Tesco: Soft Near-Term Earnings Outlook Limits Upside

Summary

- Tesco delivered relatively few surprises in its FY22/23 results. Underlying profit fell as expected but this was offset by share buybacks.

- Looking ahead, FY23/24 looks set to deliver a modest decline in EPS based on management guidance of flat retail operating profit and higher taxes.

- I still expect high single-digit annualized returns over the long run, but there are few catalysts to realize that in the near term.

onfilm/iStock Unreleased via Getty Images

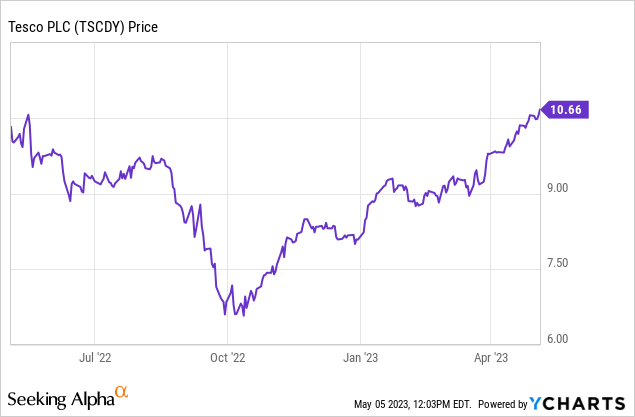

Tesco (OTCPK:TSCDY)(OTCPK:TSCDF) stock has been on a bit of a yo-yo ride this past year or so, with the shares falling sharply toward the back-end of 2022 only to recover almost as quickly.

The extent of the sell-off struck me as slightly overdone given Tesco's earnings outlook (slightly negative, but aided by stock buybacks), and that ultimately drove a rather opportunistic 'Strong Buy' rating when I last covered the company back in Q4 of last year.

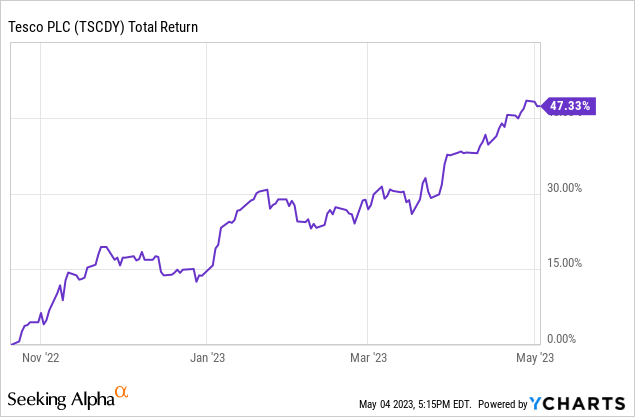

These shares have returned a good 35% since then (with dividends) in GBP terms in London trading, while the ADSs have also received an extra bump from currency (with the weak GBP also forming an added component of that 'Strong Buy' rating for US-based investors).

Looking ahead, I believe that "more of the same" is probably on the cards for Tesco operationally, and by that I mean that its near-term earnings outlook is again quite soft. With the shares re-rating upwards from circa 10x EPS to circa 13x EPS, I think that likely caps any upside from a valuation perspective, too, implying a relatively quiet year ahead in terms of total shareholder return. I still think these shares offer high single-digit annualized total returns potential in the long-run, but with few catalysts to realize that over the next 12 months I'm downgrading to 'Hold'.

Few Surprises In FY22/23

We already had a good idea of how FY22/23 was going to play out last time, with a combination of a tough macro environment plus structural issues in the UK grocery market leading to a weakening earnings outlook.

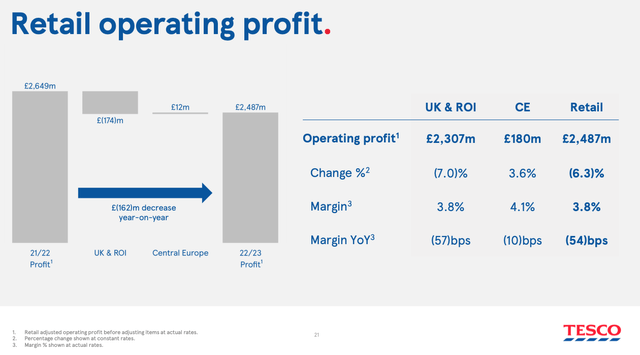

With that in mind, full-year results released last month contained relatively few surprises. Group adjusted operating profit was duly down for the year, falling a little over 7% to £2.630B. Retail operating profit of £2.487B was down just over 6%, landing within guidance.

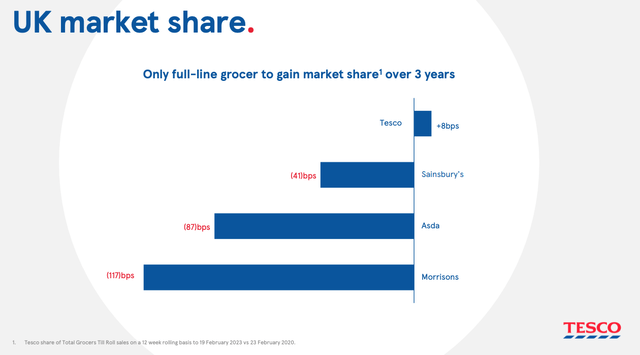

Digging a little deeper, Tesco's main issues were threefold. Firstly, normalization of shopping habits post-COVID (when people were prevented from eating out, increasing grocery store sales) had a negative impact on volumes, hurting retail profit margins. Secondly, inflation also put downward pressure on retail margins through a combination of weaker volumes (financially sensitive consumers), higher costs like employee pay and energy, and Tesco's own "value" strategy.

