LXP Industrial: High Yield And Great Value

Summary

- LXP Industrial carries a strong portfolio and is seeing high occupancy and robust lease spreads.

- The majority of its debt is fixed rate and it carries an investment grade credit rating.

- Meanwhile, LXP yields well above its industrial peers, giving investors higher income combined with capital appreciation potential.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

porcorex

It’s great to be part of a growing sector, such as that of industrial real estate, which doesn’t face the headwinds that office landlords are seeing. It seems, however, that the market has also caught onto the merits of owning this segment.

For example, the leading name in industrial REITs is Prologis (PLD), and its stock price has soared by 27% since hitting a 52-week low in October last year. At its current P/FFO of 23.2, PLD is certainly not for bargain hunters.

This brings me to LXP Industrial Trust (NYSE:LXP), which I last covered here back in September last year, and is also seeing strong growth but comes with a far cheaper price tag. In this article, I highlight its recent quarterly results and discuss why it’s a great bargain at present.

Why LXP?

LXP Industrial is a self-managed REIT that transformed in recent years from being primarily an office REIT (formerly called Lexington Property Trust) into an industrial REIT. At present, it has 109 properties, of which 77% are located in the top 25 markets in the U.S., and 92% are located in the top 50 markets.

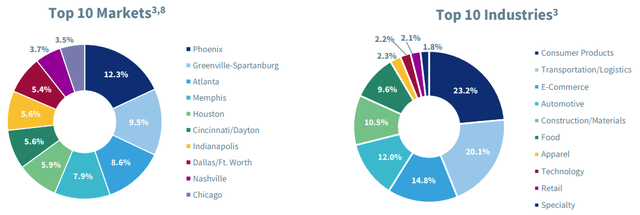

LXP’s properties are diversified across the Northeast, Sunbelt, and Midwestern regions. It also counts well-recognized and moat-worthy tenants among its top 10, including Amazon (AMZN), Kellogg (K), Walmart (WMT) and FedEx (FDX). As shown below, LXP’s top 10 markets comprise solidly Tier 1 and Tier 2 cities and its top 10 industries are generally defensive in nature.

Meanwhile, LXP is seeing strong demand for its properties, as its industrial portfolio is virtually fully occupied with a 99.5% leased rate. LXP also completed 2.3 million square feet of lease extensions during the first quarter, raising cash rents by 29%.

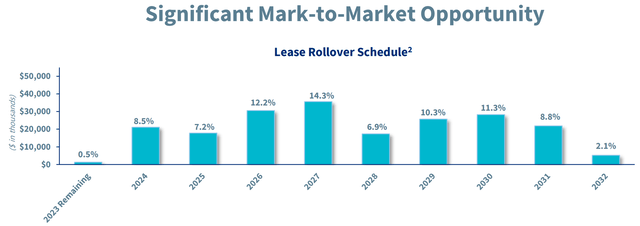

This, combined with LXP’s average annual 2.6% rent escalators on existing leases helped it to achieve same store NOI growth of 5% YoY during the quarter. Further adding stability to the portfolio, LXP has very little lease rollovers for the remainder of the year, and its lease maturities are well-staggered beyond this year, as shown below.

Plus, LXP isn’t dependent on having to acquire properties for growth, as it’s consistently had a development pipeline throughout its history. Near term growth to the top and bottom line should come from the placing into service of a 1.1 million square foot Columbus development project leased to an investment grade rated tenant at an attractive 7.3% initial cash yield.

LXP also recently completed 2 warehouse facilities containing 2.1 million square feet in Central Florida and Indianapolis. At present, LXP has 6 development projects with an aggregate investment value of $31 million. Looking ahead, LXP could see an acceleration in its annual rent bumps, as that’s what it’s seeing in its Atlanta market due to high demand. This market has seen an increased annual rent bump from 2.5% to 4%, signifying the strong fundamentals of this market.

LXP also carries a sound BBB- investment grade rated balance sheet with a low weighted average interest rate of 3.2%. 91% of LXP’s debt is locked in at fixed rates, and it carries a net debt to adjusted BITDA of 6.1x, including the stabilization of its Phoenix facility leased during Q1, and its subsequently leased Columbus property after Q1. Management expects for leverage to be in its target 5x to 6x range upon stabilization of its development portfolio.

Notably, LXP currently yields a respectable 5.2% that sits well above that of industrial peers like Prologis and STAG Industrial (STAG). LXP has also grown its dividend every year since right-sizing it in 2019 to account for its transition from office to industrial properties. The current dividend rate is well covered by an AFFO payout ratio of 74%, based on Q1 AFFO per share of $0.17.

Turning to valuation, LXP is attractively priced at $9.66 with a forward P/FFO of 14.1. This is considering its respectable growth in high demand markets. Sell side analysts who follow the company have a conservative average price target of $11, implying a potential 19% total return over the next 12 months.

Investor Takeaway

LXP is attractively priced for an Industrial REIT and has since seen strong demand for its properties. It has a robust development pipeline, strong cash spreads on new and renewal leases, and high occupancy. It also has an investment grade rated balance sheet comprised primarily of fixed rate debt and has a low weighted average interest rate.

As such, income investors seeking a higher yield from the industrial sector combined with potential for capital appreciation in the near term ought to give LXLP a hard look at its current valuation.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.