Toronto-Dominion Bank: Attractive Valuation And Superior Capital Ratios

Summary

- TD Bank stands out in the banking sector, with its strong focus on retail banking, convenience and accessibility.

- Its tried-and-tested business model propelled the Canadian giant into becoming the 7th largest US bank in terms of deposits.

- Valuations in the banking sector, including TD Bank, are currently attractive, offering investment opportunities following the Silicon Valley Collapse.

- TD Bank demonstrated financial stability and strength, with a Common Equity Tier 1 (CET1) ratio of 15.5%, outperforming major competitors.

- The bank's profitability, as measured by Return on Equity (ROE) and net income per employee, highlights its solid financial management and scalability.

Joe Raedle/Getty Images News

Investment Thesis

In the world of banking, it is easy to get lost in the sea of numbers, balance sheets, and profit margins. However, one key aspect that separates successful banks from the rest is a clear identity around a set of values supporting a tried and tested business model. By branding itself America's Most Convenient Bank, TD Bank (NYSE:TD) has aligned its operational focus, competitive advantage, and identity to deliver on its promises to shareholders, customers, and the broader community.

TD Bank's unwavering commitment to retail banking, convenience, and accessibility has propelled it to become the seventh-largest bank in the US within just fifteen years. By offering extended branch hours, including evenings and weekends, the bank has set itself apart from competitors while catering to the unique needs of individual customers and small businesses. Navigating through its website, one can't help but notice the seamless user experience, transparent fee structures, and easy-to-understand services that maintain a level of sophistication suitable for an increasingly tech-savvy customer. This customer-centric approach, combined with strategic acquisitions and mergers since the mid-2000s has allowed TD Bank to rapidly expand its presence, particularly along the East Coast, and solidify its position as a leading financial institution in the competitive US banking landscape.

Valuation

The recent collapse of Silicon Valley Bank sent shockwaves throughout the financial markets, leading to panic selling and a sudden drop in bank stocks. While many investors were left scrambling to protect their portfolios, I saw this as a prime opportunity to capitalize on the undervalued banking sector. In my opinion, banks such as TD Bank, trade at attractive valuations, present an exciting chance for investors to reap substantial profits.

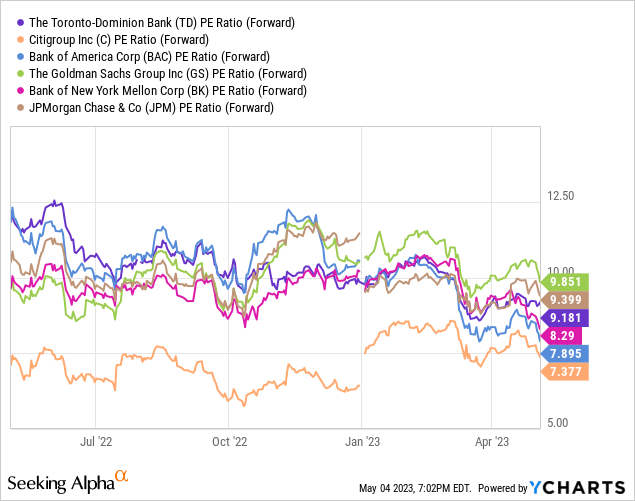

Currently, banks are trading at a forward PE ratio between 7x - 10x, making them appealing from a valuation perspective. TD with a PR ratio of 9x falls within this range. While not the cheapest option available, its valuation is in line with industry averages, and in my view, attractively priced.

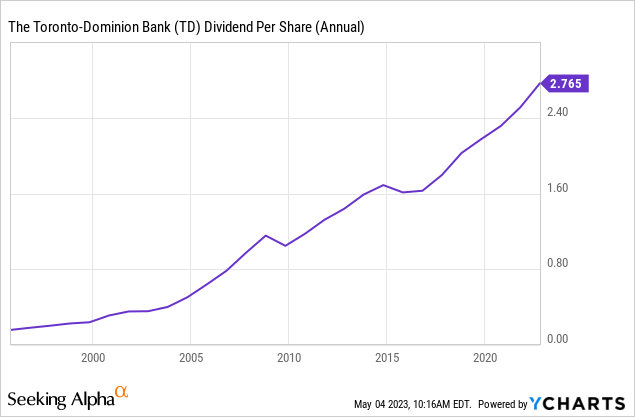

Investing in TD Bank at this level is not only about the numbers, but also about the strength of the bank's business model, and its potential for growth. The Canadian financial giant has a proven track record and a strong focus on retail banking. Its position as America's Most Convenient Bank has allowed it to carve out a niche for itself in the US, and achieve remarkable growth in just fifteen years. Furthermore, TD demonstrated resilience in the face of economic turbulence. For more than a hundred years, TD never missed a dividend payment. To be exact, 166 years of continuous dividend distribution.

