VWO: Emerging Markets Holding The 2022 Lows, Valuation Not As Cheap As You Think

Summary

- Emerging Markets have a low-teens P/E ratio, but the long-run multiple is also low.

- VWO holds more than a one-third weighting in China.

- I outline key price levels to watch on this popular index ETF, and there's the potential for a bullish reversal, but we are not there yet.

2d illustrations and photos

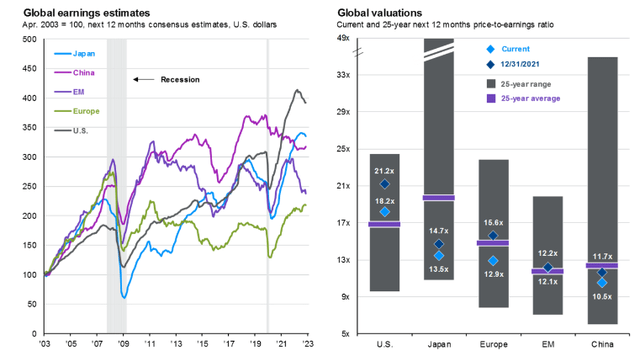

Emerging Markets are often touted for low valuations these days, but EM's 25-year average price-to-earnings ratio is about on par with current pricing. After more than a decade of trading at a depressed multiple compared to the US market, it's harder to make the case that a premium valuation is warranted.

Still, at just 12x earnings, it is cheap on an absolute basis. I have a hold rating on the Vanguard FTSE Emerging Markets Index Fund ETF (NYSEARCA:VWO) as the bulls and bears continue to battle it out.

EM: Cheap At First Blush, But Right On The 25-Year Average P/E

According to the issuer, VWO invests in stocks of companies located in emerging markets around the world, such as China, Brazil, Taiwan, and South Africa. Its goal is to closely track the return of the FTSE Emerging Markets All Cap China A Inclusion Index. VWO is a broad EM index fund and features a very low 0.08% annual expense ratio.

With inception in 2005, the fund is one of the largest foreign equity ETFs, with total assets of nearly $72 billion. The trailing 12-month dividend yield is about two times that of the S&P 500 at 3.7% though long-run performance is soft versus the SPX. Tradability is high with VWO as its 30-day median bid/ask spread is just two basis points and its 50-day average volume is close to 10 million shares.

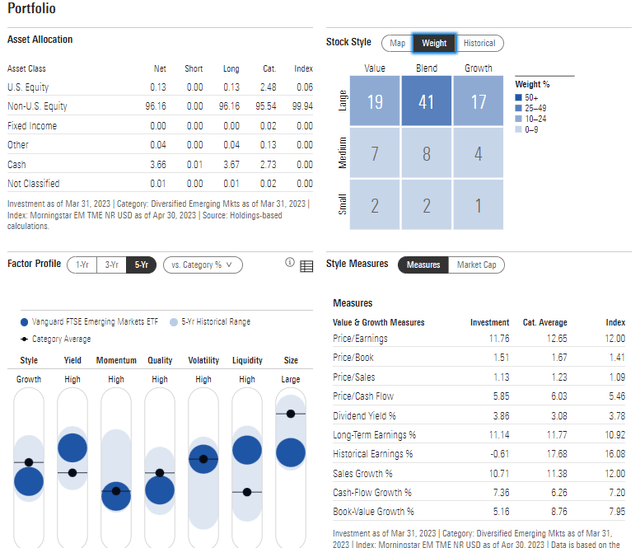

Digging into the portfolio, VWO is very much a large-cap fund with just a smattering of exposure to small and mid-sized companies. Morningstar's Style Box shows that there is about an even split between growth and value, with a focus on the center blend box. VWO holds 5,700 individual equities with a median market cap of $19.2 billion while its P/E ratio is under 12. Turnover is low with this index fund at just 7.4x, so it is fine to own in a taxable account - also consider that U.S. investors can capture the foreign tax credit on a non-US product like this.

