Fuji Pharma: High Scope For Growth In U.S. Foray, Biosimilars, And Women's Health Drugs

Summary

- Fuji Pharma Co., Ltd. is mainly a generics pharma company focused on the less volatile Japanese generics market, whose market structure is associated with less regulatory risks, competition, and generics profitability risks.

- Its generics focus is a positive thing in Japan since regulators want a greater generics to share in healthcare expenditure, and its products for women are low-penetration and received recent government support.

- Fuji Pharma also has scope to 3x revenues in new geographical markets, namely the U.S., and by developing a portfolio of several undisclosed biosimilars together with Alvotech.

- Its valuation is lower than even the cheapest and most beleaguered peers despite the best relative prospects, and it has just invested 25% of the market cap of cash into an exclusive distributorship for an early-stage biosimilar.

- Fuji Pharma's earnings growth to drive the stock price is quite likely, and idiosyncratic Japanese healthcare markets mean minimal downside. There is a decent dividend and high earnings yield, and the company is guiding to an achievable 6x increase in income over the next 6 years. Buy.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Otakeja/iStock via Getty Images

Published on the Value Lab 4/18/23.

Fuji Pharma Co., Ltd. (TYO: 4554) listed on Tokyo exchanges with ample liquidity (avg. above >$650k daily volume) is primarily a manufacturer of generics, but also has new drugs that it has developed jointly or on its own for the Japanese market. Its assets are factories for producing injectables, contrast media for surgical processes and tablets. The tablets are primarily for hormonal drugs for females addressing menstrual cramps, endometriosis, but also fertility drugs - a category that is very low penetration in Japanese markets.

There are a couple of high-likelihood and easily-executable forces that are likely to grow Fuji Pharma incomes over the next few years. The first is that their manufacturing capacity has just grown 3x after the end of some strategic CAPEX both in injectables and tablet production facilities, supporting their most major product categories. This CAPEX won't need to be continued or repeated as the associated projects are finished.

Secondly, some drugs related to female reproductive health, specifically fertility treatment, have had their coverage massively expanded by the national health insurance scheme to make them very affordable, which interacts well with capacity expansion and relates to long-term gender equity efforts in order to support reproductive rates and incentives for Japanese couples - a strategic and secular objective of Japan's.

Thirdly, Fuji is looking to move into the U.S. market with some of its products, and fourthly establish its own biosimilar business both domestically and abroad, where even just domestically the prices of biosimilars are set by the NHI at much more advantaged levels than generics relative to the incumbent drug/biologic that they imitate. They have invested heavily into acquiring commercialization rights to biosimilars for their global push, and that will move the needle and help meet management goals of 6xing income over the next 6 years. With the ASPs for healthcare being so much higher in the U.S., simply accessing the U.S. market, where Fuji is at the moment almost entirely focused on Japan, will do a lot to grow their profits.

Finally, Fuji is relatively aligned with regulators when it comes to Japan's healthcare cost control objectives because most of its portfolio are generics that are driving down healthcare costs. To the limited extent that some of their products are on the receiving end of price reductions to advantage generic producers over branded producers, the effects are basically fully reflected in the latest run-rate results. This is a credit to their downside protection, which is compounded by the fact that Japan already has low healthcare costs with little scope for major revisions in prices across the board unlike the US, where tax the rich policies have pharma squarely and explicitly in their sights.

In sum, the company has a low P/E at around 9x, high earnings yield at 11%, while also having large scope for high probability earnings growth not reflected in the current multiple that could see incomes 6x over the next 6 years. Fuji pays a decent 3% dividend yield, too, which should grow with incomes at a set 30% payout ratio. It has substantial downside protection because of its currently and historically resilient markets in healthcare, which are especially resilient and involatile in the domestic Japanese markets due to the structure of the healthcare system.

We think Fuji is a high conviction, cash generative, and relatively high-growth and optionality buy at a cheap multiple, dominating U.S. peers like Viatris Inc. (VTRS), whose prospects are a lot worse at a similar valuation, where Fuji has secular tailwinds in existing markets as well as scope to harvest ripe and low hanging fruit in the plan to expand into the U.S. With both earnings growth but also a history of massive shareholder payouts (they did a massive 25% yield buyback a couple of years ago) as potential catalysts, Fuji Pharma is a great buy for a five year horizon to get you into large, long-term capital gains.