That leads me to point three: Tesco's strategy is to defend its market share against discounters Aldi and Lidl, so offsetting price hikes were deliberately priced below the actual rate of price inflation to defend share. This strategy appears to be working, with Tesco gaining a small amount of market share over the past three years at the expense of the other "Big Four" members, but it does mean downward pressure on earnings and profit margins.

Source: Tesco FY22/23 Results Presentation

As a result of the above, UK & Ireland retail operating margin fell by 57bps to 3.8% last year.

Source: Tesco FY22/23 Results Presentation

The above was offset to a large extent by share buybacks, which was again flagged in my previous article. Tesco's weighted average share count fell 3.5% last year (from 7,746m to 7,482m), meaning that full-year adjusted EPS was virtually flat year-on-year (at 21.85 pence) despite lower operating income.

More Of The Same This Year

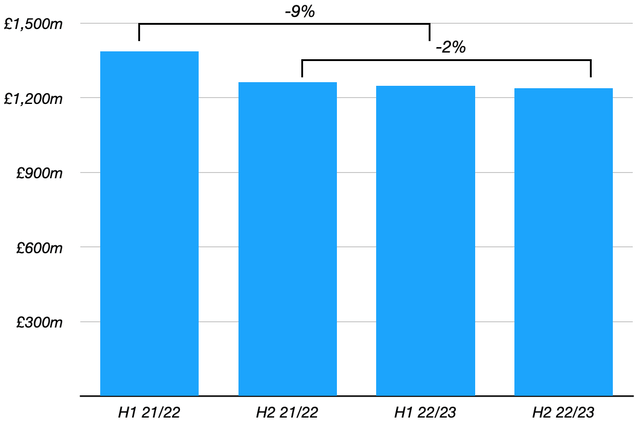

Operationally I expect more of the same in FY23/24. Tesco management expects "broadly flat" retail adjusted operating profit this year, while Tesco Bank is expected to contribute "between £130m and £160m" of adjusted operating profit, which would also be broadly flat year-on-year (Tesco Bank adjusted operating profit was £143m in FY22/23). H2 FY22/23 performance - relatively flat retail operating profit, better than H1 - lends some confidence that management guidance is likely fair.

Tesco: Retail Adjusted Operating Profit

Data Source: Tesco FY22/23 Interim And Full-Year Results

It should be noted that this would translate into lower net income, as UK corporation tax has increased to 25% from 19% previously. Management expects Tesco's effective tax rate to be 26% this year, up from 21.3% in FY22/23. All else equal that would result in just under 6% lower post-tax profit versus FY22/23.

Buybacks should again offset this to a large extent. Management guided for £750m worth of share repurchases this year, which at the current share price would equate to a circa 3.7% share count reduction (FY22/23 period-end share count was 7,318m). All else equal this implies a circa 2% fall in adjusted EPS this year, which, unsurprisingly, is the level of decline expected by analysts.

Expect Flat Near-Term Returns

In the long-run I still expect Tesco to deliver high single-digit annualized returns from these levels - in line with initial coverage. That is from a combination of the dividend (currently 10.9 pence per share, yielding 3.9%), buybacks, and a very low single-digit contribution from revenue and underlying net income growth.

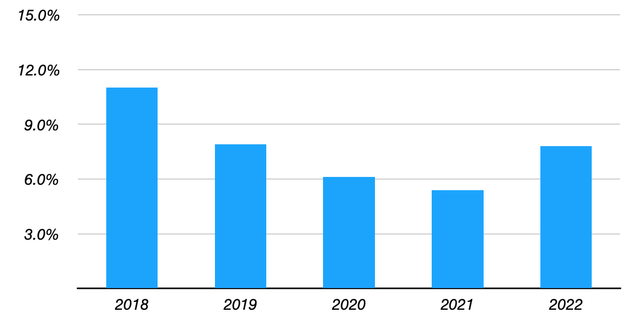

I expect returns over the next twelve months to be more subdued. First and foremost, I'm pencilling in a circa 2% EPS decline this year as per above. Moreover, unlike late last year I don't see any more scope for an upward rating in Tesco's valuation. At 280 pence in London trading, these shares trade at 13x my estimate of FY23/24 EPS of 21.4 pence - a level that looks appropriate given the company's single-digit ROCE profile, inherently low growth prospects and a relatively competitive risk-free rate.

Tesco: Return On Capital Employed (ROCE)

Data Source: Tesco 2022 Annual Report

With the dividend contributing 3.9%, an implied 12-month total return in the low single-digit area is unlikely to appeal to investors given safer short-term fixed-income yields on offer elsewhere. Hold.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSCDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.