EWC: I Still Like Canada Going Forward

Summary

- I have been a bull on Canada for a while, and holding EWC has generally served its purpose. It has produced gains and provided diversification.

- The buy case remains intact in the second half of the year in my view. The Bank of Canada has stopped hiking rates, and this fund is made up of larger-size banks.

- Domestically, I see volatility ahead. Even if the Fed is going to hit "pause", history shows us that gains post-pause are mixed. This reiterates diversification as a key tool.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

ronniechua

Main Thesis & Background

The purpose of this article is to evaluate the iShares MSCI Canada ETF (NYSEARCA:EWC) as an investment option at its current market price. This is a fund that is exclusively focused on Canadian equities, with a bias towards large and medium-sized companies.

I have owned and recommended EWC for the long term and continued to suggest this investment late last year. Since then, performance has been modest. But I will take small wins in this environment:

Fund Performance (Seeking Alpha)

As we near the mid-year mark, I always like to reassess my holdings to see if I should make any adjustments. With respect to EWC, I continue to see multiple reasons for owning it to balance out my US-heavy portfolio. This means a "buy" case can still be made and I will explain why in detail below.

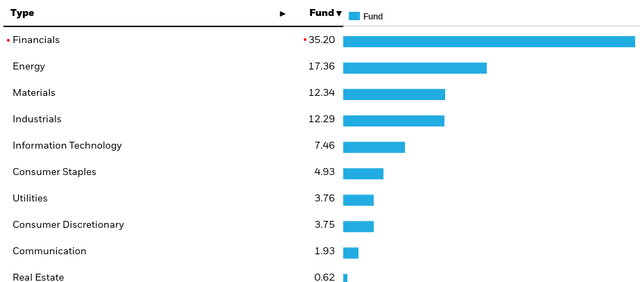

Financials Exposure Not A Major Headwind

The first attribute to look at (in my opinion) when considering EWC is the fund's sector exposure. While this is always a key consideration, it is especially critical now given the allocation to Financials. With bank failures, takeovers, and other stress indicators rattling the sector domestically, it may not seem prudent to go long on a fund that is heavily exposed to this space:

Sector Weightings (EWC) (iShares)

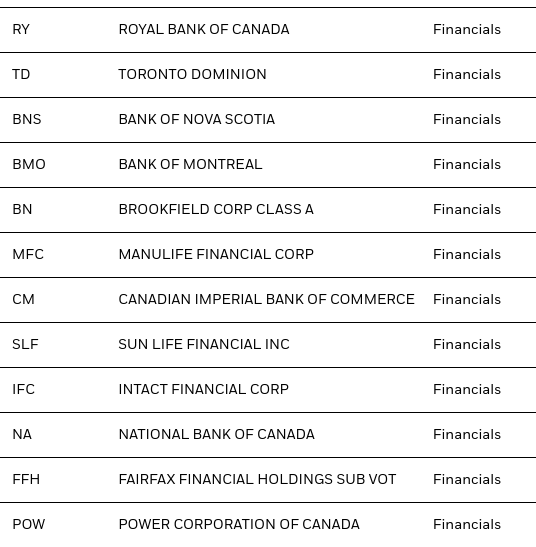

However, not all "banks" are created equal. EWC is made up of the major heavyweights in the Canadian banking sector, as well as some investment management (i.e. Brookfield Corporation (BN) and insurance companies (i.e. Manulife Financial Corp (MFC) and Sun Life Financial (SLF). While these are still part of the "Financials" sector and will be impacted if there is broader sector stress, these are a far cry from the regional US banks that are making all the headline noise today:

Top Financial Holdings (EWC) (iShares)

This is essential to why I don't have a problem owning - and adding to - this fund. Yes, "Financials" are under pressure right now, but the actual weakness in the sector is mostly limited to smaller, regional banks in the US. These are not what makeup EWC's holdings list. Further, the larger banks in the US are actually benefiting from customers bringing their assets and business to those institutions. This is something that should be a longer-term catalyst for gains. I see it hindering these stocks, such as Bank of America (BAC), JPMorgan (JPM), and Wells Fargo (WFC), among others, for the time being, because "banks" as a whole are being punished for what is going on in the sector. But over time, we will see the biggest banks get bigger and more profitable as they capture an ever-increasing share of the pie.

