Pernod Ricard: Premium Spirits, Premium Business

Summary

- Pernod Ricard SA is a company that sells wines and spirits globally.

- Revenue has grown at a CAGR of 3%, while margins have improved (30% EBITDA-M, 20% NIM).

- Growth opportunities include developing nations, Asia in particular, and non-alcoholic beverages.

- Q3 results show the business is robust against current economic conditions.

- Pernod justifies its current premium valuation.

jimmyan/iStock Editorial via Getty Images

Investment thesis

Our current investment thesis is:

- Pernod owns a host of premium brands that have a strong market positioning, allowing for organic global growth.

- Developing nations, Asia, and China represent the long, medium, and short-term opportunities for the business.

- Margins have consistently improved, with scope for additional gains in the coming 12-24 months.

- Pernod is trading at a premium to its historical valuation yet the commercial profile of the business suggests this is warranted.

Company description

Pernod Ricard SA (OTCPK:PDRDF) is a company that sells wines and spirits globally. The company offers a variety of spirits, including whiskey, vodka, gin, rum, liqueur and bitters, champagne, tequila and mezcal, and aperitif under various brand names. They also provide non-alcoholic beverages under specific brands. Some of the popular brands offered by the company include Absolut, Jameson, Martell, Chivas, Malibu, Mumm, and The Glenlivet.

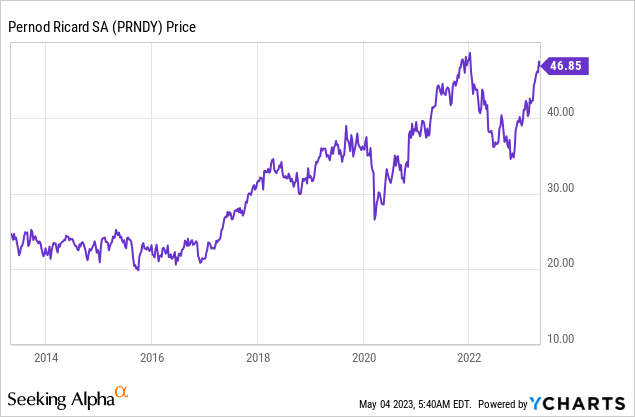

Share price

Pernod's share price has had a good decade, returning over 80% to shareholders during this period. This has been driven by the steady and consistent improvement of the business.

Financial analysis

Pernod Ricard financial analysis (Tikr Terminal)

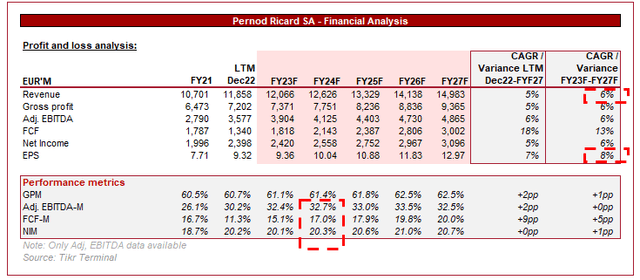

Presented above is Pernod's financial performance for the last 10 years.

Revenue

Revenue has grown at a CAGR of 3%, which is fairly mild in what has been a strong decade for beverage brands. This is partially due to its geographical spread, with the majority of sales historically weighted toward Europe, which has seen slower growth, and the US. The key growth locations are Asia, South America, and Africa (to a lesser extent) currently, with a rapid increase in the middle class and increased tourism from the West. The Asia segment is the largest mainly due to its superior growth, but the business as a whole lacks the geographical diversity of others, such as Diageo (DEO). This said, the company is making rapid improvements through its international and local brands.

As the following illustrates, the key growth area remains Asia. Interestingly, Europe is outgrowing the Americas, suggesting weakness in the region.

Geographical growth (Pernod Ricard)

Pernod's key growth brands continue to be its Spirits business, specifically, the international brands, which benefit from a global marketing strategy and brand awareness through social media. Further, Management has been able to price aggressively in these segments, targeting a minimum of MSDs.

Segment growth (Pernod Ricard)

In the last several years, we have seen a trend toward the premiumization of the alcoholic beverage industry. This has been more prominent in the spirits market, as consumers are increasingly seeking to make an "occasion" of consuming alcohol, during what is the social media generation. This means they are willing to pay more for high-quality, premium products, particularly in the spirits segment. Pernod Ricard has been focusing on developing its premium brand portfolio, which includes Absolut Elyx, The Glenlivet, and Martell. The business has done well to market these brands as a premium offering in a competitive market.

We are also seeing consumers reduce the quantity of alcohol consumed, with a trend towards health and wellness. This has been driven by greater consumer awareness of the dangers of an unhealthy diet, as well as the consequences of the overconsumption of alcohol. This has led to an increase in the market for healthier options, particularly in the beer segment, but in spirits too. Pernod Ricard has been responding to this trend by introducing low and on-alcohol variants of its iconic brands. We think this will be a key growth segment in the future, as not just alcohol drinkers begin consuming these products but non-drinkers. This is predicated on quality targeted marketing by the big alcohol brands to convince non-drinkers that it is worth trying.

The craft spirits industry has been growing rapidly in recent years, with consumers also seeking out unique products. This comes at a time when the market is saturated by large brands primarily competing with marketing rather than innovation. The market was prime for disruption and this has occurred. Consumers who look to try new things will always prefer a brand with a "story", which means it is unlikely that Pernod can just "muscle" its way into subsectors. The key is to identify opportunities for M&A, without getting caught out by hype.