Fuji in the Japanese Pharma Landscape

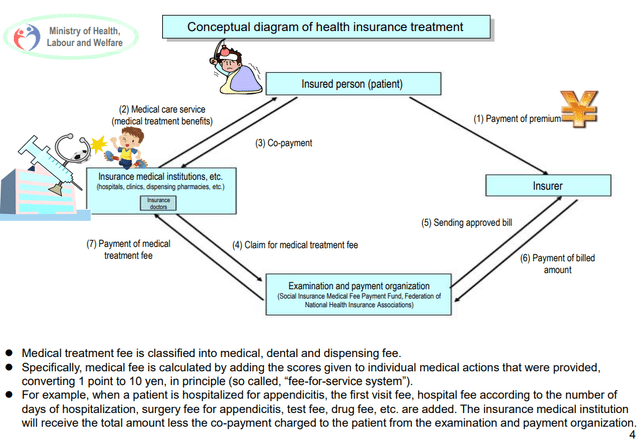

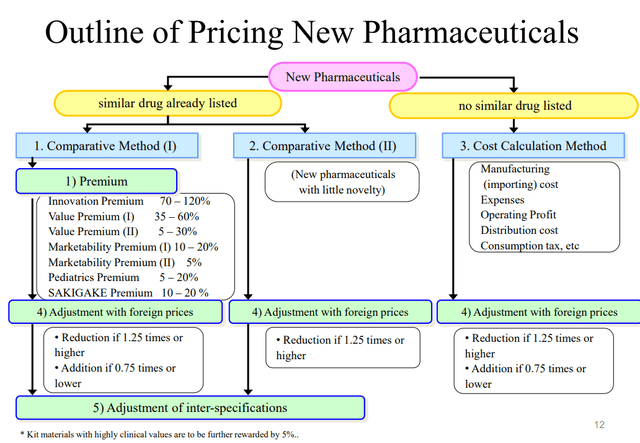

This is a useful moment to focus on the Japanese drug pricing and insurance system, since initiatives, particularly those around reducing healthcare costs, can impact the financial performance of companies like Fuji. They have a national health insurance system called the NHI which is a system where prices for drugs are specified and insurance claims can be made for those treatments. There happens to be a slight co-payment system, but that isn't relevant right now.

NHI System (Ministry of Health, Labour and Welfare)

There is a closed list of drugs that are insurable, and like in the U.S., making that list is essential for expanding the market. Some drugs' costs are more covered by insurance than others - fertility meds are now covered very highly to promote them.

Differently from the U.S., the system does not allow for extreme price markups once you know that insurance companies are paying for it. This is because prices have to be proposed and justified by mechanisms delineated by the NHI, and exclusivity doesn't work the same way. If a drug is innovative it gets a premium, but all new drugs introduced to the market, even pretty stale therapies from other geographies or local therapies simply repurposed for new indications or delivered in a new way, benefit from effective exclusivity. This is due to how the post-market evaluation system works, which makes competing generics approvals non-viable for as long as a decade after a new launch, consistent at least in duration with exclusivity periods you'd expect elsewhere. However, this exclusivity under the Japanese system does not afford incredible pricing power since prices are set by exogenous pricing mechanisms, which also means drugs don't usually fall as hard once generics (or biosimilars in the case of biologic therapies) enter the fray and drive down the price through market competition.

In some cases, actual patents are involved in the development of a drug if they are innovative enough, which can mean longer exclusivity periods, but not typically the same pricing power as you'd see in the U.S. However, with patent-connected drugs, you'd expect the innovation premium to kick in from the NHI, which could be as high as 120%. In these extreme cases, the dynamics of exclusivity loss, which comes once these so-called re-examination periods that are required to study drugs post-market finish, are similar to the patent cliffs that you'd see in the U.S. when exclusivity is lost - but only in the most extreme of cases.

Fuji is not really in this innovative space at all, so its prices start low, which makes their situation much less complex and limits scope of declines upon loss of exclusivity. They do have new drugs, but in addition to low starting price they can further limit declines by finding new indications or delivery methods for their drugs which creates new, exclusivity-covered income streams that are still protected from exceptional discounts by the NHI and direct competition. This is very common practice in the industry. Declines in Japanese drugs on exclusivity loss can be heavily tapered by finding new indications.

