Broadstone Net Lease: Bag This Generous 7% Yield Before It Recovers

Summary

- Broadstone Net Lease has a durable portfolio of quality property types that's well-diversified by geography.

- It's demonstrating solid portfolio fundamentals with a 99.4% leased rate.

- Investors get paid a handsome and growing 7% yield that's well-covered by AFFO.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

spxChrome

It’s not hard to get a high yield these days, but it’s important to focus on quality rather than quantity. That’s why it pays to be choosy, especially in the commercial real estate space, which has come under pressure as of late with headline risks around vacancies and interest rates.

This brings me to Broadstone Net Lease (NYSE:BNL), which I last covered here back in March, highlighting its strong operating metrics and balance sheet. It appears the market hasn’t yet agreed, as the stock has fallen by 2.5% since then, pushing its dividend yield up to 6.9%. In this article, I discuss BNL’s recent first-quarter results, and provide an updated valuation and recommendation.

Seeking Alpha

Why BNL?

Broadstone Net Lease is an internally managed net lease REIT that carries a diversified portfolio. At present, it owns 801 properties, 794 of which are spread across 44 U.S. states, and 7 properties across four Canadian provinces. BNL enjoys a long weighted average lease term of 10.8 years and 2% annual rent escalators.

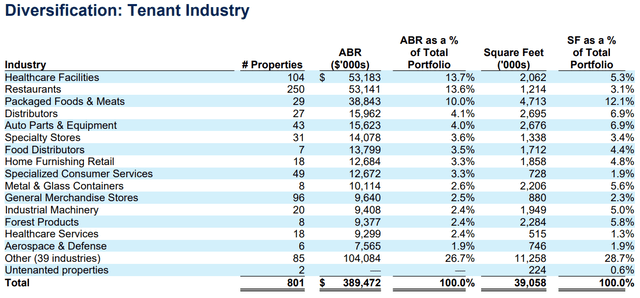

BNL’s portfolio is carefully constructed to participate in defensive and growing industries that are mission critical and/or e-commerce resistant. As shown below, healthcare, restaurants, food, distributors, and auto parts & equipment make up BNL’s top 5 sectors, comprising 45% of the company’s annual base rent.

Q1 Earnings Supplement

Meanwhile, BNL’s portfolio doesn’t appear to have vacancy issues, as it ended the first quarter with a 99.4% leased rate, with only two out of 801 properties being vacant and not subject to a lease at quarter end. All tenants also paid their full rents due during the quarter.

Headwinds to BNL include its higher cost of doing acquisitions in the current environment. That’s because at the current price of $16.33, BNL trades at a forward price to FFO ratio of just 10.8, implying a high 9.3% cost of equity. This makes raising equity at current prices unfavorable an un-accretive to shareholders. Management noted that although they sourced and evaluated billions of dollars in potential new acquisitions, they didn’t feel that cap rates had increased enough to justify investment.

Given the internal management structure, management compensation isn’t directly tied to the size of BNL’s asset size, and they recently stated on the conference call that they aren’t going to grow just for growth’s sake. Instead, BNL is finding opportunities to recycle capital.

This is reflected by the sale of 6 properties during the January through April timeframe for $52 million at a weighted average 5.4% cap rate, while was able to acquire 3 properties at a higher weighted average 7% cap rate during the same time. Management also has other avenues for growth including build-to-suit transactions, as highlighted during the recent earnings call:

We have also seen an increase in opportunities to partner with developers on build-to-suit transactions. Most notably a 200-plus million state-of-the-art, temperature-controlled food distribution facility. Opportunities like this, will make market dislocations exciting and are the reward for maintaining our discipline and selectivity throughout the year. This milestone transaction, will add the single largest asset to our portfolio and provide numerous long-term benefits for our shareholders, most importantly growth in BNL's future earnings profile.

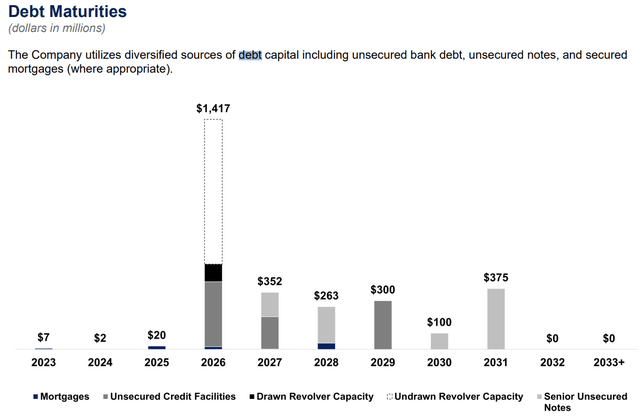

Turning to the balance sheet, BNL maintains a strong credit profile, with net debt to adjusted EBITDA of 5.1x and $892 million of availability under its revolving credit facility. As shown below, BNL has very limited debt maturities through the end of 2025.

Q1 Earnings Supplement

Notably, BNL has raised its dividend twice over the past 4 quarters. The current dividend rate is also well-covered by a 79% AFFO payout ratio, based on the midpoint of management’s AFFO per share guidance of $1.41.

Considering all the above, BNL appears to be trading well in value territory at the present price of $16.33 with a forward P/FFO of 10.8. Considering BNL’s strong balance sheet and operating fundamentals, I would expect for it to trade in the P/FFO range of 12x to 16x. Sell side analysts have a consensus Buy rating with an average price target of $20.40, implying potential for double-digit total returns over the next 12 to 18 months.

Investor Takeaway

At its current price, Broadstone Net Lease appears to offer an attractive combination of value and high income, with a high yield that's well covered by AFFO. It also has a strong balance sheet and attractive fundamentals, and while near term acquisitions may be limited, it may find opportunities through build-to-suit developments.

Meanwhile, with a 6.9% dividend yield and 2% annual rent escalators, BNL could provide meaningful long-term growth even if its valuation never recovers. As such, income investors could do well to consider BNL at current levels.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BNL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.