Viatris: That Free Cash Flow Is Not As Attractive As It Sounds

Summary

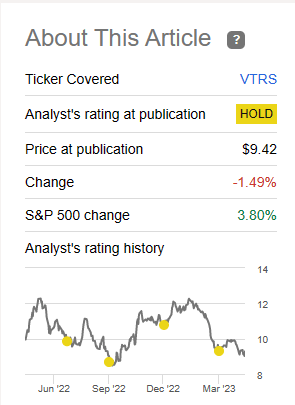

- Viatris has struggled to gain ground over the last year.

- This has happened despite management stressing the free cash flow generation ability of the business.

- Q1-2023 results showed just how much work management needs to do to make this a comeback story.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Daria Kulkova

We did not cut Viatris Inc. (NASDAQ:VTRS) a break the last time we covered the stock. Instead of recognizing the value, which bulls seem to find every day in this stock, we went in the other direction. Specifically, we said:

Our thinking is the same as before. At the low end of the range, you possibly can make some money as the market balances out probabilities of stabilizing revenues with the probabilities of a declining cash flow stream. That tactical trading aside, it is very difficult to call this a "value stock" based on fourth-grader math relying on P/E ratios. This is about as perfect a value trap as one can find.

Source: The Value And The Value Trap

The stock has gone side to side and has not made much progress since then.

Seeking Alpha

The results this morning, though, put a pep in the bull mood. We look at the numbers and tell you why the stock is a fade on a bounce.

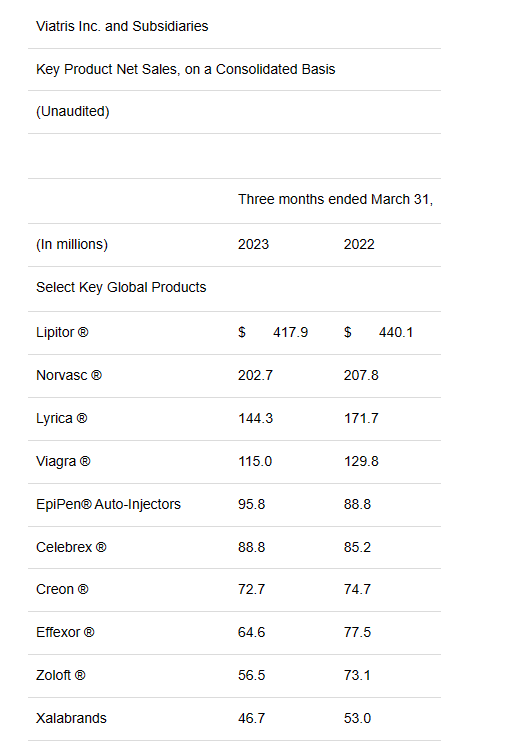

Sales, Sales, Sales

The headlines did sound a bit more optimistic than what was shown underneath.

Viatris Reports Strong Financial and Operational Results for First Quarter 2023 and Reaffirms Full-Year 2023 Guidance Ranges.

Source: VTRS Press Release

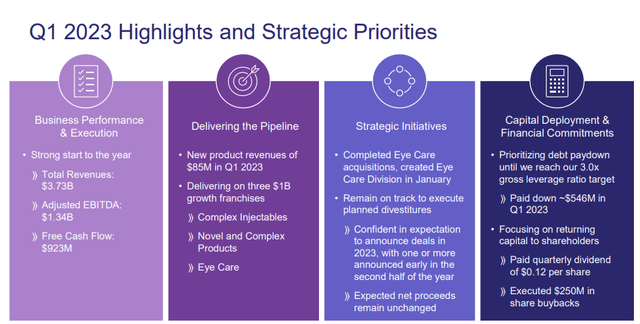

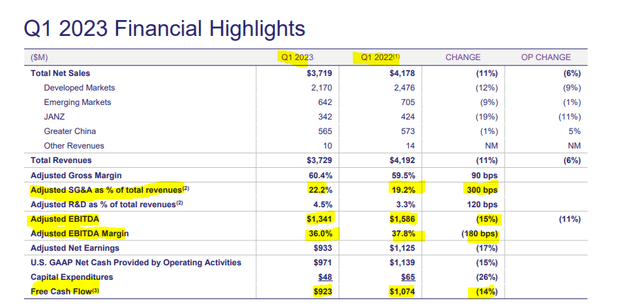

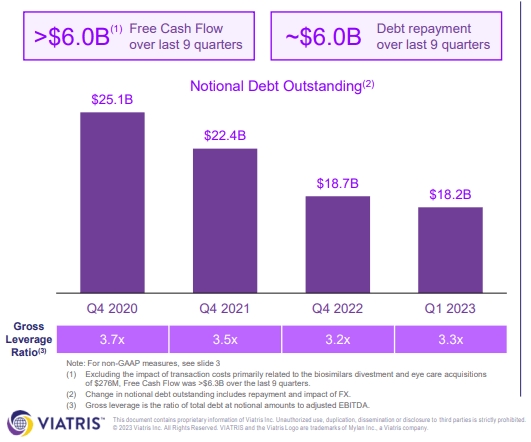

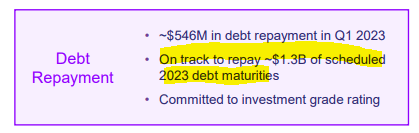

After all, VTRS did miss revenue estimates once more and came in $90 million short. But let's look at what has been presented objectively. The kickoff slide seems to be quite promising with a rather bountiful free cash flow and the paydown of half a billion of debt.

