Panasonic: Buffett Bets On Japan, But This Is My Favorite Japanese Play

Summary

- Still my favorite Japan play, Panasonic Holdings Corp. is making a big transition into a lithium battery giant.

- Panasonic Holdings Corp. has an ultra-low price-to-sales ratio, which is below book value as well.

- While Buffett is strictly in Japanese trading houses, looking at industrial infrastructure plays would be wise.

StockByM

Buffett in Japan

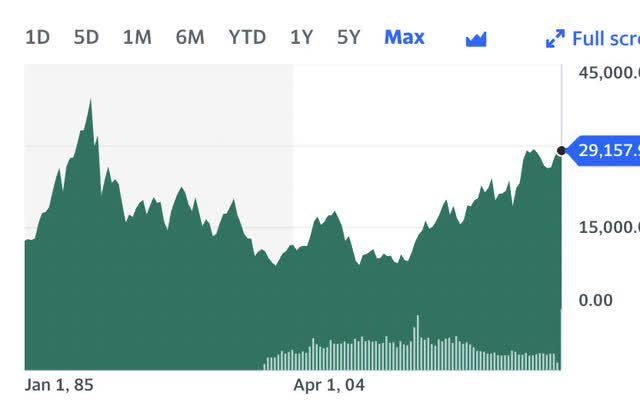

The trend of value investors looking to Japan is not something new. Japan was the hottest market in the world in the 1980s, hitting a Nikkei index high of 38k in 1989. The index still has yet to recover:

Fast forward to the modern day and we see population declines and very conservative balance sheets. Many companies are selling below book value and hoard more cash per share on average than similarly sized US-based companies.

While Buffett is betting on more Japanese-centric plays, my current favorite and only large foreign holding remain Panasonic Holdings Corp. (OTCPK:PCRFY) (OTCPK:PCRFF). It trades well within the Graham Number parameters that most Japanese stocks do at this moment with a good balance sheet. Panasonic Holdings Corp. is a global Japanese holdings company that pivots more and more every year into the lithium EV battery space. I previously covered this stock in September 2022 and the thesis has only improved in my opinion. The stock is a buy and follows many of the rules that Buffett's Japanese plays do as well.

A look at Buffett's Japan plays

Buffett is in love with the Japanese trading houses, basically diversified commodities dealers trying to achieve an all-weather status:

Not all investors love Japanese trading houses, saying their operations are too complex to understand. They are, in essence, diversified investment companies with footprints in industries ranging from energy and minerals to food, retail and health care. But for Buffett, this diversity is apparently the attraction.

The Berkshire (BRK.B) (BRK.A) Japanese holdings are as follows:

- Itochu (OTCPK:ITOCF)

- Mitsubishi (OTCPK:MSBHF)

- Mitsui (OTCPK:MITSY)

- Sumitomo (OTCPK:SSUMF)

- Marubeni (OTCPK:MARUY)

Most Japanese companies currently trade favorably using the Graham Number, price targets where the price to book times the P/E ratio does not cross Benjamin Graham's line of 22.5 You can set a price target by using the square root of 22.5 X TTM Book Value X TTM EPS.

Data from Yahoo Finance, May 2nd 2023:

| Ratios | Book Value | TTM EPS | Graham Number | |

| Itochu | 47.36 | 8.22 |

| |

| Mitsubishi | 40.02 | 6.17 |

| |

| Sumitomo | 13.32 | 3.55 |

| |

| Mitsui | 580.96 | 103.81 |

| |

| Marubeni | 117.63 | 23.80 |

|

| Itochu | Mitsubishi | Sumitomo | Mitsui | Marubeni | |

| Current price | 65.67 | 36.33 | 17.78 | 626.35 | 138.12 |

| Discount | 30% | 53% | 46% | 47% | 45% |

Not only are all of these stocks well discounted to the Graham number based on assets and earnings, but they also carry hefty dividends. Sporting conservative balance sheets to boot. Here you have some clear hedges against permanent capital loss, one of Buffett's leading goals from his original investment partnership.

