AWAY: A Bet On The Further Recovery Of Tourism

Summary

- The dynamics of AWAY will depend entirely on the conditions of the tourist market.

- High demand from the U.S., backed by a strong dollar, will continue to benefit tourist destinations in the region and beyond.

- ETF returns will benefit from an increase in average travel spending due to longer stays.

- But the economic situation if the recession begins could cause tourists to become more cautious in 2023.

- Looking for a portfolio of ideas like this one? Members of Best Short Ideas get exclusive access to our subscriber-only portfolios. Learn More »

Thomas Barwick

Introduction

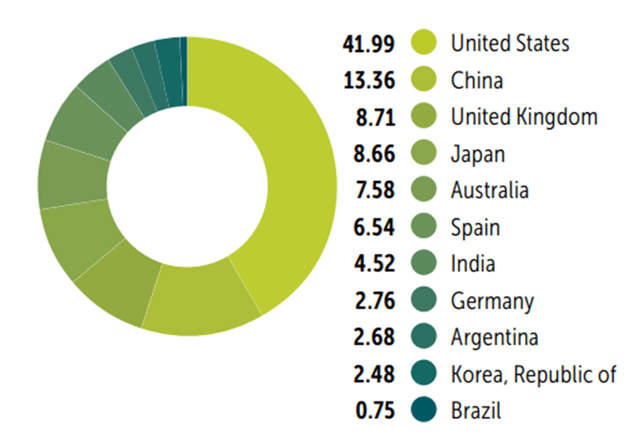

To begin with, the quotes will undoubtedly depend on the travel and tourism market, where there is a gradual recovery. World tourism should improve significantly this year and reach about 80-95% pre-pandemic levels, according to a tourism recovery forecast released by the World Tourism Organization in January. The recent lifting of COVID-related travel restrictions in China, the world's largest outbound tourism market, is an important step for the recovery of the tourism sector in the Asia-Pacific region and around the world. In the short term, the resumption of travel from China will benefit Asian destinations - this is logically accounted for in the fund by the abundance of companies from the Middle Kingdom, Australia, Japan and Korea, collectively representing 32% of assets. Strong demand from the U.S., bolstered by a strong dollar, will continue to benefit travel destinations in the region and beyond. Europe, too, is forecast to see a large influx of tourists from the U.S., in part because of the weaker euro against the dollar.

The returns of ETFs are expected to increase as a result of longer stays, travelers being more willing to spend money at their destination, and higher travel expenses due to price. This is because these factors will lead to higher average travel spending. Europe, too, is projected to see a large influx of tourists from the U.S., in part because of the weaker euro against the dollar. ETF returns will benefit from higher average travel expenses due to longer stays, travelers' willingness to spend more at the destination, and higher travel expenses due to price inflation. Of the risks, the economic situation could cause travelers to become more cautious in 2023 by cutting back on spending, shortening trips and traveling closer to home if a recession begins. Nevertheless, we don’t expect possible recession but here it is necessary to follow the market conditions.

fund ETF geo (ETF data)

General Information

Launched February 12, 2020, ETFMG Travel Tech ETF (NYSEARCA:AWAY) follows the Prime Travel Technology Index NTR (provided by investment research firm Prime Indexes), which tracks a portfolio of 32 companies that are part of the global travel and tourism industry. These companies provide services for booking travel, lodging, transportation, finding and buying tickets, comparing prices for travel and travel recommendations in general;

- 97.54% of assets are invested in index securities, 2.46% in cash (no specific currencies specified, presumably dollars and yuan, since the U.S. and China account for 42% and 13% of assets, respectively);

- Asset value $136.1 m$ (-24% y/y);

- Commission - 0.75%;

- Rebalancing - quarterly (March, June, September, December);

- Fund return since launch: -30.59%.

The fund contains exposure to the consumer cyclical and technology sectors. The focus is on industries:

