The company’s EBITDA fell 16 percent Year on Year (YoY) to Rs 3,033 crore

UPL on May 8 reported a consolidated net profit of Rs 792 crore for the March quarter of FY23, a drop of 43 percent from Rs 1,379 crore in the same quarter of the previous year, on “weaker-than-expected performance”.

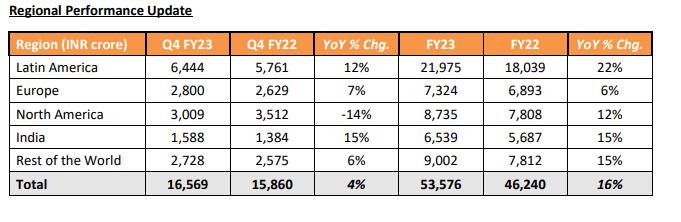

Revenue from operations came in at Rs 16,569 crore, growing 4 percent from Rs 15,860 crore in the year-ago period, the pesticide maker said in an exchange filing.

The company’s EBITDA fell 16 percent year on year (YoY) to Rs 3,033 crore and EBITDA margin slipped 338 basis points YoY to 18.3 percent during the quarter.

The March quarter was impacted by a rapid decline in product prices and delays in the planting season that resulted in headwinds for product placements, the company said in a statement.

“FY23 was a tale of two distinct periods, our performance in the first nine months delivered >20 percent growth in revenue and EBITDA. The fourth quarter was an unusual one with pricing pressure and delayed purchases by channel in the post-patent space due to oversupply of certain molecules,” said Mike Frank, CEO–UPL Global Crop Protection.

“Our focus in the last quarter was to grow share in key markets, liquidating most of our high-cost inventory, closely manage working capital and smartly set up our inventory position for the next year.”

Frank said UPL was well placed to deal with the challenging market conditions, which were likely to persist in the first half of FY24, but also to benefit once the market would begin to normalise.

During the financial year 2022023, the company generated strong cash flows and utilised it towards deleveraging the balance sheet and returning cash to shareholders. The gross debt was reduced by $617 million and net debt by$ 440 million (net Debt of $2.06 billion as of 31st March 2023), it said.

At 2.27 pm, the share was quoting at Rs 722.60 on the National Stock Exchange, up 1.08 percent from the previous close.