Charlie Munger Says 'A Lot Of Real Estate Isn't Good Anymore': Our Top Picks

Summary

- Legendary billionaire Charlie Munger recently warned of 'trouble' and 'agony' for the real estate sector.

- We look at his comments and offer our perspective on the issues confronting the real estate sector today.

- We also share some of our top real estate picks for profiting from the looming crisis facing the sector.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

Philip Openshaw/iStock via Getty Images

Legendary billionaire investor Charlie Munger of Berkshire Hathaway (BRK.A)(BRK.B) recently warned of 'trouble' and 'agony' for the real estate sector (VNQ).

In this article, we look at Mr. Munger's comments and offer our perspective on the issues confronting the real estate sector today. We also share some of our top real estate picks for profiting from the looming crisis facing the sector.

Charlie Munger's Real Estate Warning

Mr. Munger warned that commercial real estate had a tough road ahead of it, stating:

A lot of real estate isn't so good any more. We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There's a lot of agony out there.

Why does Mr. Munger think that commercial real estate - especially office and retail - is in trouble?

The Office real estate sector in the US is facing significant challenges, stemming from the rapid rise in interest rates (which is resulting in valuations to plunge and making refinancing maturing property-level debt increasingly difficult to afford), the surging work-from-home trend which has reduced demand for office space, and now companies beginning to reduce their office presence to cut costs as the economy slows.

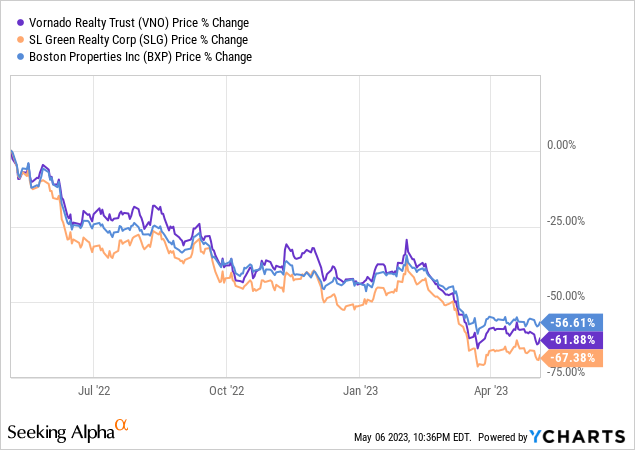

The impacts are already being felt, with average office valuations dropping by 15% in March and the stock prices of prominent Office REITs like Vornado (VNO), SL Green (SLG), and Boston Properties (BXP) plunging by many times more than that over the past year:

Unfortunately, the worst may not be over yet for the sector, with some estimates suggesting that office property values could fall by over 30% this year as a surge in office mortgage defaults could lead to excess supply on the market.

Meanwhile, retail real estate is also under pressure from the combination of the explosion in e-commerce fueled by the rapid rise of companies like Amazon (AMZN) and eBay (EBAY), the overbuilt state of retail real estate in the United States, and lingering and perhaps permanent impacts from the COVID-19 lockdowns. As a result, the wave of retail bankruptcies in recent years - most recently headlined by the demise of Bed Bath & Beyond (OTCPK:BBBYQ) - has dramatically reduced the pricing power of many lower quality retail real estate giants and forced even the best properties - owned by the likes of Simon Property Group (SPG), Macerich (MAC), Federal Realty Investment Trust (FRT), and Brookfield (BN)(BAM)(BPY) - to invest billions of dollars in transforming their properties to keep them relevant and economically vibrant.

While there will likely always be a place for high-quality, well-located malls, shopping centers, and office buildings, the incremental demand for them will likely be gradually eroding. This will become even more prominent as artificial intelligence and software in large increasingly dominate the economy, driving more and more of the economy out of the physical world and into the virtual world.

Companies like AMZN, Google (GOOG)(GOOGL), Microsoft (MSFT), and Meta (META) are investing extremely aggressively to bring this to fruition, forcing the hand of many bricks and mortar retailers to increasingly digitize their businesses while many leading corporations are also investing aggressively in their information technology capabilities to implement data science and machine learning as much as possible. All of this will likely reduce the incremental need for physical office and retail space in the coming years, making all but the very best real estate assets practically obsolete.