The system in Japan results in prices that are generally pretty low whether drugs are generics, biosimilars or new, and market dynamics end up being generally pretty undramatic, especially for a company like Fuji. The discussion changes when you're dealing with innovative drugs, but that isn't at issue around Fuji.

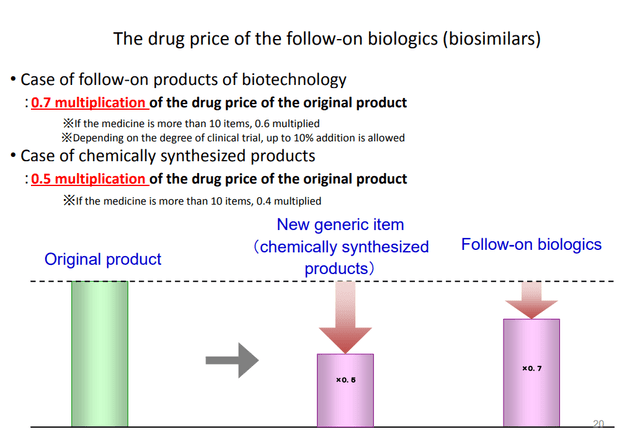

Price discounting of Biosimilars vs Generics (Ministry of Health, Labour and Welfare)

Let's focus on biosimilars, since this is an area that Fuji is looking to get into. Referring to the above chart, the reason biosimilars are more valuable is that they're harder to make since they leverage organic and not synthetic processes, and cannot be replicated by chemical and synthetic processes due to the organic nature of the molecules and therapies. Terminologically, if a biologic is used to treat a disease (some naturally occurring protein or organic product), the biologic's generic equivalent (which can be approved after expiry of the biologic's patent) would be a biosimilar. If an off-patent med was synthesized chemically, a generic would be the exact same med synthesized chemically in the exact same way but just by a company that doesn't have the brand name. The NHI's pricing mode acknowledges that biosimilars are more value-add than generics (and why Fuji is moving into biosimilars now) even though they are still "copying" a biologic once it's off patent.

Biosimilars are also at abnormally low penetration rates in Japan, meaning biologics in this market have abnormally little biosimilar competition. Biosimilar manufacturers, much like generic manufacturers, are also getting support from government to gain share and drive down healthcare costs. This is being done by the NHI targeting biologic producers with price decreases to increase their incentive to direct capacity into different markets, so the biosimilar market is seen particularly as a growth market in Japan due to open seas and currently little market-oriented price competition against incumbent biologics.

Recent Initiatives to Control Healthcare Costs

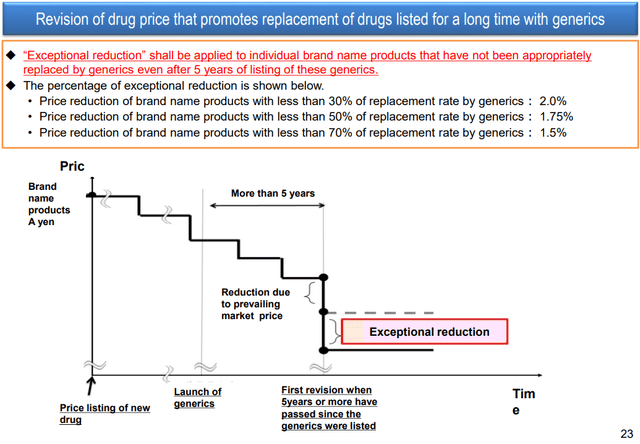

Incumbent drugs usually see price decreases in a market manner from generic competition once new drugs are able to enter the market. However, it is quite common for drugs that have gone off patent to not encounter generics competition for quite a while, or to encounter pretty minimal generics competition in terms of volume (same goes for biosimilars).

Recent initiatives by the Japanese government to penalize drugs which are off-patent but also still pretty dominant in the market are things like exceptional price decreases. But even these are not aggressive in quantum. Fuji has Lunabell and some other off-patent (but still trademarked) drugs that may be exposed to this government ire, but not more than a maximum of 15% of sales are exposed, and these drugs may already have enough competition where exceptional reductions by the NHI won't apply. Still, assuming a 15% exposure indicates pretty minimal downside risk since the exceptional discounts aren't that big, only a couple-hundred bps.