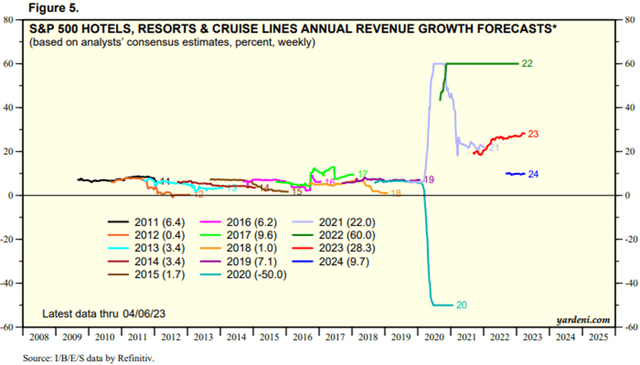

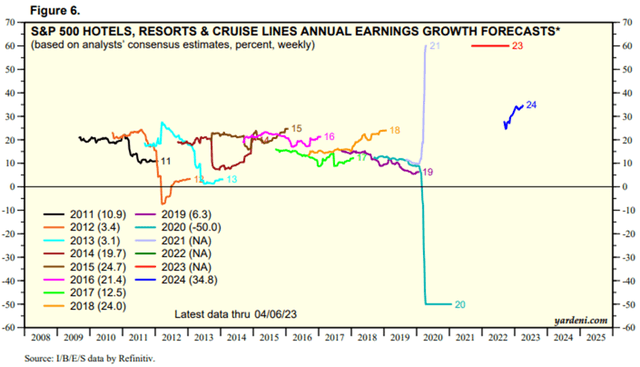

- Technology, application software (companies that provide search and purchase services for tickets, lodging, tours, and cab aggregators). Forecast for 2023 revenue growth is 10.2%, profit 18.8%. For 2024 the revenue growth is +10,2%, and the profit growth is +16,4%.onsumer cyclical, travel services. Forecast for 2023 28.3% revenue growth, not comparable to 2022 on profits due to last year's loss. For 2024, the revenue forecast will fall back to the 10-year average growth rate (+9.7%), meaning the travel market will return from post-pandemic consumer activity peaks to its normal pre-pandemic state.

revenue growth forecast (Refinitiv)

revenue growth forecast (Refinitiv)

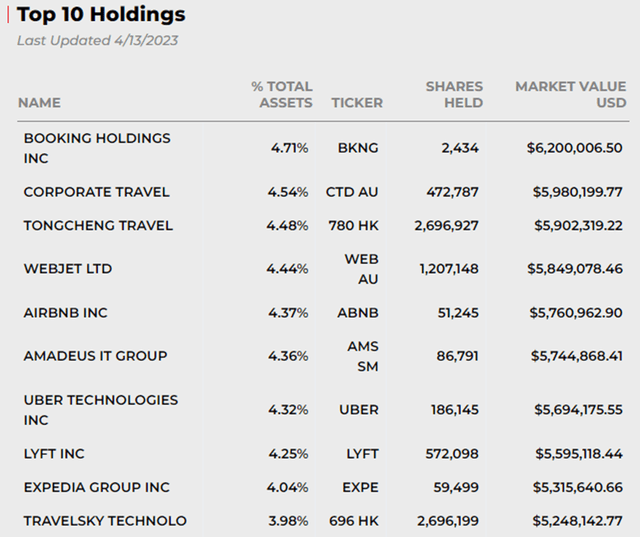

Top holdings

Definitely, to understand the dynamics of the fund, you need to know what companies it contains. Of the frankly weak companies, we can mention Lyft, but its share is small, and it has already fallen quite a lot, laying down negative expectations for this year.

- Booking Holdings (BKNG) is an online accommodation booking service. P/E FWD 2023: 20 (+41% to the industry average);

- Corporate Travel Management (CTD, traded on the Australian exchange) - corporate, work (to remote locations), team sports and leisure travel service. P/E FWD 2023: 17 (+22% vs. industry average);

- Tongcheng Travel (780, traded on the Hong Kong exchange) is the third largest online hotel and transportation booking platform in China. P/E FWD 2023: 24 (+70% vs. industry average);

- Webjet (WEB, traded on the Australian exchange) is Australia's leading online travel agency. P/E FWD 2023: 23 (+65% vs. industry average);

- Airbnb (ABNB) is an online accommodation booking service. P/E FWD 2023: 32 (+128% vs. industry average);

- Amadeus IT Group (AMS, traded on European exchanges) is a Spanish provider of digital distribution and commerce solutions for the travel, tourism, and airline industries. P/E FWD 2023: 26 (+84% vs. industry average);

- Uber Technologies (UBER), software for cab search, vehicle rental, food ordering and delivery, and other products; trucking intermediary. P/E FWD 2023: 32 (+94% vs. industry average);

- Lyft (LYFT) is a driver search service for passenger and freight transportation. P/E FWD 2023: 71 (+327% to the industry average);

- Expedia Group (EXPE) is an online travel agency. P/E FWD 2023: 10 (-31% vs. industry average);

