Realty Income: The Good, The Bad, The Ugly

Summary

- Realty Income Corporation just released its quarterly results.

- There is both some good and bad news for this REIT.

- We share our latest thoughts on Realty Income Corporation.

- We're currently running a sale for our private investing group, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Liliboas/E+ via Getty Images

Realty Income Corporation (NYSE:O) is one of the most popular real estate investment trusts ("REITs") in the world. For the most part, it deserves the praise that it is getting:

- The company owns Class A net lease properties that generate consistent and predictable cash flow that's recession and e-commerce resistant.

- It has an A-rated balance sheet with low debt, mostly fixed rate, and well-staggered debt maturities, giving it access to low-rate debt even today.

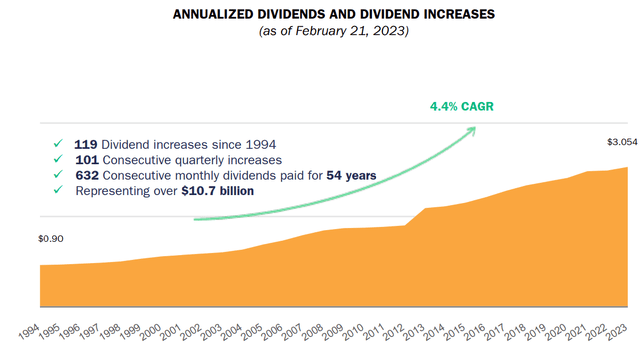

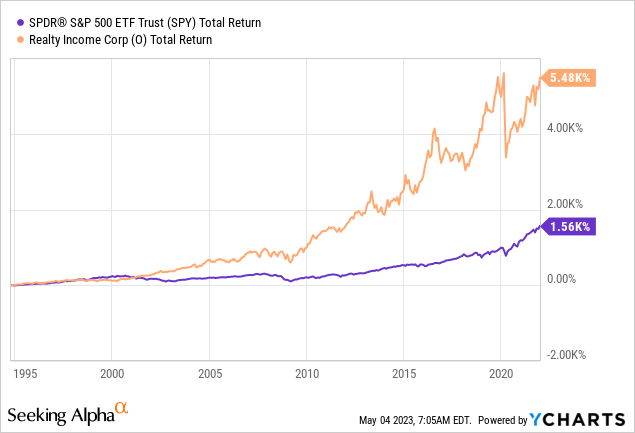

- Finally, the management has a multi-decade track record of steady dividend growth, even through times of crises, and it has significantly outperformed the rest of the market (SPY, VNQ) since going public in 1994:

That's all great for those who bought the stock in the past...

...But is it still a good investment opportunity today?

The latest results of the company can help us answer this question.

The company just released its Q1 results and here's the good, the bad, and the ugly:

The Good

Its quarterly results were very good. They were even better than what the market had expected.

They beat expectations because they were able to acquire more properties than they had anticipated and with better terms as well.

In the first quarter alone, Realty Income acquired $1.7 billion worth of properties. This allowed them to increase their 2023 guidance by another billion from $5 to $6 billion.

These acquisitions occurred at an attractive 7% cash cap rate. Historically, they have acquired properties at closer to a 5.5-6.5% cap rate, so this is a clear improvement.

It shows that Realty Income is able to adapt and seek accretive investment opportunities even in today's higher interest rate environment.

The REIT also issued some new debt at a 4.7-5.05% interest rate during the quarter, so it is still earning a ~200 basis point spread on top of that.

That's good!

The Bad

As I have previously explained, my main concern with Realty Income is that its sheer size will either hinder AFFO per share growth, erode underwriting standards, or both. And the need to buy tons of real estate every year ($6 billion guidance for 2023!) is increasingly making management jacks of all trades and (perhaps) masters of none.

Pre-2008, Realty Income Corporation was heavily diversified and entirely retail-focused. Post-2008, O became highly focused on investment-grade tenants and branched out into industrial and a little bit of office and agriculture (vineyards). And today? IG tenancy has come down from about 50% a few years ago to ~40% now. And it's hard to find a throughline connecting their various acquisitions:

- A regional casino

- A portfolio of dental offices (with very high-cost interior buildouts)

- A portfolio of convenience stores (purchased, admittedly, at a great cap rate of 6.9%)

- Vertical farms

- Italian wholesale clubs.

Here you might say: "But you like W. P. Carey Inc. (WPC) and it is also highly diversified. I smell hypocrisy on your breath." Yes, WPC is highly diversified because it used to follow an "anything goes" investment strategy, but they are a lot more focused and specialized on Class A industrial properties and European retail today.

WPC is becoming more specialized while O is becoming less.

