Snap: Speculative Product Play With Near-Term Potential

Summary

- Snap posted a poor quarter that saw it experiencing declines across both revenue and gross margin.

- User growth as well as cash flows remained on the upswing, however.

- SNAP has also just deployed an AR shopping product that appears more readily commercializable than its previous offerings. Initial feedback has been very good.

- The picture here is of a company that is still growing in terms of engagement and continuing to innovate. I am cautiously optimistic that SNAP will turn itself around and begin growing revenues again.

Justin Sullivan

Overview

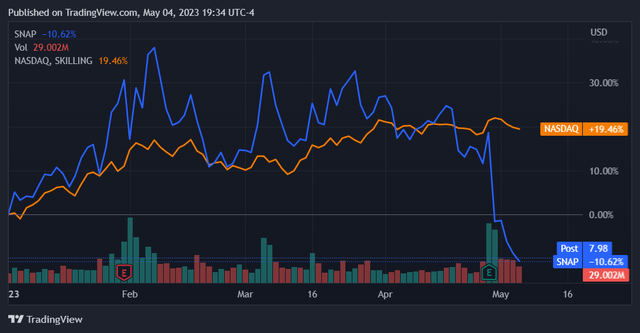

Snap (NYSE:SNAP) has sold off precipitously in the wake of its latest earnings report and is now trailing the NASDAQ Composite by roughly 9% year-to-date. This was due to Snap experiencing a YoY decline in revenue during a quarter in which other digital advertising players, such as Meta and Google, posted above-consensus top line growth.

Seeking Alpha

While this is obviously a poor showing, there is a good degree of nuance here. In this article I’ll outline what’s driving short-term headwinds for Snap while also detailing what I believe makes this company differentiated in the B2C technology market.

Short-Term Headwinds

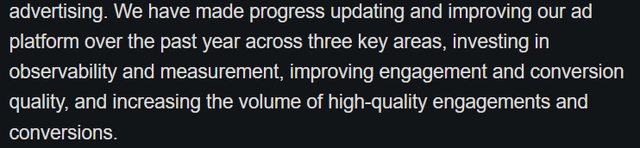

Worth noting is the fact that Snap has been in the middle of rearchitecting its advertising platform since the middle of 2022. The ad platform is a self-service system that advertisers use to place ads across Snap’s product base. The technical details of this involve Snap bringing the product in-line with top platform offerings such as Meta’s and Google’s and are primarily focused around improving ROI for advertisers through better conversion.

Seeking Alpha

As of Q4 2022, Snap’s management made clear that it will take time for this to translate into revenue growth results.

Seeking Alpha

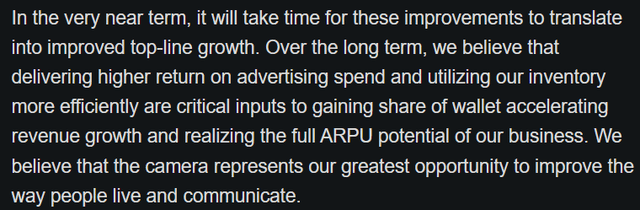

This translated into poor results in Q1, which was something expected (although not in a particularly clear way) by management.

Seeking Alpha

The situation here is such that Snap is continuing to orient itself for the long-term by actively investing in its technology. While we can’t chalk up all of the revenue decline to advertising platform changes, we can’t dismiss it either. At minimum it serves as an understandable reason for why this occurred and an element of Snap’s business that should correct long-term.

Differentiation

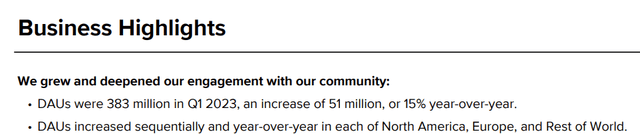

As mentioned I believe Snapchat is a differentiated product offering as far as B2C technology players. We can corroborate this by noting that user growth has remained brisk; Snapchat gained 51M DAU’s at a 15% YoY growth rate. Since user engagement is critical for any B2C technology company, we can rest assured that this is far from being a company in decline.