Pricing discount when market forces aren't enough (Ministry of Health, Labour and Welfare)

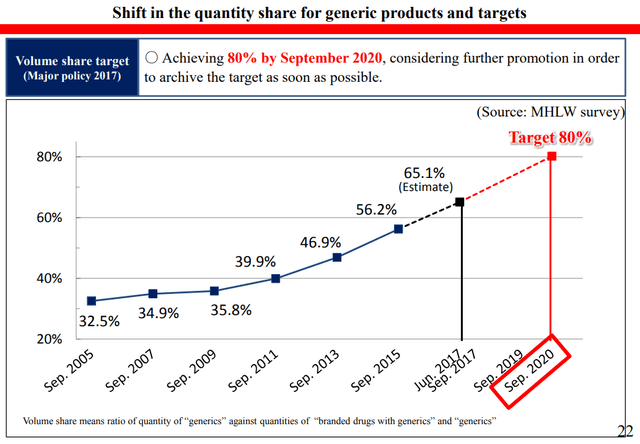

Consistent with policies like exceptional price reduction, the regulators want more generics and biosimilars to enter the market, and for the majority of expenditure to be on generic and biosimilar analogues since they're cheaper for the consumer. This initiative to price down branded generics and biologics with little competition started after 2019, and hopefully will start directing those companies' capacities into other drugs to increase share of generics selling in those markets.

Japan Wants higher Generics Share (Ministry of Health, Labour and Welfare)

Another measure for reducing healthcare costs, and this was instituted within the last two years, is the change of the revision period for prices of drugs from every two years to every year, which allows for more frequent updates and downward revisions for drugs. Last year it resulted in 6.7% average price decreases across the industry, but this was driven by some specific Pfizer Inc. (PFE) products like Vyndaqel that got slashed immensely. Fuji has seen comprehensive price slashing meaningfully below that Japan average, and these price decreases aren't compounding downwards at all in most treatment areas.

These pricing revisions being more frequent means less deferral of inevitable price decreases of generics, especially in cases where new competition has entered the market. While there are several mechanisms, broadly speaking drugs in Japan are priced based on EU drug prices or based on comparable drugs' prices already in the Japanese market, so the values are pretty anchored and start pretty low, leading to quite low volatility in prices and profitability of companies. The point is, there is ultimately little impact to Fuji but also most other drug companies to government initiatives to affect drug prices. There are systems to make premium innovative drugs, and there are also markup systems for pricing drugs that are completely new to the market that assure decent margins for drug developers, but nothing like the U.S.

Mechanisms for setting price (Ministry of Health, Labour and Welfare)

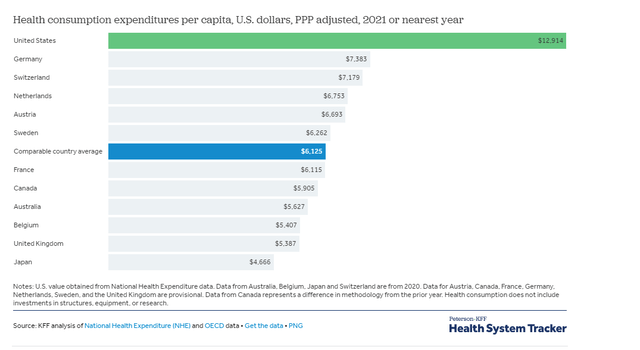

As said, Japan already has very low healthcare costs for consumers, and this is a good thing because it means that measures to make things cheaper have less scope to worsen the economics of various pharma companies with exposure to drug prices in Japan. Compare this to the situation in the US, where regulation has become increasingly aggressive to curb prices of even patented blockbuster drugs and where U.S. pharma companies depend so much on the obscene costs of healthcare that are standard in the U.S. Still, the Japanese healthcare market is the 3rd largest in the world, and almost every major pharma company has a meaningful share of revenues coming from Japan - they just do it without needing very high per capita costs.

