Apple Bears: Learn The iPhone Lesson

Summary

- In my view, a fatal flaw in Apple bears’ argument is treating the iPhone as “another smartphone” on the market.

- I will argue that iPhone will continue to be a robust growth driver, with both price and volume increases.

- It reminds me of a joke/fact about Stanford University’s tuition.

- While parents complain about how expensive tuition is, they feel happy to write the check to Stanford.

- Jokes aside, I see fundamental similarities here as a symbol of status and a social currency with the expanding subscriber base.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Wavebreakmedia/iStock via Getty Images

Thesis

By this time, a few Seeking Alpha articles have already reviewed Apple's (NASDAQ:AAPL) recent earnings report ("ER") in detail. Therefore, here I will only focus on one issue - the iPhone sales. The issue has been used by both AAPL bears and bulls to argue their case. And the thesis of this article is to argue that AAPL's iPhone will continue being a key growth driver into the future. And I will even further the argument to assert that it will become an even more potent driver given the rapid growth of its user base and paid subscribers. In my view, AAPL bears made the fatal mistake of treating the iPhone as "another smartphone" on the market. It is an "extraordinary product", as Warrant Buffett just commented in its shareholder meeting, which enjoys a unique bond with its owners. Quote:

Warren Buffett: Apple is in a [unique] position with consumers, where they're paying maybe $1,500 bucks, or whatever it may be, for a phone. And the same people pay $35,000 for having a second car, and [when] they have to give up a second car or give up their iPhone, they'd give up their second car. I mean, it's an extraordinary product.

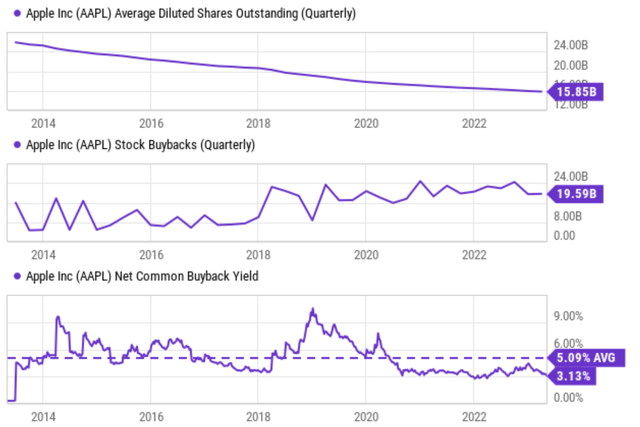

Thanks to the ample cash flow provided by iPhone sales and also the recurring cash provided by subscriptions, the company will keep enjoying capital allocation flexibility and rewarding shareholders with dividends and buybacks. And this leads to me its valuation. As to be elaborated later, I do not view its valuation as expensive (not cheap either) at this point. As such, I do view its large-scale buybacks as value accretive for investors in the long term.

The Extraordinary iPhone

Against the backdrop of a continuous decline in global smartphone sales, many investors, especially bears, expect iPhone sales to decline as well. However, iPhone demonstrated counter-trend growth in the past quarter. Growth was actually quite robust. When all regions are included (i.e., including the Asia-Pacific region and India), iPhone sales grew by 15% year-on-year.

What is more extraordinary is its prices (see the chart below). Buffett may not be well informed of the latest iPhone prices (and less so on all the accessories). But he certainly nailed the key point - consumers are happily paying for their iPhones. As seen, the average price of the latest iPhone models reached $988 in the most recent quarter. Over the two years alone, the average price has risen from $873 to the current level, a whopping 13% in 2 years. And the higher prices simply did not stop people from buying.

Source: Consumer Intelligence Research Partners

The situation with iPhone prices reminds me of a joke (not sure if it counts as a joke if it is factual) on Stanford University's tuition. While parents complain about how expensive tuitions are in U.S. colleges, they feel happy to write the check to Stanford.