Economic considerations

Current economic conditions do not lend favorably to premium products. With high inflation and heightened rates, we are seeing consumers facing squeezed finances. This has contributed to reduced discretionary spending across many industries. Our view is that this will continue for the coming year, as central banks continue to fight inflation with monetary policy.

From Pernod's perspective, we see this being a soft year for the business. It has shown resilient demand, which suggests a decline or flat growth is unlikely.

Margin

Pernod's margins have impressively improved over the last 10 years. Although GPM has dipped by 1%, EBITDA-M has increased by 2%. This suggests the business has not seen a material shift in product mix, but instead has found efficiencies through operational gains. This is seen in the S&A expense growth, which lags revenue. As a percentage of revenue, this expense is at an all-time low.

The most recent dip in GPM is likely a reflection of inflationary pressures, with glass costs rising. This is likely a short-term issue, which could mean an upside of c.50 to 150 bps in the coming 12-24 months, dependent on how inflation develops.

These margins are extremely attractive, allowing the business to consistently fund generous distributions. Further, as a mature business with high brand recognition, these margins will continue to remain sticky.

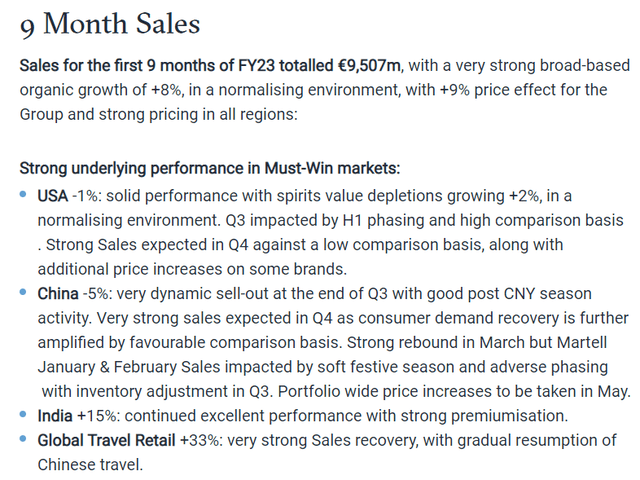

Q3 results

Presented above is Pernod's 9M23 result. The business has seen continued organic growth, with strong pricing actions driving this. Ideally, volume is the primary contributor as it suggests underlying consumer interest, however, given the current market conditions, pricing action is required.

A potential tailwind in FY23 is the opening of China to travel. The country ended its zero-covid policy in late FY22. Following a period of heightened rates, the country is now seeing this return to normal. Similar to the West, this will likely mean an increase in travel and discretionary spending.

Balance sheet

Pernod's debt profile is relatively good, with an ND/EBITDA ratio of 2.6x. This does not leave a large amount of flexibility but is sufficient to support M&A activity if required.

The company has spent the majority of its excess capital, as well as some cash in recent years, on distributions. Management has consistently repurchased shares, as well as increased dividend payments at an impressive 10% rate. On an absolute basis, the dividend yield is unimpressive but alongside buybacks, the returns are attractive. The company is currently generating EUR 1.4BN-1.8BN in FCF, which suggests growth in distributions must slow marginally for sustainability.

Outlook

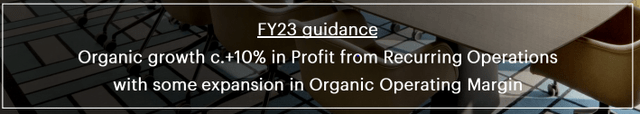

Management guidance (Pernod Ricard)

Management is guiding c.10% organic growth, alongside an improvement in margins. The growth target looks reasonable given the 9M performance, reflecting what is a highly resilient business. The margin expansion comes as inflationary pressures ease, allowing GPM to creep up.

Presented above is Wall Street's forecast for the coming 5 years.

Revenue growth is expected to pick up, with a CAGR of 5% into FY27. This looks reasonable based on the company's current trajectory, with Asia likely leading this.

Margin expansion is forecast to continue, although not to a material level. This looks reasonable as a mature business such as this is unlikely to have the flexibility required to make substantial gains.

Based on this, the company can fund slightly higher distributions, reiterating that growth will likely need to slow.

Valuation

Valuation (Tikr Terminal)

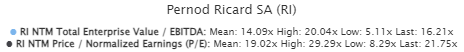

Pernod is currently trading at a NTM EV/EBITDA multiple of 16x, and a 22x P/E ratio. This is a premium to its historical mean multiple on both metrics.

The bull case to support a premium is:

- The Asian market has shown itself to be a long-term growth area, with sufficient runway to support continued strong organic growth.

- Expansion into non/low alcoholic beverages represents a new growth area that can significantly increase the company's TAM.

- NIM is at an all-time high level, maximizing shareholder returns.

The bear case arguing a mean reversion would be:

- Diageo, an alternative Global Spirits business, has superior margins, growth, and brands while trading at a similar valuation.

- Dividends are mediocre and total distributions may slow if Management does not intend to raise debt or use cash.

Overall, the arguments for a premium are greater. The business is better and despite its relative weakness to Diageo, we believe that business should be worth far more than it is.

Key risks with our thesis

The risks to our current thesis are:

- Growth slowdown if volume declines or pricing action is no longer favorable.

- Markets react unfavorably if distributions are reduced, or do not grow in line with expectations.

Final thoughts

Pernod is a quality business with a wide range of global brands. The business is in a mature position which reduces the risk of margin dilution or a material competitive threat. We see organic growth continuing and reasons to support its current elevated valuation.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.