Healthcare expenditure per Capita (Healthsystemtracker.com)

Fuji's Businesses

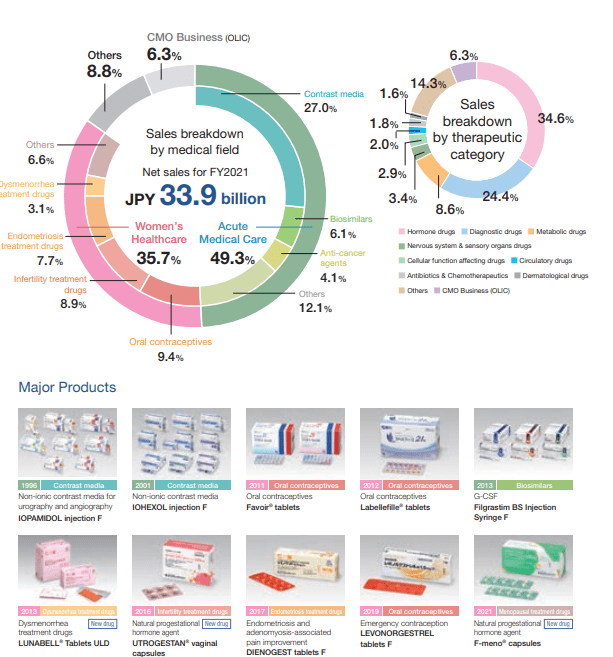

Fuji manufactures mainly generics drugs and sometimes develops new drugs of its own, in some cases jointly with other drug developers, to introduce to the Japanese market. Its new drugs are for indications in infertility treatments as well as some for period cramps within their large women's health business, accounting for 33% of sales. These would be patented (at least effectively patented due to the systems explained above), but the drugs that aren't now would behave as generics.

Accounting for around 25% of sales is contrast agents used for diagnostic procedures, a stable and resilient market. It has been hit by lower general procedure rates associated with COVID-19 hitting healthcare system capacity, but Japan had a lighter lockdown and the rebound is happening now. Moreover, growth in women's health products thanks to greater government support have offset those declines, resulting in sales growth. The rest of the portfolio of products is less coherent in stuff for acute medical care and a nascent biosimilar exposure, which we expound upon later.

Sales Breakdown (Corporate Report 2022)

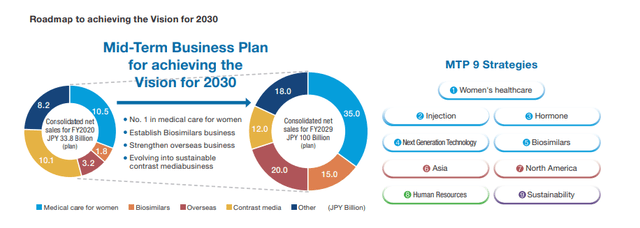

The appeal of Fuji is primarily from the fact that high-likelihood earnings growth over the next 6 years can drive returns while being able to get in at a low, no growth-implied multiple today. There are several avenues by which management plans to create earnings growth that cumulatively make a compelling case for large and likely earnings growth for the company, consistent with the 6x earnings and 3x revenue initiative in the management plan. Then there is also downside protection in healthcare products like contrast agents and the domestic, stable Japanese generics and biosimilars market to make returns asymmetric.

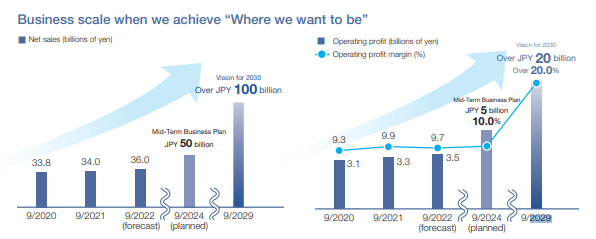

Management Plan (Corporate Report 2020)

Income Growth Plan (Corporate Report 2022)

Women's Health in Japan

Products related to female reproductive health have generally been pretty underpenetrated in Japanese markets as values remain pretty traditional. For example, only recently were abortion pills legalized, and treatments related to fertility and women's health have also recently seen coverage expanded under the NHI, reducing costs of these drugs by as much as 70% for patients. These initiatives to massively cover women's health products related to about 9% of Fuji's sales, and the initiatives are as of early 2022 so we haven't seen the full extent of growth here yet, so far only offsetting contrast agents. Also, other Fuji women's health products could be next to receive direct government support. The whole product category is aligned with broad and multi-partisan social initiatives to increase Japanese fertility rates. With the new inclusion of fertility and other women's reproductive drugs in the NHI system, it not only makes these drugs available and affordable, but the indirect appeal to gender equity might actually help replacement rates in Japan.