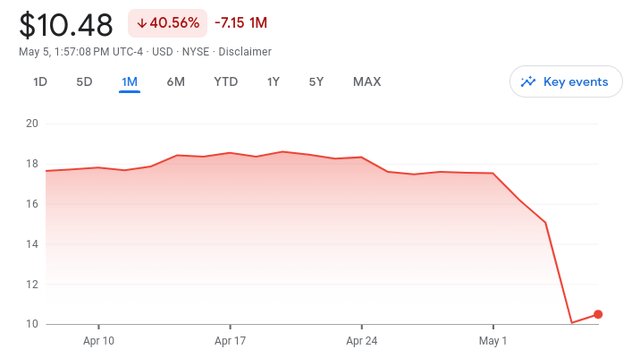

Beyond that point, I like how Canadian banks such as The Toronto-Dominion Bank (TD) is backing off building on its US exposure. This Canadian bank already has a stake in The Charles Schwab Corporation (SCHW), which makes it one of the most exposed to US markets. While not "good", I am encouraged by the fact that talks to take over First Horizon (FHN) fell apart. While TD Bank had to pay roughly $225 million in costs related to that pull out, I'd rather see that short-term hit than a longer-term uncertainty regarding increased US exposure. How the market was going to react to the ultimate takeover would have remained to be seen, but the initial news of the deal being called off punished FHN's stock enough to suggest avoiding buying that company was probably the prudent move:

First Horizon Share Movement (1-Month) (Google Finance)

The conclusion I draw here is not to avoid EWC outright because of the sector weightings. I would not fault anyone for deciding at this time that the banking sector or other financial firms are not what they want to own. Everyone has to know their own risk tolerance and limits. But I am suggesting to dig deeper than just the headline "Financials" exposure what making that evaluation. EWC is filled with some of the largest banks in the developed world and other financial firms more focused on investment management and insurance than lending. And lending - especially private credit - is where a lot of the risk is at the moment.

EWC is not heavily exposed to this arena and the recent move by TD Bank to get out of the First Horizon deal gives me confidence that Canadian banking management is taking the current situation seriously. This bodes well for future returns in my view.

Bank Of Canada Has Paused, Kept Rate Elevated

My second topic is an expansion on the first in terms of how Financials exposure could benefit from the current macro-environment north of the border. This relates to what the Canadian central bank has done to tackle inflation (yes, it is a problem there too!).

Importantly, the Bank of Canada has already begun its "pause" cycle, well before the Fed. While it has left the door open for more hikes down the road, the past few meetings have resulted in no movement on rates and that is expected at the next meeting as well:

Bank of Canada Expectations (Yahoo Finance)

What I see here is that equities are supported by a stable rate environment and banks/lenders in particular will continue to benefit from an elevated rate environment. Personally, I'd rather see central banks hike quickly and then pause - rather than this slow march and constant wondering on what will happen next. Banks and lenders perform well when rates are rising, yes, but only if rates stay there. People and companies won't borrow at higher rates if they anticipate much lower rates soon. They will simply delay. If the central banks around the world follow Canada's lead and keep rates elevated - but not too high - then that is a win-win for some of EWC's biggest holdings. This supports why I believe the fund remains a buy for now.

History Suggest S&P 500 To Be Volatile

My next thought takes a look at why I want to be looking outside US borders. As my followers know, my portfolio tends to be US-centric. So, while I have owned non-US assets for a long time, the S&P 500 is still a dominating factor on how I perform as a portfolio manager. Over time, I have tried to reduce this exposure by adding to both developed and non-developed markets and that has provided me a more diverse and less concentrated portfolio.

But a key element to the thesis for buying EWC usually comes at the expense of US stocks. After all, we always have choices when we buy anything. Choosing what to buy should come with careful consideration of substitutes. When looking at EWC, I get diversification inherently so that is always a reason to buy and hold it. But for why to buy now usually depends on my outlook for US stocks at large.

In this vein, I do see some volatility and/or headwinds on the horizon domestically that make me keen to add to my non-US holdings. First of which is the possibility for a Fed "pause", after its recent hike earlier this week. Many in the market have been anticipating the Fed will be done raising rates, and extending that belief into a bull case for equities. While I can see the logic in that theory, history suggests we should have a bit more caution than some are advocating.

