Charles Schwab: Warren Buffett Has A Warning For Bank Investors

Summary

- Warren Buffett warned bank investors over the weekend that he doesn't "know where the shareholders of banks are heading."

- Schwab's balance sheet remains under pressure as clients search for higher yields.

- The company must demonstrate its ability to continue attracting and holding on to client assets as it navigates a subsequent earnings recovery.

- The recent banking crisis worsened last week as speculators bet on the next bank to collapse.

- Investors looking to add more exposure must pay close attention to the rapidly-changing dynamics.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

TrongNguyen/iStock Editorial via Getty Images

The Charles Schwab Corporation (NYSE:SCHW) has continued to engage its investors after its April earnings call, assuring them that "client outflows have decelerated for the third consecutive month."

CFO Peter Crawford presented an update on May 5 that outflows slowed to $1B in April 2023, down from $1.19B in March. It also included the impact of "seasonal tax payments," suggesting that Schwab could have performed better.

As such, the wide moat integrated finance company has strengthened the thesis of its April update, increasing its confidence that the outflow could abate this year, leading to a "resumption in the growth of client cash on the balance sheet."

However, the recent events in the regional banking sector over the past week suggest that holders must be prepared for more volatility, as it came under attack from short-sellers and speculators.

The crisis threatened to engulf PacWest Bancorp (PACW) and Western Alliance Bancorporation (WAL), as speculators assessed that both banks could be next to collapse.

However, the massive short-covering on Friday (May 5) saw PACW and WAL recover more than 80% and nearly 50%, respectively. As such, it's incredibly challenging for investors to time an entry in banking stocks right now, particularly the regional banks.

We also reminded members of our service that it might be more prudent to consider a regional banks ETF (IAT) (KRE) as a bet on the sector recovery than individual banks. We wouldn't know where the "cockroaches" are hiding until it's too late.

Schwab investors saw SCHW nearly crumbling to take out the lows it formed in March. We reassessed the buying sentiments last week and believe that SCHW's March lows continue to hold remarkably well, despite the collapse in the regional banks.

Accordingly, the KRE and IAT have fallen to lows last seen in 2020, as the fallout threatened to engulf the entire sector.

Therefore, the company's timely update on Friday could have soothed some lingering fears about Schwab's ability to hold on to its deposits, critical to underpinning a recovery in 2024.

As such, SCHW holders likely saw a dip-buying opportunity over the week, defending a critical support zone to prevent it from crashing toward its 2020 lows.

Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett sounded a word of caution for bank stock investors at the company's annual meeting yesterday (May 6).

The Oracle of Omaha stressed that he doesn't "know where the shareholders of banks are heading." While he suggested he's not worried about his personal deposits above the $250K insured limit with his "local bank," he cautioned that "in terms of owning banks, events will determine their future." He reminded bank investors that "every event starts creating a different dynamic."

Schwab's assurance of its operating model (including its decision not to de-bank) as CEO Walter Bettinger accentuated that "Schwab's franchise strength and financial model remain intact."

As such, Bettinger doesn't see a need to reconfigure its "multi-decade approach to conservatively managing its bank balance sheet." As such, while Schwab sees a short-term impact on earnings due to the current dynamics, it should not have a long-term material impact on its business model.

Moreover, Bettinger reminded investors, "Schwab's bank is unique as it serves as a bank for investors."

In an interesting column last week, Bloomberg's Matt Levine highlighted why "nobody trusts the banks now." He reminded readers that the current banking crisis had unveiled a critical flaw that relied on the intangible assets of "relationships" to help mitigate the asset-liability mismatch risks that banks face. Levine added:

Relationship businesses in general are on the decline. In a world of electronic communication and global supply chains and work-from-home and the gig economy, business relationships are less sticky. - Bloomberg

Therefore, we assessed Schwab must demonstrate that it can maintain its strong relationship with its customers. In addition, Morningstar reminded investors that Schwab's "low costs and large client base give it the flexibility to create products offering a value proposition."

Notably, Schwab assured investors its focus has not deviated even as rates surged, helping the bank to retain client assets even as they searched for higher yields.

Accordingly, Schwab "responded by introducing new products with higher yields to attract client cash." The company has also continued "exploring other options to help clients earn higher returns on their cash."

Notably, its ability to attract $132B in core net new assets in the past quarter is a testament to Schwab's customer-centric focus.

Therefore, management remains confident that "its model is working well and is attracting new clients to the firm." Despite that, investors must remain alert to the rapidly-changing dynamics in the current banking crisis, which could continue to hurt its deposit outflow, as it fell to $326B in FQ1.

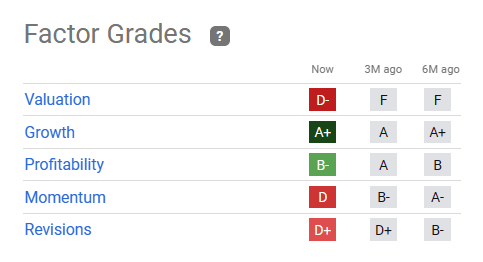

SCHW quant factor ratings (Seeking Alpha)

Seeking Alpha Quant suggests that SCHW's valuation grade of "D" is not attractive, even though it has improved from its "F" grade over the past six months.

Schwab's ability to improve Wall Street analysts' confidence about its earnings growth prospects will be critical toward a better revisions grade moving ahead.

Analysts have penciled in further net revenue decline through the quarter ending December 2023, reflecting a further hit to its net interest revenue, which accounted for more than 54% of its net revenue in FQ1.

As such, investors should expect Schwab's adjusted EPS to fall further through 2023 before a possible recovery in 2024.

We assessed that analysts' estimates seem to align with management's commentary about an earnings growth inflection in 2024. However, given the current dynamics, we believe it's too early to tell.

Hence, investors assessing a buying opportunity must have high conviction in Schwab's franchise and business model, allowing the firm to chart a subsequent earnings recovery.

Rating: Buy (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet. See: https://seekingalpha.com/who-to-follow

JR Research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service.

Ultimate Growth Investing specializes in a price action-based approach to uncovering the opportunities in growth and technology stocks, backed by actionable fundamental analysis.

We believe price action is a leading indicator.

Price action analysis is a powerful and versatile toolkit for the informed investor because it can be used to analyze any publicly traded security. As such, it offers investors with invaluable insights into understanding market behavior and sentiments.

Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis.

We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups.

Join us and start seeing experiencing the quality of our service today.

Lead writer JR's profile:

I was previously an Executive Director with a global financial services corporation. I led company-wide award-winning wealth management teams that were consistently ranked among the best in the company.

I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia's #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I'm also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I was the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major. I graduated as the Distinguished Honor Graduate from the Armor Officers' Advanced Course as I finished first in my cohort of Armor officers. I was also conferred the Best in Knowledge award.

My LinkedIn: www.linkedin.com/in/seekjo

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCHW, BRK.B, IAT, KRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.