AI is the buzz on earnings calls, bodes well for tech spending - BofA

Shutthiphong Chandaeng

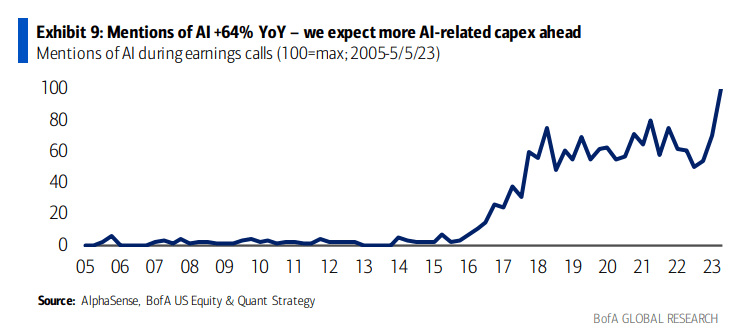

Chatter about artificial intelligence among company executives has rocketed this past year, according to BofA Securities.

AI mentions on corporate earnings calls are up 64% year over year and that should signal spending in the tech sector, strategist Savita Subramanian and team wrote in a note Monday.

"We expect more AI-related capex ahead," Subramanian said.

"1Q23 capex is tracking +12% YoY (+15% YoY ex-GOOGL, down just slightly from +18% YoY in 4Q)," she said. "Above- to below-consensus capex guidance tracks 1.8x since February and 1.5x in April – above average of 1.4x."

Looking at earnings season with 87% of the S&P 500 reporting, "EPS tracks 5% better than analysts expected at $53.07 (-3%% y/y). 71% of companies beat on sales, 77% on earnings, 58% on both, handily clearing the averages of 58% / 59% / 40%," Subramanian noted.

"Health Care (XLV) has seen the most top- and bottom-line beats (74%); strong fundamentals drew PMs into the sector which is now crowded, explaining flat to negative reactions to positive surprises," she said.

Looking at the rest of the sectors on top- and bottom-line beats:

- Consumer Discretionary (XLY) 71%

- Industrials (XLI) 69%

- Consumer Staples (XLP) 67%

- Info Tech (XLK) 67%

- Real Estate (XLRE) 52%

- Communication Services (XLC) 47%

- Materials (XLB) 46%

- Financials (XLF) 45%

- Energy (XLU) 38%

- Utilities (XLU) 38%

"Despite a beat and raise, the S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) is flat vs. the start of earnings season, beats have outperformed half as much as usual (+60bp next day vs avg. of +150bp) and misses have lagged more (-360bp vs avg. of 240bp)," Subramanian said.