2 Magnificent Dividend Stocks That Dominated Earnings

Summary

- The time to invest for income has never been better.

- As earnings continue to be released, income investments continue to outperform expectations.

- Let the market pay your way in retirement.

- We look at two opportunities with yields up to 10%.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

fotostorm/E+ via Getty Images

Co-authored with Treading Softly

I'm always amazed when a perfectly fine-tuned system gets disturbed as someone tries to improve it. Have you ever been in that situation? In a workplace where everything is running smoothly - you have a process that works end to end without hiccups. Suddenly you have a new manager or boss who comes in and wants to update or alter how that workflow runs, thinking they can make it faster or more efficient. Something that worked well becomes dysfunctional until everyone learns the new system or gives up and returns to the old one.

When it comes to the stock market, many believe that the stock market is efficient, meaning that every company is priced exactly as it "should" be. I can tell you through my decades of experience that the market is anything but efficient in the short term. The market will operate more like an emotionally disturbed teenager in the short term than it does like a rational decision-making adult. There is a famous quote that says that the stock market is a voting machine in the short term and, in the long term, is a weighing machine.

A big reason for this is that investors will trade emotionally. In a way, it makes sense. This is the life savings that they have worked diligently for decades to build in a mass. The last thing they want is for it to melt before their eyes. Sadly, reactionary trading often causes more loss and diminishment of their savings than if they had just stood still. This effect is exponentially larger when we're in a bear market.

Often, you have companies that have very good systems. They are generating profits, doing the same thing day in and day out. Then the market comes along and sells them off, insisting that something is different from last year. It demands that companies "do something different". Then the market is surprised at earnings to see that the system is still working, the company is still making a lot of money, and shareholders are still being rewarded with dividends.

Today I want to look at two opportunities that, before their earning release, were trading negatively year to date. These outstanding income opportunities proved their place in your portfolio when their earnings came out and beat expectations on multiple fronts.

Let's dive in!

Pick #1: ARCC - Yield 10.5%

Last year, Ares Capital Corporation (ARCC) hit many home runs. The dividend was being raised, supplements were being paid, and earnings were climbing every quarter. For Q1, it was earnings that would have looked spectacular in 2019, but given the past year, it's a solid double. Source

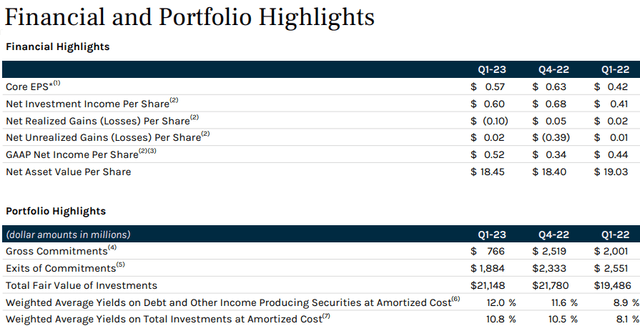

Net Investment Income, NII, came in at $0.60, which covers the current $0.48 dividend by a comfortable 125%. It is a step down from Q4's $0.68. The primary reason for the variation was $1.88 billion in exits and only $766 million in new commitments. ARCC's debt-to-equity ratio declined from 1.26x to 1.09x.

We are perfectly happy with this more conservative stance. With the risk of a recession on the horizon, ARCC should become increasingly picky about making new investments. Earnings are dramatically outearning the dividend, so ARCC has a lot of room to back off the pedal and be a little more cautious.

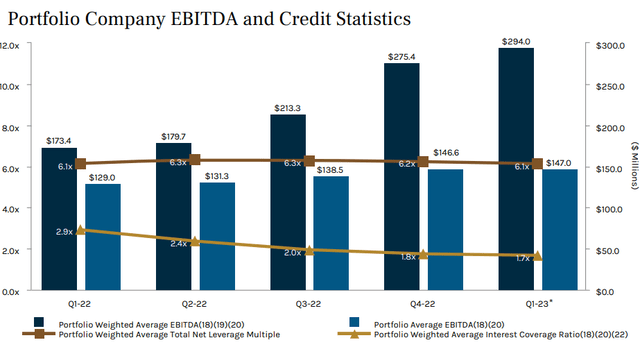

ARCC has continued to focus on companies with high EBITDA, currently averaging $294 million, a 70% increase from Q1 2022.