SNAP

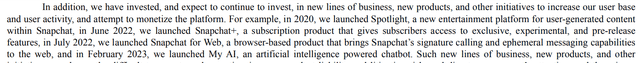

Snap also continues to innovate rapidly. The changes that Snap has made over the last 3 years bring it much closer to being a credible TikTok competitor. Spotlight, as well as Snapchat for Web, have essentially replicated TikTok’s offering. Given the popularity of the short-form video space across both desktop and mobile, this positions it well to capitalize on this ongoing trend. Furthermore Snap would be a direct beneficiary of any (unlikely) regulation brought upon TikTok here in the US.

SNAP

Snapchat+ is relatively well-understood and mostly an upgrade on the core experience. Much more recent is My AI, a digital helper tool for people using Snapchat. While the product was initially quite polarizing, I am inclined to think that it is getting used. Given Chegg’s recent underperformance, it may be the case that school-aged users are going to Snapchat and its ChatGPT-integrated AI bot for homework help.

What has been getting much less attention, however, is Snap’s entrance into the enterprise augmented reality market. While Snap has always derived its revenue from businesses buying ads, this is an entirely new avenue for it to generate revenue.

Snap’s offering in this realm is catered to online shoppers. Through the integration of an augmented reality capability into the Snapchat app, users can now do things like virtually try on clothes and view 3D renderings of products. Given how large the digital retail space is overall, I think this has significant potential for growing Snap’s revenues.

Preliminary feedback across early adopters has also been very positive, with impressive and differentiated metrics across all 3 early adopters:

SNAP

Cash Flow Trendline

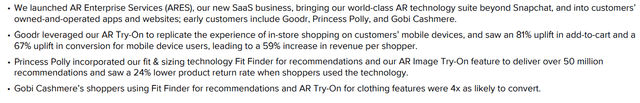

While Snap may have suffered a decline across both revenues as well as gross margins, it is worth noting that the company has continued to make progress across cash metrics. Even with the decreased performance of its business, Snap posted a continuing trend of increasing operating and free cash flow.

SNAP

While income metrics remain negative, this is still a good sign; at the minimum, they should be able to keep the lights on. I interpret this trendline as more significant given that the company had declining revenue in its most recent quarter.

Valuation

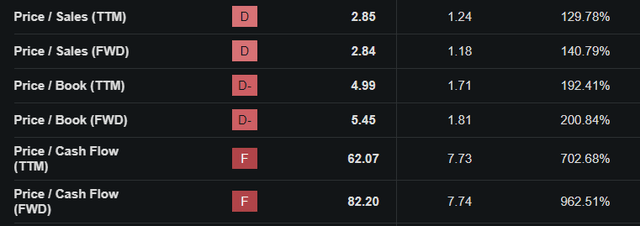

Even though Snap has sold off significantly in recent trading, it remains expensive. It trades at a significant premium across both sales and cash flow metrics. Any investor entering SNAP stock should expect a long time before the fundamentals catch up to the valuation here. This is a speculative, forward-looking trade.

Seeking Alpha

Risks

Snap also continues to face material risks to its business, namely across digital advertising as well as its user base. If it continues to capture a lower proportional share of the digital advertising market, it will not be able to continue growing. If its userbase begins to decline, that will be particularly worrisome and could very well spell the end for Snap. Thankfully, this has not yet occurred.

Conclusion

I am willing to believe Snap’s management in that its current performance has been hampered by product changes. Furthermore I am made more optimistic by the company’s continually growing user base as well as its new product offerings. I am particularly optimistic about the AR-enabled shopping feature, as this seems to be more directly commercial and valuable than anything Snap has released to date. By the next quarter we should begin to see this having an impact on the top line. If the company can leverage these new products to return to revenue growth, its increasing capital efficiency should yield a more consistently rising cash flow picture. While there is significant risk here, I am going to cautiously call SNAP stock a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.