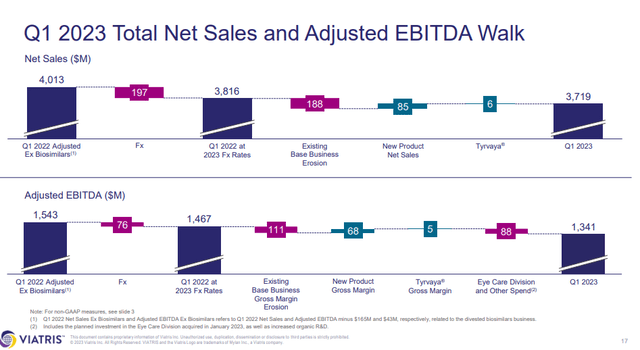

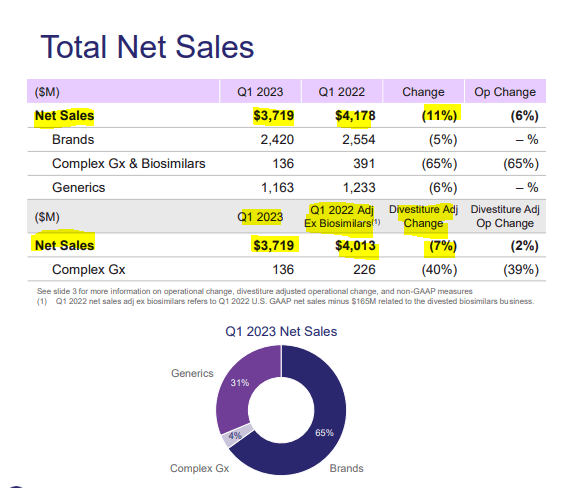

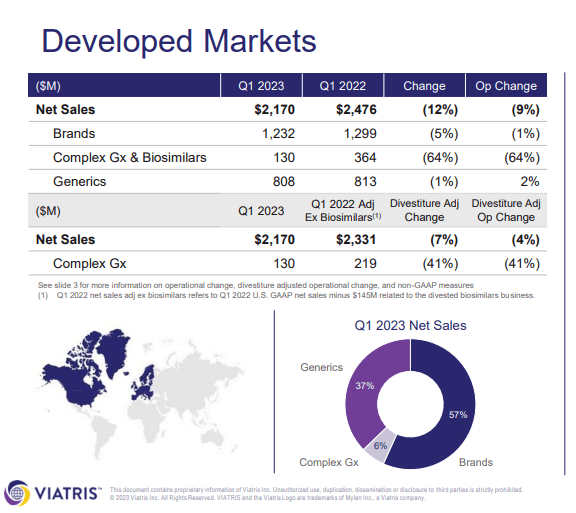

That impression held until you reached the next slide showing the sales numbers. A 11% drop in sales year-over-year is pretty serious for any business and this drop was 7%, even after excluding the impact of Biosimilar asset sale.

VTRS Q1-2023 Presentation

Developed markets, which formed the bulk of total sales, were down similar percentages.

VTRS Q1-2023 Presentation

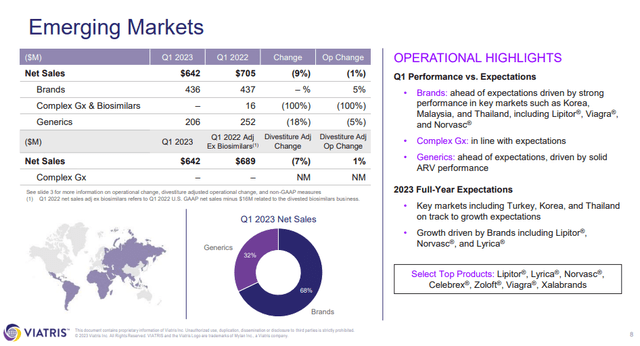

Emerging markets did a bit better.

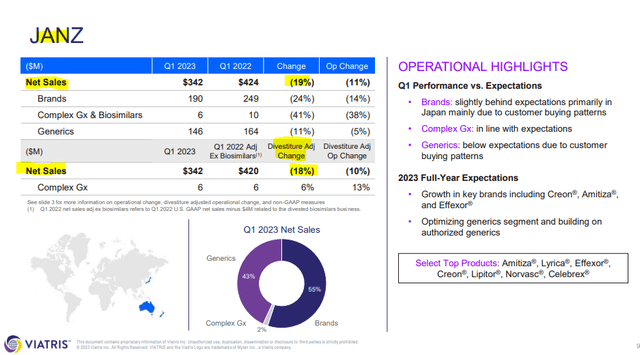

Japan, Australia & New Zealand, known as JANZ to VTRS, dropped the hardest. A 20% sales collapse is hard to swallow.

