exhibit 7:

Reynolds Consumer Products Debt-to-EBITDA Ratio and Return on Invested Capital (Seeking Alpha)

Exhibit 8:

Reynolds Consumer Products Debt Maturities (SEC.GOV)

Exhibit 9:

Reynolds Consumer Products Return on Invested Capital (Seeking Alpha, Author Calculations)

The dividend must be higher, given poor growth prospects and high debt

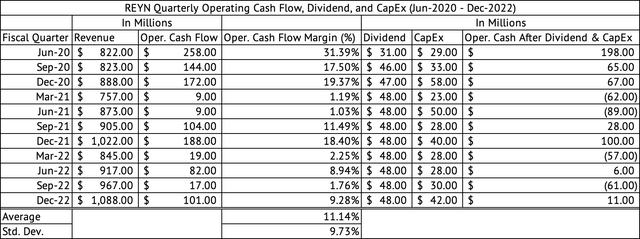

Most investors likely own this stock for its 3.3% yield, higher than the sector median of 2.4% and the 1.6% yield offered by the Vanguard S&P 500 ETF (VOO). The company is not growing its revenue, and it needs to reduce its debt and will find it difficult to increase its dividend soon. The company paid $192 million in dividends, $48 million each quarter, in 2022 and generated $219 million in operating cash flows (Exhibit 10). The company does not have much wiggle room to increase its dividend now, given the need to pay for capital expenditure and maintain its current dividend.

Exhibit 10:

Reynolds Consumer Products Quarterly Operating Cash Flow, Dividend, and CapEx (Seeking Alpha, Author Calculations)

The per-share dividend was increased from $0.59 per share in 2020 to 0.92 per share in 2021. That dividend raise might have been a mistake, given the company's debt level. The company should be able to improve its operating cash flow in 2023 due to the improving profitability of its Reynolds Cooking and Baking segment. The unplanned maintenance that impacted this segment in 2022 would have been resolved, resulting in lower costs and higher output in 2023. In short, investors should wait for the stock to yield 4% before buying. At $23, the stock would yield 4%. Investors may be better off waiting for the stock to revisit its 52-week low of $24.54 before buying.

Reynolds Consumer Products has poor growth prospects. Its high debt will limit its ability to return cash to shareholders via dividend increases and share buybacks. A recession in the U.S. would impact its profitability. The company generates poor returns on invested capital and is richly valued. The dividend is the only reason investors need to hold this stock, and they should expect close to a 4% yield before investing. The stock has to drop 12% before I consider investing.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of REYN, VOO, VDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.