KLA Corp: The Moat Is Only Increasing

Summary

- Despite the recent pullback in wafer equipment spending, KLAC will convert a bigger share of the industry capex in revenues.

- KLAC's market share will keep on expanding because the big WFE manufacturers are not focusing on process control.

- KLAC has an increasing moat, good margin of safety and the ability to beat the market in the next years.

naphtalina/iStock via Getty Images

KLA Corporation (NASDAQ:KLAC) has been on an impressive run, beating the nasdaq100 (QQQ) by more than 13% points in the past year. Despite the expected pullback in wafer equipment spending I expect KLAC to keep outperforming the QQQ. KLAC should convert a bigger share of the chip manufacturers capex into revenue and, in the long run, keep growing its top line due to the growth in AI, vehicle and renewable energy chips.

Company profile

Chip manufacturing is split in multiple stages. The most important one is lithography because it’s when the circuit patterns are printed on the wafer. The circuits are printed by exposing the wafer to ultraviolet light with wavelength as small as 13.5 nm generating patterns thousands times smaller than a grain of sand. Getting the patterns right every time is tricky causing some chips to be produced with the wrong shape or in the incorrect place reducing the process yield. Here enter the KLAC machines designed to measure pattern dimensions and pattern placement helping manufactures to control the process and improve the lithography machine performance and yield.

The lithography machines are very expensive some costing more than 150 million dollars and require, sometimes, 700 steps to produce the chips. Since the machines are so expensive it is important to produce with high quality to improve the return on investment. That is why the KLAC machines are crucial for the chip manufacturers.

KLAC's top two customers are Samsung Electronics and Taiwan Semiconductor Manufacturing Company both generating more than 10% of revenue for the past three years. KLAC's revenues are highly dependent on the capex of the semiconductor industry which is led by its top 2 customers.

Industry capex

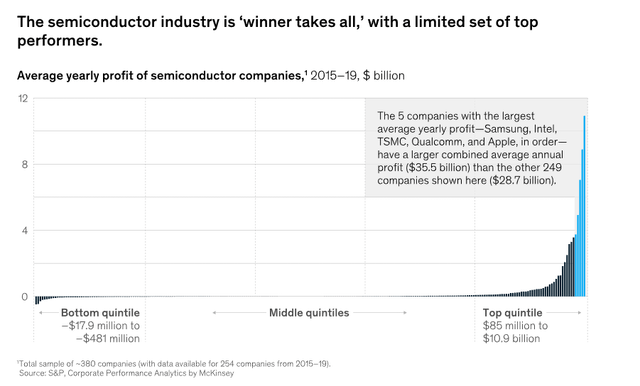

Industry capex is very important for KLAC because it is the money employed by the industry to build new factories and upgrade existing ones. The semiconductor industry is very competitive. Usually the most technological advanced firms capture most of the business. This makes it very capex intensive and opens opportunities for firms as KLAC to innovate and win business.

Chips capex, right now, has two levers. First one is capex by the advanced chip foundries and the second one is capex by the lagging chip foundries, most of them being Chinese.

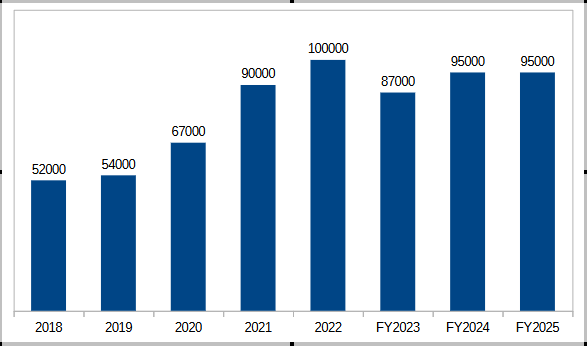

TSM, Samsung and Intel capex (Market Screener)

The advanced chip foundries capex peaked in 2022 because of the chip shortage that started around 2021. There has been an elevated demand for the most advanced chips that are used in pcs, gaming consoles, servers and for trailing chips used in vehicles. It is expected that new 72 fabs or major expansions will come online in 2024 increasing the supply for the advanced and trailing chips consequently reducing the chip shortage. Supply and demand are expected to become balanced in the future reducing the capex needs. Still the capex level is forecasted to be significantly higher than 2020 because of the anticipated growth in advanced chips. They require advanced fabs and higher capex per unit of supply.

The pullback in capex spending should affect KLAC's growth. Since the future capex spending will be in the most advanced fabs and KLAC is an enabler for the EUV machines and not just a yield management company we will see an increased conversion of industry capex in KLAC's revenues. In the 2023 Q1 earnings call KLAC's CEO said this:

I think the other thing that's changed, particularly with EUV is we're actually more an enabling technology now. And before, we might have been more about yield management. And now with some of our products, particularly in BBP and then Rapid, those are the tools that our customers have repeatedly said, no matter what happens in this downturn, keep us on your list.