Fuji is well aligned with government objectives by being largely exposed to women's health, but the real growth comes in interaction with the fact that they have 3xed their capacity for tablet production and have invested in new facilities for producing injectables to support primarily women's health but also biosimilars. The associated CAPEX to this capacity growth would have finished around October 2022, so the growth CAPEX is over and won't be dragging on FCF going forward. Many of these women's health drugs are newly developed and achieving nice prices domestically, so there should be some nice mix effects as well as greater NHI coverage boosts these markets.

This is the first and more organic driver of growth along the management plan.

U.S. Foray

Besides a 6% sales exposure to Thailand, Fuji is otherwise fully exposed to Japan's domestic market. A major and pretty easy avenue to further sales and earnings growth comes from plans to deploy its pharmaceuticals in the U.S. Pricing is more favorable in the U.S., on average being 2x the prices of domestically sold pharmaceuticals in Japan. Even if Fuji's products aren't particularly successful, any market share in the U.S. would move the needle meaningfully because of systematically lower prices associated with any healthcare system outside the U.S.

The details of how they plan this commercialization is unclear, but it can either be through selling commercial rights of their drugs in the U.S., outsourcing manufacturing with local partners, or actually investing in facilities to begin production in the U.S. A capital-lite approach is preferred by us since the Yen is currently still weak, and we'd rather Fuji not buy as much USD and sell Yen to make their foray happen.

ASEAN

While not quite as much as a gold mine as selling into the US, ASEAN markets are also relevant for Fuji, and with their acquisition of OLIC they have a vehicle to sell products into new markets like Thailand and other ASEAN countries. Domestic production plants in Japan are a good starting point to service these markets, and penetration of women's health products and other things sold by Fuji are low in ASEAN markets as well as domestically, so there is scope for Fuji's portfolio to grow in these markets as well and drive the penetration.

Biosimilars

Biosimilars is the most impactful initiative on the company's finances and performance. They spent more than 7 billion JPY on buying an exclusive and global distributorship from their frequent partner in biosimilar development Alvotech (ALVO) for a specific, early stage biosimilar candidate. This right makes it the primary beneficiary of sales from this drug on a global basis, so it could become an important element in the U.S. foray. In Japan, biosimilars are priced much better than generics relative to the original drug/biologics' price, so there should be good mix effects from biosimilars growing their share of Fuji sales, currently in the mid single-digits of sales.

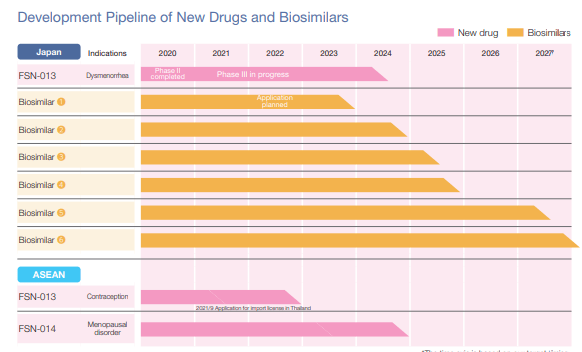

Biosimilar Launches (Corporate Report 2022)

Besides the distributorship that is now principally in the hands of Fuji thanks to the large upfront payment, the other several biosimilars that are being developed in partnership with Alvotech are more in Alvotech's hands, but Fuji is being cut in for the Japan effort to rollout these biosimilars. Their contribution to the partnership for these other biosimilar in the partnership are that Fuji are earmarking capacity to produce these biosimilars in Japan as well as providing local know-how to approach the healthcare market, including applying for approval and dealing with the Ministry of Health, Labour and Welfare, more or less Japan's FDA. Together with the CAPEX initiatives for increasing tablet production for women's health, the initiatives to grow capacity for biosimilars is already complete, and will likely get put to use soon with the first biosimilar approvals expecting to hit the market in 2023.