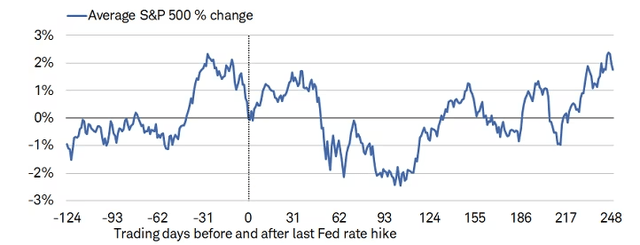

For perspective, if we look back at the average performance of the S&P 500 after a Fed rate hiking cycle ends, we see mixed results:

S&P 500 Performance Post-Fed Pause (Charles Schwab)

The takeaway here is that we can't necessarily expect a rally, drop, or something in between when it comes to performance after a Fed "pause". Clearly, the S&P 500 moves for a variety of factors and will require more analysis than just "the Fed is done so stocks will go up (or down)". The average performance tells us stocks do tend to have a positive reaction initially (first 30 days) but after that, we are likely to see a bit of volatility.

Does this mean I am selling off my US exposure? Of course not, and the S&P 500 will continue to be a benchmark for me and crucial to my overall investment success. But it does mean I will continue to view diversification as a necessary element in my portfolio. Canada is a developed, stable market in which to achieve this, and remains an easy way for me to accomplish my diversification objective.

Consumer Picture Still Clear

The next topic to discuss is the state of the Canadian consumer/household. Similar to America, consumer spending is a big driver of Canada's economy engine and success. So, evaluating this area is important just like when considering broad US-focused index funds.

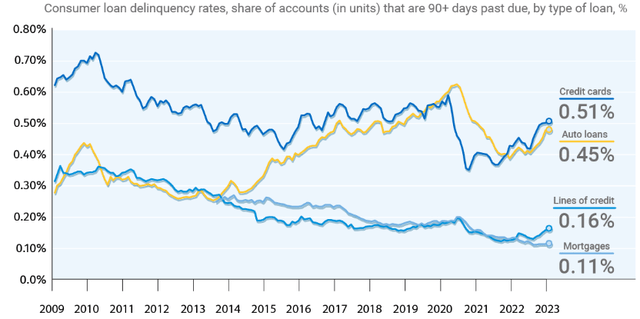

In fairness, there are signs of stress emerging with respect to consumer lending and debt management. With interest rates pushing higher by about 4% since this time last year - that is to be somewhat expected. But while "more" delinquencies are never what we want to hear, we have to put it in perspective. Yes, more loans/credit cards are falling behind in the short-term, but these delinquency rates are still below or at longer term averages:

Consumer Delinquency Rates (Canada) (RBC)

I use this to justify a continued bull stance but I won't get overly optimistic with it either. Ultimately, these figures are a little concerning given they are rising, but not anything to panic over considering where they sit in a multi-year comparison. To me, this means "wait and see". I will monitor these figures and if the trend pushes higher still and above the 1% mark, I will definitely re-evaluate.

But with higher absolute rates, lenders can afford some level of delinquencies and still come out with more profit than if everyone paid back their loans but rates were lower. So, I view this environment positively, and I think the uptick in delinquency rates is not anything to get alarmed about at the moment.

Bottom-line

Being raised in Upstate New York put Canada on my radar at an early age. I was a few hours from the border and the summer trip to Montreal was the poor man's way of getting the European experience! While I don't live there any longer, I still monitor the Canadian dollar, equities, and broader economic health quite closely. Their economy is distinct from America's and allows me to gain exposure to a safe, developed market but also diversify away from the Tech and "FAANG" heavy US index.

Over time, this strategy has served me well and I believe it will continue to do so. The Financials sector exposure within Canada does not alarm me, and recent moves by Canadian banks to avoid more US banking exposure tells me caution and prudence are still Canadian principles. Further, consumer spending and an elevated rate environment should give a boost to other top holdings in the fund. While recent gains have been modest, I am encouraged by any type of win in this environment. Therefore, my "buy" rating still has merit, and I encourage my readers to give the idea some consideration at this time.

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, VCV, PML, PDO

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EWC, VOO, RSP, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.