Kilroy Realty: Young Portfolio Will Be Resilient To Work From Home

Summary

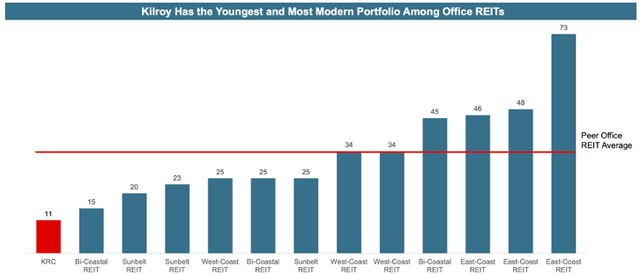

- Kilroy has the youngest portfolio of all major office REITs with buildings just 11 years old on average.

- This gives it a major advantage in attracting tenants.

- I present my bullish thesis for the company.

Bet_Noire

Earlier this week I published an article on Boston Properties (BXP) highlighting the fact that office REIT that have new A-class buildings positioned in central city locations could actually benefit from the current work from home trend as they gain market share from some of the older office buildings. Boston Properties is indeed well positioned, but there is one REIT in particular which I like even more – Kilroy Realty Corporation (NYSE:KRC). Why is that? Well, because it has the youngest portfolio of all major office REIT in the US. I cannot emphasize enough how important this is, especially when comparing REIT based on the FFO which excludes maintenance CAPEX. Young buildings are unlikely to need significant levels of investment, which really helps on the cost side. Moreover and perhaps more importantly, they are more likely to attract tenants which in turn will drive higher revenues. So with that let’s dive deeper into KRC stock.

The REIT owns and operates throughout the West coast with operations in Los Angeles, San Diego, San Francisco, and Seattle. A pure West coast exposure has scared away a fair amount of investors but as I argued in my article on BXP, I don’t see the market as all doom and gloom. Actually quite the opposite, as I believe that at current valuation levels, there are better opportunities in legacy markets compared to the hyped up Sunbelt region. So location wise it’s clear. Now back to the age of their portfolio which is where Kilroy shines. Their buildings are only 11 years old on average while the average stands at 34 years. That’s quite a difference and even compared to their nearest competitors (Boston Properties and Highwoods) the difference is meaningful.

KRC Presentation

Because of this, the company has been able to retain a high occupancy of 93%, which is significantly better than peers in the area. What’s even more important is that lease expirations over the next two years are very low – only about 8% per year. This means that the leasing department won’t be under too much pressure to find new tenants. Similarly to peers Kilroy is also pushing to increase their Life Sciences exposure. This has been a theme for a while as labs cannot be moved home as easily as a laptop and therefore are more resistant to the work from home trend. Management has announced their plan to increase the proportion of Life Sciences to 30% over the next 5 years.

So overall thing is looking fine for Kilroy. But management remains conservative in their guidance. They forecast a drop in occupancy for the year to around 87%. That’s not very reassuring and as a result their FFO estimates are flat for the year at $4.50 per share. What’s positive is that that’s still a 2x coverage for their $2.12 dividend which already yields over 7%. And while I never invest in stocks for the dividend alone, it’s definitely something to like.

Finally before looking at valuation, I always like to look at the balance sheet, especially now that interest rates are high and we have a banking crisis on our hands. On this front, KRC is solid. They have a BBB rating (compared to BBB+ for BXP) and the vast majority of their debt is fixed rate (95%). They will also have the flexibility necessary to get through these difficult times as they have no debt maturities until December 2024. So really there’s a lot to like here. The question is whether it’s a buy right now.

To answer that we turn to valuation. The stock currently trades at just 6x forward 2023 FFO. That’s low by any comparison but notably is below BXP’s multiple of 7.4x. Looking at fast graphs I see that historically the stock has traded at much higher multiples, I don’t think a return to this average is realistic under the current conditions, but there is definitely some upside here. Looking at implied cap rates paints the same picture. Looking at their NOI I calculate an implied cap rate of almost 11%! That’s crazy high for an 11 year old portfolio and way above BXP’s implied cap rate. Again I don’t want to sound too optimistic, I don’t expect a quick recovery here, but at these prices it’s time to start thinking about slowly building positions in the best of breed which KRC certainly is. That’s why I issue my first buy rating for KRC here at $27 per share.

This is a long-term turnaround play for me so I don’t have a strict price target, but to give you an idea of what sort of upside we’re talking about here in addition to the already solid dividend yield, here’s my thinking. Applying a 300 bps spread over 10-year treasury yields, I get a realistic risk adjusted cap rate for the portfolio of say 7-7.5% so that corresponds to a conservative upside of around 33% (or a PT of $36 per share). I say conservative because it doesn’t assume a drop in rates which would mean further upside and it assumes zero FFO growth for the next three years. As always, I encourage you to make up your own mind, but personally I will start building a position in the youngest office portfolio.

Fast graphs

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.