Berkshire Hathaway Annual Meeting And Q1 2023 Key Takeaways

Summary

- Berkshire Hathaway's Q1 operating earnings improved 12.6% in the first quarter, driven primarily by higher interest rates.

- GEICO, despite an impressive headline improvement from last year, has significant issues that need to be addressed.

- Early results from the Pilot acquisition show it to be a fairly expensive deal.

- Share repurchases accelerated with $4.4B of shares bought back during the quarter, with the bulk of the purchases happening in March at $305/share.

- I believe Berkshire's size could be making it hard to manage well, and hope to see continued repurchases instead of acquisitions.

Scott Olson

Berkshire Hathaway's (NYSE:BRK.A) (NYSE:BRK.B) 2023 Annual Meeting, like many before it, is an absolute sight to behold and contained lots of information about the company and the broader economy.

Berkshire 2023 Annual Meeting (Berkshire )

After listening to most of the meeting and reading the 10-Q, here are some of my key takeaways.

Berkshire Hathaway Q1 Operating Results

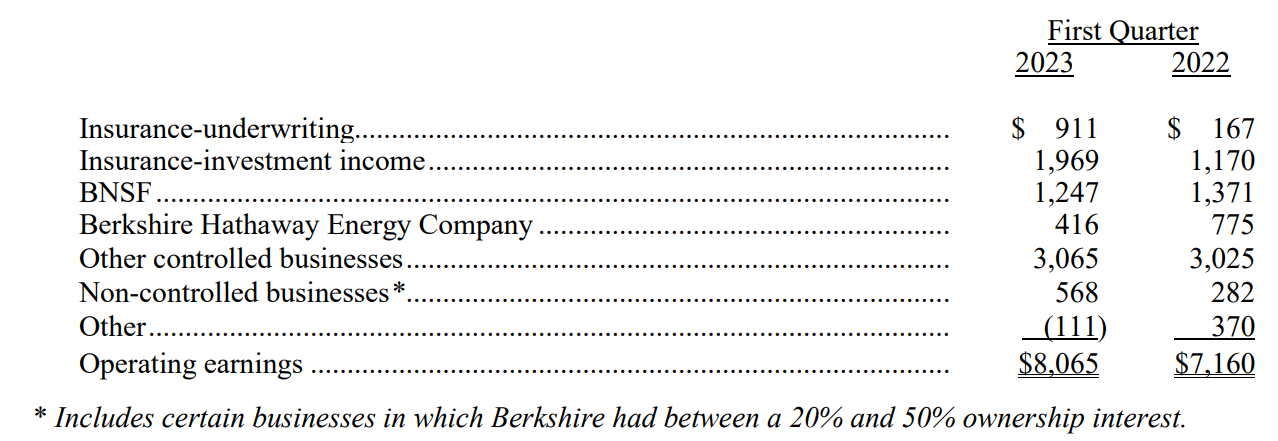

In my recent article Will Berkshire Repurchases Return In Force In 2023 I estimated Q1 earnings at $7.15 billion for Q1. I was expecting a breakeven quarter for Insurance-underwriting, so on the surface these results looked good. But digging further into Berkshire's Q1-23 10-Q revealed all is not well at GEICO.

Q1-23 Operating Results (Berkshire Hathaway Q1 10-Q)

When comparing the periods, the primary difference has been higher interest rates boosting Insurance-investment income. Beyond that, results are mostly flat year over year even after adding $20 billion in acquisitions (Alleghany and Pilot.) This, combined with Buffett's commentary that most Berkshire businesses will be down this year, may imply that Berkshire, like many other businesses, has been mildly over-earning the past few years. As owners, we should temper our expectations for future periods.

Serious Concerns on GEICO

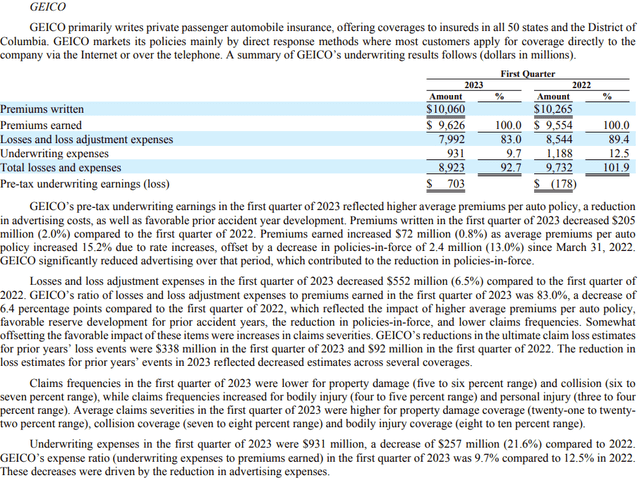

GEICO posted a $703 million underwriting profit versus a $178 million loss in the prior year. But digging under the surface, there are major concerns, and the optically positive results should not be celebrated.

GEICO Q1-23 Performance (Berkshire Q1-23 10-Q)

- Individual premiums were 15.2% higher than last year, but GEICO lost 2.4 million, or 13% of their policyholders. They're losing market share very quickly.

- A significant portion of the better results came from $257 million in reduced expenses was primarily driven by reduced advertising spend, as well as prior year reserve releases.

In the meeting, Ajit Jain also said

"GEICO's technology needs a lot more work than I thought it did. It has more than 600 legacy systems that don't really talk to each other. That's a monumental challenge"

Ajit also noted in last year's meeting that Progressive (PGR) has been on the telematics bandwagon for nearly 20 years, and GEICO is just getting started on it in the past 2-3 years.