VWO: Large-Cap Emerging Market Exposure, Low-Teens P/E

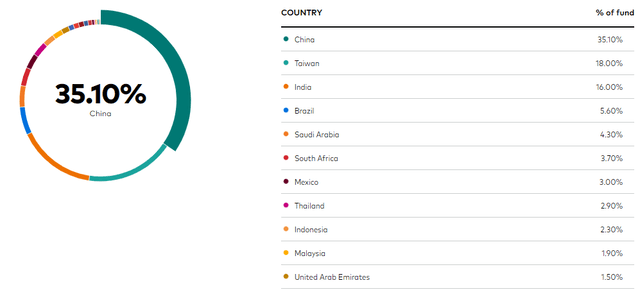

Some investors are uneasy with EM's high exposure to China. Indeed, the world's second-largest economy has the highest individual country weight in VWO at 35%. While there are products that back out China from its portfolio composition, I assert that the market appropriately values companies from China, even with political and regulatory risks seen there.

VWO: Country Exposure

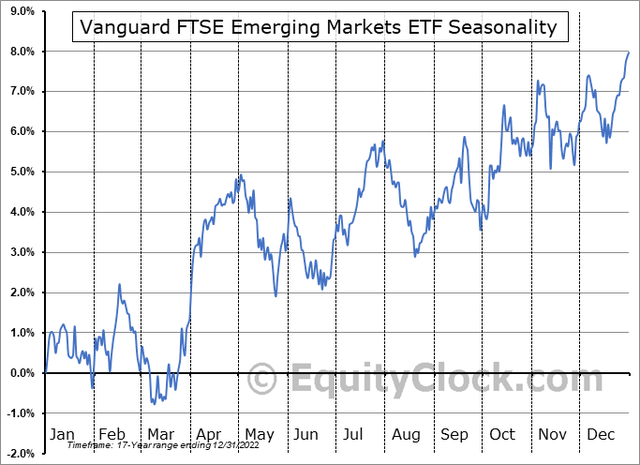

Seasonally, VWO tends to generally trade higher from late May through year-end, but the rate of change is not all that strong, according to data from Equity Clock. Moreover, compared to the S&P 500, emerging markets have tended to peak in mid-April, losing ground to large-cap US equities during much of Q2 through Q4. So, I am not overly impressed by calendar trends right now.

VWO: Bullish Seasonality, But Not So Relative To SPX

The Technical Take

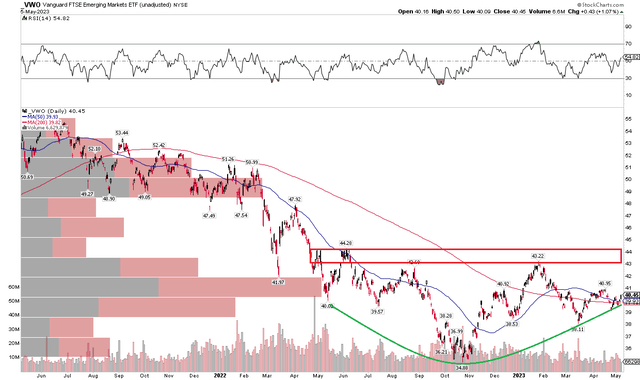

With a valuation that is near its 25-year average and soft seasonal trends right now, the chart is just as lackluster. Notice in the graph below that shares trade right on the long-term 200-day moving average as well as the shorter-term 50-day moving average. With high volume by price in the current trending range. I do notice, though, that shares may be putting in a bullish to bearish reversal pattern.

The so-called "rounded bottom" with resistance in the $43 to $44 zone would have an upside measured move price objective to the mid-$50s on a breakout. That remains to be seen, and there's near-term important support at $38 based on the lows from December and March. Overall, it's a hold technically.

VWO: Bullish Rounded Bottom In Play, But Waiting For A Breakout

The Bottom Line

I am a hold on VWO here. The valuation is simply near its long-term average (though cheap on a nominal basis) and price action is not yet indicative of an established uptrend, but it appears the downside action seen in 2021 and much of last year has stabilized. For long-term investors, I see VWO as an ideal, low-cost, liquid, and diversified way to get EM exposure.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VWO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.