Service Corporation: One Of Those 'Buy And Hold Forever' Type Stocks

Summary

- Service Corporation is in a niche sector with a moat.

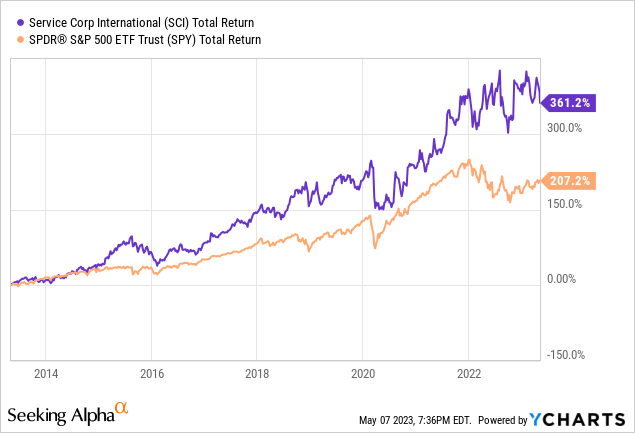

- The company has a history of strong execution and market-beating returns.

- Valuation is below historical trends.

- This is a great stock for buy-and-hold investors.

vermontalm/iStock via Getty Images

I like companies that are in unique industries with a moat, and this article covers one of such companies. Service Corporation International (NYSE:SCI) is the largest funeral home operator in the world, and it has a solid track record of delivering strong results for its investors. I believe this is unlikely to change anytime soon.

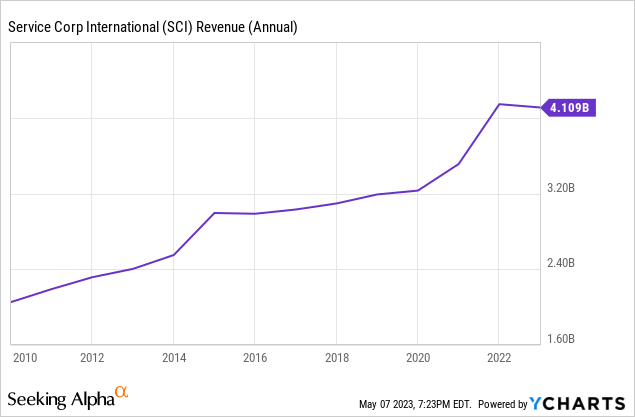

The company has been around since 1962, and it operates close to two thousand funeral homes and cemeteries across the US and Canada. You would think that the funeral home business is a highly commoditized sector with limited growth, but this company will surprise you with its results, as it almost tripled its revenues since 2010.

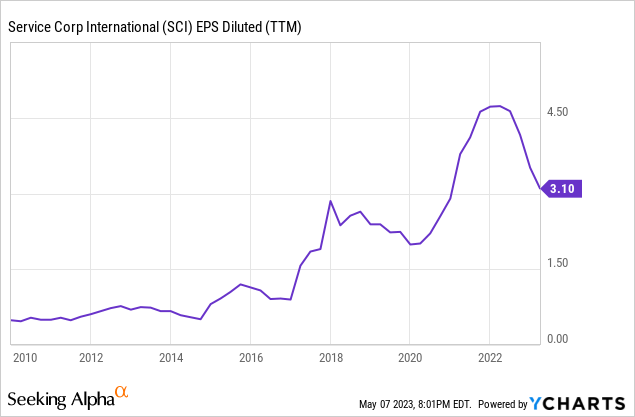

Historically speaking, the company's profits have been more cyclical due to the fact that it goes through cycles of mergers and acquisitions, but generally trended up. Since 2010, the company's net profits nearly tripled, but they have been slightly down recently.

One could say that the funeral home business is recession-proof because people don't stop dying during recession and families don't stop having funerals for their loved ones. In many cases, funeral expenses are paid from people's life insurance policy payouts. At the same time, there are many variable and add-on costs in a funeral based on individual selections and people might end up choosing fewer add-ons and less expensive packages during recession, so it's not correct to say that this business is completely recession-proof, but it's as close as it gets in my opinion.