Berkshire's Share Repurchases

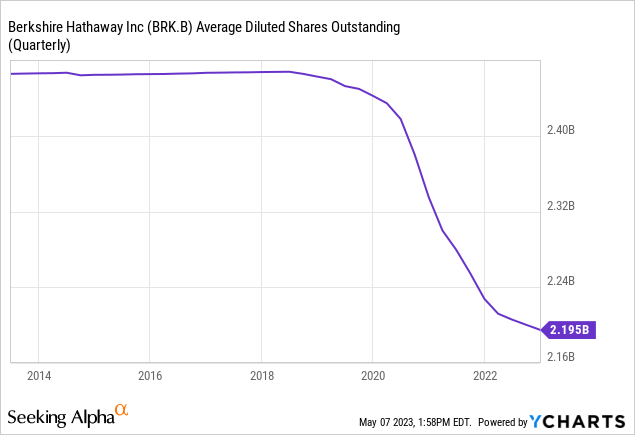

Berkshire repurchased $4.4B of shares during the quarter, up from $2.6B in Q4-2022. I'm happy to see this and continue to believe that major share repurchases are by far the best use for Berkshire's cash.

Berkshire Q1 Repurchases (Berkshire Q1-23 10-Q)

The bulk of the repurchases, around $3.4 billion, happened in March.

Berkshire Price to Book Value (Author's Estimates for Q1)

I don't think this is a coincidence, and believe it likely had to do with Berkshire's share price staying flat while its equity book, driven by Apple (AAPL) gained value, pushing the Price/Book back towards the 1.3x level.

With shares somewhat higher now, it will be interesting to see what Berkshire does. I think repurchases up to ~1.5x book make sense, although earning 5% in treasuries is not a bad alternative either.

Pilot

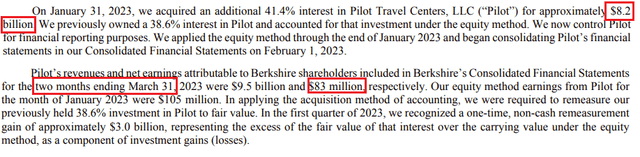

Berkshire purchased any additional 38.6% interest in Pilot Travel Centers for $8.2 billion this January. This negotiated price struck me as expensive. The closest comparison that I found to this deal was Marathon (MPC) selling Speedway to 7-Eleven for $21 billion in 2021. In 2018, Speedway had around 4000 locations and net income of $1.03 billion. The sale seemed like a win for Marathon.

Pilot Q1-23 Results (Berkshire Q1 10-Q)

February and March are two of the weakest seasonal months for trucking, and Pilot recorded $83 million in earnings. Including January, the first quarter had $188 million in earnings.

Knowing that driving and trucking seasonality increases in Q2 and Q3, the initial read looks like this is a $1 billion net income/year business, similar to Speedway. This deal still looks expensive to me, but we will see what it looks like going forward.

Buffett was asked a question at the meeting about why Pilot was worth so much more than what BP (BP) paid for Travel Centers of America. He said that deals were not comparable, but did note that the sellers for the recent 38.6% stake got a good price due to market conditions last year.

Berkshire Business Outlook

"The majority of our businesses will report lower earnings this year than last year

...

During the last six months or so, the “incredible period” for the US economy has been coming to an end

-Warren Buffett, May 6th, 2023

This should not be a surprise to anyone as it matches other recent commentary from Buffett, but he is certainly not mincing words. It's worth considering this outlook knowing that results for many of Berkshire's business are already showing small year over year declines.

Buffett signaled a cautious outlook on US Banks and it sounds like he has completely sold out of Bank of NY Mellon (BK), Citigroup (C) and U.S. Bancorp (USB) and only still holds Bank of America (BAC). We will find out for certain when the 13F is released next week.

Conclusion

Buffett responded to a question at the meeting and indicated he still prefers acquisitions over returning capital. But I believe more than ever that Berkshire owners are best served by using the majority of the free cash flow to repurchase shares when it can be done at a reasonable price and Berkshire should stop acquiring wholly owned businesses (with perhaps an exception for insurance businesses, as I do believe Berkshire's unique structure is synergistic with these.)

Berkshire has proven to be an exceptional company, but I believe it has grown larger than optimal with too many unrelated businesses. The "conglomerate discount" exists for many reasons, but among them is the problem of a lack of focus. Would GEICO be performing better if Warren, or even Ajit, devoted 100% of their time towards it?

GEICO itself is a huge operation and various estimates peg its standalone value between $35-50 billion. So when Ajit says that a business of this size's "technology needs a lot more work than I thought it did" that is a red flag that the business may have become too big to manage well. If Progressive or Allstate (ALL) released results showing they lost 13% of policyholders in a year while disclosing that they need a complete IT overhaul, shares would get pummeled.

In addition to the results at GEICO, Greg Abel fielded questions at the meeting on BNSF underperformance and conceded they have "work to do" and they had to "reset the railroad" in 2022 to focus on longer term performance.

I'm concerned that if two of Berkshire's largest businesses have major issues, what other challenges are lurking at some of the smaller ones that don't have the same level of disclosure as GEICO and BNSF? I think Berkshire needs to admit to itself that it shouldn't grow any further and further embrace share repurchases going forward.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.