Same with Agree Realty Corporation (ADC). Over the last few years, ADC's portfolio has only become more focused on IG retailers. Its investment criteria are well-defined and thought out. O's investment criteria appear to be "anything that meets our minimum underwriting and cap rate requirements, regardless of industry or property type."

That is a worrying development for me.

I generally prefer to invest in smaller REITs that are laser-focused on maximizing value in a specific market niche in which they build competitive advantages. That is not the case with Realty Income anymore.

The Ugly

Even after hiking its guidance, the growth is still expected to be quite disappointing. Here is what the CEO said in their earnings release (emphasis added):

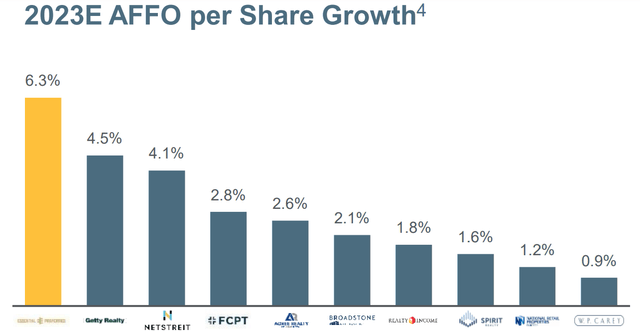

"Supported by the stability of our portfolio and investment activity to date, we are updating 2023 AFFO per share guidance range to $3.94 to $4.03, representing 1.7% annual growth at the midpoint."

I understand that interest rates are up and this is a tougher year for most companies, but the reality is that quite a few peers of Realty Income are able to grow a lot faster than that.

To give you a few examples: VICI Properties Inc. (VICI) expects to grow its FFO per share by about 10% in 2023. Essential Properties Realty Trust, Inc. (EPRT) expects to grow it by 6.3% as well.

Essential Properties Realty Trust

That's a lot more than the growth of Realty Income.

How are they able to grow so much faster?

It really comes down to two things:

1) They have larger rent hikes in their leases. EPRT, as an example, has ~2% rent hikes in most of its leases, but Realty Income's same-store rent is expected to rise by just 1.25% in 2023.

2) They are smaller in size and new acquisitions really move the needle. Realty Income has a more than 10x bigger market cap than EPRT and as a result, it must buy a lot more properties to grow. EPRT can achieve the same or better results by buying 10x fewer properties, allowing it to be more selective in its approach, focusing on deals that offer the most accretion.

That, on its own, does not make Realty Income unattractive.

But it makes it less attractive than its peers, relatively speaking, because its valuation is not reflective of its slower growth. Even today, Realty Income actually trades at a small valuation premium relative to peers like EPRT and VICI.

Bottom Line

Here are the pros and cons of O as I see it.

| PROS | CONS |

| Low cost of debt from its A- credit rating | Massive portfolio will either hinder per-share growth or cause erosion of underwriting standards, or both |

| Wide diversification from its huge portfolio | Relatively high cost of equity (6.7% AFFO yield as of this writing) |

| Largely defensive tenant base (grocery, convenience, dollar stores, QSRs, pharmacies) | Increasing lack of focus or specialization |

| Ability to borrow in GBP and euros at lower interest rates | Steady slate of debt maturities every year this decade |

| Falling share of investment-grade tenants |

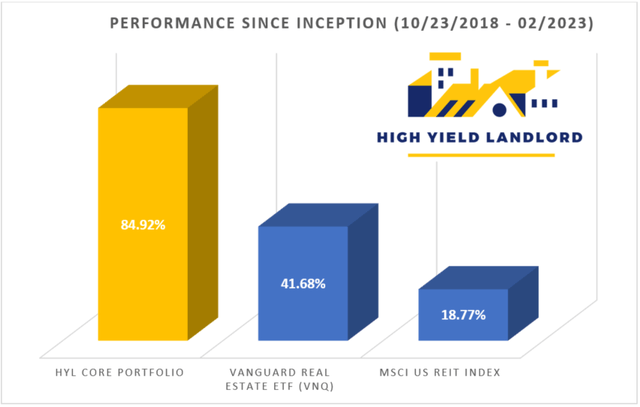

I give Realty Income a Buy rating, and we own a small position in our Retirement Portfolio at High Yield Landlord. I think that it makes sense for conservative income-oriented investors who want to earn steady monthly dividend income.

But we continue to think that other net lease REITs are more attractive for total return-oriented investors. Agree Realty owns better properties on average, it is growing faster, and its valuation is today comparable. Alternatively, if you are willing to take a bit more risk, then Essential Properties Realty Trust is another good option, offering a path to greater returns in the long run.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O; EPRT; ADC; VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.