Riskified Expects Further Growth As Macro Uncertainties Mount

Summary

- Riskified Ltd. went public in July 2021, raising approximately $368 million in a U.S. IPO.

- The firm provides a platform for e-commerce fraud detection and prevention to businesses worldwide.

- Riskified continues to grow revenue at a moderate rate, but operating losses remain material and the firm faces macroeconomic risks in a slowing economy ahead.

- I'm Neutral [Hold] on Riskified Ltd. for the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Laurence Dutton/E+ via Getty Images

A Quick Take On Riskified

Riskified Ltd. (NYSE:RSKD) went public in July 2021, raising approximately $368 million in gross proceeds in an IPO that was priced at $21.00 per share.

The firm provides an ecommerce risk management platform to reduce fraud for merchants and improve consumer experiences.

Given the company’s continued material operating losses and the acknowledged risks associated with slowing economic activity, my outlook on Riskified Ltd. in the near term is Neutral [Hold].

Riskified Overview

Tel Aviv, Israel-based Riskified Ltd. was founded to create a platform that aggregates data from large online merchants to increase approval rates for online orders while reducing the risk of payment fraud.

Management is headed by co-founder and CEO Eido Gal, who was previously an analyst at BillGuard and at PayPal.

The company’s primary offerings include:

Chargeback Guarantee

Policy Protect

Deco

Account Secure

PSD2 Optimize.

The firm pursues customers via a direct sales approach and seeks to "land and expand" its offerings with each customer.

RSKD focuses its efforts on obtaining enterprise-sized merchants with a minimum of $75 million in online sales per year.

Riskified’s Market & Competition

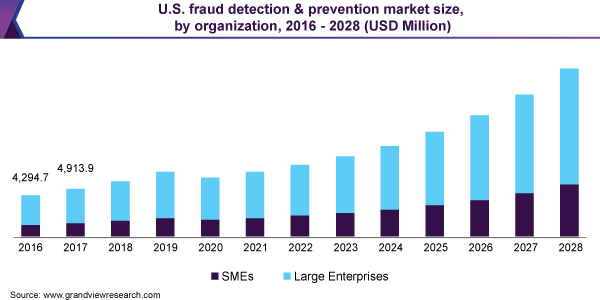

According to a 2021 market research report by Grand View Research, the global market for e-commerce fraud detection and prevention market was an estimated $21 billion in 2020 and is forecast to reach $66 billion by 2028.

This represents a forecast CAGR of 15.4% from 2021 to 2028.

The main drivers for this expected growth are the growing penetration of the Internet and smartphone usage worldwide and a wider set of threat vectors for increasingly sophisticated fraud entities.

Businesses of all sizes are increasingly focused on providing the best online shopping experience with seamless integration to consumers, while reducing fraud and allowing bona fide customers to purchase without disruption.

An increasing number of e-tailers is expected to produce strong demand growth, as are emerging economies such as India and Indonesia, among others.

Also, the chart below shows the historical and projected future growth trajectory for the U.S. fraud detection and prevention market, through 2028 by customer organization type:

U.S. Fraud Detection & Prevention Market (Grand View Research)

Major competitive or other industry participants by type include the following:

Signifyd

ClearSale

Sift

Kount

Forter

NICE Actimize

LexisNexis Risk Solutions

Fraud Barrier

Interceptas

Fraud.net

BehavioSec

Others.

RSKD’s Recent Financial Trends

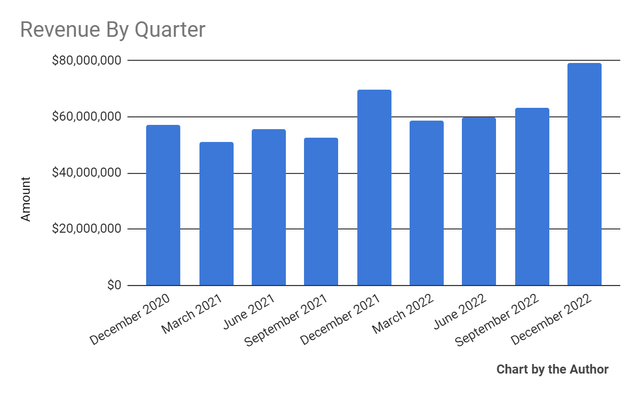

Total revenue by quarter has grown according to the following chart:

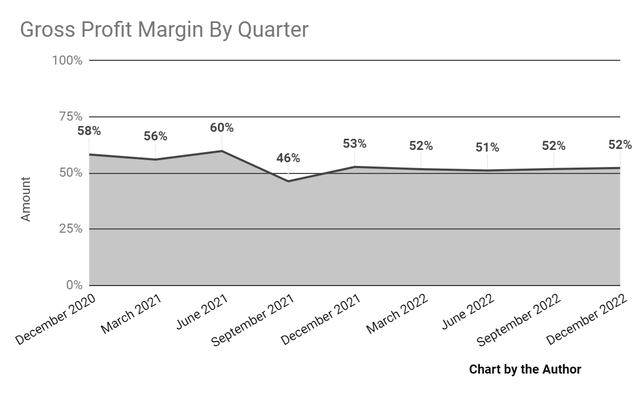

Gross profit margin by quarter has trended slightly lower in recent quarters:

Gross Profit Margin (Seeking Alpha)

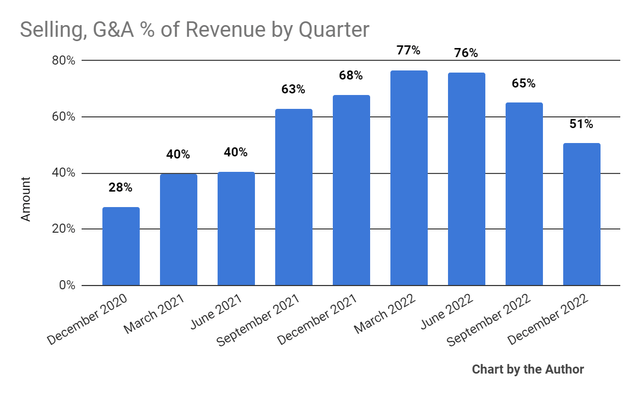

Selling, G&A expenses as a percentage of total revenue by quarter have varied per the following chart:

Selling, G&A % Of Revenue (Seeking Alpha)

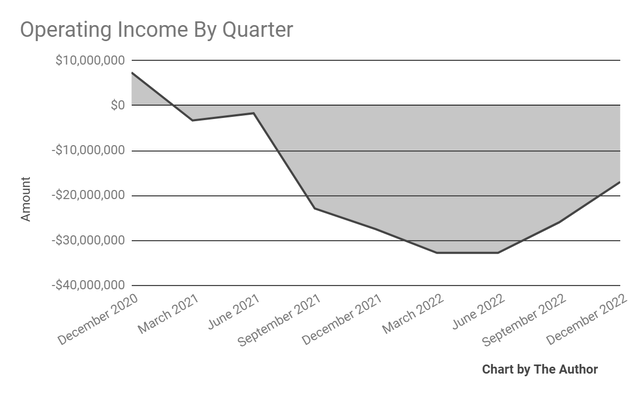

Operating losses by quarter have improved somewhat recently, but remain a concern:

Operating Income (Seeking Alpha)

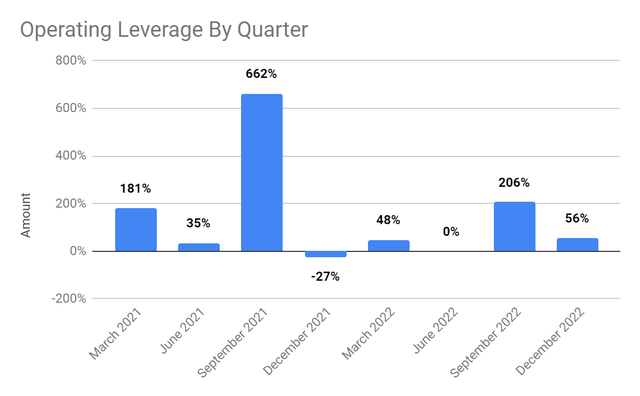

Operating leverage by quarter has generally remained in positive territory in recent quarters, as shown below:

Operating Leverage (Seeking Alpha)

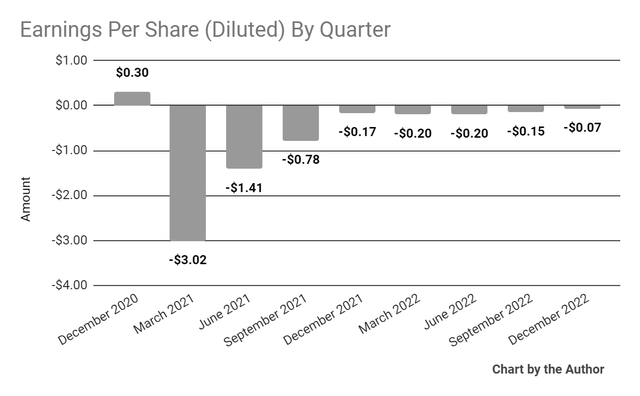

Earnings per share (Diluted) have remained negative but have made progress toward breakeven:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

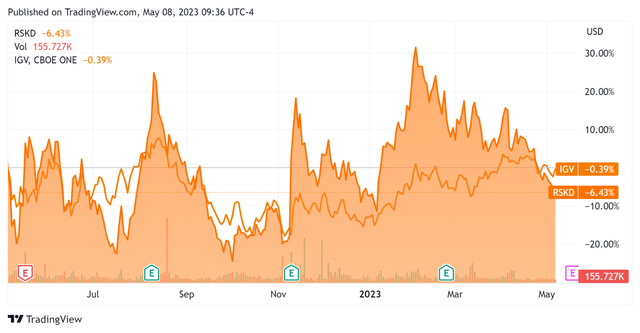

In the past 12 months, RSKD’s stock price has fallen 6.43% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) slide of 0.39%, as the chart indicates below (company stock price in filled-in area):

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm finished the quarter with $475.7 million in cash, equivalents and short-term investments and zero debt.