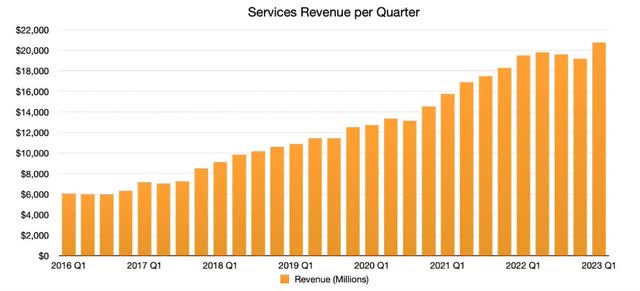

I see a remarkable analogy here. Apple has established itself as a premium brand with a strong brand image, and many consumers perceive owning an iPhone as a status symbol. Additionally, Apple has created an ecosystem around its products, including services, apps, and accessories, which further enhances the value proposition for iPhone users and justifies the higher prices. And this leads me to an even stronger prediction: the iPhone will become a more potent and sticky growth driver as Apple's subscriber base grows. Kind of like how the value of a Stanford degree grows over time as its alumni network expands. To wit, the Services business reported a record revenue of $ 20.7 billion versus the past quarter, representing 6.4% growth YoY. As its CFO Luca Maestri commented:

We set an all-time revenue record of $20.8 billion in our Services business, and in spite of a difficult macroeconomic environment and significant supply constraints, we grew total company revenue on a constant currency basis.

Valuation, repurchases, and expected return

Another common bear's argument is its expensive valuation. It is true that its valuation is not cheap either in relative or absolute terms (see the chart below). However, keep in mind that for rare species like AAPL, we should use a different P/E baseline to start with. And I use 20x P/E because of the following reasoning. Any valuation near 20x P/E should be a no-brainer for a stock with ROCE (return on capital employed) consistently near 100% (which is AAPL's case) as it provides extremely favorable odds for double-digit annual return. The return will come from about 5% real growth assuming a 5% reinvestment rate, 5% earnings yields (from 20x P/E), and also whatever the inflation escalator happens to be.

Under AAPL's current financial, 20x P/E would correspond to a price of around $140 when its cash position and owners' earnings are considered. See details in my earlier article entitled "Apple: Why I Bought More At $140". Its current price ($173 as of this writing) is about 23% above this "baseline" price. Not the most ideal entry point, but not in any bubble regime either. At the current valuation, I estimate its long-term return to be close to 10% (5% real growth, 3~4% earnings yield, plus some inflation factor). Still, it's quite an attractive opportunity, especially when risks are adjusted for.

Speaking of risk, AAPL's announced share repurchase plan already makes up about 1/3 of my estimated return already. AAPL has been consistently and aggressively buying back its stock (see the chart below). In the past decade, Apple has bought back a total of $573 billion on buybacks according to Bloomberg data. This is by far the most among all U.S. publicly traded companies. On average, the net common buyback yield has been 5.1% over the past decade. It is equivalent (or better if you consider tax implications) to a 5.1% additional dividend.

Going forward, the company is committed to continuing such large-scale repurchases. As commented by its CFO in the recent ER (the emphases were added by me):

During the March quarter, we returned over $23 billion to shareholders, including $3.7 billion in dividends and equivalents and $19.1 billion through open market repurchases of $129 million Apple shares. Given the continued confidence we have in our business now and into the future, today our Board has authorized an additional $90 billion for share repurchases as we maintain our goal of getting to net cash neutral over time.

Risks and final thoughts

AAPL is certainly not immune to all the ongoing macroscopic risks. Its sales are certainly sensitive to the overall health of the economy, especially with its premium pricing as discussed. Supply chain disruptions continue to pose problems. Apple relies on an intricate network of suppliers to manufacture its products. Disruptions in the supply chain, such as geopolitical tensions, trade disputes, or the recent COVID-19 pandemic, can impact the availability and cost of production. Apple also generates a significant portion of its revenue from international markets. Thus, fluctuations in foreign currency and geopolitical conflicts can impact its financial performance too. As a reflection of these risks, Apple was not immune to declining revenue in the last quarter. For example, its Q1 2023 total revenue dialed in at $94.8 billion, representing a 3% year-on-year decline. Its net profit declined to $24.1 billion, also a 3% year-on-year decrease.

However, I don't recommend investors focus on such quarterly jitters. Instead, long-term investors should focus on its products and services. As Warren Buffett commented, if you have to worry about what's going on every quarter, you should not have bought its shares in the first place. And also similar to Buffett, I see a series of extraordinary products at AAPL (with the iPhone as the flagship) that enjoys a unique relationship with consumers. And I further see the stickiness of these products grow as their subscription bases steadily expand.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.