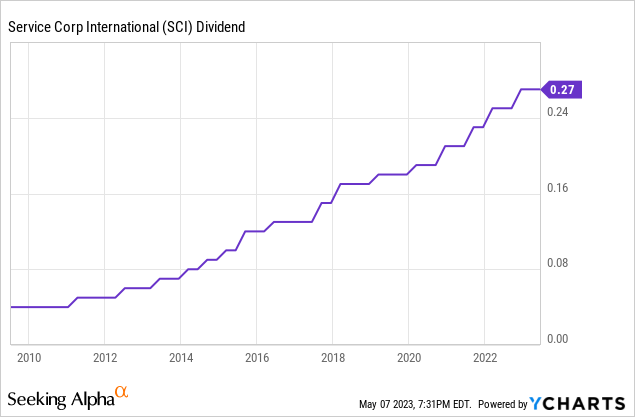

While the company's current dividend yield of 1.7% might not be very impressive, it's been raising dividends every year consistently since 2010 and the company's management seems fully committed to returning cash to investors for the foreseeable future.

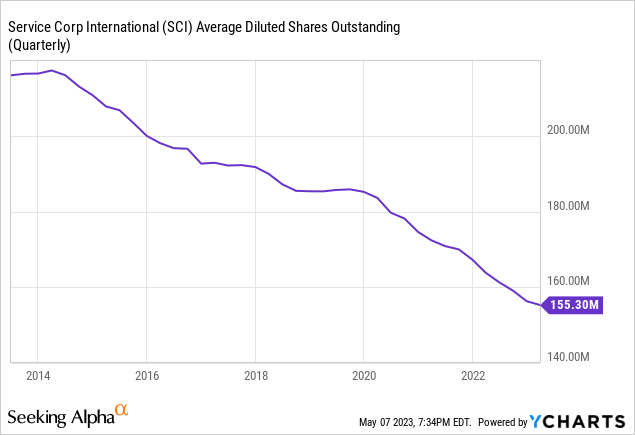

Apart from dividends, the company is not shy about reducing its share count through strategic buybacks. In the last 10 years the company's total diluted share count dropped from north of 200 million to 155 million shares and the company is committed to buy back about 2-3% of its shares every year even though it's been also aggressively buying up smaller companies through M&A activity all these years.

Since 2004, the company has returned $5.4 billion of cash to investors between dividends and share buybacks, which corresponds to about 55% of the company's current market cap of $9.9 billion.

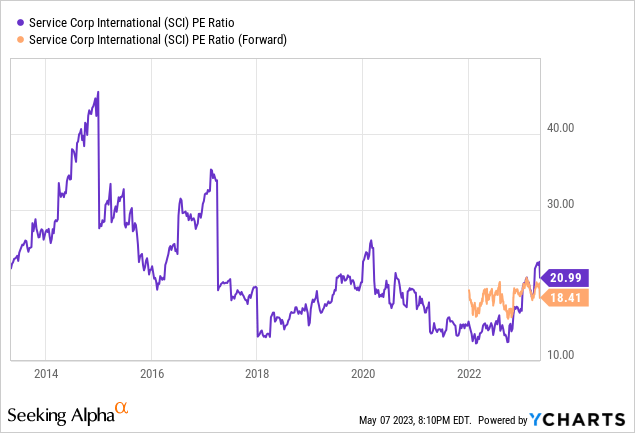

In the last 10 years the stock's total return surpassed total returns of the overall market even though its valuation stood below the market's average valuation for the most part. Even now, the company's P/E ratio sits at a low 18 versus the S&P 500's average P/E of 23, so we can expect this outperformance to continue on for a while.

The company's funeral business actually consists of 2 segments: at-need and pre-need. The at-need segment consists of funeral arrangements of a deceased person by their family after they pass away. Pre-need includes certain funeral arrangements made by people for themselves prior to their passing. All funeral revenues get recognized at the time of funeral regardless of when the arrangement was made, but it should be mentioned that SCI's pre-need segment currently has a backlog of $10 billion, which is about 4 years' worth of revenues for their funeral business.

