Nutrien: Undervalued And Oversold Going Into Earnings (Rating Upgrade)

Summary

- Nutrien's stock has been struggling, falling to new lows as investors are pricing in weaker global economic growth.

- However, potash fundamentals remain strong, providing the company with strong earnings power on a prolonged basis.

- I believe that NTR will beat earnings and reinforce the longer-term bull case outlined in this article.

ithinksky

Introduction

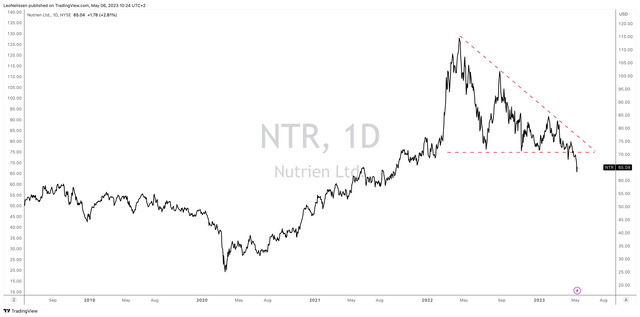

I believe I haven't included technical analysis in any of my articles in a very long time. However, in this article, I start by showing you the chart of NYSE-listed Nutrien Ltd (NYSE:NTR) shares. After peaking in early 2022, shares of this Canadian potash giant have broken down in the past two weeks.

Was I wrong? Is buying at these levels just throwing good money after bad money? Or are we dealing with a great opportunity?

As we head into the company's 1Q23 earnings release, I am using this article to re-assess the situation, which is way more bullish than one might expect, given the poor stock price performance.

While global supply is an always-present risk, fertilizer fundamentals remain stellar. When adding that NTR shares are selling off because of declining global economic sentiment, we get a situation where the longer-term risk/reward has become even more attractive.

I believe the risk/reward has become so good that I added NTR to my own portfolio despite being overweight energy and agriculture already.

Now, let me give you the details!

The Fertilizer Bull Case Remains Rock Solid

Most of my regular readers know that we started to discuss agriculture rather frequently since the end of 2020 lockdowns. The pandemic was the start of a massive bull case caused by accelerating post-pandemic demand, including strong energy demand, which fueled inflation and related agriculture input costs. Bear in mind that energy and agriculture are highly correlated, but more on that later. These issues were later amplified by the war in Ukraine and ongoing supply challenges in the energy sector.

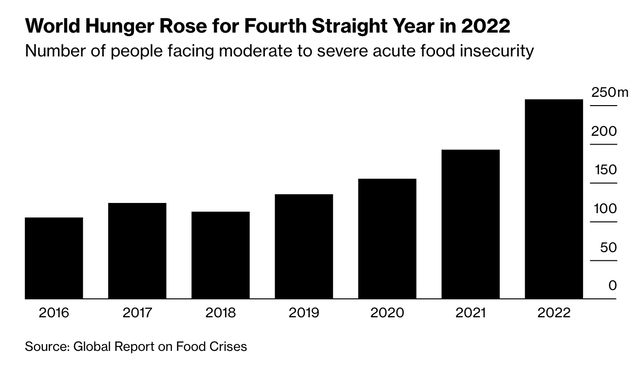

In light of these developments, one of the things I was afraid of in 2020 has become a reality. Fertilizer and energy shortages have caused world hunger to rise - significantly. In 2022, roughly 250 million people faced moderate to severe food insecurity.

While the war in Ukraine is playing a major role, there are other factors at play here.

As I wrote in a recent article, fertilizer producer Mosaic (MOS) has warned that supplies of staple crops may remain tight due to the El Nino weather phenomenon, which threatens output in key regions later this year.

Moreover, as reported by Bloomberg, China is particularly concerned about ensuring enough food, with President Xi Jinping seeing the country's reliance on food imports as a national security issue. The government is urging farmers to increase soybean harvests through a combination of subsidies, government stockpiling, and public pressure.

These comments are important because they are a big part of the bull case.