Note that interest coverage has declined steadily to 1.7x. This is a direct result of higher interest rates causing ARCC's portfolio companies to pay more interest. Higher interest rates are great because ARCC is the company receiving those interest payments, but if coverage gets too low, we could see defaults.

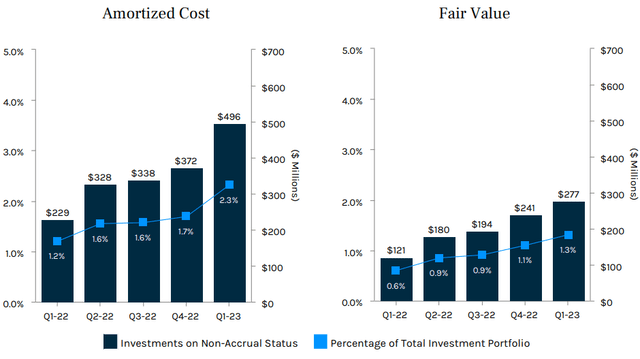

ARCC has seen a rise in non-accruals to 2.3% of its portfolio by cost.

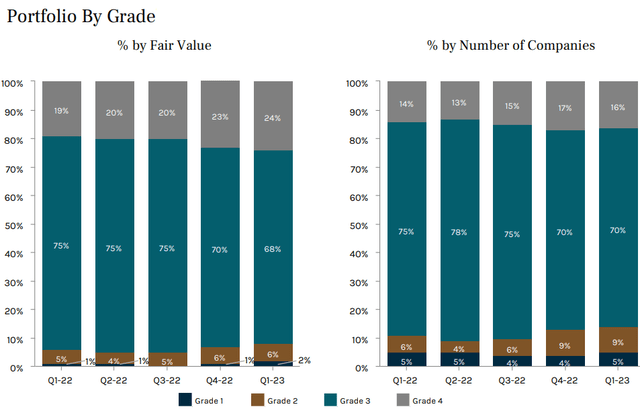

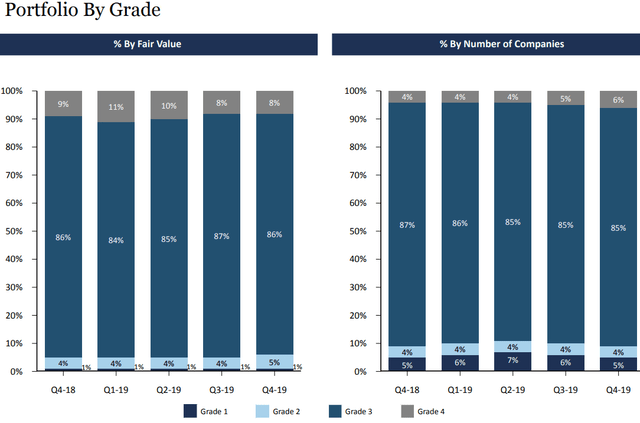

Before you go into panic mode, note that in Q1 2019, non-accruals were 2.5% of amortized cost. What we've seen is a return to more normal levels. When we look at ARCC's portfolio by grade, we can see that the portfolio is becoming bifurcated between the two extremes of thriving and struggling companies.

Grade 4 is the highest, and means the company is exceeding initial expectations. Grade 1 is the lowest and means that ARCC expects it will incur a loss. For some perspective, here is what the slide looked like in 2019: Source

ARCC is starting to see some credit issues compared to the past year of historically low defaults, but the issues are roughly on par with what we would call "normal" times. On the other hand, ARCC has an unusually large portion of its portfolio that exceeds expectations and sits in the highest ratings. We can infer from this that the difference is in the companies that have been able to benefit from inflation and rising rates and those that haven't. It is creating winners and losers in ARCC's portfolio, just like it has in the publicly traded market.