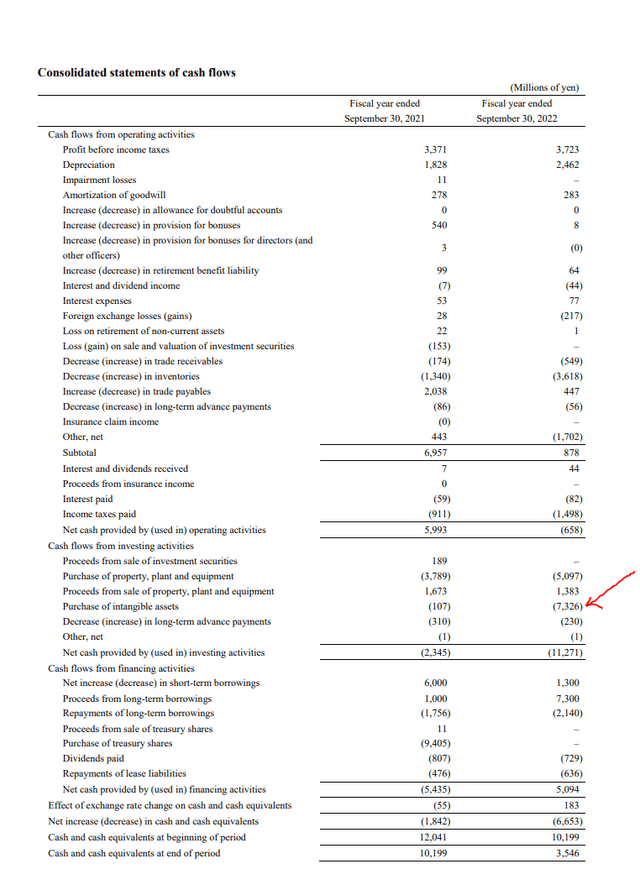

Because the 7 billion JPY was a pile of cash prior to this investment, where piles of cash are typically lying around unproductive in Japanese company balance sheets, we incorporate this unusual cash flow into a specific intangible asset as part of the valuation later on - it hasn't been set on fire so to speak, and is actually more likely to create realised value than almost zero-interest cash balances that shareholders never expect to see paid out, hence low Japan valuations.

FY 2022 Cash Flows (FY 2022 Financial Report)

Financial Comments

The current run-rate income figures incorporate the actions to try to grow sales and earnings according to the management plan, owing almost exclusively to the higher R&D costs that Fuji are incurring in order to push their biosimilars into the market. They have six biosimilars that they are trying to get on the market in Japan for the next four years in partnership with Alvotech.

Current sales have seen slight net increases with uptake in fertility treatment, offset by slight declines in contrast media from lower procedure rates due to COVID-19, as well as some price pressure on a limited portion of the Fuji portfolio.

Management guides for 10% of revenues to be R&D expenses up from 5%, and that difference accounts exactly for the higher SG&A expenses that are bringing down the latest quarterly run-rate profits, so these declines in income are a one-time punctuated decrease for as long as Fuji focuses on developing therapies. Once those biosimilars start hitting the market and grow in the mix, we should see positive mix effects and even higher margins than before consistent with the plan to double margins and revenues over the next 6 years.

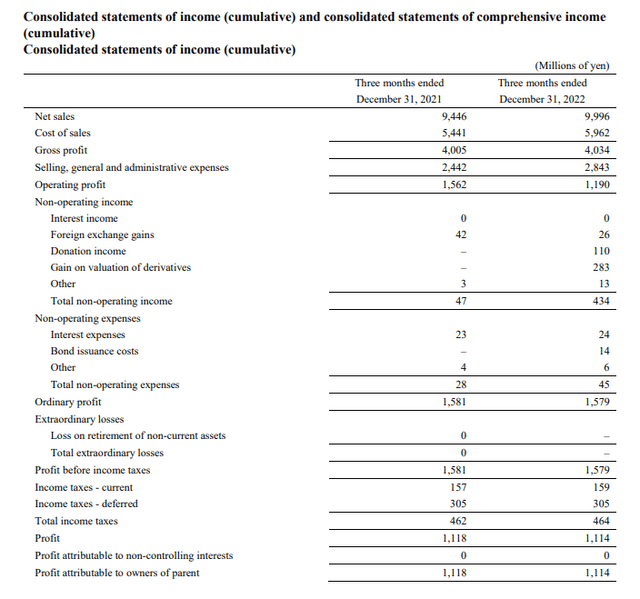

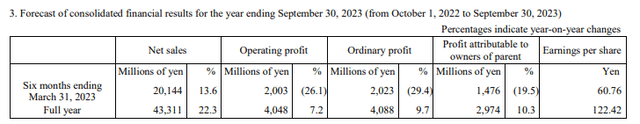

3M Q1 2023 IS (Q1 2022 Financial Report)

