China’s high turnover stock market is punishing liquidity trades

In China, one of the world’s most active equity markets, stocks that change hands most often are now the ones that are punishing investors.

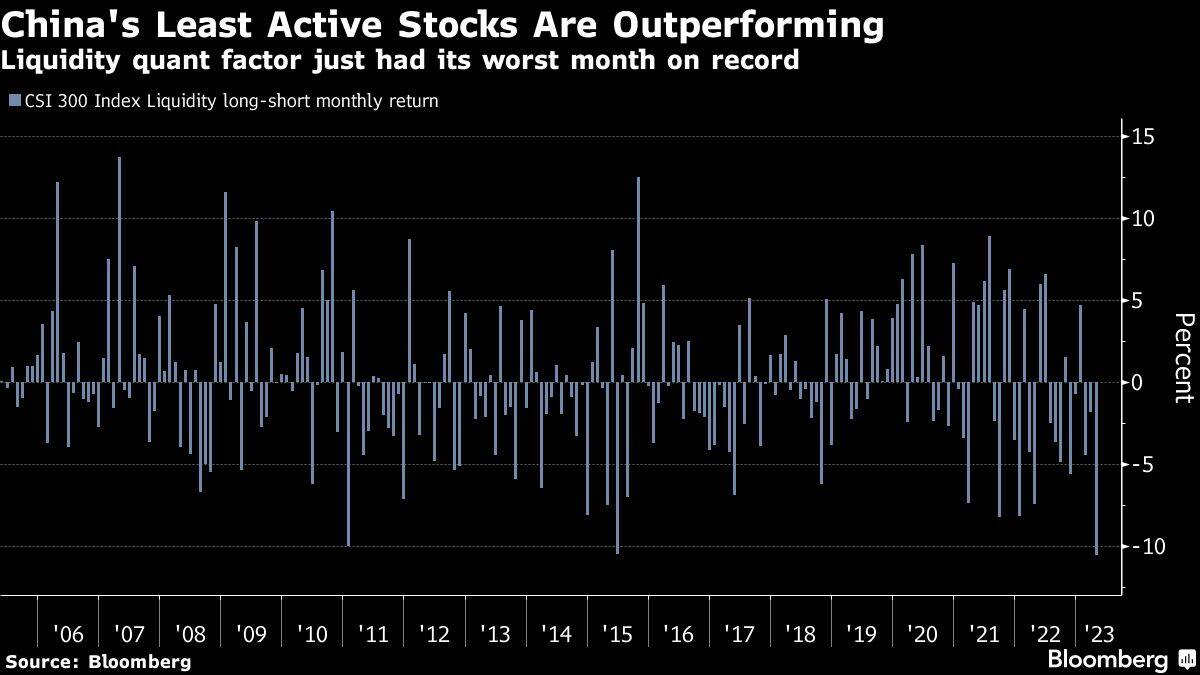

Modeling a long-short strategy that favors the CSI 300 Index’s most liquid shares would have lost traders almost 11% in April. That’s the worst performance since the benchmark of Shanghai and Shenzhen shares was launched in 2005, according to a Bloomberg function that screens indexes for quantitative factors.

High trading volumes are usually prized by quantitative investors because it makes it easier to enter and exit trades quickly. Rather than pick stocks based on their earnings or dividends, such funds typically rely on complex and proprietary mathematical models to generate returns. Instead of buy-and-hold, quants are known for their high-frequency trading systems that are well-suited for high turnover markets like China, where trading activity has surpassed 1 trillion yuan ($145 billion) every day since March.

Formidable obstacles currently face international investors wanting to hedge or short yuan-denominated shares, making long-short strategies difficult to deploy. They can use a stock link with Hong Kong, though only certain members of the city’s exchange can borrow and lend shares through that program. Short selling gained a bad reputation in China after it was partly blamed for the market’s spectacular crash in 2015, with many leveraged investors betting against the whole market via index futures.

Right now the top-performing quant strategy in China is buying value, or betting on the cheapest CSI 300 stocks while shorting the priciest. That factor had its best month since the stock bubble in 2015, with a 13% return in April.