Over the trailing twelve months, free cash used was $32.4 million, of which capital expenditures accounted for $6.1 million. The company paid a hefty $67.5 million in stock-based compensation, or SBC, in the last four quarters, the highest in the past eleven-quarter period.

Valuation And Other Metrics For RSKD

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 1.9 |

Enterprise Value / EBITDA | NM |

Price / Sales | 3.5 |

Revenue Growth Rate | 14.0% |

Net Income Margin | -39.8% |

EBITDA % | -40.2% |

Market Capitalization | $804,790,000 |

Enterprise Value | $366,530,000 |

Operating Cash Flow | -$26,250,000 |

Earnings Per Share (Fully Diluted) | -$0.62 |

(Source - Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RSKD’s most recent Rule of 40 calculation was negative (26.2%) as of Q4 2022’s results, so the firm is still in need of significant improvement in this regard, per the table below:

Rule of 40 | Calculation |

Recent Rev. Growth % | 14.0% |

EBITDA % | -40.2% |

Total | -26.2% |

(Source - Seeking Alpha.)

Future Prospects For RSKD

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted the expansion of its global footprint and growth of its coverage in certain industry vertical markets.

However, the company faced a more challenging operating environment, especially in the verticals of general retail and home products.

Management believes the company's diversification across geographies, merchants and industries makes the firm more resilient to macroeconomic ups and downs.

Riskified Ltd. continues to strategically build its presence in the Asia-Pacific region and aims to continue producing significant revenue from each of its major operating regions.

The company’s annual dollar retention rate in 2022 was 99%, indicating reasonably good product/market fit and sales & marketing efficiency; leadership said it was "consistent with prior years."

However, total revenue for Q4 2022 rose 13.6% year-over-year and gross profit margin fell half of a percentage point.

SG&A as a percentage of revenue dropped 17 percentage points in a strongly positive trend, while operating losses were reduced sequentially.

Looking ahead, management expects top-line revenue growth to be 15% at the midpoint of the range but "macro uncertainty we faced last year [2022] will remain."

The company's financial position is strong, with substantial liquidity, no debt; the firm used $32.4 million in free cash over the past 12 months, so management will need to reign that negative result in.

Regarding valuation, the market is valuing RSKD at an EV/Sales multiple of around 1.9x.

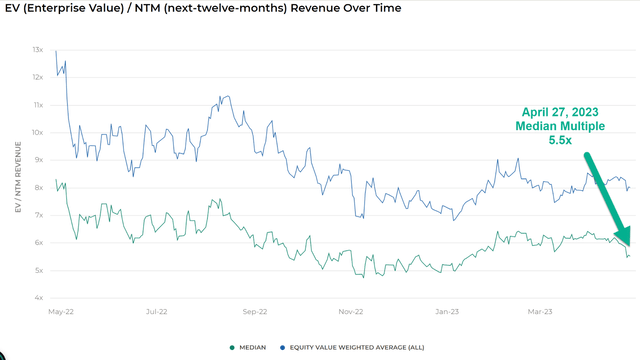

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.5x on April 27, 2023, as the chart shows here:

EV/Next 12 Month Revenue Multiple Index (Meritech Capital)

So, by comparison, Riskified Ltd. is currently valued by the market at a substantial discount to the broader Meritech Capital SaaS Index, at least as of April 27, 2023.

The primary risk to the company’s outlook is a macroeconomic slowdown as customers lengthen decision-making processes, sales cycles slow, and some banks reduce business lending activity as a result of the recent banking crisis, reducing its revenue growth trajectory.

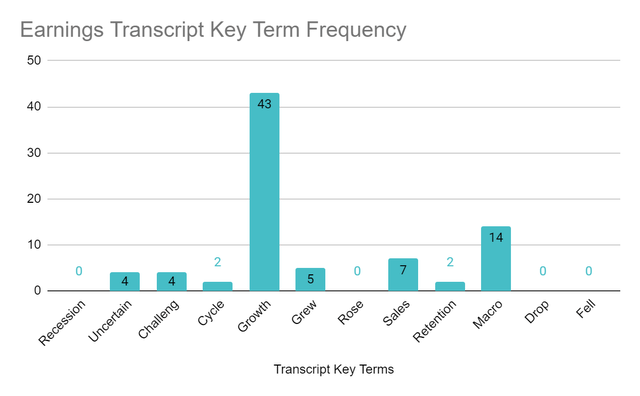

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Term Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited "Uncertain" four times, "Challeng[es][ing]" four times, and "Macro" 14 times in various contexts.

A potential upside catalyst to the stock could include a pause in U.S. Federal Reserve interest rate hikes, possibly signaling the end of its rate hike cycle and reducing downward pressure on valuation multiples.

However, the global credit market may not immediately respond to such a change and a macroeconomic slowdown may continue to proceed throughout 2023.

Given the firm’s continued material operating losses and the acknowledged risks associated with slowing economic activity, my outlook on Riskified Ltd. stock in the near term is Neutral [Hold].

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.