- TravelSky Technology (696, traded on the Hong Kong exchange) - digital solutions for China's aviation and travel industry (accounting, clearing and settlement services, electronic transactions). P/E FWD 2023: 23 (+67% vs. industry average).

fund main holdings (fund data)

Market overview

The global travel technology market, estimated at $5.4 b$ in 2022, will reach a size of $10.7 b$ by 2030, (CAGR 8.8%). Growth in the airline and hotel IT solutions segment is expected to be even more intense, with a CAGR of 2022-2030 of 11%. The global online travel agency market will grow from $761.9 b$ in 2022 to $865.5 b$ in 2023 (+13.6% YoY). But the economic situation, should the recession begin, could cause tourists to become more cautious in 2023, cutting back on spending, shortening trips and traveling closer to home.

Risks and Valuation

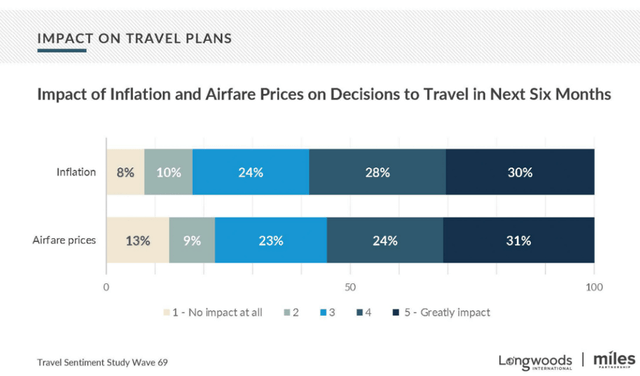

As it was previously mentioned, economic situation could worsen. «Half of U.S. travelers say concerns about their financial situation will influence their travel decisions over the next six months», according to a sentiment survey conducted in January by Longwoods International. Fifty-six percent of respondents cite the cost of airfare as a major factor. About 30% say economic problems will strongly affect their travel in 2023, up 7 p.p. from the end of August 2022. Thus, still high inflation, although pushing the prices of companies in the industry upward, is the main risk of a shift in consumer sentiment in the travel market. For now, cautious optimism reigns supreme in this industry.

Travel Sentiment Study Wave

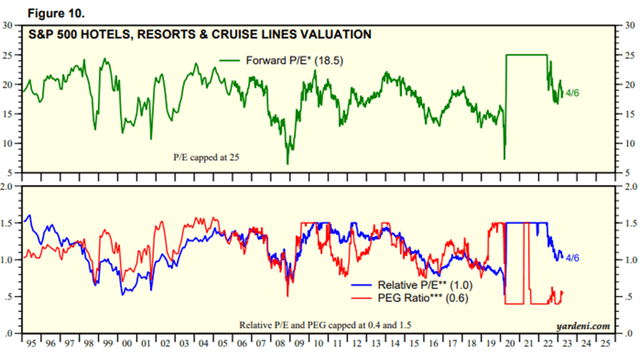

One of the weaknesses of the fund is the high asset valuation, which can be attributed in part to the ongoing recovery from the pandemic. The industry itself is valued just above the S&P 500 (FWD P/E 18.5 and 18.1, respectively). There is no question about the fund's asset mix, they represent different regions and allow betting on online services from around the world.

market valuation (Refinitiv)

Bottom line

Thus, World tourism continues its gradual recovery from the pandemic. At the time of writing, quotes are still well below early 2020 levels. Consequently, the dynamics of AWAY will be correlated with the tourism market conditions. As it was mentioned, there are no clear prerequisites for possible recession. But considering the risk profile of the individual investor, our advice is that in case the consumer sentiment worsens, we believe that AWAY quotes can roll back to $15 levels, where you should accelerate buying. And you can start buying at current level -17$. For us, these levels look attractive, given that the travel industry is still recovering. Once again, the main threats here are possible recession and valuation of the assets.

Liked the article? Bears of Wall Street is happy to announce that you can gain access to the growing library of similar articles with a bearish sentiment by subscribing to the #1 Seeking Alpha marketplace service for short ideas called Best Short Ideas. If you like to enter the world of short selling and learn more about unconventional stock market strategies, then give the service a try and opt for the FREE 14-day trial today! More details here.

This article was written by

Bears of Wall Street is a community of traders and financial analysts, who take a pragmatic approach to valuing companies. The majority of our articles have bearish sentiment and reflect our short stance on the market. Our investments include short sales of common stock. If you liked our writing style and our view on the market – don’t forget to subscribe. If you have questions – feel free to ask them via direct messaging or through the comment section.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.