Capital One: Buy The Dip Opportunity

Summary

- Capital One's financial health is showing no signs of weakness.

- Deposit inflows, delinquency rate normalization, and allowance for credit loss build are continuing.

- Valuation, relatively, is at an attractive level.

- The company's growth prospects remain healthy.

- Stock price decline or pressure from the banking industry concern only creates opportunities for investors.

wdstock/iStock Editorial via Getty Images

Introduction

2023, so far, has been a tumultuous year for the banking industry. After a few bank failures, investors have been turning more cautious toward almost all banks except for the few industry leaders. This was likely the reasoning behind a weakness seen in Capital One Financial (NYSE:COF). However, I believe this move was highly unjustified as Capital One boasts healthy financials, valuations, and future growth prospects. Thus, as some players in the banking industry are showing poor performance, unjustified weakness is being seen in the COF stock. Therefore, I believe Capital One is a buy. The company not only has solid financial health but Capital One is trading at an attractive valuation with continued growth prospects.

Solid Financial Health

Capital One has healthy financial health.

First, starting with the company's operations, the company's credit card delinquency rates have been stabilizing. Looking at it monthly, after a gradual increase back to pre-pandemic levels, the delinquency rate decreased from February to March, or 3.72% to 3.69%, showing a slowdown in increases as the delinquency rates inches closer to pre-pandemic levels. Further, in a broad perspective, during the earnings call, the management team said that "both the charge-off rate and the delinquency rate continued to normalize" to pre-pandemic levels, and the company is expecting this to happen "around the middle of this year." Further, when asked about how the management team is sure that the current trend "is truly normalization as opposed to signs of further deterioration," the management team said that their normalization estimate comes from an expectation that the unemployment rate rises to about 5% level by the end of 2023, not hinting at a potential worsening of the delinquency conditions. As such, I believe it is reasonable to assume that Capital One should be more than able to weather the storm around 5% unemployment levels comfortably as that is the company's base case scenario, and because the unemployment rate, so far, has not shown signs that it could significantly exceed this level, I believe it is too speculative and early to predict a delinquency crisis at Capital One. This, in my opinion is especially true as the company's Common Equity Tier 1 capital continued to remain resilient at about 12.5% for the past year despite its market volatilities and uncertainties including inflation and regional banking concerns.

Capital One's loss provision buildup further supports this thesis. Capital One, in recent months, has been building up allowance for credit losses. In totality, the coverage ratio sits at 4.64%. The areas of concern may be credit cards as they are directly tied to retail consumers and commercial real estate loans. For credit cards, the coverage ratio stands relatively high at 7.59% while commercial office real estate coverage sits at an extremely high level of 13.87%. Also, in regards to commercial office real estate, only accounts for 3.9% of the company's commercial banking loan portfolio, which will likely not have a material impact even in a potential crisis scenario. These levels, in my opinion, are likely enough to weather a potential storm. The current allowance coverage ratio is high. Looking at 2019Q4, Capital One's total coverage ratio stood at only 2.71% leaving a strong cushion in case of a worsening macroeconomic condition. Finally, Capital One has a strong cash flow as the company continued to report $4 billion in income before provisions. Therefore, Capital One is likely in a healthy position.

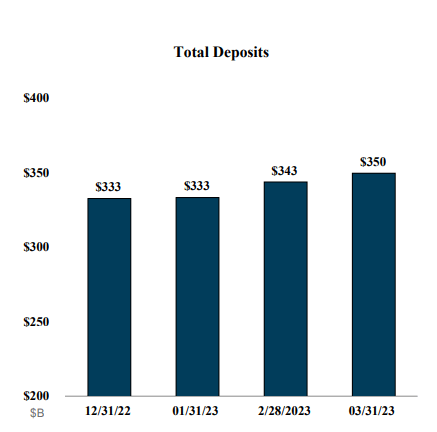

Another point of concern regarding financial health could be deposits. For Capital One, this too, did not pose a problem. As the chart below shows, Capital One's total deposit levels continued to increase even during and after the banking crisis or the collapse of Silicon Valley Bank and JP Morgan Chase's (JPM) acquisition of First Republic Bank. The management team also mentioned that the retail deposits were strong.