Panasonic recent news

Plans to build new plants in both Oklahoma and Kansas:

- Panasonic Energy Co. selected a joint venture of Turner Construction Co. and W.G. Yates & Sons Construction Co. to build a 2.7-million-sq-ft electric vehicle battery assembly plant in De Soto, Kan., as part of an overall $4-billion investment, the companies announced March 1. The plant would produce Panasonic's 2170 cylindrical lithium-ion batteries. They are used by electric vehicle maker Tesla, which Panasonic supplies from its Nevada EV battery plant. Panasonic has said it would also supply EV maker Lucid from the Kansas plant.

- Panasonic Holdings Corp. announced in November 2022 that EV battery recycler Redwood Materials would supply its plants in Nevada and Kansas. Redwood is planning to expand its Nevada campus with a $2-billion U.S. Dept. of Energy loan, announced last month.

- Oklahoma Gov. Kevin Stitt says the state has inked a contract to open a battery plant at the MidAmerica Industrial Park in Pryor. It's been widely reported to be with Japanese manufacturer Panasonic Holdings Corp.. The company would employ thousands. Stitt said the project would bring a $5 billion investment to the state.

With the above recent developments by Panasonic Holdings Corp. and partners, it appears a total buildout in the neighborhood of $11 Billion is in the works to expand the Panasonic battery ecosystem. While not all these costs and profits will solely belong to Panasonic, the TAM will expand significantly by 2025 due to these joint investments.

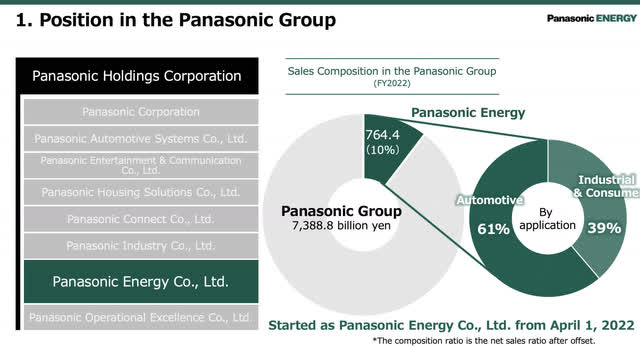

While the energy division still only comprises 10% of Panasonic Holdings Corporation's overall revenue, the capital expenditures for future growth look to be gravitating towards this segment. They know the demand for their product is without limits in this division and they look to be going all in.

Price to sales

The price to sales on Panasonic Holdings Corp. is borderline ridiculous. With a forward price to sales of .36 X, I challenge you to find a cheaper stock that's US based on this metric. James O'Shaughnessy found that price to sales at or below 1.5 X was one of the strongest lines of support for a stock you could hunt for. With the company bringing in well over its market cap in revenue every year combined with a large capital outlay for battery factories occurring right now, you can only imagine that cost-cutting measures in the future will be able to bring a lot of this revenue to the bottom line post factory buildouts.

Battery partners

Tesla (TSLA) is the most notable partner. They own Giga 1 near Reno, Nevada with the factory being split down the middle. The batteries are produced on one end and then loaded into the vehicle undercarriage on the other end of the factory. On top of that relationship, Panasonic Holdings Corp. has inked deals with Toyota (TM) and is in talks with Stellantis (STLA) and BMW (OTCPK:BMWYY).

Some highlights regarding this can be seen here discussing new plants and cells technology in Panasonic Holdings Corp.'s 2022 annual report:

From the global environment perspective, it is essential that the affordability and safety level of EVs far surpass those of cars with internal combustion engines. To reach this target, we will make Group-wide investments to thoroughly and rapidly strengthen battery capacity, safety, and cost competitiveness of our automotive batteries. More specifically, we will commercialize new high-capacity cells with a 46-mm diameter, at the fastest speed within the industry, by refining our high-quality and safer automotive battery technologies, as well as achieving industry-leading cost competitiveness. First, we will verify the productivity of the highly efficient production line at our Wakayama factory in Japan, with mass production set to start in fiscal 2024. In addition, we applied to the incentive program that the State of Kansas established to attract investments, and received the state's approval in July 2022. The construction of a manufacturing facility in Kansas, USA.