The increase in the rate of R&D expenses explains the entirety of the forecast declines in operating profits, even when just annualizing the Q1 results and comparing it to the FY forecasts.

FY and H1 2023 Forecast (Q1 2023 Financial Report)

Since the investment into the distributorship, leverage has gone up slightly two 2x ND/EBITDA, but this is entirely sustainable given almost negligible interest expense since Japan still has such low prevailing rates, and this continues with the recent Ueda decision, surprising markets.

Valuation

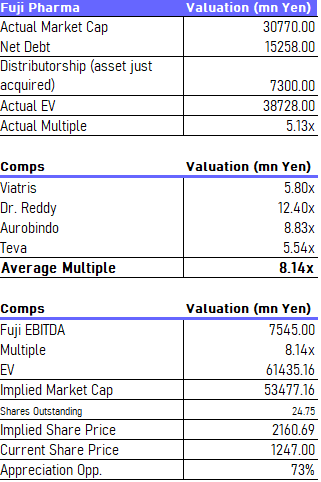

While it's not one of those Japanese stock situations where non-operating assets eclipse market caps, Fuji Pharma is clearly cheap. It trades as the cheapest in a global peer lineup, despite having above average prospects. In particular, it trades cheaper than Viatris, even though Viatris' growth has been heavily hampered by the disappointment of the Chinese market, where very punitive procurement systems have hit generics companies and crippled expectations for what was touted as a growth market for Viatris.

Valuation (VTS)

Fuji is probably closer to some of the BRICS country generics players like Aurobindo and Dr. Reddy's Laboratories Limited (RDY) in terms of potential growth, just on account of its plans to enter the U.S. market, even though it hasn't materialized yet. For now, their current proven growth is closer to generics player Aurobindo, so taking an average multiple across these peers and using a multiple a little below Aurobindo is a conservative spot for the valuation (especially because you expect a BRICS geography discount with Japan being much more developed), already yielding 73% upside. Aurobindo is already present in the large U.S. and European markets, so even they have less scope for growth than Fuji. Fuji can probably get closer to Reddy's growth except but without tapping less developed markets, where Reddy is seeing its growth coming from markets like Russia and India. Using the Viatris multiple still gives you a 16% upside, and the difference in prospects between them are pretty clear, with Viatris being a much more mature company, a combination of the massive Upjohn portfolio and the generics giant Mylan, that has already taken advantage of all the new markets that they can within their demesne.

Bottom Line

In the end, Fuji Pharma Co., Ltd. comes down to earnings growth at a very reasonable price, and with substantial potential for earnings growth the relative valuation case doesn't even need to materialise for shareholders to benefit from these levels. FCFY yields are pretty high around 8%, dividend yield is well covered around 3%, and the company may do other capital payouts as two years ago they bought back more than 20% of their shares outstanding. The scope for earnings growth is large - organically from government support to women's health and the biosimilar launches, but also from the expansion into the extremely high-price US market - and the company does know how to pay out their winnings better than other Japanese companies. With lots of options for earnings growth and a low multiple at just over 10x in P/E and 5x EV/EBITDA, both lower than global generics peers even in less developed markets or with less growth, there is a lot to say about a company in a geography that is finally getting attention from institutions like Buffett and Citadel. You don't need to rely on the relative case, but a return of capital to Japan from an ailing US lead by smart money like Buffett could help that case materialise.

Finally, with a bit of a longer-term and growth-based thesis, in many tax jurisdictions there are benefits to be had from capital gains from long-term holdings that the Fuji investment thesis aligns with, unless capital payouts or a burst of investor interest in Japan - which remains cheap and credit-flush - doesn't frontload returns, something that no shareholder would complain about either.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FUJI PHARMA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.