Capital One

Supporting this data, Capital One's financial supplement information shows that the company's loan-to-deposit ratio sits at 88.3%. As I believe that any ratio under 90% range is a healthy level, Capital One's deposit conditions are strong, especially as total deposits are showing continual increase as management team is starting to be cautious with lending. Regarding a slightly cautious lending direction, the management team said that the company made choices "earlier in the year to tighten credit" leading to an ending loan balance decline of 1%.

Finally, In the wake of a recent regional bank concerns, a tangible book value per share being greater than the current stock price could add another layer of insulation for shareholders as Capital One's TBV sits at $90.86.

Overall, looking at the deposit inflow trends, credit loss coverage ratios, and continuation of a strong net income, I believe Capital One's financial health is exceptionally strong supporting my thesis that the current downturn is unjustified as it brought my industry uncertainty.

Valuation

Apart from healthy financials, the company's valuation, when taking into account future growth prospects, is attractive as well.

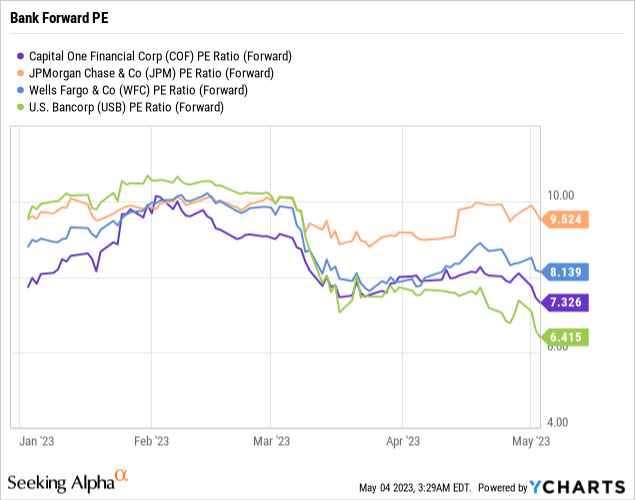

Capital One Financials has a forward price-to-earnings ratio of about 7.33, and as the chart below shows, this level of valuation multiple is on par with most of its industry competitors. JPMorgan Chase (JPM), Wells Fargo (WFC), and US Bancorp (USB) are some of the biggest banks that operate their own credit cards, consumer banking, and business banking like Capital One. Thus, this data arguably shows that Capital One, on a relative basis, has a reasonable valuation multiple.

Further, there are growth catalysts for Capital One. Going back to the company's earnings call, the management team said that the company is continuing "to see attractive growth opportunities in [the] domestic card business." This commentary is supported by the data points in the company's earnings report. The ending loan held for investment in the credit card business increased 21% year-over-year while the purchase volume increased 6% year-over-year as consumers seek more credit in times of market uncertainty. As the market uncertainty and inflationary pressure persist, I continue to believe that this trend will continue. Further, Capital One's domestic credit card portfolio is in a favorable competitive position. With the launch of the Venture X credit card in November of 2021, the company has cards for nearly all income brackets. Venture series cards for premium travelers, Savor and Quicksilver cards for cashback, and lower credit builder cards for less affluent consumers. Therefore, with elevated purchase volume and credit demand, I continue to believe Capital One will see growth in the industry, especially as the company has a competitive credit card portfolio offering.

Risk to Thesis

So far, Capital One's deposit inflows and delinquency levels were healthy. However, given a worsening macroeconomic conditions or even consumer sentiment towards relatively smaller banks compared to the biggest banks, conditions could deteriorate from current levels. During the May FOMC meeting, the Federal Reserve increased the federal funds rate by another 25 basis point as inflation has been persistently high despite its downward trajectory. As such, with a likely higher interest rate in an inflation environment, if consumer delinquencies accelerate faster than management's forecast, significant risk to Capital One could emerge. Further, if more small and mid-size banks fall during this environment, consumer deposits could see heavy inflows in only the biggest banks as they could be perceived by the public as the safest banks.

Summary

In recent months, Capital One's stock price has been pressured to the banking industry concerns. However, I believe these concerns are not relevant to Capital One. There have been no signs of deposit outflows or materially worsening delinquency rates. In fact, consumer deposits have been showing consistent inflows with delinquency rates just expected to normalize to pre-pandemic levels. Further, with a significant allowance for credit loss position, Capital One's financial health is not in a weak position. The company's growth prospects and valuations tell a similar story. Not only is it likely that the company's credit card growth will continue, Capital One's valuation multiples are within the range of its industry peers. Therefore, as the company's stock is showing signs of weakness, I believe COF stock is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.