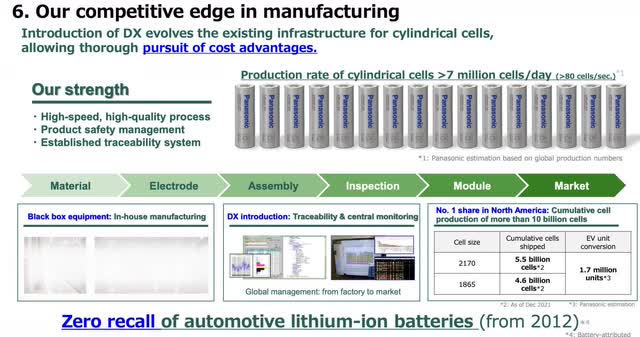

In addition to the battery deals and expansions, Panasonic Holdings Corp. is establishing battery recycling with Redwood Materials, also located near Giga 1. They will recycle and repurpose disposed battery materials that could be used again in the future at more cost-effective prices. They highlight this in their most recent energy division presentation. They are focusing on speed and density, with the new 4680 cells expected to be as powerful as 5 2170 cells.

Panasonic Energy division presentation

Additionally, the company plans to nearly eliminate nickel and cobalt in their future battery technologies which should give them supply chain cost advantages.

Panasonic Holdings Corp. is furthermore touting its cell production rate at 7 million cells/day. They claim to have had zero recalls of automotive lithium batteries since 2012. No wonder Musk in 2017 said the original 2170 cells were the "best and cheapest in the world". Especially when you don't have to endure any battery recalls.

The Graham number

After reviewing the numbers and discounts to intrinsic value for Buffett's plays, let's also run through the same exercise on Panasonic Holdings Corp. As of May 2nd, 2023, the company is sporting the following stats:

- Book value of $11.29

- TTM EPS of $.70

Incorporating these we get a Graham Number fair price based on GAAP earnings of $13.33. With the stock trading at $9.66, that's a discount of 28%. I tend to only use GAAP metrics on foreign stocks as they don't have all the same tax advantages in write offs that US companies might have.

Balance sheet

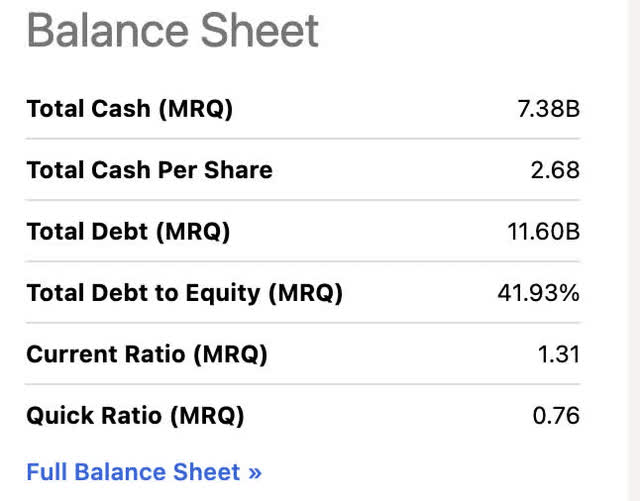

With about 30% cash per share and a debt-to-equity ratio of only 41.93%, this is a pretty conservative balance sheet. The company also has a current ratio of 1.31. Panasonic is back to being free cash flow positive at $0.42 a share, whereas they staggered through negative territory last year having a lot of capital outlays.

