TPG: Market Underpricing FAUM Scale Growth And Margin Strength

Summary

- In the trailing six months, TPG (-16.95%) has trailed both the broad market (+9.63%) in addition to the private equity industry (+10.29%).

- This reflects a steep decline in the company's revenues - down 61.28% YoY - and net income, down 95.68% in the same period.

- TPG's dependence on capital in their AUM portfolio and a subsequent decline in corporate values and asset sale values have triggered earnings declines.

- However, I believe both the company itself and its equity portfolio are due for a reversion, with increased AUM growth and FRE expansion leading the company.

- Due to a combined undervaluation and sustained AUM strength, I rate TPG a 'buy'.

We Are

TPG (NASDAQ:TPG) is a global alternative asset management firm with over $135bn in assets under management and activities across a multitude of asset classes, with a focus on equities and real estate.

Owing to these practices, TPG has recorded TTM revenues of $1.98bn alongside a net income of $86.49mn.

Introduction

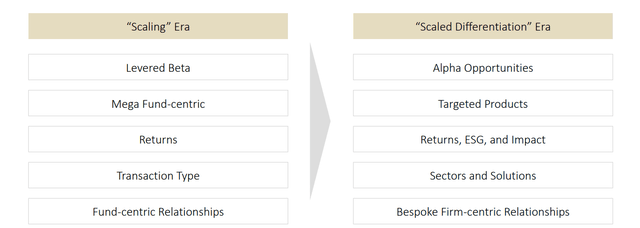

TPG's corporate strategy centres around the sixfold target of embracing 'scaled differentiation', searching for alpha opportunities, tailoring fund products for specialization, expanding organizational perspective to pursue ESG and impact products, creating sector-based solutions, and replacing fund-centric approaches with firm-centric relationships.

In conjunction with the general growth of the alternative asset industry, expected to be an 11% CAGR- 12% for real estate and private equity- TPG is positioning itself to capture maximal growth in an era of macro volatility.

Valuation & Financials

General Overview

In the trailing six months, TPG has faced significantly worse price action (-16.95%) than both the general market, represented by the SPY (+9.63%) and the private equity index, PSP (+10.29%).

TPG (Dark Blue) vs Industry & Market (TradingView)

This downturn emphasizes TPG's 61.28% revenue decline alongside a >95% decline in net income. These declines are products of general decreases in the NAV of equities in TPG's portfolio, leading to a material downtrend in asset sales and abilities to generate revenues.

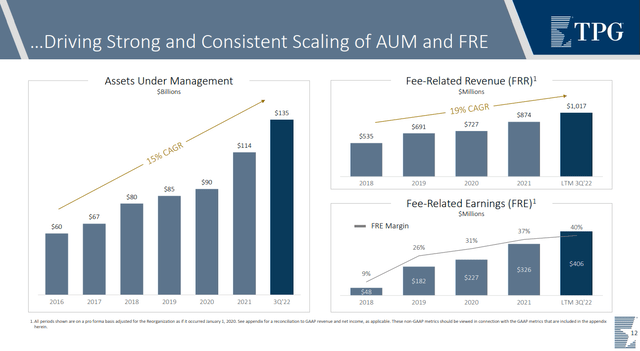

On the flip side, I believe that TPG's continued ability to support accelerated fee-related growth- with fee-related revenues increasing 30% over the trailing 12 months- demonstrates the firm's ability to resurge from macro headwinds and expand aspects of the business in spite of overall challenges.

Comparable Companies

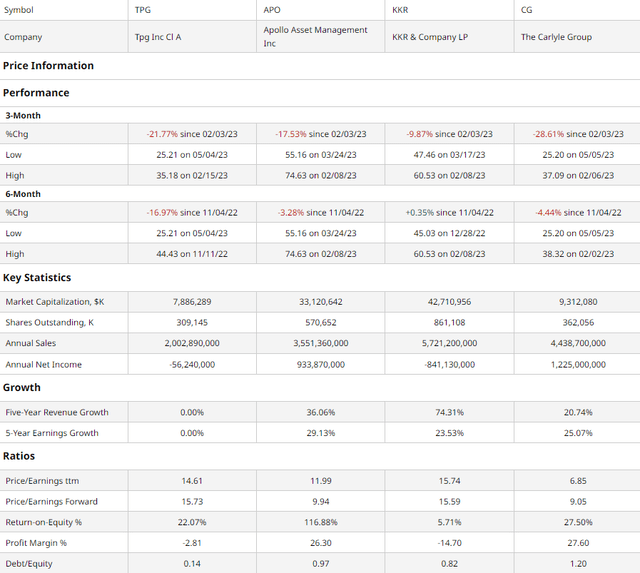

Although TPG has reduced its dependence on equity, as a firm whose FAUM portfolio is primarily centered around private capital, they are most comparable to private equity firms including, but not limited to; Apollo Global Management (APO) is a global private equity firm, owning Athene and Yahoo!; KKR (KKR) is the industry leader in LBO activity; and the Carlyle Group (CG) maintains a significant and growing footprint in private credit services.