One thing that separates BDCs from banks, is that when a borrower runs into trouble, the BDC has the option and the incentive to provide additional support if the issues can be resolved. Banks either get paid, or they fairly quickly write off the investment. A BDC has the resources and ability to provide "business development" and restructure the investment in a way that aids the company while providing more upside for ARCC. For example, ARCC could convert debt into equity, provide additional debt, or in extreme cases Ares could take over the company and install entirely new management.

With ample liquidity and a conservative leverage ratio, ARCC is well-positioned to maximize the returns from its portfolio. With interest rates likely to start declining within the next year, we do not expect another regular dividend raise. Management likely believes that the current dividend is appropriate for weathering the next interest rate cycle and remaining covered. Since it is dramatically outearning the dividend, we expect to see a supplement or large special dividend at year-end.

Pick #2: AM - Yield 8.6%

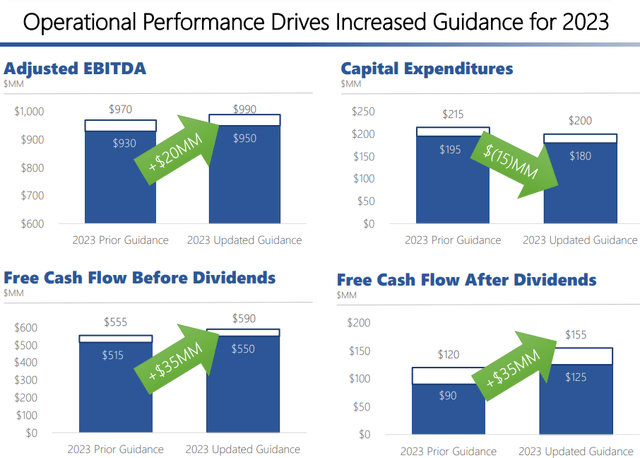

Antero Midstream Corporation (AM) had a great quarter, reporting FCF (Free Cash Flow) after dividends of $46 million. Additionally, management raised guidance for FCF after dividends by $35 million to $125-$155 million. Source

AM's goal coming into 2023 was to get debt to EBITDA below 3.5x, a target that will be exceeded with current guidance even without paying off any debt. The long-term goal is 3.0x debt/EBITDA. We don't expect AM to raise its dividend until that goal is reached.

At $990 in annual adjusted EBITDA, that implies debt needs to be paid down to about $3 billion. The current debt is $3.331 billion. So we don't expect a dividend raise this year as the high end of guidance leads to debt/EBITDA around 3.25x. However, that achievement would make it very likely for AM to raise its dividend in 2024, with even modest EBITDA growth.

When AM cut its dividend back in 2021, it was with the promise to shareholders that it would work on fully self-funding all cap-ex and having excess FCF after the dividend. It has achieved that goal, and is now working its debt down.

At the end of this process, AM will be much lower risk and should have the foundation to provide sustainable growth without having to raise capital through equity or debt. This is the kind of structure we've seen work so successfully for "blue-chip" MLPs like Enterprise Products Partners (EPD). This strategy makes sense in an industry where the cost of capital can vary wildly and at the worst possible times. MLPs that don't rely on raising capital outperform in the long run. AM is building the foundations to become a premium investment in the space, and we are happy to collect our dividends while we wait!

Conclusion

With ARCC and AM, We can enjoy strong dividend income from two top performers. Both of these companies can perform strongly and produce high levels of immediate income for your portfolio in the current economic situation and in the upcoming potential recession.

This is the kind of income that we want in our portfolio. Income that we can look to and rely upon regardless of what's going on in the economy. While neither one is fully insulated from economic situations impacting other sectors, both management teams have proven skills in the ability to generate income for their shareholders, regardless of the situation going on outside of their borders. They have systems that are working, and there is no reason for them to change course.

The next time you hear someone complain about their natural gas bill being higher or about higher interest rates on their credit cards or loans, remember this - you are a beneficiary of both of those situations if you hold these investments. My goal is to get income from everyday situations - this way, you can proudly proclaim that your retirement is paid for by dividends.

That's the beauty of our Income Method. That's the beauty of income investing.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 7500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and others.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCC, AM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.