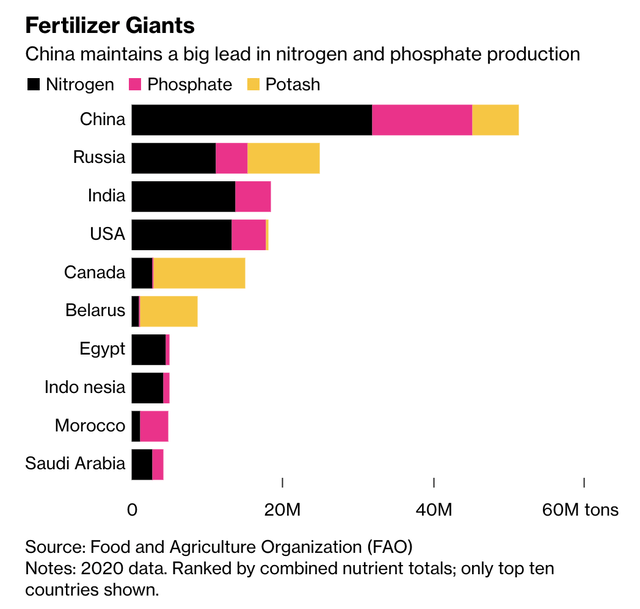

After all, note how important China is in the global fertilizer industry. No country produces more nitrogen and phosphates. Only Russia, Canada, and Belarus produce more potash. Two of these countries are allies of China, which explains why nations have started to use fertilizer as a geopolitical weapon in recent years.

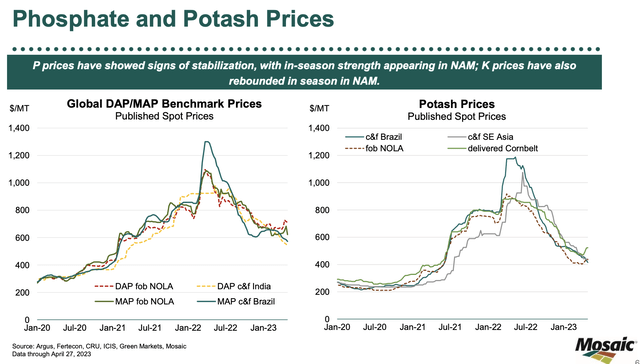

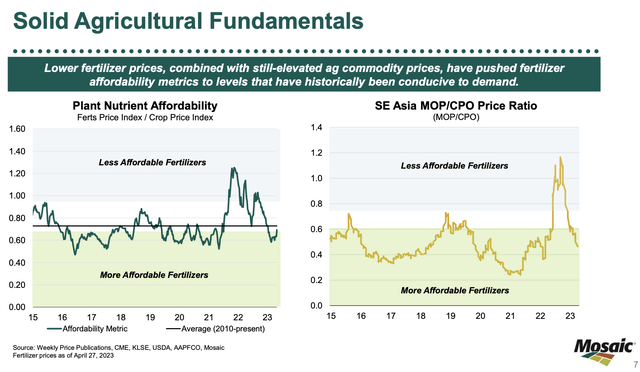

Hence, while fertilizer prices have come down since the invasion of Ukraine (when a lot of misery was priced in), we're still dealing with elevated prices. The chart below was provided by Mosaic after its most recent earnings release.

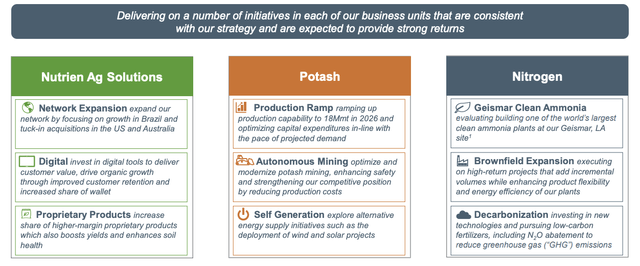

These developments have caused (expected) potash supply to increase. Nutrien is planning to increase its operating production capacity in Saskatchewan to 18 million tonnes per year by 2026.

Initially, Nutrien had planned to reach this target in 2025. However, in a recent conference, the company explained that this ramp-up requires a significant amount of capital, about $150 to $200 per ton, to be invested in new mining machines, conveyor belts, and hiring people. However, Nutrien can adjust its investments and output, allowing for flexibility in pace and timing based on market demand and customer needs.

Despite the delay, Nutrien is on track to produce 13.8 to 14.6 million tons of production this year and maintain the ability to sell 15 million tons. The company's goal of 18 million tons by 2026 remains but will be adjusted based on market conditions.

For now, fertilizer demand remains high, as farmers aren't just seeing higher affordability (as confirmed by the chart below) but also a high need to increase fertilizer application.

For example, global arable land is increasingly scarce.