Risks

The pivot Panasonic Holdings Corp. has made is clear. Their new CEO, Yuki Kusumi, elevated in 2021, was the previous head of Panasonic's automotive division. The company recently converted to a holdings company, making it easier to sell off unproductive divisions, and has been signing deals for new battery factories and planning expansions.

They appear to be going all in on the EV battery market. A slowdown in demand for EVs could be the clearest risk. If a contract gets cut halfway through a factory build, that would be trouble. However, with governments almost demanding EV expansion, the market for lithium battery cells still seems unlimited at this point.

Luckily the company has several divisions that hedge the energy division, but the majority of their new capital outlays are certainly going towards expanding the energy division exclusively.

Q3 Earnings Comps

Panasonic Investor Relations Presentation Q3 2023

Taking a quick look at the company's Feb 2nd 2023 earnings release, we see a 15% improvement in revenue growth yoy with decreases in operating and net profit. The 24% overseas revenue growth tells you a lot about the battery business as that's where the majority of EV batteries are sold. As the company continues to lay out capital in preparation to expand their battery ecosystem, I would expect more of the same going forward. Another company I track, the lithium giant Albemarle (ALB), also had poor earnings while increasing revenue during their lithium mining expansion. Now that many of the projects are operational, they are back to free cash flow positive and have compressed the earnings multiple considerably.

What I expect from Q4 2023

Consensus EPS is $0.10 a share, about half of what the company reported yoy. I expect it to look similar to recent earnings comps in the above infographic from Panasonic's Q3 - top-line beat, and bottom-line lower than previous year.

More of the same out of Panasonic Holdings Corp. through 2025. Increasing the top line while maintaining a flat to decreasing on the bottom line. Once all the projects are complete, capex will be reduced and the revenue will drop to the bottom.

Buffett says "we're not done investing in Japan"

After the conclusion of the annual Berkshire Hathaway meeting, several questions came up regarding Japanese investments and Japan as an economy overall. Most importantly in an interview with Nikkei Asia:

We're not done" in Japan, he said. He did not elaborate on details Saturday, but mentioned in a recent interview with Nikkei that talks are ongoing with the trading companies on potential collaborations.

Money has been flowing into the Japanese market ever since Buffett's renewed bets on the Japanese trading houses. Warren Buffett also stated that he's more comfortable investing in Japan than Taiwan, even though chip maker TSMC (TSM), is the cream of the crop. The political tensions are too much of a risk.

Japanese central bank leaves rates at zero

The latest BOJ meeting from April 28th left rates unchanged:

The Bank of Japan left its interest rates unchanged in newly appointed Governor Kazuo Ueda's first policy meeting.

The decision was in line with economist expectations for no changes to the benchmark interest rate, which has been held at -0.1% since the central bank took rates below zero in 2016.

One often not mentioned area of fiscal arbitrage are these Japanese conglomerates that can borrow cheaper in their own countries than US competitors. Securing financing in Japan and then building in the US should give Japanese companies a leg up going forward.

Berkshire has also sold $1.2 Billion in Japanese Yen denominated debt, levering up at cheaper borrowing rates in Japan. Thus getting more Yen in the coffers for direct buys of Japanese companies on the Nikkei versus ADRs.

Summary

Like Buffett, I see a plethora of great Japanese companies trading at or below their Graham Numbers with conservative balance sheets. Panasonic Holdings Corp. is one of many, and the Japan play may heat up if and when the international debt market dries up. Those with liquidity and cash will survive and those without may begin to fall by the wayside. Interest rates hit every segment of the stock market, and balance sheet management is more crucial than ever at this point. To me, Japan is an international market that produces products with global demand in the production of high-ticket items.

For now, Panasonic Holdings Corp. and a tiny bit of Fanuc Corporation (OTCPK:FANUY), a robotic arm maker, remain my only two foreign plays. Panasonic is still a buy in my book with a price target of $13. The play is a long one, with the payoff probably out towards 2025 from a sales growth perspective. I am waiting patiently as this plays out.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PCRFY, FANUY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.