As demonstrated above, though the private equity industry as a whole suffered from increased interest stress, TPG experienced the poorest price action of all, partially owing to the second-poorest net income figure and profit margin.

Despite this, TPG maintains a strong value, with a TTM P/E below 15 and an ROE approaching peer median levels. Alongside the lowest debt/equity ratio of the four, TPG's relative financial situation supports my thesis of undervaluation.

Combined with a unique alternative asset management operational strategy, TPG demonstrates outsized potential within the traditional private equity industry.

Valuation

According to my discounted cash flow analysis, TPG is undervalued by 34%, with its fair price being $40.45, up from $26.52 today.

My DCF covers 5 years without perpetual growth and assumes an 8% discount rate- a product of the firm's debt-light and cheaper overall cap structure. Moreover, I estimated net margins to be around 30%, predicting a semi-reversion to pre-2022 margins of 40-45%.

Additionally, revenue growth was driven by the overall growth of the RE and PE industries TPG operates within, a conservative rate of ~10% growth considering potential reversal to previous revenue figures and considering how much faster the company has scaled FAUM relative to industry growth averages.

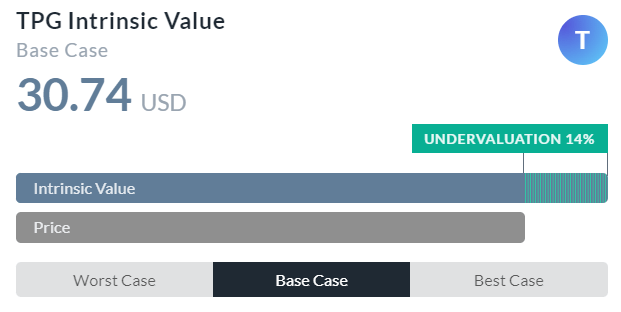

AlphaSpread

AlphaSpread's intrinsic value calculating tool, which averages out the website's in-house relative valuation tool, discounted cash flow and incorporates ROE, solvency, etc. corroborates my thesis of undervaluation.

Per AlphaSpread, the fair value of TPG is thus $30.74, with the company currently undervalued by 14%.

As such, averaging out my and AlphaSpread's fair price estimations, TPG's is worth $35.60, undervalued 24% today.

FRE Focus Enables Synergetic Fund Growth

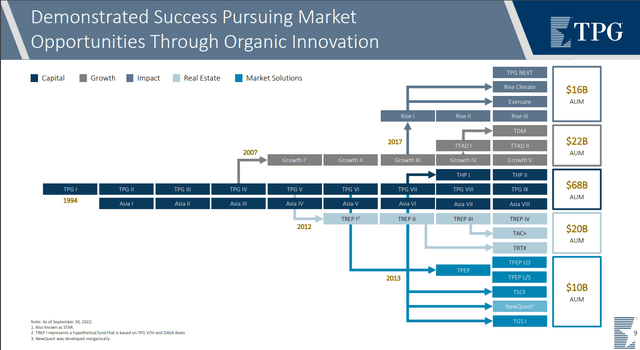

TPG stylized itself as an asset manager uniquely positioned to leverage opportunities across different landscapes; the firm's focus on alternative asset classes such as private equity and real estate offers it a structural advantage to provide superior risk-adjusted returns. Said focus on asset quality and diversification has led the company to supplement its core capital portfolio with Growth, Impact, Real Estate, and Market Solutions, each supporting the development of peripheral expertise and specializations.

Such diversification has enabled TPG to raise record levels of capital, with AUM growing at a 15% CAGR from 2016 onward, from $60bn to $135bn. Moreover, the firm puts a premium on FRE centricity, which, in spite of other cash flow issues, has fostered FRE-margin expansion, with FRE growing at a 19% CAGR since 2018. Further emphasizing TPG's inherent FRE focus and advantage is their targeted 45% FRE margin before the end of this year.