Capitalization

In the current market climate, the financial stability and strength of banks are paramount to ensure they weather economic uncertainty. One metric to consider when making an investment decision in the financial sector is the Common Equity Tier 1 (CET1) ratio, which measures a bank's core capital against its risk-weighted assets. A higher CET1 ratio signifies a stronger capital base and a more resilient financial institution. When examining the latest filings (mostly Q1 2023 reports) of major banks, TD stands out with a CET1 ratio of 15.5% outperforming its peers as shown in the table below.

| Bank Name | Ticker | Common Equity Tier 1 Ratio (Latest Filings) |

| TD Bank | (TD) | 15.5% |

| JPMorgan | (JPM) | 13.8% |

| Citi | (C) | 13.4% |

| Goldman Sachs | (GS) | 14.8% |

| Wells Fargo | (WFC) | 10.8% |

| Bank of America | (BAC) | 11.4% |

Profitability

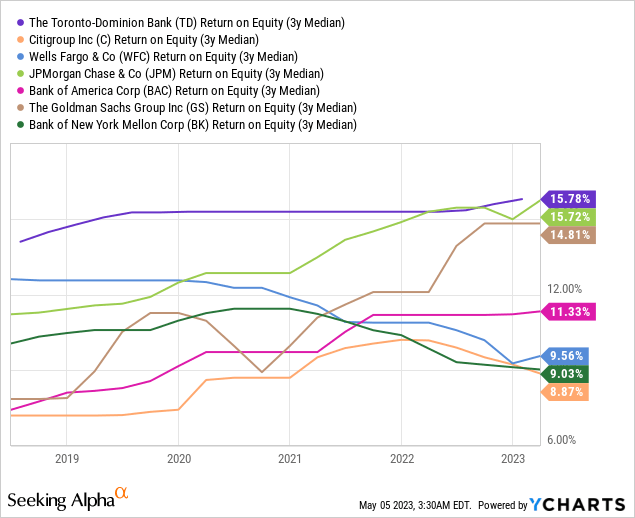

With an ROE of 15.78%, TD Bank surpasses competitors like JPM, C, WFC, BAC, GS, and BK. This superior ROE is indicative of TD's strong financial management and focus on maximizing shareholder value. Moreover, its relatively stable performance over time, when compared to banks like BAC and BK highlights its ability to maintain profitability in times of market turbulence.

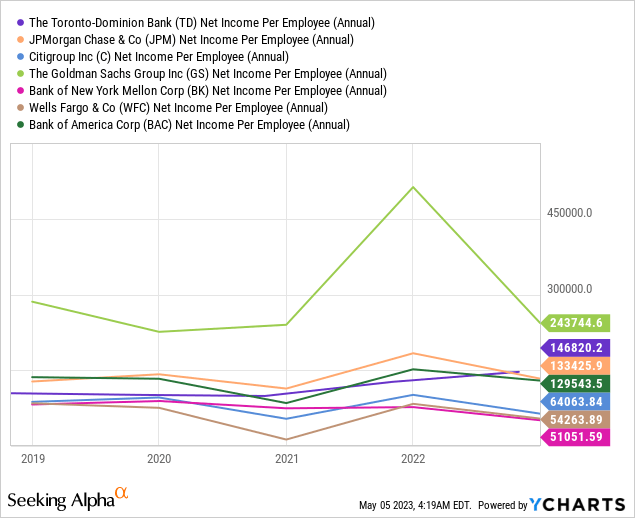

TD also showcases an impressive net income per employee, outperforming other banking giants such as JPM, BAC, and Citi, and, among US leading banks, is second only to GS. This performance highlight's the scalability of the company's business, and the success of its strategy to enhance its value proposition through cross-border banking, retail focus, and digital innovation.

How I Might Be Wrong

While TD Bank has demonstrated financial stability and strength, as mirrored in the charts above, one should note that it is not immune to macroeconomic challenges facing the economies of both Canada and the US. A severe recession due to the Fed's monetary tightening or a financial crisis due to the spill-overs of the Silicon Valley Bank collapse could negatively impact TD Bank's profitability and stock price.

TD recently reached a $1.2 billion settlement with the US Department of Justice "DOJ" concerning the Allen Stanford Ponzi Scheme. TD hasn't admitted to any wrongdoing and stressed that its banking relation with Mr. Stanford was limited to "correspondent banking services" to entities associated with Mr. Stanford. Authorities however claim that TD overlooked numerous warning signs. This is one example of the regulatory risks that TD and its shareholders face in the financial sector. I hope that TD learned from its mistakes, but such incidents raise concerns over the company's governance.

Summary

TD has been successful in carving out a unique place for itself in the US by focusing on retail banking and emphasizing convince accessibility and exceptional customer service. Within a span of fifteen years, the Canadian financial giant has become the 7th largest US bank in terms of deposits. TD Bank's stock valuation is in line with the industry average, and its CET1 capital ratio outperforms peers, signaling strong capitalization. The company's ROE and net income per employee figures also demonstrate superior profitability, financial stability, and focus on maximizing shareholder value, supported by a long history of continuous dividend distribution.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TD, JPM, C, BAC, WFC, GS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.