The global population is increasing at a rapid rate. According to the United Nations, the global population is likely to reach 9 billion by 2050, a 49% rise in population from the present value. With the increasing population, the demand for food is projected to become double, in the years to come. Supplying food to this growing population has become a threat. On the other hand, due to industrialization and urbanization, the arable land in the major agricultural countries is declining.

Our World In Data

With that said, let's discuss potash supply and demand.

Potash Remains In A Good Spot

As reported by the Wall Street Journal, potash demand is more volatile than nitrogen and phosphate-based fertilizers because farmers can reduce its usage without immediately impacting their crops. However, potash has no substitutes and needs to be replenished in crop soil.

Mining companies believe it will serve an essential role in a more resource-constrained, climate-aware world. It is more environmentally friendly than nitrogen-based fertilizers as it does not release nitrous oxide and helps with water retention. Potash is essential for growing biofuels, which are produced from plants, so the use of all fertilizers will rise as the demand for biofuels increases.

On a side note, it cannot replace other fertilizers, as it has its own unique characteristics. It's part of the N-P-K fertilizer mix.

Elitech Drip

With that in mind, BMO Capital Markets expects potash demand to grow to 76.7 million tons by 2026, a 5% increase compared to 2021 levels.

At the same time, potash production capacity is expected to grow by 18% to 95.1 million tons.

Hence, the profitability of potash for miners such as Nutrien, Mosaic, and BHP (BHP) depends in part on the supply that can ultimately come from Belarus and Russia. Export restrictions from Belarus mean it is increasingly finding ways to get potash to the market through Russian ports or using railroads to China.

While this would be bearish for prices, over the longer term, production growth from Russia and Belarus is likely limited due to restrictions on accessing Western equipment. We're also seeing an increasingly divided world between China's allies and Western nations.

However, since the two major Canadian producers, Nutrien and Mosaic, account for about 30% of global potash production, they can reduce production when prices get too low. I'm bringing this up because this also influences Nutrien's expansion plans. I am sure the company's 1Q23 earnings call will give up more details, but there is no way the company will boost potash output to 18 million tons if Russia and Belarus were to re-enter Western markets.

Hence, potash isn't just a generic commodity but a commodity with a good outlook. According to the same Wall Street Journal article, BHP sees potash as one of its future-facing commodities, alongside copper and nickel. BHP's projections indicate that if the world adheres to the Paris Agreement goals and restricts global warming to 1.5 degrees Celsius above preindustrial levels, the demand for potash will double in the next three decades compared to the last three.

Needless to say, I do not believe that the world can achieve these targets. However, trying to achieve these targets is what drives potash demand.

In other words, the potash bull case remains strong, as global geopolitical developments keep supply constraints, which higher affordability and pressure to increase crop output support demand. This excludes secular demand growth tied to net-zero initiatives.

The biggest risk to this bull case is a return of East-European supply to the market. In that situation, Nutrien and its partners would have to refrain from boosting output, as it would flood the market with too much supply.

Why I Like NTR Ahead Of Earnings

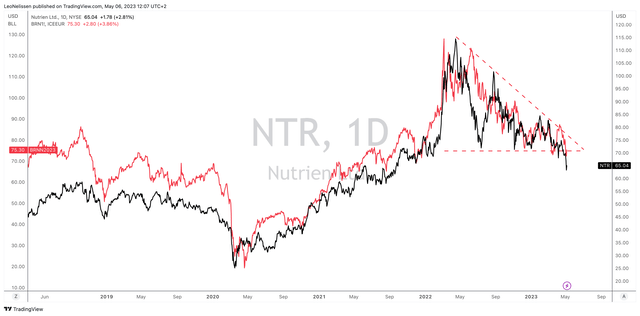

As mentioned at the start of this article, NTR's stock isn't in a great place right now. It has fallen 40% from its 52-week high. This year, the stock is down 11%.

Given what we just discussed, I do not believe the bull case is in danger. However, NTR is down, which means something is going on.

I believe that there is evidence that NTR - like its peer MOS - is being punished by a general decline in economic growth expectations and commodities.

The chart below compares NTR to the price of Brent oil (the red line). The correlation is almost perfect, although Nutrien does not produce a drop of oil.

What we're dealing with here is that markets price in slower economic growth. Leading indicators like the ISM Manufacturing Index point to contraction, which the Fed is eager to maintain hawkish until it has defeated very sticky inflation.

While I am (long-term) bullish on oil, investors have sold it to price in slower global demand.

Agriculture is highly related to energy. Energy prices determine agriculture input prices and demand for ethanol, which is a driver of corn demand. On top of that, there are other related areas like soybean oil, renewables, and more.

