Berkshire Hathaway Q1 operating earnings rise 13%; ratchets up stock buybacks

Paul Morigi

Berkshire Hathaway (NYSE:BRK.B) (BRK.A) Q1 operating earnings gained 13% Y/Y as insurance underwriting and investment income surged, the company said Saturday.

The company bought back ~$4.4B of its common stock during the quarter, compared with ~$2.6B in the last quarter of 2022.

The investment giant had $130.6B of cash and short-term securities on its balance sheet as of March 31, 2023, up slightly from ~$128.7B at Dec. 31, 2022.

Q1 operating earnings of $8.07B vs. $6.71B in Q4 2022 and $7.16B in the year-ago quarter.

Insurance float was $165B at March 31, 2022, about even ~$164B at Dec. 31, 2022.

Operating earnings by business segment:

- Insurance - underwriting: $911M vs. $244M in Q4 2022 and $167M in Q1 2022;

- Insurance - investment income: $1.97B vs. $1.17B in the year-ago period;

- BNSF: $1.25B vs. $1.37B in the year-ago quarter;

- Berkshire Hathaway Energy Company: $416M vs. $775M a year ago;

- Other controlled businesses: $3.07B vs. $3.03B in Q1 2022;

- Non-controlled businesses: $568M vs. $282M a year ago;

- Other: -$111M vs. $370M a year earlier.

Investment and derivative gains, most of which are unrealized, increased to $27.4B in Q1 2023 from $11.5B in Q4 2022 and reversed from -$1.58B in Q1 2022. That resulted in net earnings of $35.5B in the most recent quarter vs. $18.2B in Q4 2022 and $5.58B in Q1 2022.

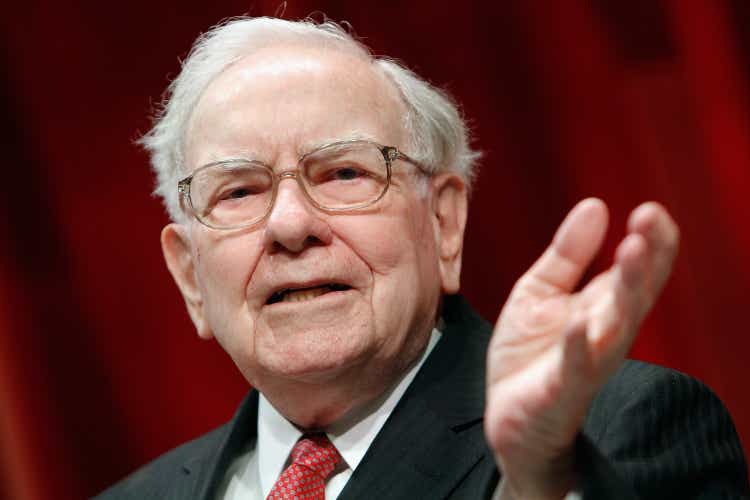

Coming up at 10:15 AM ET is the company's annual meeting, where Chairman and CEO Warren Buffett, and Vice Chairmen Charlie Munger, Greg Abel, and Ajit Jain will answer stockholder questions.