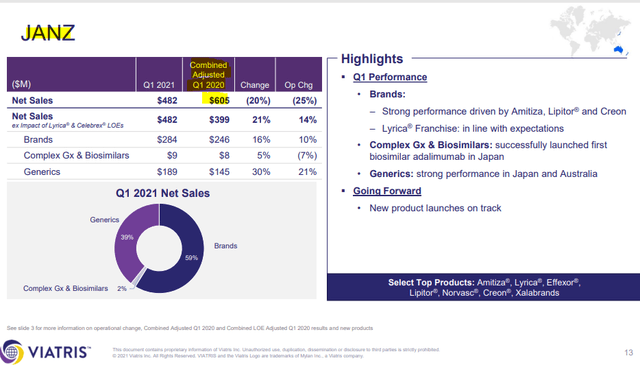

It becomes harder to digest when you recognize that this region produced $605 million before Mylan and Pfizer's generic unit merged.

So, you are down a total of 43% in sales within 3 years. That trend is not your friend.

How Much Did They Really Make?

With sales in free fall once again, it was up to the cost-cutting measures to hold up the EBITDA and the adjusted EBITDA numbers. We have highlighted the relevant numbers in the next slide. The first one we would point out here would be the 15% drop in adjusted EBITDA.

If that looks quite bad, it is because it actually is. It is difficult for your adjusted EBITDA to not drop far more than sales. You cannot reverse engineer profits when the top line is dropping so consistently. That said, the adjusted EBITDA margin drop was just 180 basis points. This is actually a little better than what we would expect. Even the increase in SG&A as a percentage of total revenues was less than expected, which is a good thing. So, some level of cost-cutting is working here, but it just buys the company a little extra time to turn around their biggest issue.

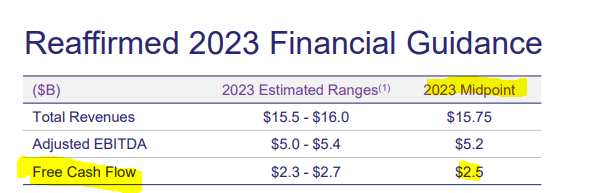

Moving on to free cash flow, we see that the company had close to $1 billion on that number. That is impressive and one that bulls tend to focus on in good quarters. But there are some nuances here which capture exactly what happened. The first nuance is that this measure is fairly lumpy and we should not get attached to any single quarter. Even VTRS is guiding for the whole year at $2.5 billion and not $3.7 billion ($923 million X 4).

VTRS Q1-2023 Presentation

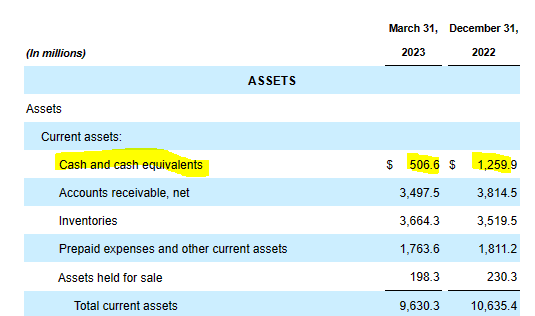

One reason for this is that even the capital expenditures are not uniform. VTRS expects to spend $450 million during the year and actually spent under $50 million in Q1-2023. The second nuance here is that even though VTRS is stressing the debt paydown in the quarter, we will note that cash and cash equivalents dropped more than the debt paydown.

VTRS 8-K

So, it was not a great quarter from our perspective.

Outlook & Verdict

If you want to buy into the VTRS story, you have to love these numbers.

VTRS Press Release

We struggle to understand the appeal, but if these numbers do it for you, you can assimilate the rest of the story. That story is that VTRS is struggling to replace falling off sales with new product sales and EBITDA is consistently dropping.

It is all there in the chart above and pretty much every quarter for the last 2 years looks very similar. The sub 3.0X leverage target on the debt has been elusive since the beginning.

VTRS Q1-2023 Presentation

The reason is that EBITDA has dropped just as fast as debt paydown. Looking at 2023, VTRS has guided for $5.2 billion in adjusted EBITDA. So, the leverage ratio is back to 3.5X. If VTRS pays down $1.1 billion more in debt during the year, the leverage ratio at the end of 2023 will be back at 3.3X. That is more or less their plan.

VTRS Q1-2023 Presentation

So, this morning's excitement aside, we would maintain our previous long-term view of the business. That view is that this is a melting ice cube. Those bullish should consider using covered calls or cash secured puts to sell volatility on this stock. We think those investors could make some longer-term returns. The buy and hold crowd will not.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.