Revenue coming from the advanced chip foundries should maintain or reduce slightly, in the short term, which is a positive for KLAC. In the long term, secular trends like AI and the computerization of the vehicle will increase its growth.

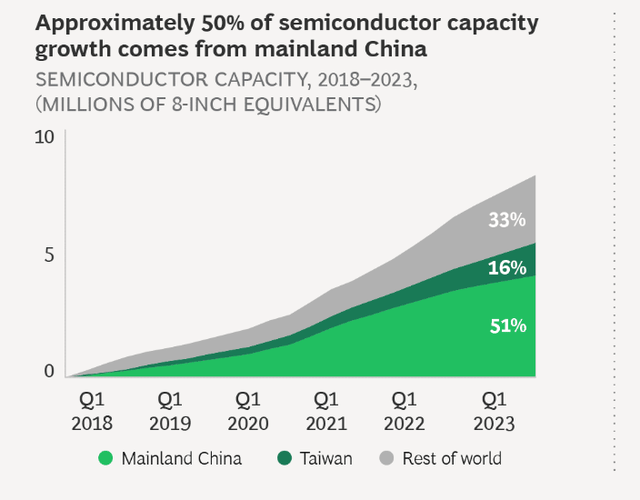

Increase in chip capacity (BCG)

The lagging chip foundries are located in China and their most used node is the 28nm therefore they don't, significantly, participate in the manufacturing of advanced chips for mobile, pc and servers. Their goal is to be able to reach the more advanced nodes like TSMC did. To do this companies like SMIC will have to invest a lot of money in upgrading their factories and building new ones. This objective has been impaired by the US government. Suppliers of advanced equipment will need to apply for an export license to conduct business with SMIC and peers. The goal is to reduce China's ability to manufacture advanced chips for military purposes.

This block will prevent SMIC from obtaining advanced equipment for chip manufacturing, but will allow the investment in equipment to develop trailing node chips. There is a lot of growing demand for trailing chips. These are used in consumer electronics, mobile, smart home and vehicles. The biggest driver for growth in trailing chips are vehicles and China has the biggest auto market. In fact, discrete chip content in vehicles could more than 12x from traditional combustion engines to electric vehicles.

Since SMIC won't be able to invest in newer nodes and the demand for trailing node chips is expected to increase, there will be opportunities of investment in new trailing node fabs and in improving the existing fabs. Semiconductor process control demand should grow in mainland China and KLAC will be a big beneficiary because it affects the trailing nodes therefore there won't be any restrictions.

From the trailing chip companies demand should increase significantly throughout the years. Overall process control demand should maintain or slightly increase in the next years.

Competition

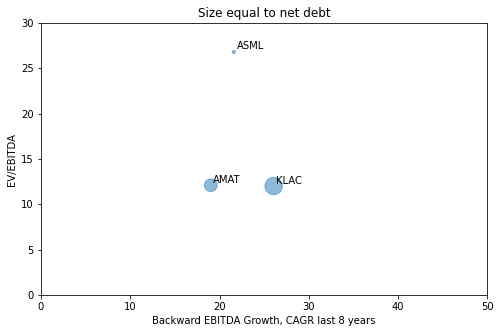

From a competition perspective KLAC is unchallenged. It has a market share of 57% in process control while the second leader has a market share of 14%. KLAC main competitors are Applied Materials (AMAT) and ASML (ASML). Although they are considered KLAC's competitors and have a bigger size than KLAC, their main research focus doesn't include process control.

AMAT's 10K report is divided in three reportable segments, the most important one being Semiconductor Systems. Then AMAT proceeds to subdivide the Semiconductor Systems segment in twelve categories. Of the twelve categories only one is related to metrology and inspection. In fact, AMAT's main business is related to chip manufacturing and not process control. Inside chip manufacturing it is focused in deposition and etching.

AMAT's latest machine, Centura Sculpta, is an EUV enabler a not related to process control. The new tool that can perform a new process step, “pattern shaping”. According to the company, the step could be used to reduce the use of EUV lithography by as much as half for some layers.

In the case of AMAT, the company works more side by side with KLAC than against it. AMAT sells manufacturing machines and KLAC's machines inspect, describe and control what is happening in the AMAT machines. Although AMAT participates in process control it is not significant to the company therefore their process control machines are not the best, making it hard to compete with KLAC.

AMSL follows the same line of reasoning. ASML main focus is on developing and maintaining their technology lead in the EUV lithography machines. Most of ASML research and development investments are deployed in lithography and not in process control therefore their process control machines are second tier making it hard to compete with KLAC.