The company's cemetery business operates a bit differently than its funeral home and performs more like a real estate company. SCI currently owns 490 cemeteries that generate $1.8 billion annually, with a backlog of $4 billion in future commitments through pre-death arrangements. This part of business can also serve as an inflation hedge for the company because it can raise its prices when real estate values go up. While funeral revenues are always recognized after the death of the individual, revenues from cemetery plot sales can be recognized almost right away, depending on the type of payment arrangements. In the last 5 years SCI's cemetery gross margins rose from 28% to 37% due to having better pricing power, cost controls and mix of more valuable real estate.

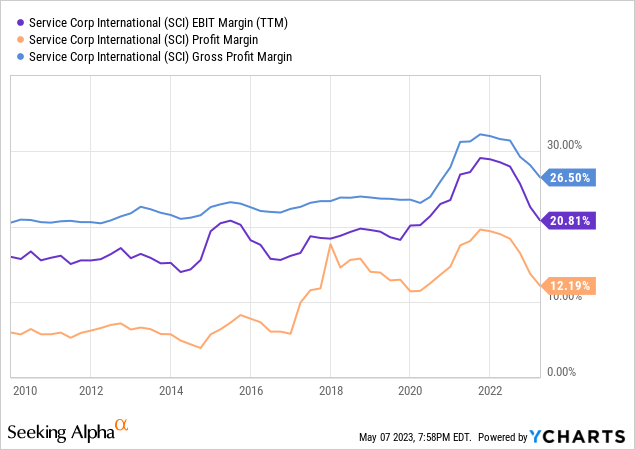

One thing this company's management is known for is their conservative approach to managing the company's finances. In the last 15 years, we've seen the company's profit margins grow at a decent rate through cost management, better pricing power and M&A synergies. Moving forward, we can expect this trend to continue or at least stabilize where we can expect the company to have a certain level of profitability regardless of economic conditions.

The company saw its business grow tremendously during the COVID-19 pandemic for obvious reasons, and many people thought this growth would be temporary and unsustainable. While it's true that the company's growth rate scaled back after the effects of the pandemic started receding, it's still growing at a healthy rate and the company is still highly profitable. SCI's current margins might be below 2021 highs, but they are still well above pre-2019 levels. Regardless of the status of the pandemic, the American population is continuously growing and getting older, which increases the available market size for this company.

As I've mentioned above, the company's forward P/E ratio is about 18 which is significantly below its historical valuations. In the last 10 years SCI's P/E ratio ranged from 14 to 45 with average P/E of 26. The company's current cheap valuation will also allow it to buyback more stock in the near future, reducing the diluted share count even further.

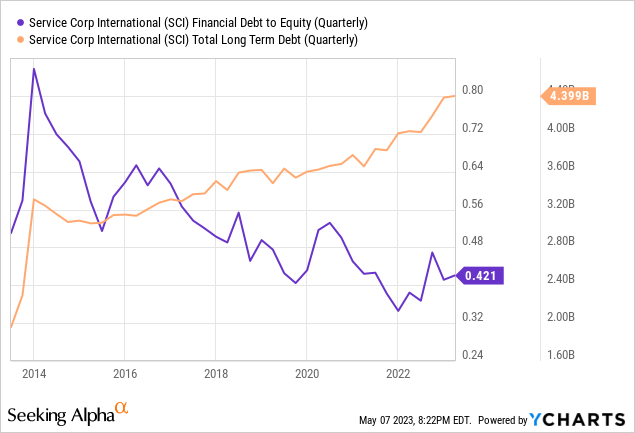

One concern people always bring up with this company is its debt levels. In the past, SCI spent a lot of money on acquisitions, and it used leverage to make this possible. Even though the company's debt levels have been increasing lately, its debt-to-equity levels have been dropping significantly, which means its debt leverage has been coming down to healthier levels. This trend should continue as the company's profit growth significantly outpaces its debt growth.

If you are a short-term trader, I wouldn't recommend this stock because there are long periods where the stock stays flat or stuck in a tight range followed by periods of strong share appreciation. Since the company's business is not exactly cyclical, timing this stock is exceptionally difficult. Instead, I'd recommend you to buy this stock in your long-term growth portfolio or retirement portfolio and not touch it for many years to come. You will more than likely be pleased with the results in the next decade or two.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.