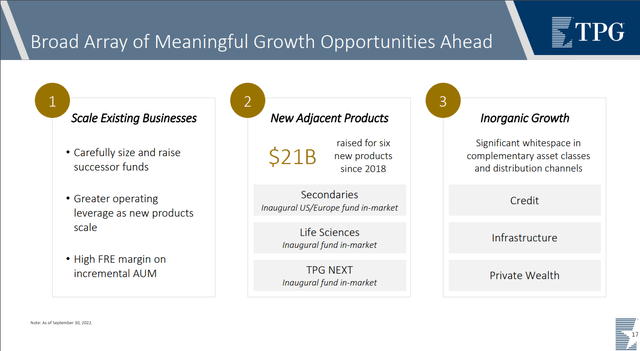

Going into the future, the company maintains large reserves of dry powder, representing 57% of FAUM and expects to deploy it in three primary arenas; first, to scale existing business verticals, raising successor funds and incremental increasing FAUM; second, for the development of new adjacent products, such as a Life Sciences inaugural fund and TPG NEXT for newer asset management ventures; third, inorganic growth, particularly in high growth alternative asset areas such as infrastructure and private credit. I believe this capital deployment strategy supports inherent value for the firm and a bullish signal.

Earnings Outlook

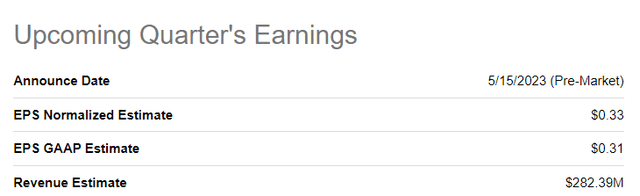

Due to the recent AUM growth of TPG, alongside positive earnings releases - in the context of macro headwinds- from peer private equity firms, I expect similar positivity from TPG.

Analysts project $0.31 EPS GAAP, relative to $0.08 in the previous quarter. Additionally, in the previous quarter, TPG presented a ~$50mn surprise, and I expect this to occur again this quarter.

Wall Street Consensus

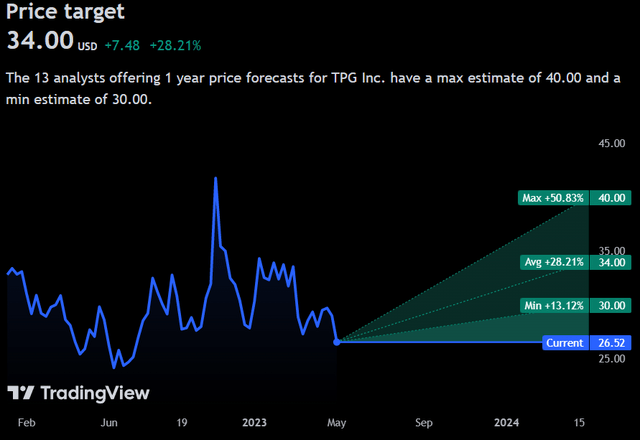

Analysts echo my positive view of the company, estimating an average price 1Y price increase to $34.00, up 28.21% from today.

Even at the minimum projected price, analysts project a minimum 1Y price movement to $30.00, up 13.12% from today. This is reflective of a shared sentiment that TPG's slowed asset sales are of temporary nature, while the firm's FAUM scaling is stickier.

Risks & Challenges

Dependency on Raised Investment

To continuously diversify the business and fundamentally execute TPG's business strategy, the firm requires continued investment and the ability to raise new funds. A failure to adequately do so may threaten the business's ability to adapt and generate future cash flows.

Decline in Asset Sales

As has happened in the trailing year, declining asset sales can put materially downward pressure on the firm's ability to generate free cash flow and can harm both profitability and scale. Although the firm looks poised to bounce back, the risk from interest rates or other recessionary pressures can once again cause asset sales to plummet.

Limitations on Fee Growth

As rates hamper the ability to raise funds and competitive intensity for financing increases, investors may be in a position to demand more competitive fees and expensing. For TPG, which increasingly looks to depend on FRE, this can put continuous downward pressure on profitability while harming operational strategy and throughput.

Conclusion

In the short term, I expect TPG stock to revert to the mean industry value and experience consequent price appreciation.

In the long term, the firm FAUM's diversification strategy and successful historic execution on this front lead be to believe in a brighter future for the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.