The semiconductor industry is defined by the winner takes all. That is why it is very concentrated in a few companies and has a tendency to develop monopolies like ASML. Being a top performer implies you have to be extremely focused in one segment building an intellectual property advantage over the competition. In the case of the process control industry, KLAC is the only big company that devotes most of its resources in process control, maintaining and increasing its technological advantage. I expect KLAC to keep expanding its market share and, in the future, to be considered the ASML of process control.

Valuation

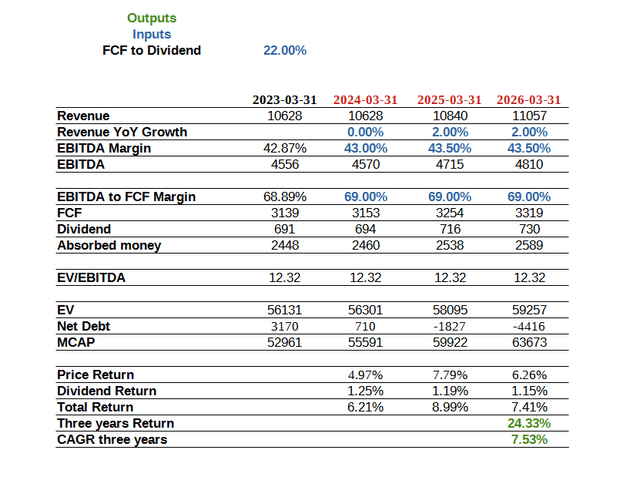

I'm going to value KLAC on an EV/EBITDA multiple because it gives a more detailed view about the company size as it incorporates net debt in the enterprise value. I prefer EBITDA to earnings or FCF because EBITDA gives a closer estimate to FCF than earnings and it is more easily disaggregated than FCF.

Wafer equipment manufacturer market should grow at a CAGR of 5% until 2031. Given the unchallenged market position of KLAC in process control, the high utility of its machines and the expected industry capex, I think it's reasonable to consider the company will grow at a CAGR of 2% from 2024 onward. Revenue will stay flat in 2023. Despite the FED tightening and the slowdown in the WFE capex I expect the EBITDA margin to stay the same in 2023. 2024 onward as KLAC expands the market share, develops an increasing dominant position and the FED reduces the interest rates, I expect the EBITDA margin to slightly improve.

Although I'm predicting the improvement of the company's fundamentals I'm assuming the EV/EBITDA will stay the same to make things simple. Instead of modelling the decrease in share count caused by the buybacks, I'm deducing the FCF after the dividend is absorbed as cash affecting the net debt. Since the market cap equals enterprise value minus net debt as we reduce the net debt, the market cap increases.

The model outputs a CAGR of 8% in three years which is a good value in a conservative scenario for the company.

Author's Calculation

Since KLAC is the only big company fully focused in process control, its R&D efforts will further increase the technological gap between KLAC and its competitors. As the technological gap increases so does the market share of KLAC, which is already happening. The continuous increase in market share of KLAC means that process control is becoming closer to a monopoly like lithography is to ASML therefore the gap between KLAC's multiple and ASML's multiple will decrease. This is a great catalyst for KLAC's price to increase, in the future, and I expect it to happen.

Taking into account the model's output and the increase in KLAC's multiple I see returns above 10% per year in the next three years.

Risks

Although there are multiple risks to my thesis I believe they have a low probability of materializing.

- The most evident risk is the increase in competition from big companies like AMAT and ASML. As the TAM of process control increases and KLAC margins expand, this chip segment becomes even more interesting for the established companies forcing them to scale their R&D efforts and develop similar or better machines than KLAC.

- There are also smaller companies specialized in process control that are trying to challenge KLAC. By being small, they have less ability to create big product lines, but can develop the best-of-bread machines for a single step in the process control diminishing KLAC's market share.

- The increase in geopolitical tensions between the USA and China could also impact KLAC. If China bans Micron (MU) from doing a part of its business in China, the USA could fight back by excluding additional chip equipment from China affecting a growing part of KLAC's business

- A significant recession could impair KLAC's growth. The decrease in consumption should diminish the chip manufacturer's capex and the machines KLAC deploys. Since KLAC's focus is on the technology road map of its clients, which will upgrade their production even in an event of a recession, this risk is minimized.

Conclusion

KLAC is the best company in the process control segment. It is also the company that spends more in process control R&D consequently its technological lead should only grow. By being essential to the EUV process KLAC should capture a bigger share of the semiconductor equipment market and increase their margins in the process. In an event of an economical slowdown it has the ability to maintain its revenue by focusing on the technological road maps of its clients. Furthermore, it converts a big share of its top line in buybacks increasing the share price. KLAC has low downside, a big moat and the potential to outperform the nasdaq100 therefore I rate it a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.