Our Top Real Estate Picks

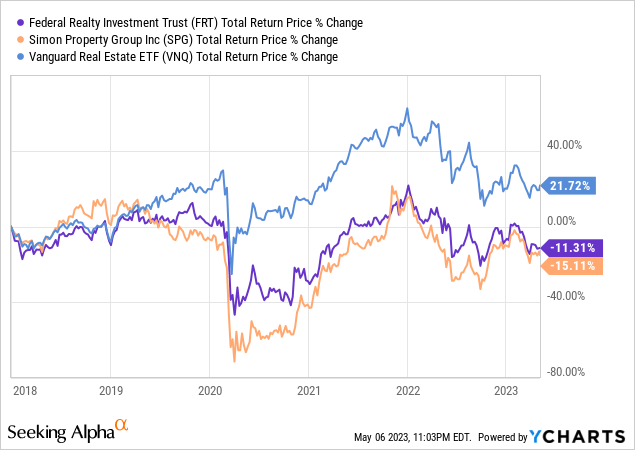

In our view, mainstream office REITs such as the ones mentioned in this article are too risky to invest in due to the uncertainties and headwinds facing the sector. While they very well could turn out to be incredibly attractive values at these beaten down levels, many thought the same about retail REITs during the retail apocalypse of 2018-2020. However, many retail landlords went bankrupt during that period despite offering what looked like compelling value (remember CBL & Associates (CBL) and Washington Prime Group?) and even the highest quality survivors have delivered very subpar returns to date:

We think the same could very well end up being the case with office real estate.

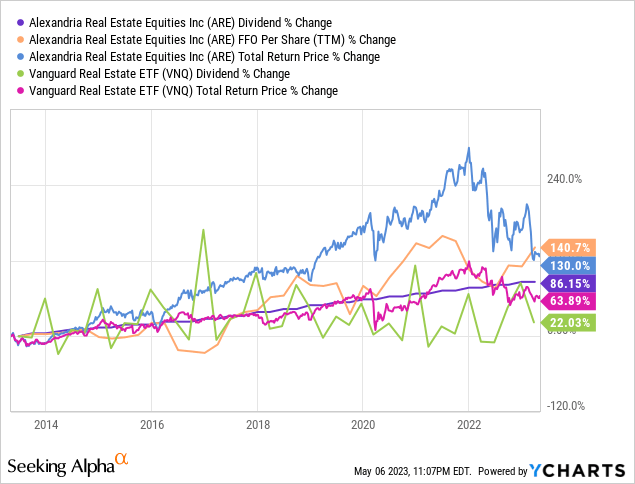

However, there are some conservative options in the broader commercial REIT sector that have been beaten down in price due to their association with office REITs, but are well-positioned to thrive moving forward with few risks in common with office REITs. Our favorite pick of the moment is Alexandria Real Estate (ARE), as it is a life sciences lab space focused REIT with strong demand for its properties and a solid balance sheet. It also has been generating exceptional organic rent growth, driving robust FFO per share and dividend per share growth and outstanding long term total returns that have crushed those of the broader REIT sector over the past decade:

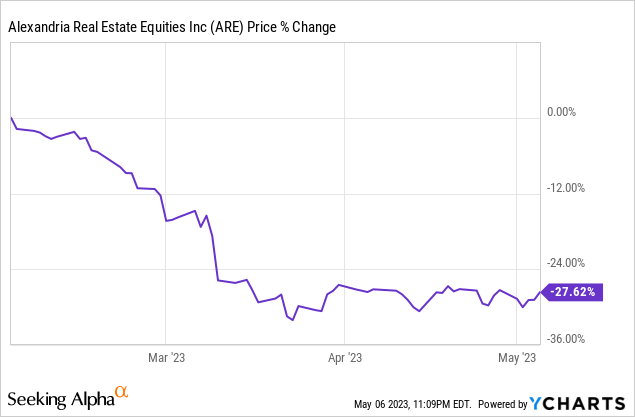

Thanks to a massive - and unwarranted - selloff in the stock price in recent months, ARE now trades at a ~33% discount to the consensus estimate of its NAV (which has been supported by valuations in substantial recent transactions in ARE's portfolio):

When it comes to retail REITs, we think that triple net lease REITs are the best place to be at the moment thanks to the growing likelihood of recession. While we like just about all of them - even the most expensive in the sector Realty Income (O) - our top picks right now are W. P. Carey (WPC) for its substantial industrial exposure and high percentage of inflation-linked leases and Spirit Realty (SRC) for its cheap valuation, solid balance sheet, and growing industrial exposure.

SPG is also a compelling value here, but is more sensitive to recessions and has a less compelling long-term growth profile than triple net lease REITs in our view. MAC is a deep value speculative bet due to its weaker balance sheet, but its extremely high quality real estate portfolio makes it a tempting high-risk, high-reward bet right now as well.

Investor Takeaway

Mr. Munger has been around a long time and has a phenomenal track record. As a result, when he speaks, we try our best to listen. Given his concerns about office and retail real estate, we are keeping our exposure to these sectors minimal at the moment at High Yield Investor, and even our loosely connected positions are well-protected from an economic downturn thanks to their fortress balance sheets and conservatively underwritten leases.

We don't know how the carnage in commercial real estate will turn out, but we are finding plenty of attractive high yield opportunities elsewhere, so we do not see the point of dumpster diving in these sectors in an attempt to get rich (and lucky). What are your thoughts on the challenges facing office and retail real estate today?

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point and a Masters in Engineering from Texas A&M with a focus on Computational Engineering and Mathematics. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC, ARE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.