At this point, however, I think the risk/reward is good.

On May 10, NTR will report its earnings after the market close.

According to Nasdaq data, the company is expected to report earnings per share of $1.54. That would be down from $2.70 in 1Q22.

This number is based on nine estimates. The company has received four EPS downgrades in the past four weeks, which is good news, as it lowers the risk of missing consensus estimates. However, it doesn't guarantee an earnings beat.

Even if the company were to miss estimates, which I don't expect to happen, the company's comments are more important.

- I expect the company to mention positive potash developments, including prolonged supply tightness and rebounding demand in North America and Australia, with outperforming demand in emerging markets.

- I expect the company to make the case that we're at least two successful crop cycles away from grain inventory normalization.

- I expect NTR to comment on its 2026 progress, highlighting that it will reduce output if potash supply growth turns out to be higher than expected. This includes an updated 2023 CapEx plan, which could come with changes in growth/maintenance CapEx and buybacks.

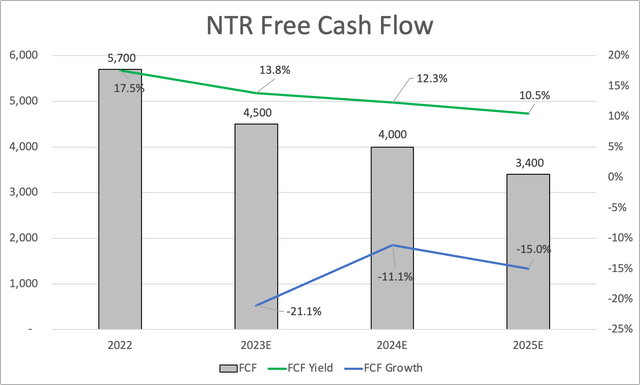

When putting demand expectations and CapEx plans together, we'll likely get an update on free cash flow from analysts. So far, the company is expected to maintain a double-digit free cash flow yield until at least 2025, despite an expected gradual decline in free cash flow. This is based on analysts expecting potash prices to normalize.

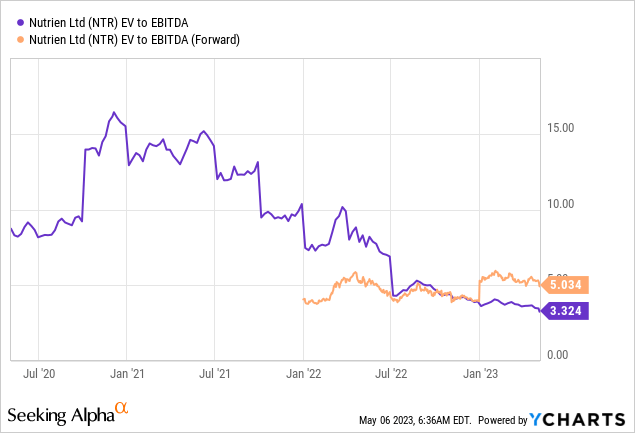

Based on everything written in this article, I believe that NTR remains extremely undervalued.

The company is trading at 5x 2023E EBITDA. I would make the case that anything below 6x EBITDA is a good deal.

As I said in my prior article, I believe that the stock should trade at least at its consensus price target. The current target is $93, implying a 40-45% upside. The most recent price target upgrade came from Scotiabank (Sector Outperform, PT $90).

However, this is not a suggestion to go overweight NTR ahead of earnings. While I believe in an earnings beat and a rally after earnings, I only wrote this article to explain the longer-term risk/reward.

Takeaway

Nutrien is scheduled to release its earnings this week. The company's stock price has been under pressure as a result of bad investor sentiment and rising recession risks. However, its industry remains in a good spot. The potash bull case remains strong as supply constraints meet rebounding cyclical demand and accelerating secular demand.

While I'm not a short-term trader, I believe that NTR will beat its earnings and bounce back if it gets support from energy commodities.

On a longer-term basis, I believe that NTR shares are between 40% to 50% undervalued.

Hence, I added NTR to my portfolio, as I like the risk/reward. I wasn't planning on adding NTR, given my existing cyclical commodity exposure. However, I think I can sell NTR at a decent profit in the months ahead, allowing me to deploy more capital in other areas.

In conclusion, while Nutrien's stock price may be experiencing a temporary dip due to market sentiment and recession risks, the company's industry fundamentals suggest a positive outlook in the long run.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NTR, MOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.